Otter Tail Corporation (Nasdaq: OTTR) today announced financial

results for the quarter and year ended December 31, 2024.

SUMMARY

- Produced record earnings, with annual diluted earnings per

share of $7.17.

- Achieved a consolidated return on equity of 19.3% on an equity

ratio of 62.2%.

- Updated our electric utility’s five-year rate base compounded

annual growth rate to 9.0% from 7.7%.

- Increased our long-term earnings per share growth rate target

to 6 to 8%.

CEO OVERVIEW

“Otter Tail Corporation produced record earnings in 2024,

generating diluted earnings per share of $7.17,” said President and

CEO Chuck MacFarlane. “Executing on our strategy coupled with the

hard work and dedication of our team members made this level of

success possible and I am grateful for their contributions.

“Otter Tail Power continues to perform well, converting our 2024

rate base growth into earnings growth at approximately a 1:1 ratio.

We continue to execute on our regulatory priorities and obtained

approval for our fully settled North Dakota general rate case in

the fourth quarter. The outcome of the case provides for a net

annual revenue requirement increase of $13.1 million premised on a

return on equity of 10.1 percent and an equity layer of 53.5

percent.

“Our Manufacturing segment continues to navigate softened end

market demand, and we have taken action to mitigate the impact of

lower sales volumes on earnings. Despite the down-cycle, this

segment continues to produce incremental cash to fund future growth

opportunities, and the long-term fundamentals remain intact.

“Our Plastics segment produced strong financial results,

generating record earnings of $201 million. We continue to benefit

from improved end market demand and customers’ sales volume growth.

We completed the first phase of the Vinyltech expansion project in

the fourth quarter, adding large diameter PVC pipe production

capability to better serve customers in the southwest market.

“We have updated our 5-year capital spending plan and revised

our long-term financial targets. Otter Tail Power’s updated 5-year

capital spending plan totals $1.4 billion and is expected to

produce a rate base compounded annual growth rate of 9 percent. We

also increased our consolidated long-term earnings per share growth

rate target to 6 to 8 percent from 5 to 7 percent, increasing our

total shareholder return target to 9 to 11 percent.

“With the strength of our balance sheet and the talent

excellence we have and continue to cultivate, we feel well

positioned to deliver on our revised financial targets over the

long-term. We are initiating our 2025 diluted earnings per share

guidance range of $5.68 to $6.08. Our guidance reflects Electric

segment earnings growth of approximately 7 percent and as expected,

a decline in Plastics segment earnings driven by a continued

reduction in product sales prices due to changing market

conditions. We also expect a decline in Manufacturing segment

earnings as end market demand conditions remain challenging.”

CASH FLOWS AND LIQUIDITY

Our consolidated cash provided by operating activities was a

record $452.7 million in 2024, compared to $404.5 million in 2023,

with the increase primarily due to a decrease in working capital

and a $7.5 million increase in net income. Investing activities

during the year included capital expenditures of $358.7 million and

a $50.1 million long-term investment in U.S. treasuries. Capital

expenditures during the year were largely within our Electric

segment, including investments in our wind repowering and advanced

metering projects, but also included investments in our facility

expansion projects within our Manufacturing and Plastics segments.

Financing activities in 2024 included the issuance of $120.0

million of long-term debt at Otter Tail Power, the proceeds of

which were primarily used to fund capital investments. Other

financing activities during the year included dividend payments of

$78.3 million.

As of December 31, 2024, we had $311.6 million of available

liquidity under our credit facilities and $294.7 million of

available cash and cash equivalents, for total available liquidity

of $606.3 million.

ANNUAL SEGMENT OPERATING RESULTS

Electric Segment

($ in thousands)

2024

2023

$ Change

% Change

Operating Revenues

$

524,515

$

528,359

$

(3,844

)

(0.7

)%

Net Income

90,963

84,424

6,539

7.7

Retail MWh Sales

5,681,268

5,772,215

(90,947

)

(1.6

)%

Heating Degree Days

5,313

6,259

(946

)

(15.1

)

Cooling Degree Days

440

590

(150

)

(25.4

)

The following table shows heating and cooling degree days as a

percent of normal.

2024

2023

Heating Degree Days

83.7

%

98.4

%

Cooling Degree Days

93.8

%

127.2

%

The following table summarizes the estimated effect on diluted

earnings per share of the difference in retail kilowatt-hour (kwh)

sales under actual weather conditions and expected retail kwh sales

under normal weather conditions in 2024 and 2023.

2024 vs Normal

2024 vs

2023

2023 vs Normal

Effect on Diluted Earnings Per Share

$

(0.13

)

$

(0.15

)

$

0.02

Operating Revenues decreased $3.8 million primarily due

to decreases in retail and wholesale revenues. The decrease in

retail revenue was driven by decreased fuel recovery revenue due to

lower market energy costs and the impact of unfavorable weather.

These decreases were partially offset by retail revenue increases

due to an interim rate increase in North Dakota in connection with

our most recent rate case, increased commercial and industrial

sales volumes, and increased rider revenue as we recover the cost

of and return on our rate base investments.

Net Income increased $6.5 million primarily due to

increased revenue resulting from the interim rate increase in North

Dakota and increased rider revenue, partially offset by unfavorable

weather, as discussed above. The revenue increases were partially

offset by increased depreciation and interest expense related to

capital investments and financing costs associated with our rate

base investments.

Manufacturing Segment

(in thousands)

2024

2023

$ Change

% Change

Operating Revenues

$

342,592

$

402,781

$

(60,189

)

(14.9

)%

Net Income

13,681

21,454

(7,773

)

(36.2

)

Operating Revenues decreased $60.2 million primarily due

to a 15% decrease in sales volumes, with declines experienced in

the recreational vehicle, agriculture, construction, lawn and

garden, and horticulture end markets. Sales volumes decreased due

to lower end market demand and inventory management efforts by

manufacturers, distributors, and dealers. A 28% decline in scrap

metal revenues, largely driven by lower production volumes, also

contributed to the decrease in operating revenues.

Net Income decreased $7.8 million primarily due to lower

sales volumes, as described above, and a decrease in gross profit

margins in our plastics thermoforming business, partially offset by

reduced general and administrative expenses. Decreased profit

margins were primarily due to a reduced leveraging of fixed

manufacturing costs resulting from decreased production and sales

volumes. Decreased scrap metal sales, as described above, also

contributed to the decrease in net income.

Plastics Segment

(in thousands)

2024

2023

$ Change

% Change

Operating Revenues

$

463,441

$

418,026

$

45,415

10.9

%

Net Income

200,747

187,748

12,999

6.9

Operating Revenues increased $45.4 million primarily due

to a 27% increase in sales volumes driven by customer sales volume

growth and strong distributor and end market demand. Sales volumes

in 2023 were negatively impacted by distributors and contractors

reducing purchase volumes in response to uncertain and competitive

market conditions. Although market conditions remain somewhat

uncertain, infrastructure investment and active construction across

our sales territories contributed to increased distributor and end

market demand in 2024. The impact of increased sales volumes was

partially offset by decreased sales prices. Our sales prices have

steadily declined after peaking in late 2022 and decreased 12% in

2024 compared to the prior year due to continuing changes in market

conditions.

Net Income increased $13.0 million primarily due to the

impact of increased sales volumes, as described above. Increased

operating revenues, driven by increased sales volumes, were

partially offset by a decrease in gross profit margins. Gross

profit margins decreased primarily due to decreases in sales

prices, as described above.

Corporate

(in thousands)

2024

2023

$ Change

% Change

Net Income (Loss)

$

(3,729

)

$

565

$

(4,294

)

n/m

Net Income (Loss) at our corporate cost center decreased

$4.3 million from $0.6 million of net income in the prior year,

primarily due to increased insurance expenses driven by higher

claims costs associated with our self-funded insurance programs, as

well as increased variable compensation based on the current year

financial performance. The increase in expenses was partially

offset by increased investment income earned on our short- and

long-term investments.

FOURTH QUARTER OPERATING RESULTS

Consolidated Results

(in thousands, except per share

amounts)

2024

2023

$ Change

% Change

Operating Revenues

$

303,111

$

314,313

$

(11,202

)

(3.6

)%

Operating Expenses

236,287

244,233

(7,946

)

(3.3

)

Operating Income

66,824

70,080

(3,256

)

(4.6

)

Other Expense

3,821

1,109

2,712

244.5

Income Before Income Taxes

63,003

68,971

(5,968

)

(8.7

)

Income Tax Expense

8,153

11,205

(3,052

)

(27.2

)

Net Income

54,850

57,766

(2,916

)

(5.0

)

Diluted Earnings Per Share

$

1.30

$

1.37

$

(0.07

)

(5.1

)%

Electric Segment

Electric segment net income was $21.5 million, a $4.5 million

increase from the fourth quarter of 2023. The increase was

primarily due to increased retail revenue driven by an interim rate

increase in North Dakota in connection with our most recent rate

case, as well as increased rider revenue, combined with a decrease

in operating and maintenance expenses. The revenue increases and

operating expense decreases were partially offset by increased

depreciation and interest expense related to capital investment and

financing costs associated with our rate base investments.

Manufacturing Segment

Manufacturing segment net loss was $0.6 million, a $1.8 million

decrease from net income of $1.2 million in the fourth quarter of

2023. The decrease was primarily due to a 25% decrease in sales

volumes compared to the same period in the prior year, driven by

soft end market demand, and a decrease in gross profit margins in

both our contract metal fabrication and our plastics thermoforming

business. Sales volume decreases were primarily in the recreational

vehicle, agriculture, construction, lawn and garden, and

horticulture end markets. Decreased profit margins were primarily

due to a reduced leveraging of fixed manufacturing costs resulting

from decreased production and sales volumes. The impacts of lower

sales volumes were partially offset by reduced general and

administrative expenses.

Plastics Segment

Plastics segment net income was $38.9 million, a $0.6 million

decrease from the fourth quarter of 2023. The decrease was

primarily due to decreased sales prices and increased general and

administrative costs. Sales prices steadily declined throughout the

year and decreased 11% compared to the same period last year. The

impact of decreased sales prices and increased general and

administrative costs was largely offset by the impact of increased

sales volumes. Sales volumes increased 23% compared to the same

period in the prior year driven by customer sales volume growth and

strong distributor and end market demand.

Corporate

Corporate net loss was $5.0 million, a $5.1 million decrease

from $0.1 million of net income in the fourth quarter of 2023,

primarily due to increased insurance expense driven by higher

claims costs associated with our self-funded insurance programs, as

well as increased variable compensation based on the current year

financial performance.

2025 OUTLOOK

We anticipate 2025 diluted earnings per share to be in the range

of $5.68 to $6.08. We expect our earnings mix in 2025 to be

approximately 39% from our Electric segment and 61% from our

Manufacturing and Plastics segments, net of corporate costs. Our

anticipated earnings mix in 2025 deviates from our long-term

expected earnings mix of 65% Electric / 35% Non-Electric as we

expect Plastics segment earnings to remain elevated in 2025

compared to our long-term view of normal earnings for this

segment.

The segment components of our 2025 diluted earnings per share

guidance compared with actual earnings for 2024 are as follows:

2024 EPS

by Segment

2025 EPS Guidance

Low

High

Electric

$

2.16

$

2.29

$

2.35

Manufacturing

0.33

0.21

0.27

Plastics

4.77

3.26

3.50

Corporate

(0.09

)

(0.08

)

(0.04

)

Total

$

7.17

$

5.68

$

6.08

Return on Equity

19.3

%

13.8

%

14.6

%

The following items contribute to our 2025 earnings

guidance:

Electric Segment - We expect segment earnings to increase

7% in 2025 based on the following assumptions:

- Normal weather conditions in 2025.

- Returns generated from an increase in average rate base of 12%

in 2025 compared to 2024.

- A planned maintenance outage at Coyote Station in 2025 (there

were no planned outages in 2024).

- Increased depreciation and interest expense from capital

expenditures and associated financing.

Manufacturing Segment - We expect segment earnings to

decline 27% in 2025 based on the following assumptions:

- Lower sales volumes in our contract metal fabrication business

as soft end market demand continues, partially offset by some

volume recovery in our horticulture plastic products business.

- Sales mix and product pricing pressure in the current sales

volume environment, and lower scrap revenues within our metal

fabrication business from lower production volumes.

- Compressed operating margins from the deleveraging of

manufacturing costs due to lower production and sales volumes.

Plastics Segment - We expect segment earnings to decline

29% in 2025 based on the following assumptions:

- Continued decline in product sales prices throughout 2025 as

pricing continues to retreat from the 2022 high point.

- Modest increase in sales volumes driven by new capacity at our

Phoenix facility, partially offset by macroeconomic

uncertainty.

Corporate Costs - We expect our corporate costs to

decrease primarily from lower incentive compensation costs compared

to 2024.

CAPITAL EXPENDITURES

The following provides a summary of actual capital expenditures

for the year ended December 31, 2024, and anticipated annual

capital expenditures for the next five years, along with average

rate base and annual rate base growth of our Electric segment:

(in millions)

2024

2025

2026

2027

2028

2029

Total

2025 - 2029

Electric Segment:

Renewable Generation

$

134

$

101

$

127

$

118

$

179

$

4

$

529

Transmission

60

59

93

162

114

100

528

Distribution

46

37

37

36

37

34

181

Other

61

54

51

31

27

25

188

Total Electric Segment

301

251

308

347

357

163

1,426

Manufacturing and Plastics

Segments

58

27

27

27

25

23

129

Total Capital Expenditures

$

359

$

278

$

335

$

374

$

382

$

186

$

1,555

Total Electric Utility Average Rate

Base

$

1,892

$

2,118

$

2,303

$

2,524

$

2,762

$

2,909

Annual Rate Base Growth

8.6

%

11.9

%

8.7

%

9.6

%

9.4

%

5.3

%

Our updated five-year capital expenditure plan includes Electric

segment investments in wind and solar resources, transmission and

distribution assets, and investments in system reliability and

technology. Our Electric segment capital expenditure plan produces

a compounded annual growth rate on average rate base of 9.0% over

the next five years and will serve as a key driver in increasing

Electric segment earnings over this timeframe. Our capital

expenditure plan in our Manufacturing and Plastics segments

includes a mix of investments to replace and upgrade existing

equipment and investments to add additional capacity or

productivity to our operations.

CONFERENCE CALL AND WEBCAST

The corporation will host a live webcast on Tuesday, February

18, 2025, at 10:00 a.m. CT to discuss its financial and operating

performance.

The presentation will be posted on our website before the

webcast. To access the live webcast, go to

www.ottertail.com/presentations and select “Webcast.” Please allow

time prior to the call to visit the site and download any software

needed to listen in. An archived copy of the webcast will be

available on our website shortly after the call.

If you are interested in asking a question during the live

webcast, visit and follow the link provided in the press release

announcing the upcoming conference call.

FORWARD-LOOKING STATEMENTS

Except for historical information contained here, the statements

in this release are forward-looking and made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. The words “anticipate,” “believe,” “can,” “could,”

“estimate,” “expect,” “future,” “goal,” “intend,” “likely,” “may,”

“opportunity,” “outlook,” “plan,” “possible,” “potential,”

“predict,” “probable,” “projected,” “should,” “target,” “will,”

“would” and similar words and expressions are intended to identify

forward-looking statements. Such statements are based upon the

current beliefs and expectations of management. Forward-looking

statements made herein, which may include statements regarding 2025

earnings and earnings per share, long-term earnings, earnings per

share growth and earnings mix, anticipated levels of energy

generation from renewable resources, anticipated reductions in

carbon dioxide emissions, future investments and capital

expenditures, rate base levels and rate base growth, future raw

materials costs, future raw materials availability and supply

constraints, future operating revenues and operating results, and

expectations regarding regulatory proceedings, as well as other

assumptions and statements, involve known and unknown risks and

uncertainties that may cause our actual results in current or

future periods to differ materially from the forecasted assumptions

and expected results. The Company’s risks and uncertainties

include, among other things, uncertainty of future investments and

capital expenditures; rate base levels and rate base growth; risks

associated with energy markets; the availability and pricing of

resource materials; inflationary cost pressures; attracting and

maintaining a qualified and stable workforce; changing

macroeconomic and industry conditions that impact the demand for

our products, pricing and margin; long-term investment risk;

seasonal weather patterns and extreme weather events; future

business volumes with key customers; reductions in our credit

ratings; our ability to access capital markets on favorable terms;

assumptions and costs relating to funding our employee benefit

plans; our subsidiaries’ ability to make dividend payments;

cybersecurity threats or data breaches; the impact of government

legislation and regulation including foreign trade policy and

environmental; health and safety laws and regulations; changes in

tax laws and regulations; the impact of climate change including

compliance with legislative and regulatory changes to address

climate change; expectations regarding regulatory proceedings,

assigned service areas, the construction of major facilities,

capital structure, and allowed customer rates; actual and

threatened claims or litigation; and operational and economic risks

associated with our electric generating and manufacturing

facilities. These and other risks are more fully described in our

filings with the Securities and Exchange Commission, including our

most recently filed Annual Report on Form 10-K, as updated in

subsequently filed Quarterly Reports on Form 10-Q, as applicable.

Forward-looking statements speak only as of the date they are made,

and we expressly disclaim any obligation to update any

forward-looking information.

Category: Earnings

About the Corporation: Otter Tail Corporation, a member

of the S&P SmallCap 600 Index, has interests in diversified

operations that include an electric utility and manufacturing

businesses. Otter Tail Corporation stock trades on the Nasdaq

Global Select Market under the symbol OTTR. The latest investor and

corporate information is available at www.ottertail.com.

Corporate offices are in Fergus Falls, Minnesota, and Fargo, North

Dakota.

OTTER TAIL CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

(in thousands, except per-share

amounts)

2024

2023

2024

2023

Operating Revenues

Electric

$

139,818

$

132,362

$

524,515

$

528,359

Product Sales

163,293

181,951

806,033

820,807

Total Operating Revenues

303,111

314,313

1,330,548

1,349,166

Operating Expenses

Electric Production Fuel

15,936

14,410

60,945

60,339

Electric Purchased Power

19,055

20,360

61,561

78,292

Electric Operating and Maintenance

Expense

54,055

56,659

190,422

191,263

Cost of Products Sold (excluding

depreciation)

91,560

102,793

434,522

454,122

Nonelectric Selling, General, and

Administrative Expenses

24,169

21,230

80,065

72,663

Depreciation and Amortization

27,541

25,319

107,121

97,954

Electric Property Taxes

3,971

3,462

15,662

16,614

Total Operating Expenses

236,287

244,233

950,298

971,247

Operating Income

66,824

70,080

380,250

377,919

Other Income and (Expense)

Interest Expense

(10,591

)

(9,392

)

(41,815

)

(37,677

)

Nonservice Components of Postretirement

Benefits

2,412

3,475

9,609

10,597

Other Income (Expense), net

4,358

4,808

18,848

12,650

Income Before Income Taxes

63,003

68,971

366,892

363,489

Income Tax Expense

8,153

11,205

65,230

69,298

Net Income

$

54,850

$

57,766

$

301,662

$

294,191

Weighted-Average Common Shares

Outstanding:

Basic

41,801

41,680

41,778

41,668

Diluted

42,088

42,065

42,072

42,039

Earnings Per Share:

Basic

$

1.31

$

1.39

$

7.22

$

7.06

Diluted

$

1.30

$

1.37

$

7.17

$

7.00

OTTER TAIL CORPORATION

CONSOLIDATED BALANCE SHEETS

(unaudited)

December 31,

(in thousands)

2024

2023

Assets

Current Assets

Cash and Cash Equivalents

$

294,651

$

230,373

Receivables, net of allowance for credit

losses

145,964

157,143

Inventories

148,885

149,701

Regulatory Assets

9,962

16,127

Other Current Assets

30,579

16,826

Total Current Assets

630,041

570,170

Noncurrent Assets

Investments

121,177

62,516

Property, Plant and Equipment, net of

accumulated depreciation

2,692,460

2,418,375

Regulatory Assets

98,673

95,715

Intangible Assets, net of accumulated

amortization

5,743

6,843

Goodwill

37,572

37,572

Other Noncurrent Assets

66,416

51,377

Total Noncurrent Assets

3,022,041

2,672,398

Total Assets

$

3,652,082

$

3,242,568

Liabilities and Shareholders'

Equity

Current Liabilities

Short-Term Debt

$

69,615

$

81,422

Accounts Payable

113,574

94,428

Accrued Salaries and Wages

34,398

38,134

Accrued Taxes

17,314

26,590

Regulatory Liabilities

29,307

25,408

Other Current Liabilities

45,582

43,775

Total Current Liabilities

309,790

309,757

Noncurrent Liabilities and Deferred

Credits

Pensions Benefit Liability

32,614

33,101

Other Postretirement Benefits

Liability

27,385

27,676

Regulatory Liabilities

288,928

276,547

Deferred Income Taxes

267,745

237,273

Deferred Tax Credits

14,990

15,172

Other Noncurrent Liabilities

98,397

75,977

Total Noncurrent Liabilities and Deferred

Credits

730,059

665,746

Commitments and Contingencies

Capitalization

Long-Term Debt

943,734

824,059

Shareholders’ Equity

Common Shares

209,140

208,553

Additional Paid-In Capital

429,089

426,963

Retained Earnings

1,029,738

806,342

Accumulated Other Comprehensive Income

532

1,148

Total Shareholders' Equity

1,668,499

1,443,006

Total Capitalization

2,612,233

2,267,065

Total Liabilities and Shareholders'

Equity

$

3,652,082

$

3,242,568

OTTER TAIL CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

Twelve Months Ended December

31,

(in thousands)

2024

2023

Operating Activities

Net Income

$

301,662

$

294,191

Adjustments to Reconcile Net Income to Net

Cash Provided by Operating Activities:

Depreciation and Amortization

107,121

97,954

Deferred Tax Credits

(182

)

(744

)

Deferred Income Taxes

23,057

13,508

Investment (Gains) Losses

(5,482

)

(7,222

)

Stock Compensation Expense

9,529

7,753

Other, net

(3,111

)

(423

)

Change in Operating Assets and

Liabilities:

Receivables

11,179

(12,750

)

Inventories

3,691

(2,450

)

Regulatory Assets

5,194

12,479

Other Assets

(11,640

)

2,817

Accounts Payable

14,826

(9,988

)

Accrued and Other Liabilities

(10,371

)

6

Regulatory Liabilities

16,821

20,973

Pension and Other Postretirement

Benefits

(9,563

)

(11,605

)

Net Cash Provided by Operating

Activities

452,731

404,499

Investing Activities

Capital Expenditures

(358,650

)

(287,134

)

Proceeds from Disposal of Noncurrent

Assets

8,849

6,225

Purchases of Investments and Other

Assets

(61,573

)

(8,378

)

Net Cash Used in Investing

Activities

(411,374

)

(289,287

)

Financing Activities

Net (Repayments) Borrowings on Short-Term

Debt

(11,807

)

73,218

Proceeds from Issuance of Long-Term

Debt

120,000

—

Dividends Paid

(78,266

)

(73,061

)

Payments for Shares Withheld for Employee

Tax Obligations

(6,457

)

(3,088

)

Other, net

(549

)

(904

)

Net Cash Provided by (Used in)

Financing Activities

22,921

(3,835

)

Net Change in Cash and Cash

Equivalents

64,278

111,377

Cash and Cash Equivalents at Beginning

of Period

230,373

118,996

Cash and Cash Equivalents at End of

Period

$

294,651

$

230,373

OTTER TAIL CORPORATION

SEGMENT RESULTS (unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

(in thousands)

2024

2023

2024

2023

Operating Revenues

Electric

$

139,818

$

132,362

$

524,515

$

528,359

Manufacturing

66,632

92,846

342,592

402,781

Plastics

96,661

89,105

463,441

418,026

Total Operating Revenues

$

303,111

$

314,313

$

1,330,548

$

1,349,166

Net Income (Loss)

Electric

$

21,478

$

17,005

$

90,963

$

84,424

Manufacturing

(590

)

1,177

13,681

21,454

Plastics

38,919

39,508

200,747

187,748

Corporate

(4,957

)

76

(3,729

)

565

Total Net Income

$

54,850

$

57,766

$

301,662

$

294,191

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250217244540/en/

Media Contact: Stephanie Hoff, Director of Corporate

Communications, (218) 739-8535

Investor Contacts: Beth Eiken, Manager of Investor

Relations, (701) 451-3571 Tyler Nelson, VP of Finance and

Treasurer, (701) 451-3576

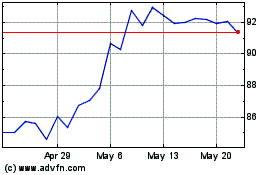

Otter Tail (NASDAQ:OTTR)

Historical Stock Chart

From Jan 2025 to Feb 2025

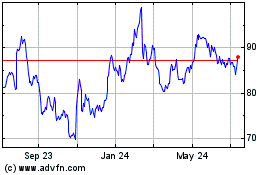

Otter Tail (NASDAQ:OTTR)

Historical Stock Chart

From Feb 2024 to Feb 2025