TIDMYCA

RNS Number : 9749N

Yellow Cake PLC

28 September 2023

THIS ANNOUNCEMENT AND THE INFORMATION IN IT IS RESTRICTED AND IS

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR WITHIN THE UNITED

STATES, CANADA, AUSTRALIA, HONG KONG, SINGAPORE, THE CAYMAN

ISLANDS, SOUTH AFRICA, JAPAN OR ANY OTHER JURISDICTION WHERE TO DO

SO MIGHT CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS

OF SUCH JURISDICTION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN

OFFER OF SECURITIES IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) NO 596/2014 AS IT

FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL)

ACT 2018, AS AMED ("MAR"). UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

28 September 2023

Yellow Cake plc

Results of Placing

Yellow Cake plc (AIM: YCA) ("Yellow Cake" or the "Company"),

founded and established by Bacchus Capital Advisers ("Bacchus") to

be a specialist company operating in the uranium sector with a view

to holding physical uranium for the long-term, is pleased to

announce that 18,700,000 new Ordinary Shares (the "Placing Shares")

have been placed with existing and new institutional investors at a

fixed price of GBP5.50 per share (the "Placing Price") via an

accelerated bookbuild (the "Placing").

The Placing was conducted using the Company's existing share

authorities. The Placing comprises 18,700,000 new Ordinary Shares,

which will raise gross proceeds of approximately GBP103 million

(approximately US$125 million). The Placing Shares being issued

represent approximately 9.4% of the existing issued ordinary share

capital (excluding treasury shares) of the Company prior to the

Placing.

Andre Liebenberg, Chief Executive Office of Yellow Cake,

commented:

"We are delighted with the strong response from both existing

and new investors, highlighting the growing interest in, and

understanding of, both uranium and the Yellow Cake investment case.

This has once again resulted in an oversubscribed book. The recent

positive momentum in the uranium price is indicative of the themes

we have consistently set out, with supply demand fundamentals and a

wider acceptance of the critical role nuclear energy will play in

supporting our net zero ambitions both acting as long-term drivers.

Looking ahead, we remain confident that spot and term prices will

need to increase further to reach an incentive price which supports

the construction of the new greenfield mines that are needed to

meet mid and long-term uranium demand expectations."

Placing:

Application has been made for the Placing Shares to be admitted

to trading on the AIM market of London Stock Exchange plc ("AIM")

("Admission"). It is expected that Admission will become effective

at commencement of trading on 2 October 2023 and settlement is

expected to take place on the same date on a T+2 basis.

The Placing is conditional upon, inter alia, Admission becoming

effective and the Placing Agreement not being terminated in

accordance with its terms.

Following Admission of all of the Placing Shares: (a) the total

number of shares of the Company in issue will be 221,440,730 of

which 4,584,283 are held in treasury; and (b) the total number of

voting shares in the Company will be 216,856,447.

Other than where defined, capitalised terms used in this

announcement have the meanings given to them in the Announcement

released by the Company at 18.17 (London time) on 27 September

2023.

Cantor Fitzgerald Canada Corporation ("Cantor"), Canaccord

Genuity Limited ("Canaccord") and Joh. Berenberg, Gossler & Co.

KG, London Branch ("Berenberg"), acted as Joint Bookrunners

(Cantor, Canaccord and Berenberg, together being the "Joint

Bookrunners"). Bacchus acted as Financial Adviser.

ENQUIRIES:

Yellow Cake plc

Andre Liebenberg, CEO Carole Whittall, CFO

Tel: +44 (0) 153 488 5200

Joint Bookrunner: Cantor

Graham Moylan James Mazur

Tel: +001 416 350 3671

Joint Bookrunner and NOMAD:

Canaccord Genuity

Henry Fitzgerald-O'Connor James Asensio

Tel: +44 (0) 207 523 8000

Joint Bookrunner: Berenberg

Matthew Armitt Jennifer Lee

Tel.: +44 (0) 203 207 7800

Financial Adviser: Bacchus

Peter Bacchus Shea O'Callaghan

Tel: +44 (0) 203 848 1640

Media & Investors: Powerscourt

Peter Ogden

Tel: +44 (0) 779 3 85 8211

Yellow Cake plc's registered office is located at: 3rd Floor,

Gaspé House, 66-72 The Esplanade, St Helier, Jersey JE1 2LH .

The information contained within this Announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No 596/2014 as it forms part of UK

law by virtue of the European Union (Withdrawal) Act 2018, as

amended. By the publication of this Announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain. The person responsible for arranging for

the release of this Announcement on behalf of the Company is Andre

Liebenberg.

IMPORTANT NOTICES

This Announcement (the "Announcement") and the information in it

is restricted and is not for release, publication or distribution,

directly or indirectly, in whole or in part, in, into or within the

United States of America its territories and possessions, any state

of the united states or the District of Columbia (collectively, the

"United States"), Canada, Australia, Hong Kong, Singapore, the

Cayman Islands, South Africa or Japan or any other jurisdiction

where to do so might constitute a violation of the relevant laws or

regulations of such jurisdiction (each a "Restricted Territory").

This announcement does not constitute an offer to sell or issue or

the solicitation of an offer to buy or acquire for placing shares

in any Restricted Territory. Any failure to comply with these

restrictions may constitute a violation of the securities laws of

such jurisdictions. Subject to certain exemptions, the securities

referred to in this Announcement may not be offered or sold in any

Restricted Territory or for the account or benefit of any national

resident or citizen of any Restricted Territory. This Announcement

has not been approved by the London Stock Exchange, nor is it

intended that it will be so approved.

In particular the securities referred to herein have not been

and will not be registered under the U.S. Securities Act of 1933

(the "Securities Act"), or with any securities regulatory authority

of any state or other jurisdiction of the United States, and may

not be offered, sold, pledged, taken up, exercised, resold,

renounced, transferred or delivered, directly or indirectly, in the

United States absent registration under the Securities Act, except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and in

compliance with any applicable securities laws of any state or

other jurisdiction of the United States. The securities referred to

herein are being offered and sold only: (i) to non-U.S. persons

outside the United States in "offshore transactions" pursuant to

Regulation S of the Securities Act and (ii) inside the United

States to "qualified institutional buyers" as defined in Rule 144A

under the Securities Act who have duly executed a U.S. investor

letter in the form provided to it and delivered the same to the

Company, Joint Bookrunners or their affiliates.

The offer and sale of the Placing Shares referred to herein has

not been and will not be registered under the applicable securities

laws of any Restricted Territory.

No public offering of the shares referred to in this

Announcement is being made in the United States, the United

Kingdom, any Restricted Territory or elsewhere.

The securities referred to herein have not been approved or

disapproved by the U.S. Securities and Exchange Commission, any

state securities commission or other regulatory authority in the

United States nor have any of the foregoing authorities passed upon

or endorsed the merits of the offering of the securities referred

to herein or the accuracy or adequacy of this Announcement. Any

representation to the contrary is a criminal offence in the United

States.

The Company has not been, and will not be, registered under the

U.S. Investment Company Act of 1940 and investors will not be

entitled to the benefits of that Act. All offers of Placing Shares

will be made pursuant to an exemption from the requirement to

produce a prospectus under the Prospectus Regulation (Regulation

(EU) 2017/1129) (the "Prospectus Regulation") in relevant member

states of the European Economic Area ("EEA") and under the

Prospectus Regulation, as it forms part of UK law by virtue of the

European Union (Withdrawal) Act 2018, as amended (the "UK

Prospectus Regulation"). This Announcement is being distributed to

persons in the United Kingdom only in circumstances in which

section 21(1) of the Financial Services and Markets Act 2000

("FSMA") does not apply. Members of the public are not eligible to

take part in the Placing.

This Announcement and the information contained herein are for

information purposes only and are directed only at: (a) persons in

Member States of the EEA who are qualified investors within the

meaning of article 2(e) of the Prospectus Regulation; (b) in the

United Kingdom, "qualified investors" within the meaning of article

2(e) of the UK Prospectus Regulation who (i) are "Investment

Professionals" specified in article 19(5) of the Financial Services

and Markets Act (Financial Promotion) Order 2005, as amended (the

"Order") or (ii) fall within article 49(2)(a) to (d) of the Order

(and only where the conditions contained in those articles have

been, or will at the relevant time be, satisfied); (c) persons that

are residents of Canada or otherwise subject to the securities laws

of Canada which are "permitted clients" as defined in National

Instrument 31 - 103 - Registration Requirements, Exemptions and

Ongoing Registrant Obligations; (d) in Australia, are sophisticated

investors or professional investors as those terms are defined in

sub- sections 708(8) and 708(11) of the Corporations Act; (e) in

Hong Kong, are professional investors as defined in the Securities

and Futures Ordinance (Cap 571) of Hong Kong and any rules made

under that Ordinance; (f) in Singapore, are institutional investors

as such term is defined in section 4A of the Securities and Futures

Act 2001 of Singapore; or (g) are persons to whom it may otherwise

be lawfully communicated (all such persons together being referred

to as "Relevant Persons"). This Announcement does not itself

constitute an offer for sale or to acquire any securities in the

Company. This Announcement must not be acted on or relied on by

persons who are not Relevant Persons. Any investment or investment

activity to which this Announcement relates is available only to

Relevant Persons and will be engaged in only with Relevant Persons.

Each Placee should consult with its own advisers as to legal, tax,

business and related aspects of an investment in Placing

Shares.

Solely for the purposes of the product governance requirements

of Chapter 3 of the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Requirements"),

and disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the UK Product Governance Requirements) may otherwise have with

respect thereto, the Shares have been subject to a product approval

process, which has determined that the Placing Shares are: (i)

compatible with an end target market of retail investors and

investors who meet the criteria of professional clients and

eligible counterparties, each defined in paragraph 3 of the FCA

Handbook Conduct of Business Sourcebook; and (ii) eligible for

distribution through all permitted distribution channels to

professional clients and eligible counterparties (the "Target

Market Assessment").

Notwithstanding the Target Market Assessment for the Placing

Shares, distributors should note that: the price of the Placing

Shares may decline and investors could lose all or part of their

investment; the Placing Shares offer no guaranteed income and no

capital protection; and an investment in the Placing Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result

therefrom.

The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the offering of the Placing Shares.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, the Joint Bookrunners will only procure investors who

meet the criteria of professional clients and eligible

counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of the UK Product Governance Requirements; or (b)

a recommendation to any investor or group of investors to invest

in, or purchase, or take any other action whatsoever with respect

to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

No representation or warranty, express or implied, is made or

given by or on behalf of the Company, the Joint Bookrunners, the

Company's nominated adviser, or any of their respective affiliates

(within the meaning of Rule 405 under the Securities Act)

("Affiliates") or any of such persons' directors, partners,

officers or employees or any other person as to the accuracy,

completeness or fairness of the information or opinions contained

in this Announcement and no liability whatsoever is accepted by the

Company, the Joint Bookrunners or any of such persons' Affiliates,

partners, directors, officers or employees or any other person for

any loss howsoever arising, directly or indirectly, from any use of

such information or opinions or otherwise arising in connection

therewith.

Canaccord is authorised and regulated by the Financial Conduct

Authority ("FCA"). Cantor is authorised and regulated by the

Financial Industry Regulatory Authority ("FINRA"). Berenberg is

authorised and regulated by the German Federal Financial

Supervisory Authority and in the United Kingdom is authorised and

regulated by the FCA. Each of the Joint Bookrunners is acting

exclusively for the Company and no one else in connection with the

Placing and they will not be responsible to anyone other than the

Company for providing the protections afforded to their respective

clients nor for providing advice in relation to the Placing and/or

any other matter referred to in this Announcement.

This Announcement is being issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by the

Joint Bookrunners (apart from the responsibilities or liabilities

that may be imposed by the FSMA or the regulatory regime

established thereunder) or by any of their respective affiliates or

agents or by any of their respective directors, partners, officers,

employees, advisers, representatives or shareholders (collectively,

"Representatives") for the contents of the information contained in

this Announcement, or any other written or oral information made

available to or publicly available to any interested party or its

advisers, or any other statement made or purported to be made by or

on behalf of the Joint Bookrunners or any of their respective

affiliates or by any of their respective Representatives in

connection with the Company, the Placing Shares or the Placing and

any responsibility and liability whether arising in tort, contract

or otherwise therefore is expressly disclaimed. Each of the Joint

Bookrunners and each of their respective affiliates accordingly

disclaim all and any liability, whether arising in tort, contract

or otherwise (save as referred to above) in respect of any

statements or other information contained in this Announcement and

no representation or warranty, express or implied, is made by the

Joint Bookrunners or any of their respective affiliates as to the

accuracy, fairness, verification, completeness or sufficiency of

the information contained in this Announcement and nothing in this

Announcement is, or shall be relied upon as, a promise or

representation in this respect, whether as to the past or future.

This Announcement does not identify or suggest, or purport to

identify or suggest, the risks (direct or indirect) that may be

associated with an investment in the Placing Shares. Any investment

decision to buy Placing Shares in the Placing must be made solely

on the basis of publicly available information, which has not been

independently verified by the Joint Bookrunners. Shares will not be

admitted on any stock exchanged other than AIM.

The distribution of this Announcement and the offering of the

Placing Shares in certain jurisdictions may be restricted by law.

Persons distributing any part of this Announcement must satisfy

themselves that it is lawful to do so. Persons (including, without

limitation, nominees and trustees) who have a contractual or other

legal obligation to forward a copy of this Announcement should seek

appropriate advice before taking any action. Any failure to comply

with these restrictions may constitute a violation of the

securities laws of such jurisdictions. Persons into whose

possession this Announcement comes are required by the Joint

Bookrunners and the Company to inform themselves about, and

observe, any such restrictions.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

This Announcement contains "forward-looking statements".

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company. Any

forward-looking statements made in this Announcement by or on

behalf of the Company speak only as of the date they are made.

Statements contained in this Announcement regarding past trends or

activities should not be taken as representation that such trends

or activities will continue in the future. You should not place

undue reliance on forward-looking statements, which speak only as

of the date of this Announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIFIFEEAAITFIV

(END) Dow Jones Newswires

September 28, 2023 02:03 ET (06:03 GMT)

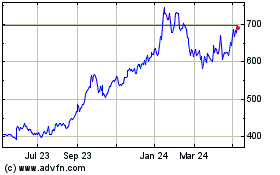

Yellow Cake (LSE:YCA)

Historical Stock Chart

From Nov 2024 to Dec 2024

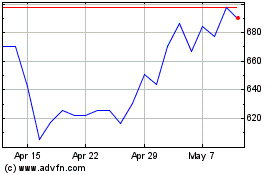

Yellow Cake (LSE:YCA)

Historical Stock Chart

From Dec 2023 to Dec 2024