Schroder Eur Real Est Inv Trust PLC Acquisition of Netherlands data centre (4354F)

February 21 2018 - 1:00AM

UK Regulatory

TIDMSERE

RNS Number : 4354F

Schroder Eur Real Est Inv Trust PLC

21 February 2018

21 February 2018

SCHRODER EUROPEAN REIT ACQUIRES NETHERLANDS DATA CENTRE FOR C.

EUR20MN

Schroder European Real Estate Investment Trust plc ("SERE"), the

company investing in European growth cities, has completed the

acquisition of a data centre in Apeldoorn, the Netherlands, for

approximately EUR20 million. The acquisition reflects an attractive

net initial income yield of 10%. SERE has now fully deployed all of

its capital currently available for investment in a ten asset

portfolio, located in growth cities and regions that are benefiting

from the favourable Eurozone economic outlook.

The 23,700 sqm mixed use building's primary usage is a data

centre, with additional office and storage space. The building was

extensively refurbished in 2006 and 2015 and includes 495 parking

spaces. It is let to a strong covenant, KPN NV, a leading Dutch

telecom and IT service provider, with an initial term expiring 31

December 2026 and subject to annual indexation.

Apeldoorn is strategically located in the centre of the

Netherlands, at the intersection of the North-South and East-West

motorway axis. Just 75km from Amsterdam, it is expected to be a

beneficiary of the growing trend of back-office relocation by

information and communications technology businesses (ICT), with

rents currently 30% of those in Amsterdam and a deep IT related

employment pool.

Supporting SERE's growth cities strategy, GDP for the Apeldoorn

region is forecast to grow at 1.6% over the next four years(1) ,

ahead of domestic GDP growth. Its population growth has seen a

steady upward trend since the 1960s, outperforming a number of

other similarly sized cities over the same period.

Apeldoorn represents the tenth acquisition by SERE, which has

now invested approximately EUR235 million at a blended net initial

yield of approximately 6.5%, in established Western European growth

cities.

Jeff O'Dwyer, Fund Manager at Schroder REIM, commented:

"This acquisition demonstrates our ability to leverage

Schroders' in-country investment expertise and identify assets that

fit with our investment strategy, being accretive to income and

offering a number of value-enhancing asset management initiatives,

in fast-growing European cities and growth industries.

"Following the announcement that Casino Group has exercised an

option to buy back two of our low yielding retail assets at a 10%

premium to valuation, we are now working on opportunities to

redeploy this capital when the sale completes in July 2018. With a

robust pipeline in place and a favourable market backdrop, we look

forward to the rest of 2018 with confidence."

Enquiries:

Duncan Owen/Jeff O'Dwyer

Schroder Real Estate Investment Management Limited Tel: 020 7658 6000

Ria Vavakis

Schroder Investment Management Limited Tel: 020 7658 2371

FTI Consulting

Dido Laurimore/Richard Gotla/ Ellie Sweeney Tel: 020 3727

1575

(1) Source: Oxford Economics, December 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

STRBUGDDIXDBGIG

(END) Dow Jones Newswires

February 21, 2018 02:00 ET (07:00 GMT)

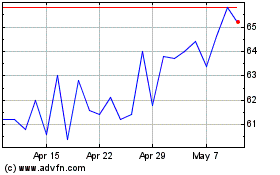

Schroder European Real E... (LSE:SERE)

Historical Stock Chart

From Apr 2024 to May 2024

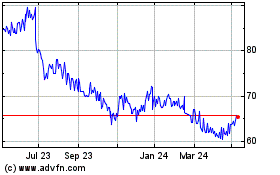

Schroder European Real E... (LSE:SERE)

Historical Stock Chart

From May 2023 to May 2024