TIDMTIDE

RNS Number : 4157N

Crimson Tide PLC

25 September 2023

25 September 2023

Crimson Tide plc

Interim results for the six months ended 30 June 2023

Crimson Tide plc ("Crimson Tide" or "the Company"), the provider

of the mpro5 solution is pleased to announce its unaudited interim

results for the six months ended 30 June 2023.

Financial headlines

-- Revenue increase of 30.9% to GBP3.0m (H1 2022: GBP2.3m)

-- Annual recurring revenue (ARR) increase of 35.1% to GBP5.9m (H1 2022: GBP4.4m)

-- Gross margin of 84.3% (H1 2022: 84.5%)

-- EBITDA profit of GBP0.1m (H1 2022: loss of GBP0.3m)

Operational highlights

-- Consistent growth in core recurring revenue

-- Resilient and high gross margins

-- Return to EBITDA profitability

-- Continued investment in product development and US

-- Substantial progress on partnership strategy

Barrie Whipp, Founder and Chairman, commented,

"Progress in the first half of the year has been positive. We

have experienced strong revenue growth, and we have returned to

EBITDA profitability as planned. Annual Recurring Revenue has

increased significantly, and our pipeline has some very exciting

opportunities. "

About the Company

mpro5 from Crimson Tide is a leading B2B app which facilitates

enhanced compliance, auditing and processes in any industry.

Enquiries:

Crimson Tide plc

Barrie Whipp / Jacqueline Daniell +44 1892 542444

finnCap Ltd (Nominated Adviser and Broker)

Corporate Finance: Julian Blunt / James

Thompson +44 20 7220 0500

Corporate Broking: Andrew Burdis

Alma PR (Financial PR)

Josh Royston +44 7780 901979

Chairman's Statement

The first half of the year has demonstrated very good progress.

Revenue and ARR growth both exceeded 30%, and our cash balance

remains healthy. These metrics were achieved in the light of an

enterprise customer going into administration, which will temper

our second-half growth; however, we still expect to achieve circa

20%. As planned, we have returned to profitability at the EBITDA

level following our growth investment phase, and we retain a

healthy cash balance, with no debt. Our gross margin remains

robust.

Notable revenue increases included a significant Internet of

Things ("IoT") implementation for an NHS Trust, while further

revenue has come from our 'land and expand' strategy. IoT is a

major focus area; we have sensor-driven opportunities in the public

and private sectors as well as in the US.

This period has been significant in terms of the mpro5 product.

Our Saturn release is ready to ship to our largest clients and

represents a significant upgrade in our core technologies. This

significant upgrade to a single repository codebase, using the

latest Ionic framework, is expected to match our previous

platform's technology longevity (five years). The second half will

see further rollouts of Saturn and the development of our project

to implement a new version of our automation technology. With the

focus on mpro5 and its strong growth, we have deprioritised

development and marketing of the Beepro app. We will target a new

B2C focused app, incorporating our other individual user apps at a

later date, however we have prudently removed Beepro figures from

our forecasts for the time being. We intend to undertake a

consolidation of our share capital in the coming months, as our

business should benefit from a more representative profile and

lower bid-offer spread.

We have strengthened our Executive team by appointing a new

Chief Marketing Officer and Chief Operating Officer, and their

focus is on continuing to optimise our processes and enhance our

partner marketing strategy. Our pipeline is strong. We have

returned, as planned, to operating Profit, and with a strengthened

management team, we look forward to the future with confidence.

Barrie Whipp

Founder and Chairman

25 September 2023

Chief Executive's Statement

Crimson Tide's performance during the first half of 2023

signalled the beginning of our enterprising scaling plans. The

unparalleled growth in revenue during the period has been the early

result of investment in more targeted marketing and sales

approaches, the organisation of an engaged and customer-focused

team and our continued technology roadmap implementation.

Capital expenditure on our mobile platform has continued through

the first half of this year, and the new mobile product is being

rolled out across our customers, with the first customers currently

going live. Initial feedback from users has been overwhelmingly

positive, and we believe the new platform represents a

world-leading mobile workflow experience. This fresh and

contemporary mobile application suite has provided a step change in

the quality and power of the user experience available to our

customers.

Investment in the product to date has been transformative in how

we develop the platform going forward, increasing the velocity and

scope for new features. In the second half of the year, we will be

focusing on the automation part of the product and will be making a

similar paradigm shift, transforming both the software, service and

operational sides of the business and how customers are able to use

more of mpro5's powerful features.

Because of external market conditions, Beepro development and

marketing was paused. In addition, there has been some natural

churn of smaller historic contracts where businesses have been

unable to grow. Because of these factors our focus will be on

profitability, emphasising and prioritising customer success. The

successful development of the partner ecosystem, initiated in the

US and now being implemented throughout the organisation will mean

revenue can continue to grow.

Jacqueline Daniell

Group CEO

25 September 2022

Financial Review

Financial indicator Six months Six months Year

ended 30 ended 30 ended

June 2023 June 2022 31 December

GBP'000 GBP'000 2022

GBP'000

Revenue 3,043 2,324 5,351

----------- ----------- -------------

Gross Profit 2,566 1,964 4,468

----------- ----------- -------------

EBITDA 106 (344) (406)

----------- ----------- -------------

(Loss)/Profit before tax (471) (860) (1,688)

----------- ----------- -------------

Annual recurring revenue

(ARR) 5,900 4,368 5,750

----------- ----------- -------------

Cash 2,865 3,731 3,618

----------- ----------- -------------

Churn rate 5.5% 1.0% 3.8%

----------- ----------- -------------

Revenue

Revenue increased by 30.9% compared to the corresponding period

of 2022, while Annual Recurring Revenue (ARR) increased by 35.1% to

GBP5.9m. Contracted long-term revenue exceeded 90% of total revenue

and revenue churn was 5.5%. MRR per customer has increased,

reflecting our focus on higher value customers. The geographic

split of revenue remains consistent with the prior year, with a UK

weighting of 92% of revenue (H1 2022: 91%).

Cashflow and liquidity

Cash at the period-end was GBP2.9m (H1 2022: GBP3.7m). Operating

cash flows before movements in working capital for the period was

an inflow of GBP28k (H1 2022: GBP813k outflow). The inflow relates

to efficient use of working capital underpinned by strong operating

cashflow.

Lease liabilities

The Company entered into a new office lease agreement at the

beginning of 2022. The lease liability is currently valued at

GBP871k (H1 2022: GBP883k) and the related Right-of-Use asset

recognised under IFRS16. The lease liability will be settled, and

the related asset depreciated, over a 5-year period.

Intangible assets

Software development costs of GBP501k (H1 2022: GBP771k) were

capitalised during the period under review, while amortisation

amounted to GBP260k (H1 2022: GBP203k). H1 2022 marked significant

investment in the Beepro platform which is on pause. The value of

the capitalised software intangible asset at period-end was GBP3.0m

(H1 2022: GBP2.8m). Other intangible assets related to goodwill,

website development costs and incremental contract costs. We

continue to invest in the core mpro5 product with some exciting

enhancements planned for H2.

Loss before taxation

The Company made a loss before taxation of GBP512k (H1: 2022

GBP860k loss). The loss was in line with management expectations

and arose due to the additional amortisation associated with

increased investment in the software platform.

Earnings per share

Basic and diluted loss per share was 0.07p (H1 2022: 0.13p loss

per share) during the period under review. 15.1 million share

options outstanding were not included in the calculation of diluted

earnings per share because they are anti-dilutive in terms of IAS

33.

Crimson Tide plc

Condensed Consolidated Statement of Profit or Loss

for the 6 months to 30 June 2023

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2023 2022 2022

GBP000 GBP000 GBP000

Revenue 3,043 2,324 5,351

Cost of Sales (477) (360) (883)

Gross Profit 2,566 1,964 4,468

Other income (8) 5 -

Operating expenses (2,452) (2,313) (4,887)

---------- ----------- -----------

Operating (loss)/profit 106 (344) (419)

Finance costs (38) (21) (54)

Depreciation (168) (194) (261)

Amortisation (371) (301) (954)

(Loss)/Profit before taxation (471) (860) (1,688)

Taxation 200 - 445

---------- ----------- -----------

(Loss)/Profit for the period attributable

to equity holders of the parent (271) (860) (1,243)

========== =========== ===========

(Loss)/Earnings per share Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2023 2022 2022

Basic (pence) (0.07) (0.13) (0.19)

Diluted (pence) (0.07) (0.13) (0.19)

Condensed Consolidated Statement of Comprehensive Income

for the 6 months to 30 June 2023

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2023 2022 2022

GBP000 GBP000 GBP000

(Loss)/Profit for the period (271) (860) (1,243)

Other comprehensive income/(loss)

for period:

Exchange differences on translating

foreign operations (18) (14) (39)

Total comprehensive (loss)/Profit

recognised in the period and attributable

to equity holders of parent (289) (874) (1,282)

========== ========== ===========

Condensed Consolidated Statement of Financial Position at 30

June 2023

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

ASSETS

Non-current assets

Intangible assets 4,072 3,928 3,812

Property, plant & equipment 263 260 264

Right-of-use asset 740 795 703

Total non-current assets 5,075 4,983 4,779

---------- ----------- -------------

Current assets

Trade and other receivables 2,102 1,406 1,646

Cash and cash equivalents 2,865 3,731 3,618

---------- ----------- -------------

Total current assets 4,967 5,137 5,264

---------- ----------- -------------

Total assets 10,042 10,120 10,043

---------- ----------- -------------

LIABILITIES

Current liabilities

Trade and other payables 1,669 1,071 1,460

Borrowings - 1 -

Lease liabilities 194 136 170

---------- ----------- -------------

Total current liabilities 1,863 1,208 1,630

---------- ----------- -------------

Non-current liabilities

Lease liabilities 677 749 607

---------- ----------- -------------

Total non-current liabilities 677 749 -

Total liabilities 2,540 1,957 2,237

---------- ----------- -------------

Net assets 7,502 8,163 7,806

---------- ----------- -------------

EQUITY

Share capital 657 657 657

Share premium 5,590 5,590 5,590

Other reserves 460 467 493

Reverse acquisition reserve (5,244) (5,244) (5,244)

Retained earnings 6,039 6,693 6,310

---------- ----------- -------------

Total equity 7,502 8,163 7,806

---------- ----------- -------------

Condensed Consolidated Statement of Changes in Equity

Six-month period ended 30 June 2023 (Unaudited)

Reverse

acquisi-tion

Share Share Other reserve Retained

capital premium reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 31

December 2022 657 5,590 493 (5,244) 6,310 7,806

Loss for the

period - - - - (271) (271)

Cancelled share

options (43) (43)

Share options

expense - - 28 - - 28

Translation

movement - - (18) - - (18)

Balance at

30 June 2023 657 5,590 460 (5,244) 6,039 7,502

Six-month period ended 30 June 2022 (Unaudited)

Reverse

acquisi-tion

Share Share Other reserve Retained

capital premium reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 31

December 2021 657 5,590 481 (5,244) 7,553 9,037

Loss for the

period - - - - (860) (860)

Translation

movement - - (14) - - (14)

Balance at

30 June 2022 657 5,590 467 (5,244) 6,693 8,163

Condensed Consolidated Statement of Changes in Equity

Year ended 31 December 2022 (Audited)

Reverse

acquisi-tion

Share Share Other reserve Retained

capital premium reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1

January 2022 657 5,590 481 (5,244) 7,553 9.037

Loss for the

period - - - - (1,243) (1,243)

Share options

expense - - 51 - - 51

Translation movement - - (39) - - (39)

Balance at

31 December

2022 657 5,590 493 (5,244) 6,310 7,806

Condensed Consolidated Statement of Cash flows

For the 6 months to 30 June 2023

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

Cash flows from operating activities

Loss before tax (471) (860) (1,688)

Adjustments for:

Amortisation of Intangible Assets 371 301 954

Depreciation of property, plant and

equipment 35 103 149

Depreciation of right-of-use assets 133 91 112

Unrealised currency translation movement (18) (14) (39)

Interest Paid 38 3 54

Cancelled share options (43) - -

Share option expense 28 - 51

--------- ---------- ------------

Operating cash flows before movement

in working capital and provisions 73 (376) (407)

Decrease in inventories - - -

Increase in trade and other receivables

* (256) (327) (567)

Increase/(Decrease) in trade and

other payables 209 (89) 300

--------- ---------- ------------

Cash generated/(utilised) by operations 26 (792) (674)

Finance costs 2 (21) (54)

Income taxes received - - 445

--------- ---------- ------------

Net cash (used in)/ generated from

operating activities 28 (813) (283)

--------- ---------- ------------

Cash flows from investing activities

Purchases of property, plant and

equipment (34) (196) (246)

Purchases of other intangible assets

** (300) (176) (218)

Development expenditure capitalised (501) (771) (1,266)

--------- ---------- ------------

Net cash used in investing activities (835 ) (1,143 ) (1,730)

--------- ---------- ------------

Cash flows from financing activities

Repayments of borrowings - (4) (5)

Additions to/(Repayments of) lease

liability 54 (45) (100)

--------- ---------- ------------

Net cash (used in)/ from financing

activities 54 (49) (105)

--------- ---------- ------------

Net movement in cash and cash equivalents (753) (2,005) (2118)

Net cash and cash equivalents at

beginning of period 3,618 5,736 5,736

--------- ---------- ------------

Net cash and cash equivalents at

end of period 2,865 3,731 3,618

--------- ---------- ------------

* R&D tax claim accrual of GBP200k is non-cash and therefore

not included in the movement of trade and other receivables.

** Includes ROU asset

Crimson Tide Plc

Notes to the Unaudited Interim Results for the 6 months ended 30

June 2023

1. General information and basis of preparation

Crimson Tide plc is a public company, limited by shares, and

incorporated and domiciled in the United Kingdom. The Company's

shares are publicly traded on the London Stock Exchange's AIM

market. The address of its registered office is Brockbourne House,

77 Mt. Ephraim, Tunbridge Wells, Kent, TN4 8BS.

Basis of preparation

The condensed consolidated interim financial statements

("interim financial statements") have been prepared using

accounting policies that are consistent with those applied in the

previously published financial statements for the year ended 31

December 2022, which have been prepared in accordance with

UK-Adopted International Accounting Standards.

The information for the period ended 30 June 2023 has neither

been audited nor reviewed and does not constitute statutory

accounts as defined in section 434 of the Companies Act 2006.

The interim financial statements should be read in conjunction

with the consolidated financial statements for the year ended 31

December 2022. A copy of the statutory accounts for that period has

been delivered to the Registrar of Companies and is available on

the Company's website. The auditor's report on those accounts was

unqualified and did not contain statements under section 498 (2) or

(3) of the Companies Act 2006.

Key estimates and judgements used in the preparation of the

interim financial statements remain unchanged from those noted in

the published financial statements for the year ended 31 December

2022.

Going concern

The interim financial statements are prepared on the going

concern basis. The financial position of the Company, its cash

flows and liquidity position are described in the interim financial

statement and notes. The Company has the financial resources to

continue in operation for the foreseeable future, a period of not

less than 12 months from the date of this report.

2. Revenue and operating segments

The Group has three main regional centres of operation; one in

the UK, the others in Ireland and the United States but the Group's

resources, including capital, human and non-current assets are

utilised across the Group irrespective of where they are based or

originate from. The Board is the chief operating decision maker

("CODM"). The CODM allocates these resources based on revenue

generation, which due to its high margin nature and the Group's

reasonably fixed overheads, in turn drives profitability and

cashflow generation. The Board consider it most meaningful to

monitor financial results and KPIs for the consolidated Group, and

decisions are made by the Board accordingly.

In due consideration of the requirements of IFRS 8 Operating

Segments, the Board consider segmental reporting by (i) business

activity, by turnover, and (ii) region, by turnover to be

appropriate. Business activity is best split between (i) the

strategic focus of the business, i.e. mobility solutions and the

resulting development services that emanate from that and (ii)

non-core software solutions, including reselling third party

software and related development and support services.

Segment information for the reporting periods is as follows:

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2023 2022 2022

GBP000 GBP000 GBP000

Revenue by business activity

Mobility solutions and related

development 2,985 2,109 4,854

Software consultancy 58 215 497

3,043 2,324 5,351

------------ ------------ ------------

Revenue can be further analysed by geographic reason as

follows:

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2023 2022 2023

GBP000 GBP000 GBP000

Revenue by geographic region

UK 2,780 2,123 4,891

Ireland 205 201 442

US 58 - 18

3,043 2,324 5,351

------------ ------------ ------------

3. Intangible assets

Consumer

Enterprise focused development Website

development expenditure develop-ment Incremental

expenditure costs contract Goodwill Total

costs

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Cost

At 1 January

2023 3,658 1,024 91 887 799 6,459

Additions 501 - - 130 - 631

-------------- --------------------- --------------- --------------- ----------- --------

At 30 June 2023 4,159 1,024 91 1,017 799 7,090

-------------- --------------------- --------------- --------------- ----------- --------

Consumer

Enterprise focused development Website

development expenditure develop-ment Incremental

expenditure costs contract Goodwill Total

costs

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Amortisation

and impairment

At 1 January

2023 (1,893) (47) (26) (681) - (2,647)

Charge for the

period (185) (74) (15) (97) - (371)

-------------- --------------------- --------------- -------------- ----------- --------

At 30 June 2023 (2,078) (121) (41) (778) - 3,018

-------------- --------------------- --------------- -------------- ----------- --------

Carrying amount

at 30 June 2023 2,081 903 50 239 799 4,072

------ ---- --- ----- ---- ------

Carrying amount

at 30 June 2022 1,861 926 82 260 799 3,928

------ ---- --- ----- ---- ------

4. Earnings per share

The calculation of the basic earnings per share is based on the

Profit attributable to ordinary shareholders and the weighted

average number of ordinary shares in issue during the period.

The calculation of the diluted earnings per share is based on

the Profit per share attributable to ordinary shareholders and the

weighted average number of ordinary shares that would be in issue,

assuming conversion of all dilutive potential ordinary shares into

ordinary shares.

Reconciliations of the Profit and weighted average number of

ordinary shares used in the calculation are set out below:

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2023 2022 2022

Earnings per share

Reported loss (GBP000) (471) (860) (1,243)

Reported basic earnings per

share (pence) (0.07) (0.13) (0.19)

Reported diluted earnings

per share (pence) (0.07) (0.13) (0.19)

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2023 2022 2022

No. '000 No. '000 No. '000

Weighted average number of

ordinary shares

Shares in issue at start of

period 657,486 657,486 657,486

Effect of shares issued during - - -

the period

------------ ------------ ------------

Weighted average number of

ordinary

shares for basic EPS 657,486 657,486 657,486

Effect of share options outstanding - - -

------------ ------------ ------------

Weighted average number of

ordinary

shares for diluted EPS 657,486 657,486 657,486

------------ ------------ ------------

At 30 June 2023 there were 15,100,000 (30 June 2022: 16,700,000;

31 December 2022: 24,300,000) share options outstanding. These

share options were not included in the calculation of diluted

earnings per share because they are antidilutive in terms of IAS

33. The reduction in share options relates to the resignation of

certain employees who held options, and as a result, in accordance

with the terms of the share option agreements, the options were

cancelled.

5. Related party transactions

Other than the interests of Directors, being in shares, share

options and remuneration, no transactions with related parties were

undertaken such as are required to be disclosed under International

Accounting Standard 24.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UUOSROKUKUAR

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

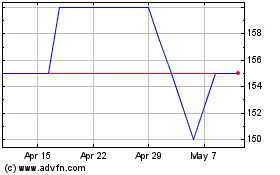

Crimson Tide (LSE:TIDE)

Historical Stock Chart

From Apr 2024 to May 2024

Crimson Tide (LSE:TIDE)

Historical Stock Chart

From May 2023 to May 2024