TIDMSDG

RNS Number : 5713I

Sanderson Design Group PLC

08 August 2023

8 August 2023

SANDERSON DESIGN GROUP PLC

("Sanderson Design Group", the "Company" or the "Group")

Half Year Trading Update

Strong performance from licensing underpins half year

profitability

Company remains on track to meet the Board's full year profit

expectations

Sanderson Design Group PLC (AIM: SDG), the luxury interior

design and furnishings group, is pleased to announce its trading

update for the six months ended 31 July 2023.

A strong performance in the half year from the Group's

high-margin licensing activities and encouraging growth in the US

have mitigated the difficult market conditions in the UK discussed

in the Company's AGM statement on 22 June 2023.

Group sales in the six-month period of GBP56.7 million

(comprising Brand product and external Manufacturing sales along

with licensing revenue) were down 2.1% in reported currency

compared with the same period last year (H1 FY23: GBP57.9m), down

3.0% on a constant currency basis.

The strong contribution from licensing means that adjusted

underlying profit before tax for the half year is expected to be

slightly ahead of the same period last year (H1 FY23: GBP6.3m).

Brand product, manufacturing and licensing revenue

Six months to 31 Change (%)

July

(GBP million)

2024 2023 Reported Constant

currency

--------- -------- --------- ----------

Brand product

UK 19.5 22.1 (11.8%) (11.8%)

--------- -------- --------- ----------

North America 10.7 9.7 10.3% 5.9%

--------- -------- --------- ----------

Northern Europe 5.1 5.5 (7.3%) (8.9%)

--------- -------- --------- ----------

Rest of the World 5.0 4.9 2.0% 0.0%

--------- -------- --------- ----------

Total Brand product

revenue 40.3 42.2 (4.5%) (5.8%)

--------- -------- --------- ----------

Manufacturing

(20.2

External 9.5 11.9 %) -

--------- -------- --------- ----------

Internal 7.6 9.7 (21.6%) -

--------- -------- --------- ----------

Total Manufacturing

revenue 17.1 21.6 (20.80%) -

--------- -------- --------- ----------

Licensing

Total Licence revenue 6.9 3.8 81.6% -

--------- -------- --------- ----------

Total revenue 56.7 57.9 (2.1%) (3.0%)

--------- -------- --------- ----------

Brand product revenue in the first half was impacted by the

challenging UK market, which represented approximately 48% of total

brand product revenue. The targeted growth market of the US

continued to perform well, with sales up 10.3% in reported

currency. The Rest of the World market benefited from an increasing

number of contract sales to the hospitality market in the Middle

East.

Third-party manufacturing at GBP9.5 million was down 20.2%

compared with the strong comparator last year (H1 FY23: GBP11.9m),

when customers restocked post Covid, and reflects a return to more

normalised trading conditions. Repeat orders were down in the first

half this year both from third-party and Group brands, although

orders for new collections have held up well.

Licensing performed strongly in the first half with total

licensing revenue up 81.6% at GBP6.9 million (H1 FY23: GBP3.8m),

driven by accelerated income of GBP4.9 million (H1 FY23: GBP1.9m)

from recently signed licence agreements.

Major new licensing deals were signed with NEXT and Sainsbury's

in February and March 2023 respectively and a considerable number

of licence renewals were also agreed, underlining the strength of

our licensing relationships. Sangetsu has recently launched Morris

Chronicles in Japan, a collection of Morris & Co. fabrics,

wallpapers and floor coverings, and, this autumn, the Company will

launch the Disney Home x Sanderson collection of vintage-inspired

fabrics and wallpapers.

The Company has recently streamlined its UK support function,

which is expected to yield annualised savings of GBP0.6 million

whilst maintaining a high level of customer focus.

Balance sheet

The Group's balance sheet remains strong with net cash of

approximately GBP15.9 million as at 31 July 2023 (H1 FY23:

GBP15.0m), compared with GBP15.4 million on 31 January 2023.

Outlook

As expected, recent consumer trends in the UK have persisted,

however, the Group continues to benefit from significant brand

strength and an increasingly diverse product range and geographical

reach. This has helped deliver a robust Group performance and, in

particular, a strong contribution from our high-margin licensing

activities, which has underpinned profitability in the first

half.

The Group remains cautious about the UK economic environment and

is committed to taking mitigating actions where necessary whilst

also maintaining momentum in delivering its strategic

objectives.

Focus remains on the significant international growth

opportunity in the US market and the growing pipeline of licencing

opportunities, both of which will underpin trading in H2 FY24 and

beyond.

The Group continues to benefit from a strong balance sheet and,

whilst the outlook is uncertain, the Board's expectations for the

Group's full year profits remain unchanged.

Notice of Results

Sanderson Design Group expects to announce its interim results

for the six months ended 31 July 2023 on 11 October 2023.

For further information:

Sanderson Design Group PLC c/o Buchanan +44 (0)

20 7466 5000

Lisa Montague, Chief Executive Officer

Mike Woodcock, Chief Financial Officer

Investec Bank plc (Nominated Adviser

and Joint Broker) +44 (0) 20 7597 5970

David Anderson / Alex Wright / Ben

Farrow

Singer Capital Markets (Joint Broker) +44 (0) 20 7496 3000

Tom Salvesen / Jen Boorer / Alex Emslie

Buchanan +44 (0) 20 7466 5000

Mark Court / Toto Berger / Abigail

Gilchrist

SDG@buchanan.uk.com

Notes for editors:

About Sanderson Design Group

Sanderson Design Group PLC is a luxury interior furnishings

company that designs, manufactures and markets wallpapers, fabrics

and paints. In addition, the Company derives licensing income from

the use of its designs on a wide range of products such as bed and

bath collections, rugs, blinds and tableware.

Sanderson Design Group's brands include Zoffany, Sanderson,

Morris & Co., Harlequin, Clarke & Clarke and Scion.

The Company has a strong UK manufacturing base comprising Anstey

wallpaper factory in Loughborough and Standfast & Barracks a

fabric printing factory, in Lancaster. Both sites manufacture for

the Company and for other wallpaper and fabric brands.

Sanderson Design Group employs approximately 600 people, and its

products are sold worldwide. It has showrooms in London, New York,

Chicago and Amsterdam.

Sanderson Design Group trades on the AIM market of the London

Stock Exchange under the ticker symbol SDG.

For further information please visit:

www.sandersondesigngroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFIITEIDIIV

(END) Dow Jones Newswires

August 08, 2023 02:00 ET (06:00 GMT)

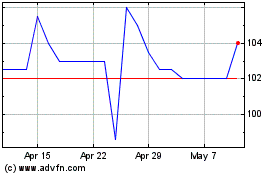

Sanderson Design (LSE:SDG)

Historical Stock Chart

From Apr 2024 to May 2024

Sanderson Design (LSE:SDG)

Historical Stock Chart

From May 2023 to May 2024