TIDMSUH

RNS Number : 9120J

Sutton Harbour Group PLC

16 December 2022

16 December 2022

Sutton Harbour Group plc

("Sutton Harbour" or "the Company")

Sutton Harbour Group plc, the AIM-listed marine and waterfront

regeneration specialist, announces its interim results for the

six-month period to 30 September 2022.

Financial Highlights

-- Profit before taxation GBP0.223m (6 months to 30 September 2021: GBP0.327m)

-- Gross assets GBP91.615m (31 March 2022: GBP89.332m) following

investment of GBP2.524m into property projects

-- Net assets GBP56.434m (31 March 2022: GBP56.211m)

-- Net assets per share 43.42p (31 March 2022: 43.26p)

-- Net debt GBP26.972m (31 March 2022: GBP24.408m)

-- Gearing 47.8% (31 March 2022: 43.4%)

Company Highlights

-- Record summer marinas season and strong parking results

-- Significant investment into two strategic projects at Sutton Harbour during first half year

-- Old Barbican (fish) Market refurbishment and two new lettings completed

-- Harbour Arch Quay on target for Spring 2023 completion with exchanges on four apartments

-- Strategic vision for delivery of new developments to realise

growth and longer-term sustainability of the core Harbour asset

Philip Beinhaker, Executive Chairman, commented:

"The Company's vision for the future sustainability and value

growth from the Sutton Harbour and Barbican area is taking shape

and good progress has been made on delivery of our strategy in the

current financial year to date. Reinvigorating the Barbican side of

the Harbour, which is most popular with visitors, has been the

visually remarkable refurbishment of the Victorian landmark Old

Barbican Market building, adding to the appeal of the area with two

new national covenant tenants and a third to complete shortly; the

Company has plans to deliver a new Fisheries Complex in

collaboration with the Local Authority to assure the vibrancy of

the commercial fishing port activity; the Company is nearing

completion of the first new building (Harbour Arch Quay) since

2009; and, this re-initiated development activity will continue

with a programme to develop new property on the eastern side of the

Harbour, which includes the consented Sugar Quay building. This is

a wholistic plan to support value creation for shareholders from

the existing Company-owned harbour assets and to assure prosperity

of the harbour environ, strengthen the linkages to the City Centre

to the North and the Ocean to the South, and to benefit our trading

activities (marinas, fisheries, rental properties and car parks)

for the medium to long term. The Company has committed significant

investment to its plans during this reporting period. The pace of

future investment will be harmonised with economic conditions as

they take shape."

For further information, please contact:

Sutton Harbour Group plc +44 (0) 1752 20 4186 Philip Beinhaker, Executive Chairman

Corey Beinhaker, Chief Operating Officer

Natasha Gadsdon, Finance Director

Strand Hanson Limited +44 (0) 20 7409 3494 James Dance

(Nominated and Financial Adviser and Broker) Richard Johnson

Related Party Transaction

On 15 December 2022 the Company extended the existing related

party loan finance, announced on 27 April 2022, by GBP280,000 to

provide additional headroom in the Company's facilities, bringing

the total shareholder loan facilities to GBP2.580m. The unsecured

loan facilities are with Beinhaker Design Services Ltd ("BDSL")

(assigned from FB Investors LLP), who provided the additional

funding, and Rotolok (Holdings) Limited (together the "Loans" or

the "Facilities"). The Loans carry a fixed 8% gross annual interest

rate with the option, included as a variation at the same time as

the above extension, at the discretion of the Company, to

capitalise some or all of the interest at a fixed 10% annual

interest rate, and are repayable by 31 May 2024. There are no other

fees payable to FB Investors LLP and Rotolok (Holdings) Limited

under the Facilities.

The Loans extension and variation constitutes a related party

transaction for the purposes of the AIM Rules, as Beinhaker Design

Services Ltd is controlled by the Beinhaker family and Rotolok

(Holdings) Limited is connected to non-executive director Sean

Swales. The directors, other than Philip Beinhaker, Corey Beinhaker

and Sean Swales, having consulted with the Company's nominated

adviser, Strand Hanson, consider that the terms of the Loans

extension and variation are fair and reasonable insofar as

shareholders are concerned.

INTERIMS RESULTS

Executive Chairman's Statement

For the six-month period to 30 September 2022

Results and Financial position

Profit before taxation for the six-month period to 30 September

2022 was GBP0.223m compared to GBP0.327m for the comparative period

to 30 September 2021. Trading through the first half year was

strong, with yet another record marinas season, good seasonal car

parks trading, and occupancy of the rented properties upheld.

Against these positive results, cost inflation and increases in the

interest rates on the corporate debt have resulted in the modest

decline in profitability. Energy cost increases did not impact the

results until after the end of this reporting period.

As at 30 September 2022, net assets were GBP56.434m (c.43.43

pence per share), up from GBP56.211m (c.43.26 pence per share) at

31 March 2022. Net Debt has increased to GBP26.972m, GBP2.564m more

than the position at 31 March 2022 of GBP24.408m net debt. This

increase was fully anticipated as the Company drew down for

financing its portion of development finance for construction of

Harbour Arch Quay and financed wholly the major refurbishment of

the Old Barbican (fish) Market. These investments increase the

value of the Company's assets and prospects for debt reduction once

construction is completed. As is normal within the Company's annual

cash cycle, the cash position typically peaks in late March as

marina fees are collected and rents are received and falls to an

annual low point by mid-autumn. As at 30 September 2022 gearing

stood at 47.8% up from 43.4% as at 31 March 2022.

Trading Report

During the first half year, the marinas were mostly occupied to

capacity with the occupancy rate as at 30 September 2022 at 98%.

The Company sets its prices 6 months in advance of the season and

whilst the tariff had been increased after a two year freeze, the

increase was below the inflation rate that transpired, and this did

result in a lower profit from this business activity than the

previous year. Fishing results were on par with last year, albeit

to remain competitive in the local market, and to encourage growth

in the fishing business, margins on fuel sales have been reduced.

Overall, contribution from the Marine trading segment was GBP0.681m

in the six month period to 30 September 2022 (30 Sept 2021:

GBP0.726m).

Since the half year end, the Company has started to sell marina

berths for the next season starting 1 April 2023. To date sales are

on par with the same time last year. It is very encouraging that

over half of the berths for the next season have now been paid for

in full, with deposits now being received to secure the remaining

berths. Prices for the King Point Marina have been raised in line

with inflation. Berthing fees at Sutton Harbour are being held to

reflect the upcoming disruption that will result from the

replacement of the lock gate cills. These works are now planned to

take place in two periods: Autumn 2023 and early Spring 2024. The

works will necessitate periods of restricted access to the harbour

which will impact the normal access and egress for both leisure and

commercial harbour users. Preparing for the works has been subject

to stakeholder consultation to explore all practical possibilities

to mitigate the impact on users and the degree of the disruption.

Sutton Lock is a national defence for flood protection and the

works are being undertaken and paid for by the Environment

Agency.

During the period, occupancy of tenanted properties and payment

of rents remained consistent. In the second half of the year

tenants will decant from North Quay House which after 27 years of

continuous occupation requires updating. The Company currently has

various interests for new lettings of the building.

As expected, power costs from 1 October 2022 rose some 3.5 fold

even after allowing for the government subsidy and this will impact

the results for the second half year. The Company is working on any

savings that can be made, whilst ensuring that normal operations

are maintained. The Company recharges a significant proportion of

its power consumption to tenants and other facility users and

prices have been increased to reflect the higher costs. Debt

servicing costs have also risen as bank base rates have increased

throughout the period. The Company has no interest rate fixes in

place.

Development / Regeneration

Harbour Arch Quay

The full height concrete structure of the 14 apartment building,

Harbour Arch Quay, is now in place. External and internal fitting

out works are now starting, and the building is on target for

completion in March/April 2023. Four exchanges for apartments have

now taken place with three further reservations, including the

penthouse, progressing to exchange. Development financing for the

completion of the building is being drawn down from a GBP5m

facility now that the Company has made its agreed contributions

from its general banking facilities.

Former Fish Market

The recently refurbished Old Barbican (fish) Market is now

occupied by one tenant, The Cornish Bakery, with Pavers (shoes) due

to open shortly and the tenancy for the third unit is pending

completion. The refurbishment of this listed property provides a

resplendent centre piece to the historic Barbican area and presents

as a 'floating glass box' whilst retaining the original elegant

Victorian structure. Total rents for the building will be more than

50% higher than with the previous tenancy.

Development Lands

The Former Airport Site is a major land resource and strategic

asset of the Company within the City of Plymouth. The Company had

invested heavily in the site during the time that the airport was

operational along with investments in the owned airline company.

Financial failure of the aviation operations led to closure of the

airport in 2011, a decision ratified by the Local Authority, and

revocation of aviation operations licences by the Civil Aviation

Authority. The Company has financed the debt resulting from the

aviation operations for over a decade and, in addition, the Company

faithfully expended funds for the maintenance and protection of the

site and the material assets, including the land management,

environmental control, security, etc. The approved Joint Local Plan

of 2019 provided for the safeguarding of the site for potential

aviation uses for a maximum five years, owing to the determination

of the strategic importance of the site. Accordingly, the Company

is preparing for submission of a masterplan for the re-development

of the site with a range of appropriate uses within the timeframe

of the safeguard which expires in early 2024. The redevelopment of

the site will enable needed land for expansion of:

-- the Derriford Hospital (major health centre in the South West

and largest employer in Plymouth).

-- Marjon University.

-- Sites for businesses and commercial operations, unable to

find lands within the city, and the bases for economic growth.

-- Senior housing, near to the hospital.

-- Student housing near to the University.

-- Market Housing.

Financial Structure

The Company has a plan to manage the current debt and to achieve

debt reduction. This plan is based on the following sets of

actions:

1. The Company is working with its bankers to extend the current

banking facilities by one year and will then prepare to secure a

longer term agreement to meet medium term financing needs.

2. Development / Regeneration - The Harbour Arch Quay

development at Sutton Harbour is scheduled to be completed in the

first half of 2023 and is expected to yield some GBP3m net of all

extended financing and building costs.

3. To provide additional headroom in the Company's facilities,

the Company has extended the Related Party Loan finance by

GBP280,000, bringing the total shareholder loan creditor to

GBP2.580m. The additional loan was advanced by Beinhaker Design

Services Limited, a 50% shareholder in FB Investors LLP who own

72.91% share capital of the Company. Philip Beinhaker and Corey

Beinhaker, who are both Directors of the Company, are Directors of

Beinhaker Design Services Limited. The Directors of the Company

regarded as independent from the Related Party Loans, agreed this

loan extension was in the best interests of shareholders and the

Company due to funding flexibility and being terms competitive to

market rates for similar short term flexible finance.

4. Realisation of the value of the Former Airport Site through development and sales of lands.

5. Further redevelopment of lands on the east side of Sutton

Harbour. The Company has recently secured lands currently used for

a wide range of construction related supplies and other storage and

land extensively used with limited employment. These lands have

been identified by the Plymouth City Council as a regeneration area

for a mixture of uses including housing, commercial, business

activity and other societal activities. Following the completion of

the Harbour Arch Quay, the Company will proceed with development of

these industrial lands, including the development of the approved

Sugar Quay site, along with lands east of Sutton Road.

6. Fish Quay - The Company has worked with the PCC, the Fishing

Industry and other interested parties for the redevelopment of the

Fish Quay. This redevelopment will provide an enhancement to the

Fishing industry with renewed and more efficient operations

facilities. Also included will be a new retail fish market open to

the general public. Enhanced circulation in this south-east sector

of the Sutton Harbour area will become a major destination and

attraction for residents and visitors to Plymouth. This project

will be part of the vision of Plymouth as "Port City" and enhance

the connection between the water and the City Centre in Britain's

Ocean City.

Summary

The Company's vision for the future sustainability and value

growth from the Sutton Harbour and Barbican area is taking shape

and good progress has been made on delivery of our strategy in the

current financial year to date. Reinvigorating the Barbican side of

the Harbour, which is most popular with visitors, has been the

visually remarkable refurbishment of the Victorian landmark Old

Barbican Market building, adding to the appeal of the area with two

new national covenant tenants and a third to complete shortly; the

Company has plans to deliver a new Fisheries Complex in

collaboration with the Local Authority to assure the vibrancy of

the commercial fishing port activity; the Company is nearing

completion of the first new building (Harbour Arch Quay) since

2009; and, this re-initiated development activity will continue

with a programme to develop new property on the eastern side of the

Harbour, which includes the consented Sugar Quay building. This is

a wholistic plan to support value creation for shareholders from

the existing Company-owned harbour assets and to assure prosperity

of the harbour environ, strengthen the linkages to the City Centre

to the North and the Ocean to the South, and to benefit our trading

activities (marinas, fisheries, rental properties and car parks)

for the medium to long term. The Company has committed significant

investment to its plans during this reporting period. The pace of

future investment will be harmonised with economic conditions as

they take shape.

Philip Beinhaker

EXECUTIVE CHAIRMAN

Consolidated Statement of Comprehensive Income

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------- -------------- -----------

Revenue 4,420 3,845 7,194

Cost of Sales (3,005) (2,436) (4,846)

Gross Profit 1,415 1,409 2,348

--------------- -------------- -----------

Fair value adjustment on fixed assets

and investment property - - 195

Administrative expenses (729) (731) (1,193)

Operating profit from continuing

operations 686 678 1,350

Financial income

Financial expense (463) (351) (789)

Net financing costs (463) (351) (789)

Profit before tax from continuing

operations 223 327 561

Taxation credit on profit from continuing

operations - (62) (820)

Profit from continuing operations 223 265 (259)

=============== ============== ===========

Basic profit/earnings per share 0.17p 0.22p (0.20p)

Diluted profit/earnings per share 0.17p 0.22p (0.20p)

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------- -------------- -----------

Profit from continuing operations 223 265 (259)

Other comprehensive income/(expenses)

Continuing operations:

Revaluation of property, plant and

equipment - - 7,016

Deferred taxation on income and expenses

recognised directly in the consolidated

statement of comprehensive income (1,116)

Effective portion of changes in fair - - -

value of cash flow hedges

Total other comprehensive income - - 5,900

--------------- -------------- -----------

Total comprehensive income for the

period attributable to equity shareholders 223 265 5,641

=============== ============== ===========

Consolidated Balance Sheet

As at As at As at

30 September 30 September 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------- -------------- -----------

Non-current assets

Property, plant and equipment 36,224 29,680 36,398

Investment property 18,857 17,622 18,195

Inventories 13,249 13,151 13,216

--------------- -------------- -----------

68,330 60,453 67,809

--------------- -------------- -----------

Current assets

Inventories 20,779 17,372 18,734

Trade and other receivables 1,515 1,846 1,810

Cash and cash equivalents 991 528 970

Tax recoverable - - 9

--------------- -------------- -----------

23,285 19,746 21,523

--------------- -------------- -----------

Total assets 91,615 80,199 89,332

--------------- -------------- -----------

Current liabilities

Other Loans 3,355 - 2,275

Trade and other payables 2,361 1,118 1,880

Finance lease liabilities 40 48 165

Deferred income 1,219 1,111 2,225

Provisions - - -

6,975 2,277 6,545

--------------- -------------- -----------

Non-current liabilities

Other interest-bearing loans and

borrowings 24,450 25,175 22,863

Finance lease liabilities 118 210 75

Deferred government grants 646 646 646

Deferred tax liabilities 2,992 1,056 2,992

Provisions - - -

28,206 27,087 26,576

--------------- -------------- -----------

Total liabilities 35,181 29,364 33,121

--------------- -------------- -----------

Net assets 56,434 50,835 56,211

=============== ============== ===========

Issued capital and reserves attributable

to owners of the parent

Share capital 16,406 16,406 16,406

Share premium 13,972 13,972 13,972

Other reserves 22,180 16,280 22,180

Retained earnings 3,876 4,177 3,653

--------------- -------------- -----------

Total equity 56,434 50,835 56,211

=============== ============== ===========

Consolidated Statement of Changes in Equity

Share Share Revaluation Merger Hedging Retained TOTAL

capital premium reserve reserve reserve earnings

----------Other Reserves----------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------- -------- ------------ -------- -------- --------- --------

Balance at 1 April 2022 16,406 13,972 18,309 3,871 - 3,653 56,211

Comprehensive

income/(expense)

Issue of Shares - - - - - 223 223

Profit for the period

Total comprehensive

income/(expense)

6 month period ended

30 September 2022 - - - - - 223 223

-------- -------- ------------ -------- -------- --------- --------

Balance at 30 September

2022 16,406 13,972 18,309 3,871 - 3,876 56,434

-------- -------- ------------ -------- -------- --------- --------

Balance at 1 April 2021 16,266 10,695 12,409 3,871 - 3,912 47,153

Comprehensive

income/(expense)

Issue of Shares 140 3,277 3,417

Profit for the period - - - - - 265 265

Total comprehensive

income/(expense)

6 month period ended

30 September 2021 140 3,277 - - - 265 3,682

-------- -------- ------------ -------- -------- --------- --------

Balance at 30 September

2021 16,406 13,972 12,409 3,871 - 4,177 50,835

-------- -------- ------------ -------- -------- --------- --------

Balance at 1 October

2021 16,406 13,972 12,409 3,871 - 4,177 50,835

Comprehensive

income/(expense)

Profit for the period - - - - - (524) (524)

Other comprehensive

income/(expense)

Revaluation of

property,

plant and equipment - - 5,900 - - - 5,900

Total comprehensive

income/(expense)

6 month period ended

31 March 2022 - - 5,900 - - (524) 5,376

-------- -------- ------------ -------- -------- --------- --------

Balance at 31 March

2022 16,406 13,972 18,309 3,871 - 3,653 56,211

-------- -------- ------------ -------- -------- --------- --------

Consolidated Cash Flow Statement

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

---- --------------- -------------- -----------

Cash generated from total operating

activities (1,321) (1,236) 59

--------------- -------------- -----------

Cash flows from investing activities

Net expenditure on investment

property (662) (12) (52)

Expenditure on property, plant

and equipment (24) (109) (196)

Proceeds from sale of plant

and equipment - 260 262

--------------- -------------- -----------

Net cash used in investing

activities (686) 139 14

--------------- -------------- -----------

Cash flows from financing activities

Proceeds from sale of shares - 3,500 3,500

Expenses of share issuance - (83) (83)

Interest paid (557) (351) (1,033)

Loan drawdowns/(repayment of

borrowings) 2,667 (2,300) (2,337)

Net finance lease (payments)/receipts (82) (69) (78)

Net cash generated from financing

activities 2,028 697 (31)

--------------- -------------- -----------

Net increase/(decrease) in cash

and cash equivalents 21 (400) 42

Cash and cash equivalents at

beginning of period 970 928 928

Cash and cash equivalents at

end of period 991 528 970

=============== ============== ===========

Notes to Interim Report

General information

This consolidated interim financial information does not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

March 2022 were approved by the Board of Directors on 19 July 2022

and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified and did not contain any

statement under section 498 of the Companies Act 2006.

Copies of the Group's financial statements are available from

the Company's registered office, Sutton Harbour Office, Guy's Quay,

Sutton Harbour, Plymouth, PL4 0ES and on the Company's website

www.sutton-harbour.co.uk.

This consolidated interim financial information has not been

audited.

Basis of preparation

The consolidated interim financial information should be read in

conjunction with the annual financial statements for the year ended

31 March 2022, which have been prepared in accordance with

International Financial Reporting Standards (IFRS) and

International Financial Reporting Interpretation Committee (IFRIC)

interpretations as endorsed by the European Union, and those parts

of the Companies Acts 2006 as applicable to companies reporting

under IFRS.

Accounting policies

Except as described below, the accounting policies applied are

consistent with those of the annual financial statements for the

year ended 31 March 2022, as described in those annual financial

statements.

Accounting estimates and judgements

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income and expenses. The estimates and

associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgements that are not readily apparent from other sources. Actual

results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised, if the revision

affects only that period, or in the period of the revision and

future periods, if the revision affects both current and future

periods.

Segment information

Management has determined the operating segments based on the

reports reviewed by the Board of Directors that are used to make

strategic decisions.

The Board of Directors considers the business from an

operational perspective as having only one geographical segment,

with all operations being carried out in the United Kingdom.

The Board of Directors considers the performance of the

operating segments using operating profit. The segment information

provided to the Board of Directors for the reportable segments for

the period ended 30 September 2022 is as follows:

6 months to 30 Real

September 2022 Marine Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

------- -------- ------------ ------------- -------

Revenue 3,358 644 418 - 4,420

Gross profit prior

to non-recurring

items 681 480 254 - 1,415

Segmental Operating

Profit before

Fair value adjustment

and unallocated

expenses - - - - -

Fair value adjustment

on fixed assets

and investment

property assets

Unallocated:

Administrative

expenses (729)

Operating profit

from continuing

operations 686

Financial income

Financial expense (463)

-------

Profit before

tax from continuing

operations

Taxation -

-------

Profit for the

year from continuing

operations 223

=======

Depreciation

charge

Marine 172

Car Parking 10

Administration 16

-------

198

=======

Segment Information (continued)

6 months to

30 September Real

2021 Marine Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

------- -------- ------------ ------------- -------

Revenue 2,648 776 421 - 3,845

Gross profit

prior to non-recurring

items 726 559 235 (111) 1,409

Segmental Operating

Profit before

Fair value adjustment

and unallocated

expenses 726 559 235 (111) 1,409

Fair value adjustment

on fixed assets

and investment

property assets - - - - -

Unallocated:

Administrative

expenses (731)

Operating profit

from continuing

operations 678

Financial income

Financial expense (351)

-------

Loss before

tax from continuing

operations 327

Taxation (62)

-------

Loss for the

year from continuing

operations 265

=======

Depreciation

charge

Marine 171

Car Parking 9

Administration 13

-------

193

=======

Segment Information (continued)

Year ended Real

31 March 2022 Marine Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

------- -------- ------------ ------------- --------

Revenue 4,771 1,427 736 260 7,194

Segmental Operating

Profit before

Fair value adjustment

and unallocated

expenses 1,199 922 389 (162) 2,348

Fair value adjustment

on fixed assets

and investment

property assets (185) 380 - - 195

Unallocated:

Administrative

expenses (1,193)

Operating profit

from continuing

operations 1,350

Financial income

Financial expense (789)

--------

Profit before

tax from continuing

operations 561

Taxation (820)

--------

Profit for the

year from continuing

operations (259)

========

Depreciation

charge

Marine 335

Car Parking 40

Administration 17

--------

392

========

30 September 30 September 31 March

2022 2021 2022

GBP000 GBP000 GBP000

Segment assets:

Marine 30,747 25,565 31,068

Real estate 19,243 18,740 18,628

Car Parking 6,382 4,954 6,428

Regeneration 33,998 30,029 31,936

Total segment assets 90,370 79,288 88,060

Unallocated assets:

Property, plant and equipment 44 77 61

Trade & other receivables 211 306 241

Cash & cash equivalents 991 528 970

Total assets 91,616 80,199 89,332

============= ============= =========

Segment Information (continued)

30 September 30 September 31 March

2022 2021 2022

GBP000 GBP000 GBP000

Segment liabilities:

Marine 1,710 1,312 2,622

Real estate 724 429 464

Car Parking 92 93 132

Regeneration 1,284 823 1,234

------------- ------------- ---------

Total segment liabilities 3,810 2,657 4,452

Unallocated liabilities:

Bank overdraft & borrowings 27,963 25,433 25,378

Trade & other payables 415 154 296

Financial Derivatives - - -

Tax payable 1 62 1

Deferred tax liabilities 2,992 1,058 2,994

------------- ------------- ---------

Total liabilities 35,181 29,364 33,121

============= ============= =========

Unallocated assets included in total assets and unallocated

liabilities included in total liabilities are not split between

segments as these items are centrally managed.

Taxation

The Company has applied an effective tax rate of 25% (2021: 19%)

based on management's best estimate of the tax rate expected for

the full financial year and is reflected in a movement in deferred

tax.

Dividends

The Board of Directors do not propose an interim dividend (2021:

nil).

Earnings per share

6 months 6 months Year Ended

to to

30 September 30 September 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

pence pence pence

--------------- -------------- -----------

Continuing operations

Basic earnings per share 0.17p 0.22p (0.20p)

Diluted earnings per share* 0.17p 0.22p (0.20p)

Basic Earnings per Share:

Basic earnings per share have been calculated using the profit

for the period of GBP223,000 (2021: profit GBP265,000, year ended

31 March 2022 loss GBP259,000). The average number of ordinary

shares in issue, excluding those options granted under the SAYE

scheme, of 129,944,071 (2021: 120,534,234; year ended 31 March

2022: 120,534,234) has been used in our calculation.

Diluted Earnings per Share:

Diluted earnings per share uses a weighted average number of

130,182,043 (2021: 120,765,411; year ended 31 March 2022

120,765,411) ordinary shares after adjusting for the effects of

share options in issue: 237,972 ordinary shares (2021: 242,063; 31

March 2022: 242,063)

Property valuation

Freehold land and buildings and investment property have been

independently valued by Jones Lang LaSalle as at 31 March 2022, in

accordance with the Practice Statements in the Valuations Standards

(The Red Book) published by the Royal Institution of Chartered

Surveyors.

A further valuation will be commissioned for the year ending 31

March 2023, as in previous years.

Cash and cash equivalents

As at As at As at

30 September 30 September 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

-------------- ------------- ----------

Cash and cash equivalents per

balance sheet and cash flow

statement 991 528 970

============== ============= ==========

Cash flow statements

6 months to 6 months to Year Ended

30 September 30 September 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------- -------------- -----------

Cash flows from operating

activities

Profit/(loss) for the period 223 265 (259)

Adjustments for:

Taxation - - 820

Financial income - - -

Financial expense 463 351 789

Fair value adjustment on fixed

assets and investment property - - (195)

Depreciation 198 193 392

Amortisation of grants - - (9)

Profit/loss on sale of property,

plant and equipment - (24) (29)

Cash generated from operations

before changes in working

capital and provisions 884 785 1,509

Increase in inventories (1,862) (1,202) (2,629)

Transfer from Inventories

to Investment property - - 93

Decrease/(increase) in trade

and other receivables 304 556 586

(Decrease)/increase in trade

and other payables 359 (612) 150

Decrease in deferred income (1,006) (708) 406

(Decrease)/increase in provisions (56) (56)

Cash generated from operations (1,321) (1,237) 59

=============== ============== ===========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFUFWIEESELE

(END) Dow Jones Newswires

December 16, 2022 02:00 ET (07:00 GMT)

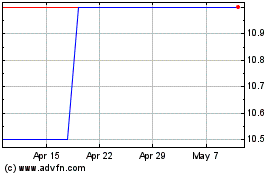

Sutton Harbour (LSE:SUH)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sutton Harbour (LSE:SUH)

Historical Stock Chart

From Jan 2024 to Jan 2025