TPXimpact Holdings PLC Trading Statement (4993Y)

May 05 2023 - 1:00AM

UK Regulatory

TIDMTPX

RNS Number : 4993Y

TPXimpact Holdings PLC

05 May 2023

5 May 2023

TPXimpact Holdings PLC

("TPX", "TPXimpact", or the "Company")

Trading Update

Current trading at the higher end of previous forecasts and

updated guidance for FY24 & FY25

TPXimpact Holdings PLC (AIM: TPX), the technology-enabled

services company focused on digital transformation, is pleased to

provide an update on its Q4 and full year trading for the year

ended 31 March 2023 and to provide guidance for the full years

ending 31 March 2024 and 2025.

Q4 and Full Year Trading

Trading for the fourth quarter of the year was at the higher end

of previous guidance.

As a result, and based on the Group's unaudited management

accounts for the year, the Board expects to report revenue of

c.GBP83 million with an Adjusted EBITDA margin of approximately 3%.

Net debt (excluding lease liabilities) was below GBP18 million at

31 March 2023.

New business generation was strong during the fourth quarter,

totalling GBP36 million, and that momentum has continued into the

new financial year. April 2023 marked a record for the Group with

new business wins exceeding GBP80 million, highlighting the

opportunity available for TPX as it secures larger contracts while

optimised for efficiency under one brand. This was primarily due to

the two major new contracts announced on 28 April with HMLR (His

Majesty's Land Registry) for up to GBP49 million over four years

and the Department for Education for GBP27.5 million over two

years, both commencing May 2023. These wins provide a solid

foundation for the current financial year and beyond.

The Board expects to release the Group's preliminary, unaudited

results for the year ended 31 March 2023 in late June 2023 and will

provide more detail on the FY23 outturn at that time.

Outlook

The Group has completed its budgeting process for the year

ending 31 March 2024 (FY24). As a result of strong new business

performance, the Board is raising its guidance on organic revenue

growth to 15-20% for FY24 (from 10-15% previously) and is targeting

an Adjusted EBITDA margin of 5-6%, which also reflects continued

investment in our people and systems. Management expect margin

improvement to be weighted to the second half of the year.

Committed (or backlog) revenues for FY24 are currently around

GBP80 million, which compares with GBP41 million at the same time

last year.

With respect to FY25, management are targeting organic revenue

growth of 10-15% and a further improvement in Adjusted EBITDA

margin of 2-3% on top of that targeted for FY24.

Debt covenants

Further to the trading update announced on 31 March 2023, and

the waiver of the Group's debt covenant tests at that date,

management continue to engage positively with the Group's bankers

in relation to their review of the Group's short and medium term

cash flow forecasts. These discussions are ongoing and the Board

will provide an update in due course.

- Ends -

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018.

The person responsible for this announcement is Steve Winters,

Group CFO.

Enquiries:

TPXimpact Holdings PLC Via Alma PR

Bjorn Conway, Group CEO

Steve Winters, Group CFO

Stifel Nicolaus Europe Limited +44 (0) 207 710 7600

(Nomad and Joint Broker)

Alex Price

Fred Walsh

Ben Burnett

Dowgate Capital Limited

(Joint Broker)

James Serjeant

David Poutney

Russell Cook +44 (0) 203 903 7715

Alma PR +44 (0) 203 405 0209

(Financial PR) tpx@almapr.co.uk

Josh Royston

Kieran Breheny

Matthew Young

About TPXimpact

TPXimpact exists to transform the organisations, services and

systems that underpin society and that drive business success. It

applies strategic and creative thinking, technology, innovative

design and user-centred approaches to bring about numerous

improvements which together multiply the impact of change.

The Company works closely with its clients in agile,

multidisciplinary teams that span organisational design,

technology, and digital experiences. It shares a deep understanding

of people and behaviours and a philosophy of putting people and

communities at the heart of every transformation.

The business is being increasingly recognised as a leading

alternative digital transformation provider to the UK public

services sector, with c.65% of its client base representing the

public sector and c.35% representing the commercial sector.

More information is available at www.tpximpact.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBCGDUUGGDGXS

(END) Dow Jones Newswires

May 05, 2023 02:00 ET (06:00 GMT)

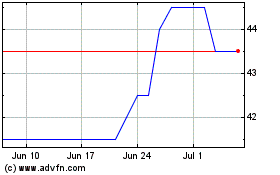

Tpximpact (LSE:TPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tpximpact (LSE:TPX)

Historical Stock Chart

From Apr 2023 to Apr 2024