TIDMYCA

RNS Number : 7748R

Yellow Cake PLC

31 October 2023

31 October 2023

Yellow Cake plc ("Yellow Cake" or the "Company")

QUARTERLY OPERATING UPDATE

Yellow Cake, a specialist company operating in the uranium

sector holding physical uranium for the long term, is pleased to

report its performance for the quarter ended 30 September 2023 (the

"Quarter").

Highlights

Market Highlights

-- The uranium spot price increased 31.3% from US$56.00/lb ([1])

on 30 June 2023 to US$73.50/lb ([2]) on 30 September 2023 and is

currently US$74.00/lb. [3]

-- Factors contributing to that trend include limited

availability of near-term inventory considered as mobile (available

for sale), growing nuclear utility concerns regarding future

production of sufficient uranium to underpin both operating and

planned nuclear reactors, as well as geopolitical risks associated

with a number of producing countries such as Russia and Niger.

-- These market factors may continue to prevail and exert upward

pressure on the uranium price, both spot and long-term. As annual

volumes under newly negotiated term uranium contracts increase,

associated prices may need to rise to incentivise necessary uranium

development, placing incremental pressure on near-term uranium

prices.

Company Highlights

-- On 30 September 2023, Yellow Cake took delivery of 1,350,000

lb of U(3) O(8) that it had elected to purchase as part of its 2022

uranium purchase option under its agreement (the "Framework

Agreement") with JSC National Atomic Company Kazatomprom

("Kazatomprom") at a price of US$48.90/lb, or US$66.0 million in

aggregate. The purchase was funded from the proceeds of an

oversubscribed share placing in February 2023 which raised gross

proceeds of approximately GBP61.8 million (US$74.3 million). The

delivery was made at the Cameco storage facility in Ontario, Canada

bringing Yellow Cake's holdings to 20.16 million lb of U(3) O(8) at

the Quarter-end.

-- An increase in the spot price of 31.3% over the Quarter from

US$56.00/lb(1) to US$73.50/lb(2) combined with a 7.2% increase in

the volume of U(3) O(8) held by Yellow Cake over the Quarter ([4])

, resulted in a 40.7% increase in the value of U(3) O(8) held over

the Quarter from US$1,053.1 million as at 30 June 2023, to

US$1,481.4 million as at 30 September 2023.

-- Increase in estimated net asset value per share of 37.2% over

the Quarter from GBP4.50 per share [5] as at 30 June 2023 to

GBP6.18 per share [6] as at 30 September 2023, a result of the

increase in the uranium price, volume of uranium held and

depreciation of Sterling over the Quarter.

-- After the Quarter-end, following the completion of a further

oversubscribed share placing on 2 October 2023 which raised gross

proceeds of approximately GBP103 million (approximately US$125

million), Yellow Cake informed Kazatomprom that it had elected to

purchase 1,526,717 lb of U(3) O(8) at a price of US$65.50/lb, or

US$100.0 million in aggregate, exercising the entirety of the

Company's 2023 uranium purchase option under its Framework

Agreement with Kazatomprom. Yellow Cake expects delivery to take

place in H1 2024. On completion of this purchase, Yellow Cake will

hold 21.68 million lb of U(3) O(8) .

-- Yellow Cake's estimated proforma net asset value on 30

October 2023 was GBP6.21 per share or US$1,637.8 million, assuming

21.68 million lb of U(3) O(8) [7] valued at a spot price of

US$74.00/lb [8] and cash and other current assets and liabilities

[9] .

-- All U(3) O(8) to which the Company has title and has paid

for, is held at the Cameco storage facility in Canada and the Orano

storage facility in France. The Company's operations, financial

condition and ability to purchase and take delivery of U(3) O(8)

from Kazatomprom, or any other party, remain unaffected by the

geopolitical events in Ukraine.

Andre Liebenberg, CEO of Yellow Cake, said:

" We continue to deliver against our strategy to buy and hold

physical uranium giving our shareholders direct exposure to the

commodity. During the quarter, the price of uranium rose by a third

and has risen ever since. This higher price, combined with our

recent uranium purchases, has taken the value of our holdings to

over US$ 1.5 billion, another significant milestone for our

company. The supply demand fundamentals we have set out previously

remain as relevant today as ever. Supply remains constrained, while

demand is growing worldwide, driven by both what is now a general

acceptance of nuclear as key to achieving our global net zero

ambitions, but also more recently concerns about the short-term

viability of renewables. We continue to be confident in the

long-term outlook for uranium."

Uranium Market Developments and Outlook

Global Uranium Market

The uranium spot price rose significantly during the Quarter

from US$56.00/lb up to US$73.50/lb, securing gains of more than

30%. The previous quarter (April-June) experienced an increase of

just under 11% while the January-March quarter saw the near-term

uranium price rise by 6%. In total, the spot market price rose by

US$25.50/lb, an increase of 53% over the first nine months of CY

2023. [10]

Aggregate spot market volumes were reported at 13.0 million lb

of U(3) O(8) for the Quarter compared to 14.4 million lb of U(3)

O(8) during the April-June quarter and 12.6 million lb of U(3) O(8)

for the January-March quarter.

Spot market buying by the Sprott Physical Uranium Trust ("SPUT")

remained relatively subdued during the Quarter with the uranium

fund reporting purchases totalling 2.74 million lbs of U(3) O(8) .

At the end of September, SPUT held a total of 62.0 million lb.

[11]

The three longer-term uranium price indicators showed

substantial upward movement during the Quarter as the 3-yr Forward

Price increased to US$75.00/lb (June 2023: US$62.00/lb) while the

5-yr Forward Price reported at US$79.00/lb (June 2023:

US$67.00/lb). The Long-Term Price rose more slowly reaching

US$61.00/lb at the end of September 2023 [12] (June 2023:

US$56.00/lb) [13] .

Nuclear Generation / Uranium Demand

Indian Secretary of the Department of Atomic Energy ("DAE") and

Chairman of the Atomic Energy Commission stated that the DAE is

pursuing the development of advanced nuclear reactors in order to

generate green energy. During his speech at the 12(th) graduation

ceremony of the NISER Bhubaneswar, Ajit Kumar Mohanty proclaimed

that the "First and foremost area which comes to immediate

attention is the necessity to develop and deploy economical and

viable green energy sources such as green hydrogen, biofuels, and

nuclear energy". [14]

Michael O. Sinocruz, Director of the Philippine Energy Policy

and Planning Bureau, reported during a virtual forum hosted by the

German-Philippine Chamber of Commerce that the Philippine

Department of Energy is considering a target of 2,400 MWe of

nuclear power capacity by 2035. Mr. Sinocruz advised that "under

the Philippine Energy Plan for 2030 to 2050, the government is

hoping to put about eight 150 MW small modular reactors in

operation by 2032 and establish a 1,200 MW nuclear facility in

Luzon by 2025." Furthermore, the government has not ruled out the

rehabilitation of the shuttered Bataan Nuclear Power Plant.

[15]

A joint development agreement has been executed between US

utility Energy Northwest and X-Energy Reactor Company for the

deployment of up to 12 Xe-100 small modular reactors in central

Washington state. The utility anticipates the first Xe-100 module

to be online by 2030 at a site adjacent to the existing Columbia

Generating Station in Richland, Washington. [16]

Japan's Kansai Electric Power Company recommenced operation of

the Takahama-1 reactor (780 MWe PWR), located in Fukui Prefecture.

The unit had been offline for 12 years following the Fukushima

accident. Takahama 2 is expected to resume operation in September

2023. Both reactors have been granted operating license extensions

which will allow the units to operate for up to 60 years. [17]

South Korea is evaluating the country's need for additional

nuclear power reactors in response to increasing electricity demand

resulting from the expansion of data centres, investment in high

technology industries (semi-conductors and batteries) and

escalating utilisation of electric vehicles. The 29(th) Energy

Committee meeting was under the auspices of the Ministry of Trade,

Industry and Energy. Based upon strong Committee support, the

Committee decided to bring forward the initiation of the 11(th)

Electricity Plan addressing the years 2024-2038. [18]

Taiwan's People's Party, the political opposition party, has

stated that if successfully elected in 2024, they will reverse the

country's nuclear phase-out policy which calls for the shut-down of

the two remaining operating nuclear power plants (Maanshan NPP) by

2025, when the units will have reached the end of their 40-year

operating licenses. Taiwan People's Party Chairman and presidential

candidate, Ko Wen-je, has stated that nuclear power is essential to

the nation's goal of attaining carbon neutrality by 2050. [19]

Having declared commercial operation of the Vogtle-3 reactor,

the first newly constructed power reactor in the United States in

more than 30 years (31 July 2023), Georgia Power announced the

commencement of fuel-loading at Vogtle-4 effective 17 August. The

unit is scheduled for commercial operation in 4Q2023 or 1Q2024.

[20]

The Polish government has initiated the process to construct a

NPP based on South Korean reactors. PGE PAK Energia Jadrowa SA

("PPEJ") submitted an application to Poland's Ministry of Climate

and Environment for a decision-in-principal for the construction of

the proposed NPP consisting of at least two APR-1400 reactors to be

built in central Poland. Assuming the approval process leads to a

license to construct and operate, PPEJ plans on commercial

operation by 2035. [21] Poland also issued an environmental permit

for its first nuclear power plant which is to be built on the

Baltic Coast. Construction is planned to begin in 2026 with the

facility operational by 2033. [22]

Sweden's Minister for Climate and Environment, Romina

Pourmokhtari, called for the Nordic country to construct up to ten

new large nuclear reactors (or the equivalent SMRs) by 2045, to

supplement the current commercial reactor fleet of six reactors

(6,937 Mwe). The Minister's comments followed the release of the

Radiation Safety Authority (Sweden) report (9 August) supporting a

pre-licensing review of new reactor designs as well as the

development of the regulatory framework which may be needed for the

future expansion of nuclear power. [23]

Turkey expects to reach agreement with China for its second

nuclear power plant to be sited near the city of Kirklareli, in the

northwestern area of the country. The NPP will follow the current

nuclear power plant being built by Russia's Rosatom which is

expected to enter commercial operation in 2024. [24]

The Italian government has established a working group to assess

the restart of the country's nuclear power programme. Historically,

Italy operated four nuclear power plants (total capacity - 1,423

Mwe). However, a decision to shut down two remaining reactors was

taken in July 1990 in response to the nuclear accident at

Chernobyl, following the earlier closure of the other two reactors.

The newly drafted "National Platform for Sustainable Nuclear" calls

for a multi-agency review of potential technologies and sites.

[25]

China's State Council approved the construction of six nuclear

reactors: units 5 and 6 of the Ningde NPP in Fujian Province, units

1 and 2 of the Shidaowan NPP in Shandong Province, and; units 1 and

2 of the Xudabao NPP in Liaoning Province. [26]

The China Nuclear Energy Association announced that China's

nuclear power sector is expected to supply 10% of that nation's

electricity by 2035. Furthermore, China's installed nuclear

capacity is planned to reach 400 MWe by 2060 supplying 18% of

China's electricity at that time. Currently, China has 55 operating

reactors with a further 24 under construction. Twenty one reactors

have been approved for construction since the beginning of the

14(th) Five-Year Plan period (2021-2025). [27]

Nuclear power development in Africa continues to progress. Kenya

announced plans to begin construction of a nuclear power plant at

coastal sites in either Kilifi or Kwale counties. The facility is

expected to cost US$3.4-4.1 billion and start construction in 2027.

[28] Ugandan President, Yoweri Museveni, announced that Russia and

South Korea will construct two nuclear power plants in Uganda.

Agreements have been reached but no date for construction start was

given except for "soon." [29] Nuclear Power Ghana has selected two

potential sites for its planned nuclear power plant with Nsuban

(Western Region) as the preferred location and Obotan (Central

Region) serving as the back-up. The country expects to select the

reactor vendor by 2030 with construction commencing that year.

[30]

Uranium Supply

On 26 July 2023, presidential guards seized Niger's president,

Mohamed Bazoum in a military coup. Niger's uranium production

totalled 5.85 million lb of U(3) O(8) in 2022 (around 5% of the

global total) from the open-pit operation of SOMAIR, an open-pit

mine owned by the French company, Orano (63.4%) and Sopamin, a

company that manages Niger's participation in mining ventures

(36.66%). The outcome of this geopolitical event remains

unresolved, but Orano has stated that any interruption in uranium

production or transport would not impact the French nuclear

programme due to sufficient uranium inventories. Two foreign

uranium companies yet to commence operations, Global Atomic (Dasa

Uranium Project) and GoviEx (Madaouela Uranium Project), reported

that their activities were proceeding as normal. [31]

Cameco held its 2Q2023 investor conference call on 2 August

2023. The company reported that its share of production during the

first half of 2023 from McArthur River / Key Lake and Cigar Lake

totalled 8.8 million lb of U(3) O(8) compared to 4.7 million lb of

U(3) O(8) for the same six-month period of 2022 (McArthur River /

Key Lake did not report any production until fourth quarter 2022

due to its ramp-up status while Cameco's ownership share of Cigar

Lake increased incrementally from 19 May 2022 (50.025% to

54.547%)). Based on 2023 production plans, Cameco expects to

receive 20.3 million lb of U(3) O(8) during CY2023. The company

expects to purchase 11 - 13 million lb of U(3) O(8) during the year

(previously 9 - 11 million lb of U(3) O(8) ) due to increased 2023

deliveries and to maintain a working inventory (that total includes

existing purchase commitments including Cameco's share of output

from the JV Inkai in Kazakhstan). Corporate executives

characterised the current term uranium market as "constructive"

although the company needs to see "more urgency in demand" to make

any decisions regarding production facility expansions or the

development of greenfields uranium projects. [32]

Kazatomprom released its first half 2023 financial results on 25

August 2023, including uranium production data. The company

reported total production of 26.6 million lb of U(3) O(8) , a

slight increase over the 1H2022 output of 26.2 million lb of U(3)

O(8) while Kazatomprom's attributable share was 14.1 million lb of

U(3) O(8) . The company's average realised price rose by 17%

reaching US$46.63/lb period-on-period. Kazatomprom reported

inventory of finished goods amounted to 15.7 million lb as of 30

June 2023 compared to 18.6 million lb at the end of the first half

of 2022. The reduction was attributed to increased uranium sales.

Production volume for the year (100% basis) continues to be guided

at 53.3 million lb - 55.9 million lb. [33]

In September 2023, Kazatomprom announced its plans for uranium

production in CY2025 and stated that, driven by a strong contract

book and already growing sales portfolio, planned output would

reach 79.3-81.9 million lb of U(3) O(8) in 2025 which would be an

increase of around 15.6 million lb above the currently planned

output for CY2024. [34]

Nuclear Power Forecasts

The International Energy Agency released an update to its 2021

report, "Net Zero Roadmap," which examines various future energy

development scenarios. Under the net-zero emissions (NZE) scenario,

the global energy analysis group now foresees global nuclear power

increasing from the current level (392 GW), reaching 916 GW in 2050

as compared to the original study which concluded the need for 812

GW by 2050. [35]

The World Nuclear Association convened its Annual Symposium in

London (6-8 September 2023). The global nuclear power organisation

released the latest edition of its comprehensive nuclear fuel

markets assessment and forecast "The Nuclear Fuel Report - Global

Scenarios for Demand and Supply Availability 2023 - 2040." The

presentation of the biennial report's conclusions regarding future

uranium availability, stated that "in 2022, only 76% of world

reactors requirements were covered by primary uranium

supply...by-mid 2020s, restart of idled capacity is expected,

however the decrease of supply from the presently-known existing

mines will continue due to further depletion of uranium resources"

and "in the long run, intense development of new projects and other

unspecified sources will be needed to fill in the supply-demand

gap." [36]

Market Outlook

Subsequent to the Quarter-end, the uranium spot price has

continued to strengthen. Factors contributing to that trend include

limited availability of near-term inventory considered as mobile

(available for sale), growing nuclear utility concerns regarding

future production of sufficient uranium to underpin both operating

and planned nuclear reactors, as well as geopolitical risks

associated with a number of producing countries such as Russia and

Niger.

These market factors may continue to prevail and exert upward

pressure on the uranium price, both spot and long-term. As annual

volumes under newly negotiated term uranium contracts increase,

associated prices may need to rise to incentivise necessary uranium

development, placing incremental pressure on near-term uranium

prices.

Net Asset Value

Yellow Cake's estimated net asset value on 30 September 2023 was

GBP6.18 per share or US$1,494.2 million, consisting of 20.16

million lb of U(3) O(8) , valued at a spot price of US$73.50/lb

[37] and cash and other current assets and liabilities of US$12.7

million. [38]

Yellow Cake Estimated Net Asset Value as at 30 September

2023

--------------------------------------------------------------------------

Units

Investment in Uranium

Uranium oxide in concentrates

("U(3) O(8) ") (A) lb 20,155,601

U(3) O(8) fair value per pound

(37) (B) US$/lb 73.50

(A) x (B)

U(3) O(8) fair value = (C) US$ m 1,481.4

------------

Cash and other net current

assets/(liabilities) (38) (D) US$ m 12.7

(C) + (D)

Net asset value in US$ m = (E) US$ m 1,494.2

------------

Exchange Rate ( [39] ) (F) USD/GBP 1.2207

(E) / (F)

Net asset value in GBP m = (G) GBP m 1,224.0

Number of shares in issue

less shares held in treasury

( [40] ) (H) 198,156,447

Net asset value per share (G) / (H) GBP/share 6.18

---------------------------------- ----------- ----------- ------------

Yellow Cake's estimated proforma net asset value on 30 October

2023 was GBP6.21 per share or US$1,637.8 million, based on 21.68

million lb of U(3) O(8) [41] valued at a spot price of US$74.00/lb

[42] and cash and other current assets and liabilities of US$12.7

million as at 30 September 2023, plus net placing proceeds of

US$120.6 million received 2 October 2023 less cash consideration of

US$100.0 million to be paid to Kazatomprom following delivery of

1.53 million lb of U(3) O(8) in H1 2024.

Yellow Cake Estimated Proforma Net Asset Value as at 30

October 2023

--------------------------------------------------------------------------

Units

Investment in Uranium

Uranium oxide in concentrates

("U(3) O(8) ") (41) (A) lb 21,682,318

U(3) O(8) fair value per pound

(42) (B) US$/lb 74.00

(A) x (B)

U(3) O(8) fair value = (C) US$ m 1,604.5

------------

Cash and other net current

assets/(liabilities) ( [43]

) (D) US$ m 33.3

(C) + (D)

Net asset value in US$ m = (E) US$ m 1,637.8

------------

Exchange Rate (F) USD/GBP 1.2164

(E) / (F)

Net asset value in GBP m = (G) GBP m 1,346.4

Number of shares in issue

less shares held in treasury

( [44] ) (H) 216,856,447

Net asset value per share (G) / (H) GBP/share 6.21

---------------------------------- ----------- ----------- ------------

ENQUIRIES:

Yellow Cake plc

Andre Liebenberg, CEO Carole Whittall, CFO

Tel: +44 (0) 153 488 5200

Nominated Adviser and Joint Broker: Canaccord Genuity Limited

Henry Fitzgerald-O'Connor James Asensio

G ordon Hamilton

Tel: +44 (0) 207 523 8000

Joint Broker: Berenberg

Matthew Armitt Jennifer Lee

Detlir Elezi

Tel: +44 (0) 203 207 7800

Financial Adviser: Bacchus Capital Advisers

Peter Bacchus Richard Allan

Tel: +44 (0) 203 848 1640

Communications Adviser: Powerscourt

Peter Ogden Jade Sampayo

Tel: +44 (0) 7793 858 211

ABOUT YELLOW CAKE

Yellow Cake is a London-quoted company, headquartered in Jersey,

which offers exposure to the uranium spot price. This is achieved

through its strategy of buying and holding physical triuranium

octoxide (" U(3) O(8) "). It may also seek to add value through

other uranium related activities. Yellow Cake seeks to generate

returns for shareholders through the appreciation of the value of

its holding of U(3) O(8) and its other uranium related activities

in a rising uranium price environment. The business is

differentiated from its peers by its ten-year Framework Agreement

for the supply of U(3) O(8) with Kazatomprom, the world's largest

uranium producer. Yellow Cake currently holds 20.16 million pounds

of U(3) O(8) , all of which is held in storage in Canada and

France.

FORWARD LOOKING STATEMENTS

Certain statements contained herein are forward looking

statements and are based on current expectations, estimates and

projections about the potential returns of the Company and the

industry and markets in which the Company will operate, the

Directors' beliefs and assumptions made by the Directors. Words

such as "expects", "anticipates", "should", "intends", "plans",

"believes", "seeks", "estimates", "projects", "pipeline", "aims",

"may", "targets", "would", "could" and variations of such words and

similar expressions are intended to identify such forward looking

statements and expectations. These statements are not guarantees of

future performance or the ability to identify and consummate

investments and involve certain risks, uncertainties and

assumptions that are difficult to predict, qualify or quantify.

Therefore, actual outcomes and results may differ materially from

what is expressed in such forward looking statements or

expectations. Among the factors that could cause actual results to

differ materially are: uranium price volatility, difficulty in

sourcing opportunities to buy or sell U(3) O(8) , foreign exchange

rates, changes in political and economic conditions, competition

from other energy sources, nuclear accident, loss of key personnel

or termination of the services agreement with 308 Services Limited,

changes in the legal or regulatory environment, insolvency of

counterparties to the Company's material contracts or breach of

such material contracts by such counterparties. These

forward-looking statements speak only as at the date of this

announcement. The Company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any forward

looking statements contained herein to reflect any change in the

Company's expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

[1] Daily spot price published by UxC, LLC on 30 June 2023.

[2] Daily spot price published by UxC, LLC on 30 September 2023.

[3] Daily spot price published by UxC, LLC on 30 October 2023.

[4] Based on 18,805,601 lb U O held by the Company as at 30 June

2023 and 20,155 ,601 lb U O held by the Company as at 30 September

2023.

[5] Estimated net asset value as at 30 June 2023 of US$1,134.1

million comprises 18.81 million lb of U(3) O(8) valued at the daily

spot price of US$56.00/lb published by UxC, LLC on 30 June 2023 and

cash and other current assets and liabilities of US$81.0 million.

Estimated net asset value per share as at 30 June 2023 is

calculated assuming 202 ,740,730 ordinary shares in issue less

4,604,645 shares held in treasury on that date and the Bank of

England's daily USD/ GBP exchange rate of 1.2714.

[6] Estimated net asset value as at 30 September 2023 of

US$1,494.2 million comprises 20.16 million lb of U(3) O(8) valued

at the daily spot price of US$73.50/lb published by UxC, LLC on 30

September 2023 and cash and other current assets and liabilities of

US$12.7 million. Estimated net asset value per share as at 30

September 2023 is calculated assuming 202 ,740,730 ordinary shares

in issue, less 4,584,283 shares held in treasury on that date and

the Bank of England's daily USD/ GBP exchange rate of 1.2207.

[7] Comprises 20.16 million lb of U(3) O(8) held as at 30

October 2023 plus 1.53 million lb of U(3) O(8) which the Company

has committed to purchase in H1 2024.

[8] Daily spot price published by UxC, LLC on 30 October 2023.

[9] Estimated proforma net asset value per share as at 30

October 2023 is calculated assuming 221 , 440,730 ordinary shares

in issue, less 4,584,283 shares held in treasury, a USD/ GBP

exchange rate of 1.2164 and the daily spot price published by UxC,

LLC on 30 October 2023. For purposes of estimating proforma net

asset value, cash and other current assets and liabilities is

calculated as US$12.7 million as at 30 September 2023 plus net

placing proceeds of US$120.6 million received 2 October 2023 less a

total cash consideration of US$100.0 million to be paid to

Kazatomprom following delivery of 1.53 million lb of U(3) O(8) in

H1 2024.

[10] Ux Weekly; "Ux Price Indicators"; 2 October 2023.

[11] Sprott.com; "Daily and Cumulative Pounds of Uranium (U3O8)

Acquired by the Trust"; 25 October 2023.

[12] Ux Weekly; "Ux Price Indicators"; 2 October 2023.

[13] Ux Weekly; "Ux Price Indicators"; 3 July 2023.

[14] The Times of India; "Atomic energy dept carrying out

development of advanced power reactors"; 18 July 2023.

[15] BusinessWorld; "DoE may set 2,400 MW goal for nuclear power by 2035"; 19 July 2023.

[16] World Nuclear News; "Multiple Xe-100 SMRs planned for Washington State"; 19 July 2023.

[17] World Nuclear News; "Eleventh Japanese reactor resumes operation"; 28 July 2023.

[18] World Nuclear News; "South Korea considering new nuclear plants"; 12 July 2023.

[19] Taipei Times; "Taiwan needs nuclear energy, Ko says"; 13 August 2023.

[20] Nuclear Newswire; "Vogtle-4 fuel load started"; 18 August 2023.

[21] Korea Economic Daily; "Poland starts approval process to

import S. Korean reactors"; 24 August 2023).

[22] Reuters; "Poland issues environmental permit for first

nuclear power plant"; 22 September 2023.

[23] Bloomberg News; "Sweden Needs to Treble Nuclear Power as

Electricity Demand Soars": 9 August 2023.

[24] Nikkei Asia; "Turkey close to deal with China on nuclear

power plant"; 15 September 2023.

[25] Nature Italy; "Italian nuclear industry revival on the table"; 11 September 2023.

[26] World Nuclear News; "Six reactors approved for construction in China"; 1 August 2023.

[27] China Daily; "China's nuclear power to generate 10% of

total electricity by 2035": 26 September 2023.

[28] TRT Afrika; "Kenya plans construction of nuclear power plant"; 26 September 2023.

[29] Anadolu Agency News Broadcast System; "Russia, South Korea

to build nuclear power plants in Uganda"; 8 September 2023.

[30] Ghana News Agency; "Ghana selects Nsuban, Obotan as

potential sites for first nuclear plant"; 20 September 2023.

[31] World Nuclear News; "A guide: Uranium in Niger"; 28 July 2023.

[32] Cameco Corporation; "2023 Q2 Conference Call": 2 August 2023.

[33] Kazatomprom; "Kazatomprom 1H23 Financial Results"; 25 August 2023.

[34] Kazatomprom Press Release; "Kazatomprom announces 2025

Production Plan"; 29 September 2023.

[35] International Energy Agency; "Net Zero Roadmap - A Global

Pathway to Keep the 1.5 C Goal in Reach 2023 Update"; September

2023.

[36] World Nuclear Association; "Fuelling Our Nuclear Future:

The Nuclear Fuel Report 2023"; 7 September 2023.

[37] Daily spot price published by UxC, LLC on 30 September 2023.

[38] Cash and cash equivalents and other net current assets and

liabilities as at 30 September 2023.

[39] Bank of England's daily USD/ GBP exchange rate as at 30 September 2023.

[40] Estimated net asset value per share on 30 September 2023 is

calculated assuming 202 ,740,730 ordinary shares in issue less

4,584,283 shares held in treasury on that date.

[41] Comprises 21.68 million lb of U(3) O(8) held as at 30

October 2023 plus 1.53 million lb of U(3) O(8) which the Company

has committed to purchase in H1 2024.

[42] Daily spot price published by UxC, LLC on 30 October 2023.

[43] Cash and other current assets and liabilities of US$12.7

million as at 30 September 2023 plus net placing proceeds of

US$120.6 million received 2 October 2023 less cash consideration of

US$100.0 million to be paid to Kazatomprom following delivery of

1.53 million lb of U3O8 in H1 2024.

[44] Estimated proforma net asset value per share on 30 October

2023 is calculated assuming 221 ,440,730 ordinary shares in issue,

less 4,584,283 shares held in treasury on that date.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDURURROWUROUA

(END) Dow Jones Newswires

October 31, 2023 03:00 ET (07:00 GMT)

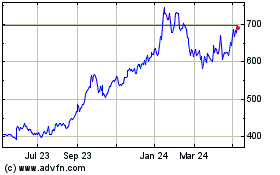

Yellow Cake (LSE:YCA)

Historical Stock Chart

From Nov 2024 to Dec 2024

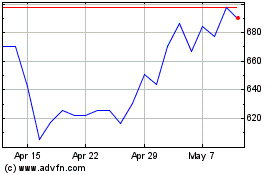

Yellow Cake (LSE:YCA)

Historical Stock Chart

From Dec 2023 to Dec 2024