TIDMSLP

RNS Number : 7743I

Sylvania Platinum Limited

09 August 2023

_____________________________________________________________________________________________________________________________

9 August 2023

Sylvania Platinum Limited

("Sylvania", the "Company" or the "Group")

Chrome Ore and PGM Treatment Joint Venture Agreement

Sylvania (AIM: SLP), the platinum group metals ("PGM") producer

and developer, with assets in South Africa, is pleased to announce

that its wholly owned South African subsidiary, Sylvania Metals

(Pty) Limited ("Sylvania Metals"), has entered into an

unincorporated Joint Venture Agreement ("JV") with Limberg Mining

Company (Pty) Limited ("LMC"), a subsidiary of ChromTech Mining

Company (Pty) Limited ("ChromTech"). The JV will process PGM and

chrome ores from historical tailings dumps and current arisings

("Mining Area") from the Limberg Chrome Mine, located on the

northern part of the Western Limb of the Bushveld Complex, South

Africa . The JV will trade and operate under the name Thaba Joint

Venture ("Thaba JV").

The Thaba JV represents a major step in delivery of Sylvania's

growth strategy and is a significant step forward for Sylvania

Metals in expanding its operations and leveraging its expertise in

the recovery of chrome and PGM concentrates, adding attributable

production of approximately 6,500 4E PGM ounces and introduce

200,000 tons of chromite concentrate to Sylvania Metals' existing

annual production profile.

Highlights

-- Sylvania Metals has entered into a 50:50 JV agreement to recover chromite and PGM concentrates from run-of-mine

ores and historical tailings deposited on the Tailings Storage Facility ("TSF") at the Limberg Chrome Mine;

-- New processing infrastructure will include a new secondary fine chromite and PGM beneficiation plant;

-- Sylvania Metals will share equally in both the PGM and chromite concentrate revenue and it is estimated that the

Thaba JV will produce approximately 13,000 4E PGM ounces (approximately 15,500 6E PGM ounces) and 400,000 tons of

metallurgical grade chromite concentrate per year over the initial 10 years of the JV, which the parties may

negotiate to further extend;

-- The Thaba JV will increase forecast annual production of 4E PGM ounces by approximately 9% and add chrome to the

Company's commodity portfolio;

-- The capital and establishment costs ("Upfront Capex") at the Thaba JV of approximately ZAR600 million ( $32

million) will initially be funded by Sylvania Metals from its existing cash resources. The initial working

capital facility required by the Thaba JV following commissioning will be advanced by Sylvania Metals ( $5

million);

-- Sylvania Metals will manage the Thaba JV on behalf of the partners who will collectively apply their respective

PGM and chrome expertise to maximise recovery efficiencies and production;

-- The project execution phase will be 18-24 months with first production expected in H2 FY2025;

-- Attractive investment return indicated on the Thaba JV, exceeds Company IRR hurdle rate of at least 20% per annum

and with a cash pay back within three years of commissioning, based on current long term consensus pricing, and

-- The first PGM beneficiation facility on primary chrome ore and tailings on the northern part of the Western Limb

of the Bushveld Complex and will be an enabler for further growth opportunities in the region.

Jaco Prinsloo, CEO of Sylvania, said : "The Thaba JV combines

the strengths and expertise of both companies in the mining and

processing industry - Sylvania Metals has a proven track record in

the recovery, sale, and distribution of PGMs, while LMC contributes

ChromTech's extensive experience of chrome operations, with

particular expertise in fine chrome beneficiation. We are looking

forward to collaborating with LMC, who will provide access rights

to the Mining Area and brings its knowledge and skills in mining

and processing operations to ensure the production of low-cost,

high-grade chromite concentrate and PGMs from the Middle Group Reef

on the north of the Western Limb of the Bushveld Complex in South

Africa.

"We are excited about the prospects of the Thaba JV to create

substantial value for our shareholders, and to add chrome to our

portfolio of commodities, whilst strengthening our PGM production.

The Thaba JV will add an attributable production of approximately

6,500 4E PGM ounces and 200,000 tons of chromite concentrate to

Sylvania Metals' existing production profile and offers an

attractive investment return on the project that exceeds our

Company IRR hurdle rate of at least 20%, along with a cash pay back

of less than three years from commissioning, based on current long

term consensus pricing.

"The establishment of the JV holds significant potential for

Sylvania as it aligns with the Company's growth strategy and

enhances its position in the mining and processing industry. The JV

will enable Sylvania Metals to access valuable resources, expand

its production capabilities, and strengthen its distribution

channels for target products, ultimately driving value for the

Group and its stakeholders."

Jono Gay, CEO of LMC, said : "The establishment of the Thaba JV

is a ground-breaking collaboration between industry leading

operators that is anticipated to generate sustainable value for all

stakeholders. LMC eagerly anticipates the formation of this

long-lasting partnership with Sylvania Metals. Both our companies

share a philosophy for unwavering excellence, underpinned by our

collective commitment to Environmental, Social and Governance

principles. With this JV, we are poised to unlock LMC's potential

and position it as a key growth engine within the ChromTech Group.

In light of our continued business diversification into open-cast

chrome and PGM mining, LMC, the most recent acquisition of the

ChromTech Group, represents an essential growth area for our

company."

Figure 1: Location of Thaba JV in comparison to other Sylvania

Platinum assets

Details of the Joint Venture Agreement

The LMC Thaba Chrome Mine is an established open cast chrome

mine on the northern part of the Western Limb of the Bushveld

Complex with approximately two million tons of existing chrome

tailings and an existing Run of Mine ("ROM") chrome beneficiation

plant. LMC has been under voluntary business rescue since late

2020, impacted by COVID-19, lower chrome market prices and illegal

mining activities that have since been fully resolved. The mine is

currently in production and marketing LG6 chrome ore. The mine has

a 30-year mining right which was issued during 2010 for both chrome

and PGMs and all operations will take place under the existing LMC

permits and regulatory approvals.

The Thaba JV will treat a combination of approximately 50,000

tons per month ROM ore and 16,000 tons per month historical chrome

tailings dump material from LMC's Thaba Mine and will produce

approximately 13,000 4E PGM ounces ( 15,500 6E PGM ounces) and

400,000 tons of chromite concentrate per year over the initial 10

years (50% attributable to Sylvania Metals). The addition of 6,500

attributable 4E PGM ounces will increase the Company's estimated

annual production by approximately 9%.

The JV will construct new secondary fine chrome and PGM

beneficiation plants which are anticipated to commence

commissioning within approximately 18 months from 1 September 2023

with first production and sales expected during H2 FY2025. These

beneficiation plants will be similar to those at the Mooinooi

Sylvania Dump Operations in terms of circuit configuration and

technology and therefore the Company is confident it can replicate

its previously established and tested methods and utilise its

expertise to maximise both production and deliver value for all

stakeholders.

The Thaba JV agreement provides for an equal 50% participation

interest for Sylvania Metals and LMC, allowing for a fair

distribution of profits generated from the operations conducted by

the Thaba JV. Both parties will share in the revenue, costs and

ultimately profit generated by the Thaba JV.

The total capital expenditure (inclusive of all engineering

fees, costs, and expenses) required to undertake and complete the

Build Project is provisionally budgeted at ZAR600 million ( $32

million). This will initially be funded by Sylvania Metals from its

existing cash resources and will be spent over the 18-24 months of

the Build Project. Ultimately, the JV partners will contribute

equally to all capital costs except the Upfront Capex, subject to

the final Build Project Budget approved by the JV Board. LMC's 50%

portion of the Upfront Capex will be funded by way of a loan from

Sylvania Metals. The loan will bear interest linked to the South

African Prime Lending rate (currently 11.75%) and will be repaid to

Sylvania Metals in equal quarterly instalments commencing on the

first anniversary of the commissioning of the PGM and chrome

plants. Repayments will be made from LMC's attributable profits of

the JV, and any shortfall will be funded by LMC. In case of an

Event of Default, Sylvania has the right to demand immediate

repayment or claim specific performance from LMC.

The loan advanced to LMC will be secured by means of a Special

Notarial Bond to be registered over the existing two million tons

chrome tailings resources. Additionally, Sylvania Metals shall, on

a revolving credit basis at a similar interest rate, fund the

approximate $5 million working capital and operating expenditure

requirements, together with all other business and operational

costs, of the JV in compliance with the relevant approved budget

and any applicable capital expenditure programmes for a maximum

period of 24 months if required.

LMC will perform all mining activities and will supply both ROM

ore and chrome tailings material to the JV according to a Material

Supply Agreement, while Sylvania Metals is appointed as the JV

Manager and will operate the chrome and PGM plants under a

Management Services Agreement. Marketing of the chromite

concentrate and PGMs will be undertaken by the JV partners and

profits shared equally. The Thaba JV will comprise a Board made up

of an equal number of representatives from each JV partner. While

the initial agreed duration of the JV Agreement is 10 years from

the date of first production, the parties could negotiate in good

faith to further extend the term to benefit from the remaining life

of the Thaba Chrome Mine.

Inside information

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) no.596/2014 as amended by the

Market Abuse (Amendment) (EU Exit) Regulations 2019. For the

purposes of MAR and Article 2 of Commission Implementing Regulation

(EU) 2016/1055, this announcement is being made on behalf of the

Company by Jaco Prinsloo.

CONTACT DETAILS

For further information, please

contact:

Jaco Prinsloo CEO

Lewanne Carminati CFO +27 11 673 1171

Nominated Adviser and Broker

Liberum Capital Limited +44 (0) 20 3100 2000

Richard Crawley / Scott Mathieson

/ Kane Collings

Communications

BlytheRay +44 (0) 20 7138 3205

Tim Blythe / Megan Ray sylvania@BlytheRay.com

CORPORATE INFORMATION

Registered and postal address: Sylvania Platinum Limited

Clarendon House

2 Church Street

Hamilton HM 11

Bermuda

SA Operations postal address: PO Box 976

Florida Hills, 1716

South Africa

Sylvania Website : www.sylvaniaplatinum.com

About Sylvania Platinum Limited

Sylvania Platinum is a lower-cost producer of platinum group

metals (PGM) (platinum, palladium and rhodium) with operations

located in South Africa. The Sylvania Dump Operations (SDO)

comprises six chrome beneficiation and PGM processing plants

focusing on the retreatment of PGM-rich chrome tailings materials

from mines in the Bushveld Igneous Complex. The SDO is the largest

PGM producer from chrome tailings re-treatment in the industry. The

Group also holds mining rights for PGM projects in the Northern

Limb of the Bushveld Complex.

For more information visit https://www.sylvaniaplatinum.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

JVEMZGGRKLNGFZG

(END) Dow Jones Newswires

August 09, 2023 02:00 ET (06:00 GMT)

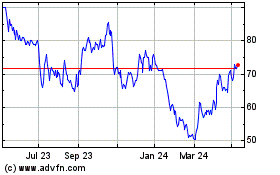

Sylvania Platinum (LSE:SLP)

Historical Stock Chart

From Apr 2024 to May 2024

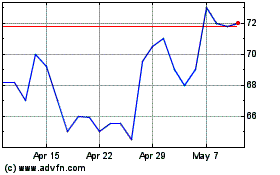

Sylvania Platinum (LSE:SLP)

Historical Stock Chart

From May 2023 to May 2024