TIDMUAV

RNS Number : 0923B

Unicorn AIM VCT PLC

31 May 2023

Unicorn AIM VCT plc ("The Company")

Half-Yearly Report Announcement for the six months ended 31

March 2023

Financial Highlights

For the six months ended 31 March 2023

-- Net Asset Value ("NAV") total return per share for the six

months ended 31 March 2023, after adding the back the dividends

paid in the period, was -4.3%.

-- GBP2.1 million of qualifying investments (GBP2.0 million new,

GBP0.1 million follow-on) made in the period.

-- Interim dividend of 3.0p per share declared for the six months ended 31 March 2023.

-- The Offer for Subscription, launched on 24 January 2023, was

oversubscribed by 6 February 2023, and raised GBP14.6 million

(after costs of GBP0.4 million).

Fund Performance

Shareholders'

Net asset

value plus

Cumulative cumulative

Net asset dividends dividends

value per paid per paid per

Funds* share (NAV) share** share** Share price

Ordinary Shares (GBPmillion) (p) (p) (p) (p)

31 March 2023 218.4 125.5 102.5 228.0 103.5

30 September

2022 221.1 134.8 99.0 233.8 126.5

31 March 2022 315.3 195.7 64.0 259.7 167.0

30 September

2021 370.8 248.6 53.5 302.1 219.0

* Shareholders' funds/net assets as shown in the Condensed

Statement of Financial Position below.

** Total dividends (including special dividends) paid since 30

September 2013.

Percentage of Assets Held as at 31 March 2023

Description Total Qualifying Non- qualifying

% % %

AIM Traded 70.6 69.1 1.5

Unquoted 12.3 12.3 -

Other funds 8.1 - 8.1

Fully Listed 3.2 - 3.2

Cash and other assets 5.8 - 5.8

Valuation based on fair value

Chair's Statement

I am pleased to present the unaudited Half-Yearly Report of the

Company for the six-month period ended 31 March 2023.

As at 31 March 2023, the net assets of the Company were GBP218.4

million. This figure is GBP2.7 million lower than at the start of

the current financial year. After accounting for the additional

shares in issue following a successful Offer for Subscription and

after adding back dividends paid in the period, the total return in

the six-month period under review was -4.3%.

The decline in net asset value recorded in the first half of the

Company's financial year is both disappointing and represents a

period of relative underperformance. The FTSE AIM All-Share Index

recorded a small positive total return of 1.1%.

Investor appetite for equity risk continued to wane throughout

the first half of the financial year and this resulted in a

significant derating of smaller, less liquid AIM stocks and a

widening divergence of returns across the market capitalisation

range. On average during the period, there were twenty-two

companies listed on the AIM Index with a market capitalisation in

excess of GBP1 billion. The value of these companies, represented

26% of the total value of the AIM Index and they posted an average

total return of +20.4% over the six-month period under review. By

contrast, there were 653 companies valued at a market

capitalisation of GBP150m or less, in aggregate accounting for only

23% of AIM Index value.

These smaller businesses posted an average total return of -9.8%

over the same period. Such statistics illustrate the divergence in

performance between smaller, earlier stage growth companies, where

the majority of our investments must be directed, and the larger,

more established businesses listed on the AIM Index.

Higher interest rates have weighed particularly heavily on

early-stage growth companies, where valuations are typically more

dependent on longer term expectations of profitability. This

dynamic has placed significant pressure on the share prices of many

AIM-listed companies. Larger, more established businesses,

especially those listed on the FTSE 100 Index, again significantly

outperformed companies at the lower end of the market

capitalisation range.

Inevitably, there were also a small number of discouraging

trading updates in the six months under review. Nonetheless, the

period can best be characterised by the resilience and adaptability

shown by most investee companies despite the extremely challenging

operating conditions environment. The most notable exception was

The British Honey Company ("British Honey"), a UK based producer of

spirits, honey, and jams. A weak balance sheet, combined with poor

operational management, exacerbated the mounting challenges posed

by order delays, a difficult consumer environment and severe cost

inflation. At the end of March, the Board of British Honey

announced its intention to place the business into administration

in order to avoid trading insolvently. Although British Honey has

been an extremely disappointing investment, the impact on

performance in the period was minimal due to declines in British

Honey's carrying value in previous periods. It is now highly

unlikely that any meaningful recovery in value will be

achieved.

Your Investment Manager continues to manage the portfolio in a

prudent fashion with the aim of developing a diverse portfolio of

high-quality companies capable of generating significant

Shareholder returns over the long term. The team at Unicorn has

extensive experience of investing in AIM listed businesses across

the full spectrum of market conditions and they are well placed to

successfully navigate the current challenging environment.

Investment Performance

A review of the ten most meaningful contributions to performance

in absolute terms (both positive and negative) follows.

Hasgrove (11.1% of net assets, +GBP5.4 million) is an unquoted

company, whose sole operating subsidiary, Interact, is a

fast-growing Software as a Service (SaaS) provider of corporate

intranet solutions. Hasgrove reported strong results for its

financial year ended 31 December 2022, during which revenues grew

by 28% to GBP29.4 million and adjusted EBITDA increased by 22% to

GBP10.1 million. Management also reported a strong start to trading

in the current financial year, underpinned by high levels of

recurring revenue from its core Interact software product. As a

result, further growth is anticipated in the current financial year

ended 31 December 2023, and the Fair Value of the Company's holding

in Hasgrove has therefore been adjusted upwards to GBP24.3 million.

This uplift represents an increase of GBP5.4 million compared to

the assessed Fair Value as at the VCT's previous financial year

ended 30 September 2022.

Aurrigo International (3.7% of net assets, +GBP4.8 million) is a

leading international provider of transport technology solutions

and is highly regarded as a specialist in autonomous and

semiautonomous solutions. Aurrigo International has delivered

strong operational and financial performance following its IPO on

AIM in September 2022. Since its IPO, Aurrigo has invested in the

further development of its Autonomous and Aviation division and

signed an agreement with Singapore's Changi Airport Group for the

next development phase of its 'Auto-Dolly' baggage transportation

solution.

MaxCyte (4.3% of net assets, -GBP4.5 million) is a US-based life

sciences company that provides cell engineering and gene editing

technologies to support drug discovery and cell therapy

applications. During the period, MaxCyte released results for its

financial year ended 31 December 2022, which highlighted a 31%

growth in revenues to $44.3 million. The aggregate potential value

of all milestone payments is now reported to have increased to over

$1.55 billion from eighteen strategic platform licence (SPL)

agreements. The management team expects further revenue growth of

between 21% to 26% in its current financial year. MaxCyte remains

well-funded with total cash and cash equivalents of circa $227

million as at 31 December 2022. However, sentiment towards biotech

companies has deteriorated markedly in the past two years and

MaxCyte has certainly not been immune from this process, despite

encouraging operational and financial performance.

Anpario (1.7% of net assets, -GBP4.0 million) is an

international manufacturer and distributor of natural animal feed

additives for animal health and nutrition, with a focus on

sustainable and eco-friendly solutions. Anpario reported a weaker

operational and financial performance in recent months, announcing

a 25% decline in its gross profits due to supply chain disruption

and significant inflation in the cost of raw materials. Sales

growth across Asia, Middle East & Africa, and the Americas has

been offset by a decrease in European revenues. Despite this recent

setback, the business, remains profitable, maintains a strong

balance sheet, offers a broad range of products and is

geographically diverse. Your Investment Manager believes that the

share price is likely to recover strongly once the current

headwinds abate.

Abcam (5.8% of net assets, -GBP3.0 million) is a UK-based life

sciences company that produces and distributes research-grade

antibodies and other biological reagents for use in scientific

research and diagnostics. In December 2022, Abcam delisted from the

AIM Index, and we consequently exchanged our UK listed shares for

an equivalent value of American Depository Shares. Abcam had been

dual listed on AIM and NASDAQ since October 2020. In March 2023,

Abcam released results for its financial year ended 31 December

2022, which highlighted that profit growth had been constrained by

two main factors; the implementation of a new ERP system, which

disrupted sales in September and October, and sales performance in

China that was disrupted by the regime's zero-COVID policy.

Saietta (0.5% of net assets, -GBP1.9 million) is a designer and

manufacturer of axial flux motors for electric vehicles.

Unfortunately, Saietta was forced to issue a profit warning in

March 2023, due to significantly weaker than expected sales in its

Comet (heavy-duty) and Propel (Marine) divisions. Meanwhile, orders

for Saietta's light-duty integrated eDrive product have been

expanding at pace, requiring significantly increased investment to

ensure a successful transition to volume manufacturing. The Board

of Saietta has confirmed its confidence that the business is in a

position to fully finance the current financial year (2023/24),

without recourse to further external fundraising. Saietta's cash

balance as at 28 February 2023 was GBP11 million.

Surface Transforms (2.4% of net assets, -GBP1.8 million) designs

and manufactures high-performance carbon ceramic brake discs for

use in the automotive and aerospace industries. In January 2023,

Surface Transforms reported on technical problems, which included

an issue with one of its key furnaces. These problems have

adversely affected output over the past six months, which was

already under pressure due to industry-wide supply chain

constraints. These issues negatively affected turnover, have

increased production costs, and have consequently resulted in a

larger than expected operating loss for the company's financial

year ended 31 December 2022. The management team has taken various

steps to improve the manufacturing process, including the use of

more readily available raw materials. These changes have been

successfully implemented, and production issues therefore now

appear to have been resolved.

Engage XR (0.3% of net assets, -GBP1.6 million) is a technology

business focused on Virtual Reality. In December 2022, Engage XR

issued a weaker than expected trading update, which reported on

slow conversion of the group's sales pipeline. Engage XR had

previously increased its cost base by expanding its sales,

marketing, and support teams, which led to sharply higher losses in

its financial year ended 31 December 2022. Management is now taking

action to reduce the cost base in light of the more challenging

trading environment.

Animalcare (1.2% of net assets, -GBP1.5 million) is an

international animal health business. In March 2023, Animalcare

announced results for its financial year ended 31 December 2022,

which highlighted a modest decline in annual sales, primarily as a

result of reduced antibiotic use in Spain. Animalcare has, however,

made good progress in increasing its gross margins through sales of

higher margin products and its Board expects to report on a return

to revenue growth in the current financial year.

Angle (0.3% of net assets, -GBP1.3 million) is a world-leading

liquid biopsy company. Angle has not been immune from the wider

economic and market headwinds and the management team has therefore

taken swift action to control the cost base, which has included the

closure of its Canadian operations. These measures are expected to

deliver cost savings of GBP2.6 million in 2023 and GBP4.0 million

per annum thereafter but have also resulted in one-off costs of

circa GBP2 million. Angle ended 2022 with net cash of circa GBP32

million.

In aggregate, the eight largest detractors from performance

delivered an unrealised capital loss of GBP19.6 million, while the

two largest contributors to performance contributed GBP10.2 million

to positive performance.

Investment Activity

Investment activity is deliberately tightly controlled when the

outlook for equity markets looks unsettled. Consequently, there has

been limited investment activity during the period under

review.

One new VCT qualifying investment into Oxford Biodynamics was

completed in the six-month period to the end of March,2023 at an

investment cost of GBP2.0 million. In addition to this new

investment, one secondary investment was made in SulNOx at a cost

of GBP0.1 million.

The Investment Manager continues to engage with the management

teams of our investee companies on a regular basis, in order to

monitor their performance and ensure that they are navigating the

currently tough economic conditions as effectively as possible.

It is also important to note that new opportunities to create

long term value are not being overlooked and, although the IPO

market is currently subdued, the near-term investment pipeline

remains encouraging.

Offer for Subscription

The Company's latest Offer for Subscription was launched on 24

January 2023 and opened for applications on 6 February 2023. The

Offer reached full subscription of GBP15 million on 6 February 2023

and was closed shortly thereafter. On behalf of the Board, I would

like to welcome all new Shareholders and to thank existing

Shareholders for their continued support.

Dividends

The Board has declared an interim dividend of 3.0 pence per

share, for the six months ended 31 March 2023. This interim

dividend will be paid on 11 August 2023 to Shareholders on the

register on 14 July 2023. The shares will be quoted ex-dividend on

13 July 2023.

Dividend decisions are taken by the VCT Board and are always

subject to a number of factors including; market conditions,

satisfactory returns, and/or availability of cash and distributable

reserves.

Dividend Reinvestment Scheme ("DRIS")

On 14 February 2023, 560,504 Ordinary Shares were allotted at a

price of 129.7 pence per share, being the latest published net

asset value at 31 January 2023, to Shareholders who elected to

receive Ordinary Shares under the DRIS as an alternative to the

final cash dividend for the year ended 30 September 2022.

Share Buybacks

During the period from 1 October 2022 to 31 March 2023, the

Company bought back 1,587,397 of its own Ordinary Shares for

cancellation, at an average price of 114.8 pence per share

including costs.

As at 31 March 2023, there were 174,104,558 Ordinary Shares in

issue.

Material Transactions

Other than the Offer for Subscription, Share Buybacks and the

purchase of investments described above, there were no material

transactions in the six-month period ended 31 March 2023.

VCT Status

The Company comfortably exceeded the VCT qualifying threshold

required by HM Revenue & Customs, with approximately 99.4%

(excluding new capital) of total assets by VCT value being invested

in VCT qualifying companies at the end of the period under review.

The Company has complied with all other HM Revenue & Customs'

regulations, and your Board has been advised by PwC that the

Company has maintained its venture capital trust status.

Summary & Outlook

Small AIM-listed businesses continue to experience significant

pressures. Access to growth capital is difficult, debt funding

costs are high and input costs, such as wages and raw materials,

have spiralled upwards. Against this backdrop, it is unsurprising

that investor enthusiasm for early-stage, loss-making companies

remains fragile.

However, there are reasons to believe that the outlook is

improving. Inflation appears to have peaked, which should negate

the need for significant interest rate increases. Pressures on the

global supply chain have eased, which is enabling businesses to

fulfil vital orders. Despite the gloomy forecasts from most

economists, the UK economy has so far managed to avoid falling into

recession and, for the time being at least, stability also appears

to have been restored in Westminster. UK quoted companies generally

remain in good financial health and continue to demonstrate their

operational and financial resilience.

The FTSE AIM All-Share Index has suffered a significant

contraction in value over the past two years which, although

understandable, has been disproportionate to other equity markets.

Encouragingly, in the early weeks of the second half of the VCT's

financial year, equity market conditions have shown tentative signs

of recovery, perhaps in response to an increased level of interest

from prospective acquirers of UK listed businesses. Merger &

Acquisition and IPO activity has certainly picked up noticeably in

recent weeks.

The Board believes that the Company's investment portfolio is

well placed to deliver a strong recovery in performance as and when

these positive trends gather momentum.

Tim Woodcock

Chair

30 May 2023

Investment Objective

The Company's objective is to provide Shareholders with an

attractive return from a diversified portfolio of investments,

predominantly in the shares of AIM quoted companies, by maintaining

a steady flow of dividend distributions to Shareholders from the

income as well as capital gains generated by the portfolio.

It is also the objective that the Company should continue to

qualify as a Venture Capital Trust, so that Shareholders benefit

from the taxation advantages that this brings. To achieve this at

least 80% for accounting periods commencing after 6 April 2019

(previously 70%) of the Company's total assets are to be invested

in qualifying investments of which 70% by VCT value (30% in respect

of investments made before 6 April 2018 from funds raised before 6

April 2011) must be in ordinary shares which carry no preferential

rights (save as permitted under VCT rules) to dividends or return

of capital and no rights to redemption.

Investment Policy

In order to achieve the Company's investment objective, the

Board has agreed an investment policy which requires the Investment

Manager to identify and invest in a diversified portfolio,

predominantly of VCT qualifying companies quoted on AIM that

display a majority of the following characteristics:

experienced and well-motivated management;

products and services supplying growing markets;

sound operational and financial controls; and

potential for good cash generation in due course, to finance

ongoing development and support for a progressive dividend

policy.

Asset allocation and risk diversification policies, including

maximum exposures, are to an extent governed by prevailing VCT

legislation. No single holding may represent more than 15% (by VCT

value) of the Company's total investments and cash, at the date of

investment.

There are a number of VCT conditions which need to be met by the

Company which may change from time to time. The Investment Manager

will seek to make qualifying investments in accordance with such

requirements.

Asset Mix

Where capital is available for investment while awaiting

suitable VCT qualifying opportunities or is in excess of the 80%

VCT qualification threshold for accounting periods commencing after

6 April 2019, it may be held in cash or invested in money market

funds, collective investment vehicles or non-qualifying shares and

securities of fully listed companies registered in the UK.

Borrowing

To date the Company has operated without recourse to borrowing.

The Board may however consider the possibility of introducing

modest levels of gearing up to a maximum of 10% of the adjusted

capital and reserves, should circumstances suggest that such action

is in the interests of Shareholders.

Venture Capital Trust Status

The Company has satisfied the requirements for approval as a

Venture Capital Trust ("VCT") under section 274 of the Income Tax

Act 2007 (ITA). It is the Directors' intention to continue to

conduct the business of the Company so as to maintain compliance

with that section.

Unaudited Investment Portfolio Summary

as at 31 March 2023

Qualifying investments % of net

assets

Book cost Valuation by value

GBP'000 GBP'000 *

AIM quoted investments:

Tracsis 1,500 14,520 6.7

Abcam 1,161 12,748 5.8

MaxCyte 2,926 9,445 4.3

Aurrigo International 3,000 8,125 3.7

Avingtrans 996 6,806 3.1

Keywords Studio 303 6,801 3.1

Cohort 1,278 5,520 2.5

Mattioli Woods 1,626 5,503 2.5

Tristel 878 5,233 2.4

Surface Transforms 3,164 5,164 2.4

Access Intelligence 3,159 5,152 2.4

Avacta Group 932 4,773 2.2

AB Dynamics 793 4,650 2.1

Directa Plus 4,610 4,522 2.1

Idox 1,242 4,010 1.8

Feedback 4,000 3,643 1.7

Anpario 1,422 3,637 1.7

Instem 985 3,462 1.6

Belvoir Group 1,883 3,381 1.5

Arecor Therapeutics 2,778 2,997 1.4

Animalcare Group 2,401 2,568 1.2

Futura Medical 2,300 2,556 1.2

City Pub Group 2,250 1,705 0.8

Oxford Biodynamics 2,000 1,355 0.6

Ilika 1,528 1,294 0.6

Lunglife AI 3,080 1,225 0.6

Verici DX 2,125 1,201 0.5

Smoove 1,500 1,181 0.5

Saietta Group 3,151 1,129 0.5

Destiny Pharma 2,500 1,121 0.5

47 investments, each valued at less

than 0.5% of net assets 58,493 15,565 7.1

----------------------------------------------- ------------------ -------------- ------------------

119,964 150,992 69.1

Qualifying investments

Unlisted investments:

Hasgrove 1,303 24,259 11.1

nkoda Limited 2,497 962 0.5

Heartstone Inns 1,112 687 0.3

Phynova Group 1,500 430 0.2

LightwaveRF 2,616 279 0.1

Osirium Technologies - Loan Stock 500 250 0.1

6 investments, each valued at less than

0.1% of net assets 4,904 - -

----------------------------------------------- ------------------ -------------- ------------------

14,432 26,867 12.3

----------------------------------------------- ------------------ -------------- ------------------

Total qualifying investments 134,396 177,859 81.4

----------------------------------------------- ------------------ -------------- ------------------

Non-qualifying investments

Royal London Short Term Money Market

Fund Y(OEIC) 7,002 7,013 3.2

Blackrock Cash Fund Class D (Unit Trust) 7,000 7,011 3.2

Fully listed UK equities 8,357 6,932 3.2

Unicorn Ethical Fund (OEIC) Income 4,483 3,645 1.7

AIM quoted investments 4,883 3,409 1.5

Other unlisted investments each valued

at less than 0.1% of net assets 556 - -

-----------------------------------------------

Total non-qualifying investments 32,281 28,010 12.8

----------------------------------------------- ------------------ -------------- ------------------

Total investments 166,677 205,869 94.2

Cash and cash equivalents 13,851 6.4

Current assets 174 0.1

Current liabilities (1,473) (0.7)

----------------------------------------------- ------------------ -------------- ------------------

Net assets 218,421 100.0

----------------------------------------------- ------------------ -------------- ------------------

* Based on fair value not VCT carrying value

Responsibility Statement

Directors' Statement of Principal Risks and Uncertainties

The important events that have occurred during the period under

review and the key factors influencing the financial statements are

set out in the Chair's Statement above.

In accordance with DTR 4.2.7, the Directors consider that with

the exception of those mentioned below, the principal risks and

uncertainties facing the Company have not materially changed since

the publication of the Annual Report and Accounts for the year

ended 30 September 2022.

The principal risks faced by the Company include, but are not

limited to:

-- investment and strategic

-- regulatory and tax

-- operational

-- fraud, dishonesty and cyber

-- financial instruments

-- economic and political

In addition, the Directors also assess the possibility of new

and emerging risks.

A more detailed explanation of these risks and the way in which

they are managed can be found in the Strategic Report on pages 31

and 32 and in the Notes to the Financial Statements on pages 79 to

81 of the 2022 Annual Report and Accounts - copies can be found via

the Company's website, www.unicornaimvct.co.uk .

Directors' Statement of Responsibilities in Respect of the

Financial Statements

In accordance with Disclosure and Transparency Rule (DTR)

4.2.10, Tim Woodcock (Chair), Charlotta Ginman (Senior Independent

Director), Jeremy Hamer (Chair of the Audit Committee) and Josie

Tubbs, the Directors, confirm that to the best of their

knowledge:

-- the condensed set of financial statements, which have been

prepared in accordance with FRS 104 "Interim Financial Reporting"

give a true and fair view of the assets, liabilities, financial

position and loss of the Company for the period ended 31 March

2023, as required by DTR 4.2.4;

-- this Half-Yearly Report includes a fair review of the

information required as follows:

the interim management report included within the Chair's

Statement and the Investment Portfolio Summary, includes a fair

review of the information required by DTR 4.2.7 being an indication

of important events that have occurred during the first six months

of the financial year and their impact on the condensed set of

financial statements; and a description of the principal risks and

uncertainties facing the Company for the remaining six months of

the year; and

there were no other related party transactions in the first six

months of the current financial year that are required to be

disclosed in accordance with DTR 4.2.8.

Cautionary Statement

This report may contain forward looking statements with regards

to the financial condition and results of the Company, which are

made in the light of current economic and business circumstances.

Nothing in this report should be construed as a profit

forecast.

The Half-Yearly Report was approved by the Board of Directors on

30 May 2023 and the above responsibility statement was signed on

its behalf by:

Tim Woodcock

Chair

30 May 2023

Management of the Company

The Board has overall responsibility for the Company's affairs

including the determination of its investment policy. Risk is

spread by investing in a number of different businesses across

different industry sectors. The Investment Manager, Unicorn Asset

Management Limited, is responsible for managing sector and stock

specific risk and the Board does not impose formal limits in

respect of such exposures. However, in order to maintain compliance

with HMRC rules and to ensure that an appropriate spread of

investment risk is achieved, the Board receives and reviews

comprehensive reports from the Investment Manager on a monthly

basis. When the Investment Manager proposes to make any investment

in an unquoted company, the prior approval of the Board is

required. The Board continues to take the need for transparency and

independence seriously. When a conflict arises involving a

relationship between any Director and an investee or proposed

investee company, that Director abstains from any discussion or

consideration on any such investment by the Company.

The Administrator, ISCA Administration Services Limited,

provides Company Secretarial and Accountancy services to the

Company.

Unaudited Condensed Income Statement

for the six months ended 31 March 2023

Six months ended Six months ended Year ended 30 September

31 March 2023 (unaudited) 31 March 2022 (unaudited) 2022 (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Net unrealised

losses on

investments 7 - (8,773) (8,773) - (61,056) (61,056) - (113,641) (113,641)

Net gains

on

realisation

of

investments 7 - 7 7 - 921 921 - 12,771 12,771

Income 4 751 - 751 578 - 578 1,753 - 1,753

Investment

management

fees 2 (523) (1,567) (2,090) (742) (2,229) (2,971) (1,322) (3,965) (5,287)

Other expenses (382) - (382) (356) - (356) (771) - (771)

-------------- --------------- --------------- -------------- --------------- --------------- -------------- ---------------- ----------------

Loss on

ordinary

activities

before

taxation (154) (10,333) (10,487) (520) (62,364) (62,884) (340) (104,835) (105,175)

-------------- --------------- --------------- -------------- --------------- --------------- -------------- ---------------- ----------------

Tax on loss

on ordinary 3 - - - - - - - - -

activities

-------------- --------------- --------------- -------------- --------------- --------------- -------------- ---------------- ----------------

Loss and

total

comprehensive

income after

taxation (154) (10,333) (10,487) (520) (62,364) (62,884) (340) (104,835) (105,175)

Basic and

diluted

earnings

per share:

Ordinary

Shares 5 (0.09)p (6.23)p (6.32)p (0.35)p (41.38)p (41.73)p (0.22)p (67.10)p (67.32)p

-------------- --------------- --------------- -------------- --------------- --------------- -------------- ---------------- ----------------

All revenue and capital items in the above statement derive from

continuing operations of the Company.

The total column of this statement is the Statement of Total

Comprehensive Income of the Company prepared in accordance with

Financial Reporting Standards ("FRS"). The supplementary revenue

return and capital return columns are prepared in accordance with

the Statement of Recommended Practice ("AIC SORP") issued in July

2022 by the Association of Investment Companies.

Other than revaluation movements arising on investments held at

fair value through Profit or Loss Account, there were no

differences between the (loss)/profit as stated above and at

historical cost.

The notes form part of these Half-Yearly financial

statements.

Unaudited Condensed Statement of Financial Position

as at 31 March 2023

As at As at As at

31 March 2023 31 March 2022 30 September

2022

Notes (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------ -------------------------------- -----------------------------------------

Non-current

assets

Investments at

fair 1e,

value 7 205,869 291,075 198,541

Current assets

Debtors 174 156 515

Cash and cash

equivalents 13,851 26,242 23,751

------------------------------ -------------------------------- -----------------------------------------

14,025 26,398 24,266

Creditors;

amounts

falling due

within

one year (1,473) (2,181) (1,681)

------------------------------ -------------------------------- -----------------------------------------

Net current

assets 12,552 24,217 22,585

------------------------------ -------------------------------- -----------------------------------------

Net assets 218,421 315,292 221,126

------------------------------ -------------------------------- -----------------------------------------

Share capital

and

reserves

Called up

share capital 1,741 1,611 1,640

Capital

redemption

reserve 129 102 113

Share premium

account 100,292 79,193 85,063

Capital

reserve 46,267 147,402 55,038

Special

reserve 59,207 66,176 68,338

Profit and

loss account 10,785 20,808 10,934

------------------------------ -------------------------------- -----------------------------------------

Equity

Shareholders'

funds 218,421 315,292 221,126

------------------------------ -------------------------------- -----------------------------------------

Basic and

diluted

net asset

value per

share of 1p

each

Ordinary

Shares 8 125.45p 195.74p 134.81p

The financial information for the six months ended 31 March 2023

and the six months ended 31 March 2022 have not been audited.

The notes form part of these Half-Yearly financial

statements.

Unaudited Condensed Statement of Changes in Equity

for the six months ended 31 March 2023

Called

up Capital Share Unrealised Profit

share redemption premium capital Special and loss

capital reserve account reserve reserve* account* Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ ---------------- ------------- ---------------- -------------- -------------- --------------

Six months ended 31 March

2023

As at 1

October

2022 1,640 113 85,063 55,038 68,338 10,934 221,126

Loss after

taxation - - - (8,771) - (1,716) (10,487)

Transfer to

special

reserve - - - - (1,567) 1,567 -

Shares issued

under Offer

for

Subscription,

net of costs 111 - 14,508 - - - 14,619

Net proceeds

from DRIS

share

issue 6 - 721 - - - 727

Shares

purchased

for

cancellation

and cancelled (16) 16 - - (1,823) - (1,823)

Dividends paid - - - - (5,741) - (5,741)

At 31 March

2023 1,741 129 100,292 46,267 59,207 10,785 218,421

------------ ---------------- ------------- ---------------- -------------- -------------- --------------

Six months ended 31 March

2022

As at 1

October

2021 1,491 88 53,602 222,185 87,659 5,773 370,798

(Loss)/profit

after

taxation - - - (74,783) - 11,899 (62,884)

Transfer to

special

reserve - - - - (3,136) 3,136 -

Shares issued

under Offer

for

Subscription,

net of costs 127 - 24,258 - - - 24,385

Net proceeds

from DRIS

share

issue 7 - 1,333 - - - 1,340

Shares

purchased

for

cancellation

and cancelled (14) 14 - - (2,747) - (2,747)

Dividends paid - - - - (15,600) - (15,600)

At 31 March

2022 1,611 102 79,193 147,402 66,176 20,808 315,292

------------ ---------------- ------------- ---------------- -------------- -------------- --------------

Year ended 30 September

2022

As at 1

October

2021 1,491 88 53,602 222,185 87,659 5,773 370,798

(Loss)/profit

after

taxation - - - (167,147) - 61,972 (105,175)

Transfer to

special

reserve - - - - (4,872) 4,872 -

Shares issued

under Offer

for

Subscription,

net of costs 127 - 24,281 - - - 24,408

Net proceeds

from DRIS

share

issues 47 - 7,180 - - - 7,227

Shares

purchased

for

cancellation

and cancelled (25) 25 - - (4,440) - (4,440)

Dividends paid - - - - (10,009) (61,683) (71,692)

------------ ---------------- ------------- ---------------- -------------- -------------- --------------

At 30

September

2022 1,640 113 85,063 55,038 68,338 10,934 221,126

The financial information for the six months ended 31 March 2023

and the six months ended 31 March 2022 have not been audited.

The profit and loss account comprises the revenue reserve of

GBP(825,000) and the realised capital reserve of GBP11,610,000.

*The special reserve and profit and loss account are

distributable to Shareholders. The special reserve is used to fund

market purchases of the Company's own shares, to make distributions

and to write-off existing and future losses.

The notes form part of these Half-Yearly financial

statements.

Unaudited Condensed Statement of Cash Flows

for the six months ended 31 March 2023

Notes Six months Six months Year ended 30

ended 31 March ended 31 March September 2022

2023 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

-------------------- -------------------- --------------------

Operating activities

Investment income

received 1,119 878 1,609

Investment management

fees paid (2,133) (3,166) (5,831)

Other cash payments (440) (363) (778)

-------------------- -------------------- --------------------

Net cash outflow

from operating

activities (1,454) (2,651) (5,000)

Investing activities

Purchase of investments 7 (16,100) (6,535) (9,813)

Sale of investments 7 8 23,938 79,022

Net cash (outflow)/inflow

from investing

activities (16,092) 17,403 69,029

-------------------- -------------------- --------------------

Net cash (outflow)/inflow

before financing (17,546) 14,752 64,209

Financing

Dividends paid 6 (5,014) (14,244) (64,433)

Shares issued

under Offer for

Subscription (net

of transaction

costs paid in

the period) 14,881 24,855 24,407

Expenses of DRIS

share issues - (16) (32)

Shares repurchased

for cancellation (2,221) (2,747) (4,042)

-------------------- -------------------- --------------------

Net cash inflow/(outflow)

from financing 7,646 7,848 (44,100)

-------------------- -------------------- --------------------

Net (decrease)/increase

in cash and cash

equivalents (9,900) 22,600 20,109

Cash and cash

equivalents at

start of period 23,751 3,642 3,642

-------------------- -------------------- --------------------

Cash and cash

equivalents at

end of period 13,851 26,242 23,751

-------------------- -------------------- --------------------

Reconciliation

of operating loss

to net cash outflow

from operating

activities

Loss for the period (10,487) (62,884) (105,175)

Net unrealised

losses on investments 8,773 61,056 113,641

Net gains on realisation

of investments (7) (921) (12,771)

Transaction costs - (5) (5)

Decrease/(increase)

in debtors and

prepayments 341 298 (61)

Decrease in creditors

and accruals (72) (186) (613)

Reconciling items

- dividends reinvested (2) (9) (16)

Net cash outflow

from operating

activities (1,454) (2,651) (5,000)

-------------------- -------------------- --------------------

The financial information for the six months ended 31 March 2023

and the six months ended 31 March 2022 have not been audited.

The notes form part of these Half-Yearly financial

statements.

Notes to the unaudited financial statements

for the six months ended 31 March 2023

1. Principal accounting policies

a) Statement of compliance

The Company's Financial Statements for the six months to 31

March 2023 have been prepared under UK Generally Accepted

Accounting Practice ("UK GAAP") and the Statement of Recommended

Practice, 'Financial Statements of Investment Trust Companies and

Venture Capital Trusts' ('the SORP') issued in July 2022 by the

Association of Investment Companies.

The financial statements have been prepared in accordance with

the accounting policies set out in the statutory accounts for the

year ended 30 September 2022.

b) Financial information

The financial information contained in this report does not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The financial information for the periods ended

31 March 2023 and 31 March 2022 have not been audited or reviewed

by the Company's Auditor pursuant to the Auditing Practices Board

guidance on such reviews. The information for the year to 30

September 2022 has been extracted from the latest published Annual

Report and Financial Statements, which have been lodged with the

Registrar of Companies, contained an unqualified auditors' report

and did not contain a statement required under Section 498 (2) or

(3) of the Companies Act 2006.

c) Going concern

After due consideration, the Directors believe that the Company

has adequate resources for the foreseeable future and that it is

appropriate to apply the going concern basis in preparing the

financial statements. As at 31 March 2023, the Company held cash

balances of GBP13.9 million and a further GBP17.7 million is held

in OEIC funds and a Unit Trust. A large proportion of the Company's

investment portfolio remains invested in AIM and fully listed

equities which may be realised, subject to the need for the Company

to maintain its VCT status. Cash flow projections covering a period

of twelve months from the date of approving the financial

statements have been reviewed and show that the Company has

sufficient funds to meet both contracted expenditure and any

discretionary cash outflows from buybacks and dividends. The

Company has no external loan finance in place and is therefore not

exposed to any gearing covenants.

d) Presentation of the Income Statement

In order to better reflect the activities of a VCT and in

accordance with the SORP, supplementary information which analyses

the Income Statement between items of a revenue and capital nature

has been presented alongside the Statement of Comprehensive Income.

The revenue column of loss attributable to Shareholders is the

measure the Directors believe appropriate in assessing the

Company's compliance with certain requirements set out in Section

274 Income Tax Act 2007.

e) Investments

All investments held by the Company are classified as "fair

value through profit or loss", in accordance with FRS102. This

classification is followed as the Company's business is to invest

in financial assets with a view profiting from their total return

in the form of capital growth and income and in accordance with the

Company's risk management and investment policy. In the preparation

of the valuation of assets, in accordance with current IPEV

guidelines, the Directors are required to make judgements and

estimates that are reasonable and incorporate their knowledge of

the performance of the investee companies.

-- For investments actively traded on organised financial

markets, fair value is generally determined by reference to Stock

Exchange market quoted bid prices at the close of business on the

balance sheet date. Purchases and sales of quoted investments are

recognised on the trade date where a contract of sale exists whose

terms require delivery within a time frame determined by the

relevant market.

-- Unquoted investments are reviewed at least quarterly to

ensure that the fair values are appropriately stated and are valued

in accordance with current IPEV guidelines as updated in December

2018, which relies on subjective estimates. Fair value is

established by assessing different methods of valuation, such as

price of recent transaction, sales multiples, earnings multiples,

discounted cash flows and net assets. Purchases and sales of

unlisted investments are recognised when the contract for

acquisition or sale becomes unconditional.

-- Where a company's underperformance against plan indicates a

diminution in the value of the investment, provision against cost

is made, as appropriate. Where it is considered the value of an

investment has fallen permanently below cost, the loss is treated

as a permanent impairment and as a realised loss, even though the

investment is still held. The Board assesses the portfolio for such

investments and, after agreement with the Investment Manager, will

agree the values that represent the extent to which an investment

loss has become realised. This is based upon an assessment of

objective evidence of that investment's future prospects, to

determine whether there is potential for the investment to recover

in value.

-- Redemption premiums on loan stock investments are recognised

at fair value when the Company receives the right to the premium

and when considered recoverable.

f) Capital reserves

(i) Realised (included within the Profit and Loss Account

reserve)

The following are accounted for in this reserve:

-- Gains and losses on realisation of investments;

-- Permanent diminution in value of investments; and

-- Transaction costs incurred in the acquisition of

investments.

(ii) Unrealised capital reserve (Revaluation reserve)

Increases and decreases in the valuation of investments held at

the period end are accounted for in this reserve, except to the

extent that the diminution is deemed permanent.

In accordance with stating all investments at fair value through

profit or loss, all such movements through both unrealised and

realised capital reserves are shown within the Income Statement for

the period.

(iii) Special reserve

The costs of share buybacks are charged to this reserve. In

addition, any realised losses on the sale of investments, and 75%

of the management fee expense, and the related tax effect, are

transferred from the Profit and Loss Account reserve to this

reserve. This reserve can also be used for distributions made by

the Company.

2. Investment Management Fees

Unicorn Asset Management Limited ("UAML") receives an annual

management fee, calculated and payable quarterly in arrears, of

2.0% of the net asset value of the Company, excluding the value of

the investments in the OEIC which is also managed by UAML, up to

net assets of GBP200 million, 1.5% of net assets in excess of

GBP200 million and 1.0% of net assets in excess of GBP450 million.

If the Company raises further funds during a quarter the net asset

value for that quarter shall be reduced by an amount equal to the

amount raised, net of costs, multiplied by the percentage of days

in that quarter prior to the funds being raised.

The Directors have charged GBP1,567,000, being 75% of the

investment management fees to the capital reserve and the balance

of 25% being GBP523,000 to revenue.

At 31 March 2023, GBP1,024,000 payable to the Investment Manager

is included in creditors due within one year.

3. Taxation

The total allowable expenses exceed income hence there is no tax

charge for the period.

4. Income

Six months Six months Year ended

ended ended 30 September

2022

31 March 31 March (audited)

2023 2022

(unaudited) (unaudited) GBP'000

GBP'000 GBP'000

Dividends 608 513 1,525

Unicorn managed OEICs (including

reinvested dividends) 65 74 201

Other OEICs 2 - -

Bank deposit interest 76 - 27

Loan stock interest - (9) -

----------------- ----------------- ------------------

751 578 1,753

----------------- ----------------- ------------------

5. Basic and diluted earnings and return per share

` Six months Six months Year ended

ended ended 30 September

31 March 31 March 2022

2023 2022

(unaudited) (unaudited) (audited)

Total earnings after taxation

(GBP'000) (10,487) (62,884) (105,175)

------------------ ------------------ ------------------

Basic and diluted earnings

per share (6.32)p (41.73)p (67.32)p

Net revenue from ordinary activities

after taxation (GBP'000) (154) (520) (340)

------------------ ------------------ ------------------

Basic and diluted revenue earnings

per share (0.09)p (0.35)p (0.22)p

------------------ ------------------ ------------------

Total capital return after taxation

(GBP'000) (10,333) (62,364) (104,835)

------------------ ------------------ ------------------

Basic and diluted capital earnings

per share (6.23)p (41.38)p (67.10)p

------------------ ------------------ ------------------

Weighted average number of

shares in issue in the period 165,899,485 150,691,628 156,227,923

There are no instruments in place that may increase the number

of shares in issue in the future. Accordingly, the above figures

represent both basic and diluted earnings per share.

6. Dividends

Six months Six months Year ended

ended ended

31 March 31 March 30 September

2023 2022 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Amounts recognised as distributions

to equity holders in the period:

Interim capital dividend of

nil pence (2022: 3.0 pence)

per share for the year ended

30 September 2022 paid on 11

August 2022 - - 4,809

Special interim capital dividend

of nil pence (2022: 32.0 pence)

per share for the year ended

30 September 2022 paid on 11

August 2022 - - 51,292

Final capital dividend of 3.5

pence (2022: 3.5 pence) per

share for the year ended 30

September 2022 paid on 14 February

2023 5,741 5,200 5,200

Special interim capital dividend

of nil pence (2022:7.0 pence

per share for the year ended

30 September 2022 paid on 10

February 2022 - 10,400 10,400

Total dividends paid in the

period* 5,741 15,600 71,701

Unclaimed dividends returned -- -- (9)

5,741 15,600 71,692

----------------- ----------------- ------------------

* The difference between total dividends paid and that shown in

the Condensed Cash Flow Statement is GBP727,000, which is the

amount of dividends reinvested under the Dividend Reinvestment

Scheme ("DRIS").

7. Investments at fair value

Unlisted

Fully Traded Unlisted loan Other

listed on AIM shares stock Funds** Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Book cost at

30 September

2022 8,357 122,935 14,303 500 4,483 150,578

Unrealised

(losses)/

gains at 30

September 2022 (2,275) 47,514 11,392 (375) (1,218) 55,038

Permanent

impairment

in value of

investments - (2,442) (4,633) - - (7,075)

----------------- ------------------ ------------------- ------------------- ---------------- --------------

Opening

valuation

at 30

September

2022 6,082 168,007 21,062 125 3,265 198,541

----------------- ------------------ ------------------- ------------------- ---------------- --------------

Shares delisted - (188) 188 - - -

Purchases at

cost - 2,100 - - 14,002 16,102

Sale proceeds - - (8) - - (8)

Net realised

gains* - - 7 - - 7

Movement in

unrealised

gains 850 (15,518) 5,368 125 402 (8,773)

----------------- ------------------ ------------------- ------------------- ---------------- --------------

Closing

valuation

at 31 March

2023 6,932 154,401 26,617 250 17,669 205,869

----------------- ------------------ ------------------- ------------------- ---------------- --------------

Book cost at

31 March 2023 8,357 124,847 14,488 500 18,485 166,677

Unrealised

(losses)/gains

at 31 March

2023 (1,425) 31,996 16,762 (250) (816) 46,267

Permanent

impairment

in value of

investments - (2,442) (4,633) - - (7,075)

----------------- ------------------ ------------------- ------------------- ---------------- --------------

Closing

valuation

at 31 March

2023 6,932 154,401 26,617 250 17,669 205,869

----------------- ------------------ ------------------- ------------------- ---------------- --------------

*Transaction costs on the purchase and disposal of investments

of GBPnil were incurred in the period.

** Other funds include the Unicorn Ethical Fund and the Royal

London Short Term Money Market Fund which are both OEICs and the

BlackRock Cash Fund which is a Unit Trust.

Reconciliation of cash movements in investment transactions

The difference between the purchases in Note 7 above and that

shown in the Condensed Cash Flow Statement. is GBP2,000 which is

the reinvested dividends in the Royal London Short Term Money

Market Fund Y.

Fair value hierarchy

The table below sets out fair value measurements using FRS 102

s11.27 fair value hierarchy. The Company has one class of assets,

being at fair value through profit or loss.

Level 1 Level Level 3 Total

GBP000 2 GBP'000 GBP'000

GBP'000

------------ ------------- ------------- -------------

At 31 March 2023

Equity investments 161,333 - 26,617 187,950

Loan stock investments - - 250 250

Other funds* 17,669 - - 17,669

Total 179,002 - 26,867 205,869

------------ ------------- ------------- -------------

At 31 March 2022

Equity investments 210,076 51,856 24,702 286,634

Loan stock investments - - 350 350

Open ended investment companies 4,091 - - 4,091

Total 214,167 51,856 25,052 291,075

------------ ------------- ------------- -------------

At 30 September 2022

Equity investments 174,089 - 21,062 195,151

Loan stock investments - - 125 125

Open ended investment companies 3,265 - - 3,265

Total 177,354 - 21,187 198,541

------------ ------------- ------------- -------------

* Other funds include the Unicorn Ethical Fund and the Royal

London Short Term Money Market Fund which are both OEICs and the

BlackRock Cash Fund which is a Unit Trust.

There are currently no financial liabilities at fair value

through profit or loss.

Categorisation within the hierarchy has been determined on the

lowest level input that is significant to the fair value

measurement of the relevant asset as follows:

Level 1 - valued using quoted prices in active markets for

identical assets.

Level 2 - valuation by reference to valuation techniques using

directly observable inputs other than quoted prices included within

Level 1.

Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data.

The valuation techniques used by the Company are explained in

the accounting policies in Note 1.

The fair value of unquoted investments, categorised as Level 3,

is established by assessing different methods of valuation, such as

price of recent transaction, sales multiples, earnings multiples,

discounted cash flows and net assets, therefore no assumptions are

disclosed, or sensitivity analysis provided.

A reconciliation of fair value measurements in Level 3 is set

out below:

Equity Loan stock

Investments Investments Total

GBP'000 GBP'000 GBP'000

----------------- ----------------- --------------

Opening balance at 1 October

2022 21,062 125 21,187

Shares delisted 188 - 188

Sales (8) - (8)

Total gains included in (losses)/gains

on investments in the Condensed

Income Statement

- on assets sold 7 - 7

- on assets held at the period

end 5,368 125 5,493

Closing balance at 31 March

2023 26,617 250 26,867

----------------- ----------------- --------------

8. Net asset values

At 31 March At 31 March At 30 September

2023 2022 2022

(unaudited) (unaudited) (audited)

Net assets GBP218,421,000 GBP315,292,000 GBP221,126,000

Number of shares in

issue 174,104,558 161,074,952 164,023,203

------------------- ------------------- --------------------

Net asset value per

share 125.45p 195.74p 134.81p

------------------- ------------------- --------------------

9. Post Balance Sheet Events

There are no post balance sheet events to report.

10. Related party transactions

During the first six months of the financial year, no

transactions with related parties have taken place which have

materially affected the financial position or the performance of

the Company.

11. Copies of the Half Yearly Report

Copies of the Half Yearly Report will be available for download

on the Company's website: www.unicornaimvct.co.uk.

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on this announcement (or

any other website) is incorporated into, or forms part of this

announcement.

A copy of the 2023 Half Yearly Report will be submitted shortly

to the National Storage Mechanism ("NSM") and will be available for

inspection at the NSM, which is situated at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FBLLXXELBBBV

(END) Dow Jones Newswires

May 31, 2023 02:00 ET (06:00 GMT)

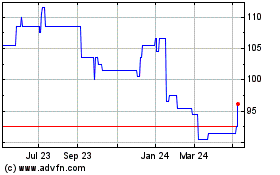

Unicorn Aim Vct (LSE:UAV)

Historical Stock Chart

From Apr 2024 to May 2024

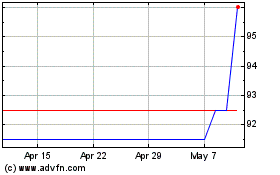

Unicorn Aim Vct (LSE:UAV)

Historical Stock Chart

From May 2023 to May 2024