TIDMTPX

RNS Number : 6356V

TPXimpact Holdings PLC

05 December 2023

5 December 2023

TPXimpact Holdings PLC

("TPXimpact", the "Company or the "Group"")

Interim Results

Strong first half performance in line with management

expectations

TPXimpact Holdings PLC (AIM: TPX), the technology-enabled

services company focused on people-powered digital transformation,

is pleased to announce its interim results for the six months ended

30 September 2023.

Financial highlights(1) :

-- Revenue (like-for-like) up over 22% to GBP41.6m (H1 2023:

GBP34.1m)

-- Acceleration in revenue growth as the year has progressed:

7% in Q1, 38% in Q2

-- Record new business wins of GBP105m in the first half,

including previously announced significant contracts with

the Department for Education and His Majesty's Land Registry

-- Adjusted EBITDA(2) of GBP2.0m (H1 2023: GBP0.9m) with

Adjusted EBITDA(2) margin increasing to 4.8% (H1 2023:

2.6%)

-- Reported operating loss of GBP(9.0)m (H1 2023: GBP(3.9)m),

after including GBP5.6m (H1 2023: GBPNil) non-cash goodwill

impairment charge

-- Adjusted profit before tax (2) of GBP0.6m (H1 2023: GBP0.4m)

-- Reported loss before tax GBP(10.1)m (H1 2023: GBP(4.3)m)

-- Adjusted diluted earnings(2) per share of 0.5p (H1 2023:

0.4p)

-- Reported diluted loss per share of (10.2)p (H1 2023: (4.1)p)

-- Net debt(2) (excluding lease liabilities) as at 30 September

2023 of GBP12.8m (31 March 2023: GBP17.5m)

-- Comfortable headroom against new debt covenants reset

in June 2023

Operational and Impact highlights:

-- Over 90% of H1 revenues came from public services clients

-- Department for Education and His Majesty's Land Registry

engagements now fully mobilised and progressing in line

with expectations

-- Completed sale of Questers for GBP7.5m cash in September

2023; disposed of TPXimpact Norway as announced on 18

September and 16 October 2023, respectively

-- New talent recruited to lead our commercial and technology

capabilities

-- Staff retention rates improved to a run-rate of 86% on

an annualised basis

-- Total headcount (including contractors) of around 700

people: permanent staff (FTE) numbers increased (like-for-like)

by over 9% in H1 to 535 and the number of contractors

fell by almost 20% to 162

-- New London hub is now fully operational; new lease signed

for Chesterfield hub

-- Accreditation of ISO 27001, ISO 9001 and the UK National

Cyber Security Centre's (NCSC) Cyber Essentials accreditation

-- Carbon footprint reduced by 7% partly due to relocation

of London hub; further reductions expected in H2 due to

Questers disposal

-- Female representation stands at 51% (H1 2023: 49%) and

ethnic minority representation stands at 20% (H1 2023:

19%)

Post-period outlook

-- TPXimpact continues to trade in line with the targets

announced at the beginning of FY 2024 and expects to deliver

revenue in the range of GBP80-85 million and Adjusted

EBITDA in the range of GBP4-5 million for the full year

-- Backlog or committed revenue now represents almost 90%

of full year projected revenues and the pipeline of potential

new business remains encouraging

(1) Unless otherwise stated financial measures are based upon

the results of continuing operations.

(2) In measuring our performance, the financial measures that we

use include those which have been derived from our reported results

in order to eliminate factors which distort period-on-period

comparisons. These are considered non-GAAP financial measures, and

include measures such as like-for-like revenue, adjusted EBITDA and

net debt. All are defined in note 9.

Bjorn Conway, Chief Executive Officer, commented:

"I am delighted by the way the business unit leadership and

their teams have responded to the new vision and strategy for

TPXimpact, enabling us to deliver strong business results in the

first half of FY24.

Like-for-like revenue increased over 22% and adjusted EBITDA

margin at almost 5% compares well with less than 3% for FY23. The

Group is on track to meet the guidance we issued at the start of

the year with revenue growth of 15-20% and adjusted EBITDA margin

of 5-6%. This is a significant improvement on FY23 and a sign that

our focus on our customers, our people, and operational

improvements is producing the intended results.

The major wins of up to GBP49m at His Majesty's Land Registry

and up to GBP27.5m at the Department for Education demonstrate the

scale and breadth of capability that we can bring through working

together effectively to deliver Digital Transformation and the

positive impact we can have on systems that touch the lives of many

tens of thousands of people.

Equally, our Digital Experience business dramatically improves

the connection between organisations and the public as evidenced by

our award winning work with the Zoological Society of London and

our impressive work with Breast Cancer Now to support their mission

to eradicate breast cancer.

We have made excellent progress in advancing our 3-year strategy

to simplify the wider business and invest in creating our exciting

Digital Transformation and Digital Experience businesses as the

core platforms for future growth. The next 6-12 months will see

these integrations completed to enable the core businesses to

flourish.

12 months into the role of CEO at TPXimpact, my initial

impressions of the passion, capability and commitment of the teams

have been validated and I am energised by their enthusiasm for

making the business better and delivering the best outcomes for our

customers."

Enquiries:

TPXimpact Holdings PLC Via Alma

Bjorn Conway, Group CEO

Steve Winters, Group CFO

Stifel Nicolaus Europe Limited +44 (0) 207 710 7600

(Nomad and Joint Broker)

Fred Walsh

Ben Burnett

Dowgate Capital Limited

(Joint Broker)

James Serjeant

Russell Cook +44 (0) 203 903 7715

Alma Strategic Communications +44 (0) 203 405 0209

(Financial PR) tpx@almastrategic.com

Josh Royston

Kieran Breheny

Matthew Young

About TPXimpact

TPXimpact exists to transform the organisations, services and

systems that underpin society and that drive business success. It

applies strategic and creative thinking, technology, innovative

design and user-centred approaches to bring about numerous

improvements which together multiply the impact of change.

The Group works closely with its clients in agile,

multidisciplinary teams that span organisational design,

technology, and digital experiences. It shares a deep understanding

of people and behaviours and a philosophy of putting people and

communities at the heart of every transformation.

The business is being increasingly recognised as a leading

alternative digital transformation provider to the UK public

services sector, with over 90% of its client base representing

public services in the six months ended 30 September 2023.

More information is available at www.tpximpact.com.

CEO's statement

With a new vision and three-year strategic plan, the Group has

had a strong first half, delivering revenue growth and EBITDA

margin improvement in line with management expectations.

Trading performance in the first half was strong with revenues

of GBP41.6 million which equates to like-for-like revenue growth of

over 22%. Adjusted EBITDA margins increased to c.5% compared to

less than 3% in H1 2023.

New business wins in the first half amounted to GBP105m, and the

significant new engagements at the Department for Education for up

to GBP27.5m over two years, and His Majesty's Land Registry for up

to GBP49m over four years, are now fully mobilised and progressing

in line with expectations.

Net debt (excluding lease liabilities) was GBP12.8m at 30

September 2023 (compared with GBP17.5m at 31 March 2023). The Group

has comfortably satisfied its banking covenants which were reset in

June 2023.

Our growth has been led by the Consulting business which had a

strong first half, validating our strategy to invest in its

operations. This will enable it to form the bedrock of the future

Digital Transformation business which will also incorporate the

Data & Insights and Red Cortex businesses over the coming

months. Meanwhile, our Digital Experience business is well placed

to support our charity clients, who are having to be innovative to

maintain donation levels.

This positive trading performance has been achieved whilst

remaining true to our new PACT (Purpose, Accountability, Craft and

Togetherness) values and delivering a positive impact on the

planet, people and places through our work.

Focus & Balance

The Group has made good progress against its three-year-plan.

Our strategic theme for this year is 'Focus & Balance' and a

consequence of 'Focus' is a decision to invest management time and

energy on our future strategic platforms - Digital Transformation

and Digital Experience. It is for this reason that we took the

decision to divest our Bulgarian resourcing business (Questers) and

Norwegian strategy consultancy. As well as more management focus on

the core businesses, the Questers transaction enabled the Group to

reduce Net Debt.

We progressed the integration of three agencies into our Digital

Experience business with an ambition of it becoming the UK's

leading purpose-driven agency. The Digital Experience team has

re-focused their new business effort towards sectors where they

hold deep and long-lasting relationships. This includes

partnerships and charities; memberships and events organisations;

as well as a select group of public and commercial entities.

We have also strengthened our new business development and

management teams with the appointment of a Managing Partner for

Commercial clients and a Chief Technology and Innovation Officer to

lead our technology and engineering teams.

Under 'balance' we have worked to make the business better,

primarily by managing for a balance of commercial and purpose

outcomes, and in doing so putting in place the business information

tools developed internally by our Consulting business, and

management processes to monitor, predict and manage key KPIs of

utilisation, gross margin by engagement and capability team, and

adjusted EBITDA. This has enabled our businesses to better manage

internal and contractor resources and drive improved business

performance. The business information tools will be adopted by

other business units in the second half of the year.

We have maintained a high level of team member communications

and launched our new PACT values that align closely with the

strategic direction of the business:

o Purpose - positive change with measurable impact

o Accountability - self-organisation and accountability

o Craft - bringing our best capabilities to bear through

a shared vision of excellence

o Togetherness - long-lasting relationships built on honesty,

openness, and trust

Our recent pulse survey showed team member engagement scores

improved slightly to 6.7 from 6.6 against a target of 7.5 Whilst we

are working hard to achieve further progress, we see this as a

positive result given the organisational changes implemented in the

first half. Employee retention remains high at 86%, indicating

greater stability in the business.

Our purpose

Our purpose at TPXimpact is to deliver greater outcomes for

people, places and the planet. We are pleased that our carbon

emissions reduced by 7% in the first half of the year (in part due

to the move to a single London office with better sustainability

credentials) and expect further reductions in the second half of

the year, reflecting the disposal of Questers. Our purpose team is

also now fully integrated into the operational units of the

business, reinforcing a balanced approach between profit and

purpose.

We are also encouraged by the trends we are seeing in diversity

and inclusion. Female representation stands at 51% (H1 2023: 49%),

illustrating our commitment to gender equality. Furthermore, our

ethnic minority representation stands at 20% (H1 2023: 19%).

Appointment of Senior Independent Director

The Board is pleased to announce the appointment of Rachel

Neaman as Senior Independent Director. Rachel already serves as a

Non-executive Director of TPXimpact and brings a wealth of

experience of the UK charity and public sectors. In her new role,

Rachel will help ensure the Board and Management deliver against

the balanced needs of our stakeholders.

Market conditions

We continue to see exciting growth opportunities for our core

Digital Transformation and Digital Experience businesses, and our

outlook remains positive. Although a General Election in 2024 may

well introduce some degree of disruption and uncertainty next year,

we are encouraged that the policy agendas of both main political

parties place a renewed emphasis on the importance of digital

transformation and citizen engagement, both of which represent core

strengths in our business.

Whilst some industry observers, such as Tech Market View, are

predicting an easing in the rate of growth of the UK digital

transformation market in 2024*, they nevertheless expect demand to

be relatively strong, with mid single-digit CAGR forecast to 2026.

This is especially true for our core market of public services and,

within that sector, Central Government (60% of Group revenues).

TPXimpact is increasingly well-placed to increase market share and

capitalise on the opportunities these trends will create.

Bjorn Conway

CEO, TPXimpact

*Tech Market View. UK SITS Consulting Market: Suppliers, Trends

& Forecasts 2022 - 2026

Financial Review

The interim results for the six months ended 30 September 2023

(H1 2024) are in line with the trading update issued on 16 October

2023 and show strong growth in revenues, profitability and

margins.

As a result of the sale of Questers in September 2023 and

TPXimpact Norway in October 2023, the Group has treated both

businesses as discontinued operations in the first half, and prior

period comparatives have been restated accordingly. Like-for-like

performance measures are based on the results of continuing

operations.

Revenues from continuing operations were up 22.1% to GBP41.6m in

the first half of the year. Growth was driven by our Consulting

business (67% of Group revenues) due to the significant new

business wins with Central Government in the second half of last

year and first quarter of this. Revenues in our Digital Experience

business (13% of Group revenues) eased due to clients in the

charitable sector holding back spend. Sequentially, on a

like-for-like basis, Group revenues increased by 7.4% in Q1 and

38.3% in Q2, recovering from being down 7.2% in the last financial

year. New business wins amounted to a record GBP105m in the first

half.

Public service clients represented over 90% of revenues in the

first half, reflecting the increasing significance of Central

Government (60% of revenues) to the Group, as well as the disposal

of our Questers and Norway businesses, whose client base was

largely commercial. Management are committed to expansion of our

commercial sector revenues and have recently introduced new

leadership for both our commercial and technology capabilities.

As revenues grew, so did the cost of sales, which were up over

24% to GBP30.7m from GBP24.7m in H1 2023. Gross profit therefore

increased to GBP10.9m from GBP9.3m. Although gross margins reduced

to 26.2% from 27.4% in H1 2023, there was a progressive gross

margin improvement from Q1 to Q2 as we completed recruitment of

permanent roles, and reduced reliance on contractors, to service

the expansion in revenues.

Total headcount, including contractors, was around 700 people at

both 30 September 2023 and 31 March 2023, on a like-for-like basis.

There was, however, a shift in the mix between permanent FTE staff

and contractors: FTE headcount increased by over 9% to 535 people

in the first half, whilst the number of contractors reduced by

almost 20% to 162 people, providing greater efficiency going into

H2. Productivity also improved with increased utilisation rates,

particularly in Consulting. We therefore expect further improvement

in gross margins in the second half of the year. Staff retention in

the first half was 86% (on an annualised basis), a marked

improvement on a year ago.

Adjusted EBITDA of GBP2.0m and a margin of 4.8% in the first

half was significantly ahead of H123, on a like-for-like basis. All

our businesses met or exceeded budgeted Adjusted EBITDA

expectations, with the exception of RedCortex (6% of Group

revenues), which faced softness in client spend in the health

sector in Wales.

The Group made a reported operating loss on continuing

operations of GBP(9.0)m in the first half against an operating loss

of GBP(3.9)m for the same period last year. This reflects the

GBP1.6m increase in gross profit explained above, more than offset

by an increase of GBP6.6m in administrative costs, which was

largely due to a non-cash goodwill impairment charge of GBP5.6m in

relation to RedCortex. Charges for share-based payments increased

to GBP0.5m (H123: credit of GBP0.1m) due to share incentive grants

in the second half of last year, whilst restructuring costs fell to

GBP0.7m (H1 2023: GBP1.3m).

The Group made an adjusted profit before tax on continuing

operations of GBP0.6m (H1 2023: GBP0.4m) and a reported loss before

tax of GBP(10.1)m (H1 2023: loss of GBP(4.3)m). Finance costs in

the first half increased to GBP1.1m (H123: GBP0.4m) due to

increased average borrowings and higher interest rates. Taxation

amounted to a credit of GBP0.9m (H1 2023: GBP0.6m) due to deferred

tax credits on amortisation of intangible assets. Adjusted profit

after tax on continuing operations was GBP0.5m (H123: GBP0.4m).

The disposal of Questers in September 2023 gave rise to a gain

on disposal of GBP3.8m which has been included in the income

statement within profit after tax from discontinued operations. The

Group's interest in TPXimpact Norway has been presented as an asset

held for sale in the balance sheet at 30 September 2023, prior to

its disposal in October 2023. As the Norway disposal was for

nominal consideration of GBP1, the Group has recorded a goodwill

impairment charge of GBP1.9m as a cost of discontinued operations

in the first half.

Reported diluted earnings per share from continuing operations

for the first half was a loss of (10.2) pence per share (H1 2023:

(4.1) pence per share), reflecting the reported losses in the

period, including the goodwill impairment charge of GBP5.6m. On an

adjusted basis, diluted earnings per share on continuing operations

increased to 0.5 pence per share (H1 2023: 0.4 pence per

share).

Whilst the Board has decided there will be no interim dividend

in respect of the first half of this year (H123: 0.3 pence per

share), the improvement in performance is encouraging and dividend

policy will continue to be reviewed on a regular basis.

Net debt and Cash flow

Net debt (excluding lease liabilities) at 30 September 2023 was

GBP12.8m compared with GBP17.5m at 31 March 2023. The decrease in

net debt of GBP4.7m includes GBP7.5m of cash proceeds from the sale

of Questers, less GBP1.0m of interest paid and a net working

capital outflow of GBP1.7m (largely attributable to the unwinding

of deferred income recorded at year-end). The disposal of Questers

resulted in GBP1.3m of cash being deconsolidated from the balance

sheet, together with a similar amount of current liabilities.

The Group used GBP4.3m of the Questers proceeds to repay debt,

so borrowings reduced to GBP20.0m at 30 September 2023, and a

further GBP1.0m was repaid in November. The Group has comfortably

satisfied its banking covenants since they were reset in June 2023

and our forecasts indicate this headroom will continue.

Current trading

Like-for-like revenue growth in the month of October 2023 was

42%, continuing the trend seen in Q2, and again driven by our

Consulting business. Margins were in line with management

expectations. Backlog or committed revenue now represents almost

90% of our full year projected revenues and the pipeline of

potential new business remains encouraging.

Outlook

In the trading update released on 16(th) October 2023, the Board

reaffirmed the FY 2024 targets of 15-20% like-for-like revenue

growth and Adjusted EBITDA margins of 5-6% and this guidance is

maintained. These targets would equate to FY 2024 revenue in the

range of GBP80-85m and Adjusted EBITDA in the range of GBP4-5m. We

expect revenue growth to be weighted towards Q3 more than Q4 given

the stronger comparative performance in Q4 of last year.

Management are also targeting net debt (excluding lease

liabilities) to be in the range of GBP11-12m at 31 March 2024 and,

therefore, a net debt to Adjusted EBITDA ratio of <2.5x by the

end of the financial year, or shortly thereafter.

The outlook for FY 2025 is also maintained with like-for-like

revenue growth of 10-15% and further margin improvement of 2-3% on

top of that achieved in FY 2024. The contract length of our recent

large wins and the ongoing, successful execution of our strategy

provides a solid foundation for our projections, notwithstanding

the possible disruption and uncertainty that may arise from a

general election in the coming year. We believe the fundamental

demand for our skills and services will remain strong for the

foreseeable future.

Steve Winters

CFO, TPXimpact

Unaudited interim results for the six months ended 30 September

2023

Consolidated Income Statement

For the six months ended 30 September 2023

Audited

Unaudited Year

Unaudited 6 months ended

6 months to 30 31

to 30 September September March

2023 2022(1) 2023(1)

Note GBP'000 GBP'000 GBP'000

Revenue 41,622 34,075 69,672

Cost of sales (30,718) (24,734) (50,816)

Gross profit 10,904 9,341 18,856

Administrative expenses (19,937) (13,369) (38,377)

Other income 45 79 492

Operating loss (8,988) (3,949) (19,029)

Finance costs (1,070) (371) (1,084)

-------------------------------------- ----- ----------------- ----------- ---------

Loss before tax from continuing

operations (10,058) (4,320) (20,113)

Taxation 874 587 1,494

-------------------------------------- ----- ----------------- ----------- ---------

Loss after tax from continuing

operations (9,184) (3,733) (18,619)

Profit after tax from discontinued

operations 2,213 1,253 1,061

-------------------------------------- ----- ----------------- ----------- ---------

Net loss (6,971) (2,480) (17,558)

Other comprehensive (loss)/income:

Exchange difference on translation

of foreign operations (22) 91 20

Exchange adjustments recycled to

the income statement on disposal

of discontinued operations 27 - -

--------------------------------------------- ----------------- ----------- ---------

Total comprehensive loss for

the period (6,966) (2,389) (17,538)

-------------------------------------- ----- ----------------- ----------- ---------

Earnings per share from continuing and discontinued

operations

Basic (p) 8 (7.7p) (2.7p) (19.5p)

Fully diluted (p) 8 (7.7p) (2.7p) (19.5p)

Earnings per share from continuing

operations

Basic (p) 8 (10.2p) (4.1p) (20.6p)

Fully diluted (p) 8 (10.2p) (4.1p) (20.6p)

(1) Prior year figures have been re-presented in accordance with

IFRS 5 Non-current Assets Held for Sale and Discontinued

Operations, as described in note

Consolidated Statement of Financial Position

At 30 September 2023

Unaudited Unaudited Audited

30 September 30 September 31 March

2023 2022 2023

Note GBP'000 GBP'000 GBP'000

--------------------------------- ----- -------------- -------------- ----------

Non-current assets

Goodwill 6 49,085 68,493 59,486

Other intangible assets 19,521 29,041 23,458

Property, plant and equipment 330 544 473

Right of use assets 1,907 1,168 1,438

Other investments 2,188 2,188 2,188

Deferred tax assets 169 54 159

--------------------------------- ----- -------------- -------------- ----------

Total non-current assets 73,200 101,488 87,202

--------------------------------- ----- -------------- -------------- ----------

Current assets

Trade and other receivables 10,904 14,058 17,812

Contract assets 7,513 2,894 2,999

Corporation tax asset 257 - 335

Cash and cash equivalents 7,171 6,199 6,772

Total current assets 25,845 23,151 27,918

Assets held for sale 731 - -

--------------------------------- ----- -------------- -------------- ----------

Total assets 99,776 124,639 115,120

--------------------------------- ----- -------------- -------------- ----------

Current liabilities

Trade and other payables (8,658) (6,882) (8,943)

Contract liabilities (977) (2,368) (3,608)

Other taxes and social

security costs (2,472) (2,984) (4,073)

Corporate tax liability - (1,077) -

Deferred and contingent

consideration - (717) (225)

Lease liabilities (637) (378) (564)

Borrowings - (69) -

Total current liabilities (12,744) (14,475) (17,413)

--------------------------------- ----- -------------- -------------- ----------

Liabilities directly associated

with assets held for sale (385) - -

--------------------------------- ----- -------------- -------------- ----------

Non-current liabilities

Deferred tax liabilities (4,855) (6,769) (5,796)

Borrowings (19,979) (20,270) (24,317)

Lease liabilities (1,396) (881) (909)

--------------------------------- ----- -------------- -------------- ----------

Total non-current liabilities (26,230) (27,920) (31,022)

Total liabilities (39,359) (42,395) (48,435)

--------------------------------- ----- -------------- -------------- ----------

Net assets 60,417 82,244 66,685

--------------------------------- ----- -------------- -------------- ----------

Equity

Share capital 922 912 919

Own shares (983) (688) (983)

Share premium 6,538 6,530 6,538

Merger reserve 73,703 85,095 73,474

Capital redemption reserve 15 15 15

Foreign exchange reserve (67) (1) (72)

Retained earnings (19,711) (9,619) (13,206)

--------------------------------- ----- -------------- -------------- ----------

Total equity 60,417 82,244 66,685

--------------------------------- ----- -------------- -------------- ----------

Consolidated Statement of Changes in Equity

For the six months ended 30 September 2023

Capital

Share Share Merger redemption Own Foreign Retained

capital premium reserve reserve shares exchange earnings Total

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- ---------- ---------- ---------- ------------- --------- ----------- ----------- ---------

At 1 April

2023 919 6,538 73,474 15 (983) (72) (13,206) 66,685

---------- ---------- ---------- ------------- --------- ----------- ----------- ---------

Loss for the

period - - - - - - (6,971) (6,971)

---------- ---------- ---------- ------------- --------- ----------- ----------- ---------

Exchange

differences

on translation

of foreign

operations - - - - - (22) - (22)

---------- ---------- ---------- ------------- --------- ----------- ----------- ---------

Exchange

adjustments

recycled to

the income

statement

on disposal

of discontinued

operations - - - - - 27 - 27

---------- ---------- ---------- ------------- --------- ----------- ----------- ---------

Transactions

with owners

---------- ---------- ---------- ------------- --------- ----------- ----------- ---------

Shares issued 3 - 229 - - - - 232

---------- ---------- ---------- ------------- --------- ----------- ----------- ---------

Share-based

payments - - - - - - 466 466

------------------- ---------- ---------- ---------- ------------- --------- ----------- ----------- ---------

At 30 September

2023 (Unaudited) 922 6,538 73,703 15 (983) (67) (19,711) 60,417

------------------- ---------- ---------- ---------- ------------- --------- ----------- ----------- ---------

For the year ended 31 March 2023

Capital Foreign Share

Share Share Merger redemption Own exchange option Retained

capital premium reserve reserve shares reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ --------- --------- --------- ------------ -------- ---------- ---------- ---------- ---------

At 1 April

2022 874 6,449 78,705 15 (356) (92) 1,089 (8,123) 78,561

--------- --------- --------- ------------ -------- ---------- ---------- ---------- ---------

Reclassification

to retained

earnings* - - - - - - (1,089) 1,089 -

--------- --------- --------- ------------ -------- ---------- ---------- ---------- ---------

Loss for the

period - - - - - - - (2,480) (2,480)

--------- --------- --------- ------------ -------- ---------- ---------- ---------- ---------

Exchange

differences

on translation

of foreign

operations - - - - - 91 - - 91

--------- --------- --------- ------------ -------- ---------- ---------- ---------- ---------

Transactions

with owners

--------- --------- --------- ------------ -------- ---------- ---------- ---------- ---------

Shares issued 38 81 6,390 - (81) - - - 6,428

--------- --------- --------- ------------ -------- ---------- ---------- ---------- ---------

Share-based

payments - - - - - - - (105) (105)

--------- --------- --------- ------------ -------- ---------- ---------- ---------- ---------

Share options

exercised - - - - (251) - - - (251)

------------------ --------- --------- --------- ------------ -------- ---------- ---------- ---------- ---------

At 30 September

2022 (Unaudited) 912 6,530 85,095 15 (688) (1) - (9,619) 82,244

------------------ --------- --------- --------- ------------ -------- ---------- ---------- ---------- ---------

Loss for the

period - - - - - - - (15,078) (15,078)

Transfer to

retained earnings - - (12,147) - - - - 12,147 -

------ -------- --------- ----- -------- ------- ---- ----------- ---------

Exchange differences

on translation

of foreign

operations - - - - - (71) - - (71)

------ -------- --------- ----- -------- ------- ---- ----------- ---------

Transactions

with owners

------ -------- --------- ----- -------- ------- ---- ----------- ---------

Shares issued 7 8 526 - (9) - - - 532

------ -------- --------- ----- -------- ------- ---- ----------- ---------

Own shares

transferred

from EBT - - - - 11 - - (11) -

------ -------- --------- ----- -------- ------- ---- ----------- ---------

Dividends paid - - - - - - - (815) (815)

------ -------- --------- ----- -------- ------- ---- ----------- ---------

Share-based

payments - - - - - - - 170 170

------ -------- --------- ----- -------- ------- ---- ----------- ---------

Own shares

purchased by

EBT - - - - (297) - - - (297)

---------------------- ------ -------- --------- ----- -------- ------- ---- ----------- ---------

At 31 March

2023 (Audited) 919 6,538 73,474 15 (983) (72) - (13,206) 66,685

---------------------- ------ -------- --------- ----- -------- ------- ---- ----------- ---------

*In the year ended 31 March 2023, the share option reserve was

reclassified to form part of retained earnings.

Consolidated Statement of Cash Flows

For the six months ended 30 September 2023

Unaudited

6 months Unaudited Audited

to 6 months Year ended

30 September to 30 September 31 March

2023(1) 2022(1) 2023(1)

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities:

Loss before taxation on total

operations (Note 5) (7,820) (2,990) (18,971)

Adjustments for:

Depreciation 476 359 706

Amortisation of intangible

assets 3,918 3,215 6,347

Impairment of goodwill and

intangible assets on classification - -

as held for sale 1,848

Impairment of intangible assets - - 1,770

Impairment of goodwill 5,564 - 9,995

Share-based payments 466 (105) 65

Foreign exchange losses/(gains) 38 (2) (1)

Finance costs (Note 5) 1,081 388 1,105

Loss from fair value movement

in contingent consideration 7 148 188

Loss on disposal of property,

plant and equipment - - 6

Gain on sale of discontinued

operations (3,774) (1,474) (1,606)

Working capital adjustments:

Decrease in trade and other

receivables 358 5,068 1,271

Decrease in trade and other

payables (2,067) (5,277) (1,141)

Net cash generated from/(used

in) operations 95 (670) (266)

Tax received/(paid) 10 (350) (1,522)

Net operating cash flows 105 (1,020) (1,788)

--------------------------------------- -------------- ----------------- ------------

Cash flows from investing

activities:

Net cash paid on acquisition

of subsidiaries - (1,787) (1,969)

Disposal of subsidiaries(2) 6,236 - (127)

Purchase of property, plant

and equipment (22) (154) (340)

Additions to intangible assets (82) (269) (244)

Net cash generated from/(used

in) investing activities 6,132 (2,210) (2,680)

--------------------------------------- -------------- ----------------- ------------

Cash flows from financing

activities:

New borrowings - 2,300 6,300

Repayment of borrowings (4,300) - -

Purchase of own shares - (251) (548)

Payment of lease liabilities (332) (193) (445)

Interest paid (1,015) (380) (1,146)

Dividends paid - - (815)

--------------------------------------- -------------- ----------------- ------------

Net cash (used in)/generated

from financing activities (5,647) 1,476 3,346

--------------------------------------- -------------- ----------------- ------------

Net increase/(decrease) in

cash and cash equivalents 590 (1,754) (1,122)

Cash and cash equivalents at

beginning of the period 6,772 7,914 7,948

Effect of exchange rate fluctuations

on cash held (26) 39 (54)

--------------------------------------- -------------- ----------------- ------------

Cash and cash equivalents including

cash from discontinued operations 7,336 6,199 6,772

Cash from discontinued operations (165) - -

-------------------------------------- -------------- ----------------- ------------

Cash and cash equivalents

at end of the period 7,171 6,199 6,772

Comprising:

Cash at bank and in hand 7,115 6,099 6,717

Cash held by trust 56 100 55

--------------------------------------- -------------- ----------------- ------------

Cash and cash equivalents

at end of the period 7,171 6,199 6,772

--------------------------------------- -------------- ----------------- ------------

(1) The cash flows of discontinued operations are immaterial to

the Consolidated Statement of Cash Flows and so have not been

presented separately for the current or previous financial

period.

(2) Disposal of subsidiaries comprises cash consideration

received of GBP7.5 million less cash disposed of GBP1.3

million.

Notes to the Consolidated Financial Statements

1. General information

TPXimpact Holdings plc is a public limited company incorporated

in England and Wales under the Companies Act 2006 with registered

number 10533096. The Company's shares are publicly traded on AIM,

part of the London Stock Exchange.

The address of the registered office is 7 Savoy Court, London,

England, WC2R 0EX. The principal activity of the Group is the

provision of digitally native technology services to clients within

the commercial, government and non-government organisation (NGO)

sectors.

The interim financial information is unaudited.

2. Basis of preparation

The Group has not applied IAS 34 Interim Financial Reporting,

which is not mandatory for UK AIM listed companies, in the

preparation of this half-yearly report.

The consolidated interim financial information for the six

months ended 30 September 2023 does not, therefore, comply with all

the requirements of IAS 34 Interim Financial Reporting. The

consolidated interim financial information should be read in

conjunction with the annual financial statements of TPXimpact

Holdings plc for the year ended 31 March 2023, which have been

prepared in accordance with applicable UK-adopted international

accounting standards and the AIM rules for Companies.

This consolidated interim financial information does not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

March 2023 were approved by the Board of directors on and delivered

to the Registrar of Companies. The report of the auditors on those

accounts was unqualified and did not contain any statement under

sections 498 (2) or (3) of the Companies Act 2006. The auditor's

report drew attention by way of an emphasis of matter to the high

degree of judgement involved in supporting the carrying value of

goodwill and other intangible assets.

The interim financial statements are presented in pound sterling

(GBP), which is the functional currency of the parent company.

3. Basis of consolidation

These interim consolidated financial statements consolidate

those of the Company and all of its subsidiary undertakings drawn

up to 30 September 2023. Subsidiaries are fully consolidated from

the date of acquisition, being the date on which the Group obtains

control, and continue to be consolidated until the date that such

control may cease. The financial statements of the subsidiaries are

prepared for the same reporting period as the parent company, using

consistent accounting policies.

4. Accounting policies

The accounting policies used in the preparation of the interim

consolidated financial information for the six months ended 30

September 2023 are in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

(IFRS) and are consistent with those which were adopted in the

annual statutory financial statements for the year ended 31 March

2023.

5. Discontinued operations

The Group disposed of its subsidiaries Questers Resourcing

Limited and Questers Bulgaria EOOD ("Questers") on 18 September

2023 to Nortal AS ("Nortal") for cash consideration of GBP7.5

million.

In September 2023 the Group also decided to dispose of its

equity interests in TPXimpact Norway AS to companies controlled by

the managing partners of the business for a nominal consideration

of GBP1. This disposal is considered a related party transaction

and the directors consider, having consulted with its nominated

adviser, that the terms of the transaction were fair and reasonable

insofar as its shareholders are concerned. The associated assets

and liabilities of TPXimpact Norway have been presented as held for

sale in the statement of financial position as at 30 September

2023. The sale was completed on 13 October 2023.

The operations of both Questers and TPXimpact Norway are

presented as discontinued operations in the income statement with

the comparatives and related notes restated accordingly. The

Questers disposal generated a gain of GBP3.8 million and a GBP1.8

million goodwill impairment was recognised on classification of

TPXimpact Norway's assets as held for sale. These are included in

the profit after tax on discontinued operations in the six months

ended 30 September 2023.

Income statement reconciliation:

Continuing Discontinued Total Continuing Discontinued Discontinued Total

operations operations operations operations operations operations operations

H1 2024 H1 2024 H1 2024 H1 2023 H1 2023(1) H1 2023 H1 2023

re-presented(2)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ----------- ------------- ----------- ------------ ------------- ---------------- ------------

Revenue 41,622 7,171 48,793 34,075 27 6,288 40,390

Cost of

sales (30,718) (6,103) (36,821) (24,734) (58) (5,152) (29,944)

---------------- ----------- ------------- ----------- ------------ ------------- ---------------- ------------

Gross profit 10,904 1,068 11,972 9,341 (31) 1,136 10,446

Administrative

expenses (19,937) (2,640) (22,577) (13,369) (109) (1,137) (14,615)

Gain on

sale of

discontinued

operations - 3,774 3,774 - 1,474 - 1,474

Other income 45 47 92 79 - 14 93

---------------- ----------- ------------- ----------- ------------ ------------- ---------------- ------------

Operating

(loss)/profit (8,988) 2,249 (6,739) (3,949) 1,334 13 (2,602)

Finance

costs (1,070) (11) (1,081) (371) - (17) (388)

---------------- ----------- ------------- ----------- ------------ ------------- ---------------- ------------

(Loss)/profit

before tax (10,058) 2,238 (7,820) (4,320) 1,334 (4) (2,990)

Taxation 874 (25) 849 587 - (77) 510

---------------- ----------- ------------- ----------- ------------ ------------- ---------------- ------------

(Loss)/profit

after tax (9,184) 2,213 (6,971) (3,733) 1,334 (81) (2,480)

---------------- ----------- ------------- ----------- ------------ ------------- ---------------- ------------

(1) In the six months ended 30 September 2022 discontinued

operations represents Greenshoots Lab Limited ('GSL'), a subsidiary

of the Group which was disposed of in May 2022.

(2) Prior year figures have been re-presented to include

Questers and TPXimpact Norway as discontinued operations.

6. Goodwill

Goodwill decreased by GBP10.4 million during the six months

ended 30 September 2023. This is primarily due to a GBP5.6 million

impairment charge in relation to Red Cortex, as well as GBP3.0

million of goodwill disposed in respect of Questers and a GBP1.8

million impairment in relation to TPXimpact Norway.

7. Borrowings

At 31 March 2023, the Group had a revolving credit facility with

HSBC of GBP30 million with a GBP15 million accordion of which

GBP24.5 million had been drawn down. The Group's financing

arrangements require the following covenants to be met: Net debt to

rolling twelve month Adjusted EBITDA of 2.5x or less and Adjusted

EBITDA to interest cover of at least 4.0x, also on a twelve month

rolling basis. The Group received a waiver of these covenants at

both 31 March 2023 and 30 June 2023.

For the following four quarters, management and HSBC have agreed

a reset of the Group's lending covenants based on minimum levels of

liquidity at each month end and minimum Adjusted EBITDA levels at

each quarter-end. These terms will apply until the quarter ending

30 September 2024, at which time the covenants will return to the

previous measures. The revised covenants at 30 September 2023 were

met.

In September 2023, the Group repaid GBP4.3 million of the

facility leaving GBP20.2 million drawn down as at 30 September

2023. A further GBP1.0 million was repaid in November 2023.

8. Earnings per share

6 months 6 months Year

to 30 September to 30 ended 31

2023 September March

Number of 2022 2023

shares Number Number

of of

shares shares

'000 '000 '000

-------------------------------------- ------------------ ------------ -------------

Weighted average number of shares

for calculating basic earnings

per share 90,299 91,426 90,185

Weighted average number of dilutive

shares 1,363 990 3,839

-------------------------------------- ------------------ ------------ -------------

Weighted average number of shares

for calculating diluted earnings

per share 91,662 92,416 94,024

-------------------------------------- ------------------ ------------ -------------

6 months 6 months Year ended

to 30 September to 30 31 March

2023 September 2023 (1)

2022 (1)

GBP'000 GBP'000 GBP'000

-------------------------------------- ------------------ ------------ -------------

Loss after tax from continuing

operations (9,184) (3,733) (18,619)

Profit after tax from discontinued

operations 2,213 1,253 1,061

-------------------------------------- ------------------ ------------ -------------

Loss after tax from total operations (6,971) (2,480) (17,558)

-------------------------------------- ------------------ ------------ -------------

Adjusted profit after tax from

continuing operations(2) 499 391 875

-------------------------------------- ------------------ ------------ -------------

Earnings per share is calculated

as follows: 6 months 6 months Year

to 30 September to 30 ended

2023 September 31 March

2022 (1) 2023 (1)

Basic earnings per share

Basic earnings per share from

continuing operations (10.2p) (4.1p) (20.6p)

Basic earnings per share from

discontinued operations 2.5p 1.4p 1.1p

----------------------------------- ------------------ ------------ -----------

Basic earnings per share from

total operations (7.7p) (2.7p) (19.5p)

----------------------------------- ------------------ ------------ -----------

Adjusted basic earnings per share

from continuing operations 0.6p 0.4p 1.0p

----------------------------------- ------------------ ------------ -----------

Diluted earnings per share

Diluted earnings per share from

continuing operations(3) (10.2p) (4.1p) (20.6p)

Diluted earnings per share from

discontinued operations(3) 2.5p 1.4p 1.1p

----------------------------------- ------------------ ------------ -----------

Diluted earnings per share from

total operations(3) (7.7p) (2.7p) (19.5p)

----------------------------------- ------------------ ------------ -----------

Adjusted diluted earnings per

share from continuing operations 0.5p 0.4p 0.9p

----------------------------------- ------------------ ------------ -----------

(1) Prior year figures have been re-presented in accordance with

IFRS 5 Non-current Assets Held for Sale and Discontinued

Operations, as described in note 5.

(2) Adjusted profit after tax on continuing operations is

defined in note 9.

(3) The weighted average shares used in the basic EPS

calculation has also been used for reported diluted EPS due to the

anti-dilutive effect of the weighted average shares calculated for

the reported diluted EPS calculation.

9. Alternative performance measures (unaudited)

In measuring our performance, the financial measures that we use

include those which have been derived from our reported results in

order to eliminate factors which distort period-on-period

comparisons. These are considered non-GAAP financial measures, and

include measures such as like-for-like revenue, adjusted EBITDA and

net debt. We believe this information, along with comparable GAAP

measurements, is useful to shareholders and analysts in providing a

basis for measuring our financial performance.

Like-for-like

Like-for-like comparisons are calculated by comparing current

year results for continuing operations (which includes acquisitions

from the relevant date of completion) to prior year results,

adjusted to include the results of acquisitions for the

commensurate period in the prior year. In the six months ended 30

September 2023, there were no differences in the like-for-like and

reported comparisons due to there being no acquisitions in either

period.

Reconciliation of net debt (excluding lease liabilities):

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

--------------------------- ------------- ------------- -----------

Cash and cash equivalents 7,171 6,199 6,772

Borrowings due within

one year - (69) -

Borrowings due after

one year (19,979) (20,270) (24,317)

---------------------------- ------------- ------------- -----------

Net debt (12,808) (14,140) (17,545)

---------------------------- ------------- ------------- -----------

Reconciliation of operating loss to adjusted EBITDA:

6 months

6 months to to Year ended

30 September 30 September 31 March

2023 2022(1) 2023(1)

GBP'000 GBP'000 GBP'000

----------------------------- -------------- -------------- -----------

Operating loss (8,988) (3,949) (19,029)

Amortisation of intangible

assets 3,894 3,101 6,155

Depreciation 334 139 371

Loss from fair value

movement in contingent

consideration 7 148 188

Impairment of intangible

assets - - 1,770

Impairment of goodwill 5,564 - 9,995

Share-based payments 501 (82) 84

Costs directly attributable

to business combinations - 167 229

Costs related to business

restructuring 674 1,345 2,541

------------------------------ -------------- -------------- -----------

Adjusted EBITDA 1,986 869 2,304

------------------------------ -------------- -------------- -----------

(1) Prior period figures have been re-presented in accordance

with IFRS 5 Non-current Assets Held for Sale and Discontinued

Operations, as described in note 5.

Reconciliation of loss before tax to adjusted profit after

tax:

6 months 6 months

to to Year ended

30 September 30 September 31 March

2023 2022(1) 2023(1)

GBP'000 GBP'000 GBP'000

-------------------------------- -------------- -------------- -----------

Loss before tax from

continuing operations (10,058) (4,320) (20,113)

Amortisation of intangible

assets 3,894 3,101 6,155

Loss from fair value

movement in contingent

consideration 7 148 188

Impairment of intangible

assets - - 1,770

Impairment of goodwill 5,564 - 9,995

Share-based payments 501 (82) 84

Costs directly attributable

to business combinations - 167 229

Costs related to business

restructuring 674 1,345 2,541

--------------------------------- -------------- -------------- -----------

Adjusted profit before

tax from continuing

operations 582 359 849

Tax (excluding impact

of amortisation of intangible

assets) (83) 32 26

--------------------------------- -------------- -------------- -----------

Adjusted profit after

tax from continuing

operations 499 391 875

--------------------------------- -------------- -------------- -----------

(1) Prior year figures have been re-presented in accordance with

IFRS 5 Non-current Assets Held for Sale and Discontinued

Operations, as described in note 5.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FSEFALEDSELE

(END) Dow Jones Newswires

December 05, 2023 02:00 ET (07:00 GMT)

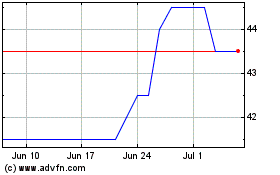

Tpximpact (LSE:TPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tpximpact (LSE:TPX)

Historical Stock Chart

From Apr 2023 to Apr 2024