Santander UK Plc Publication of Final Terms (9110K)

April 13 2018 - 8:16AM

UK Regulatory

TIDMSAN TIDM83WK

RNS Number : 9110K

Santander UK Plc

13 April 2018

SANTANDER UK PLC

EUR35 BILLION GLOBAL COVERED BOND PROGRAMME

Publication of Final Terms - Series 68

The following final terms (the Final Terms) are available for

viewing:

Issue of Series 68 GBP1,000,000,000 Floating Rate Covered Bonds

due 13 April 2021 (ISIN XS1807191058) under the EUR35 billion

Global Covered Bond Programme of Santander UK plc (the

Programme).

To view the full Final Terms document, please click on or paste

the following URL into the address bar of your browser:

http://www.rns-pdf.londonstockexchange.com/rns/9110K_-2018-4-13.pdf

A copy of the above Final Terms has been submitted to the

National Storage Mechanism and will shortly be available for

inspection at: http://www.morningstar.co.uk/uk/NSM.

The Final Terms can also be viewed at:

https://www.santander.co.uk/uk/about-santander-uk/debt-investors/santander-uk-covered-bonds.

Please see Annex 1 to this notice for additional information in

relation to the Series 68 Covered Bonds.

For further information, please contact:

Medium Term Funding

Santander UK plc

2 Triton Square

Regent's Place

London NW1 3AN

Tel: +44 (0) 20 7756 7100

Email: mtf@santander.co.uk

DISCLAIMER - INTENDED ADDRESSEES

Please note that the information contained in the Final Terms

and the base prospectus published in respect of the Programme on 2

June 2017, as supplemented on 28 July 2017, 14 September 2017, 26

October 2017, 7 February 2018 and 1 March 2018 (the Prospectus) may

be addressed to and/or targeted at persons who are residents of

particular countries only (as further specified in the Prospectus)

and is not intended for use and should not be relied upon by any

person outside these countries and/or to whom the offer contained

in the Final Terms and the Prospectus is not addressed. Prior to

relying on the information contained in the Final Terms and the

Prospectus you must ascertain from the Final Terms and the

Prospectus whether or not you are part of the intended addressees

of the information contained therein. Your right to access this

service is conditional upon complying with the above

requirement.

ANNEX 1

ADDITIONAL INFORMATION IN RELATION TO SERIES 68 GBP1,000,000,000

FLOATING RATE COVERED BONDS DUE 13 APRIL 2021

OPERATIONAL INFORMATION DOCUMENT

This Operational Information Document related to the Final Terms

dated 12 April 2018 (the Final Terms) in respect of the issue of

Series 68 GBP1,000,000,000 Floating Rate Covered Bonds due 13 April

2021 (ISIN XS1807191058).

This Operational Information Document has not been reviewed or

approved by any competent authority for the purposes of the

Prospectus Directive or otherwise and does not form part of the

Final Terms for the purposes of the Prospectus Directive. However,

for all other purposes this Operational Information Document must

be read in conjunction with the Final Terms. Words and expressions

which have a defined meaning in the Final Terms or Base Prospectus

dated 2 June 2017, as supplemented on 28 July 2017, 14 September

2017, 26 October 2017, 7 February 2018 and 1 March 2018 have the

same meanings in this Operational Information Document.

MIFID II product governance / Professional investors and ECPs

only target market Solely for the purposes of each manufacturer's

product approval process, the target market assessment in respect

of the Covered Bonds has led to the conclusion that: (i) the target

market for the Covered Bonds is eligible counterparties and

professional clients only, each as defined in Directive 2014/65/EU

(as amended, MiFID II); and (ii) all channels for distribution of

the Covered Bonds to eligible counterparties and professional

clients are appropriate. Any person subsequently offering, selling

or recommending the Covered Bonds (a "distributor") should take

into consideration the manufacturers' target market assessment;

however, a distributor subject to MiFID II is responsible for

undertaking its own target market assessment in respect of the

Covered Bonds (by either adopting or refining the manufacturers'

target market assessment) and determining appropriate distribution

channels.

DISTRIBUTION

(a) If syndicated, names of Lead Managers: Banco Santander, S.A.

RBC Europe Limited

The Toronto-Dominion Bank

(each a "Lead Manager" and together, the "Managers")

(b) Date of Subscription Agreement: 12 April 2018

(c) If not syndicated, name of relevant Dealer: Not applicable

(d) U.S. Selling Restrictions: Regulation S

This information is provided by RNS

The company news service from the London Stock Exchange

END

PFTFKNDDNBKDQQD

(END) Dow Jones Newswires

April 13, 2018 09:16 ET (13:16 GMT)

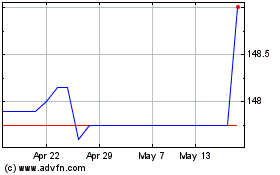

Sant Uk.10te% (LSE:SAN)

Historical Stock Chart

From Oct 2024 to Nov 2024

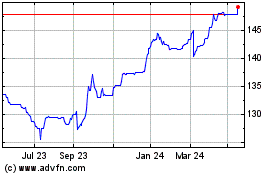

Sant Uk.10te% (LSE:SAN)

Historical Stock Chart

From Nov 2023 to Nov 2024