0000002178FALSE00000021782025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 4, 2025

ADAMS RESOURCES & ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 1-7908 | 74-1753147 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

| Wortham Tower Building, 2727 Allen Parkway, 9th Floor, Houston, Texas | 77019 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 881-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.10 par value | | AE | | NYSE American LLC |

| | | | | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | Emerging growth company | ☐ |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Introductory Note

As previously reported, on November 11, 2024, Adams Resources & Energy, Inc., a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and among the Company, ARE Equity Corporation (“ARE Equity”), a Texas corporation (as successor-in-interest to Tres Energy LLC, a Texas limited liability company), and ARE Acquisition Corporation, a Delaware corporation and a direct, wholly owned subsidiary of ARE Equity (“Merger Sub”), pursuant to which Merger Sub would merge with and into the Company, with the Company surviving the merger as a wholly owned subsidiary of ARE Equity.

On February 4, 2025 (the “Closing Date”), on the terms set forth in the Merger Agreement, Merger Sub merged with and into the Company (the “Merger”), with the Company surviving the merger as a wholly owned subsidiary of ARE Equity (the “Surviving Corporation”).

Item 1.01. Entry Into Material Definitive Agreement.

In connection with the closing of the Merger, Merger Sub entered into that certain Credit Agreement, dated as of February 4, 2025, by and among Merger Sub, Wells Fargo Bank, National Association, as administrative agent, and the other lenders party thereto (the “Wells Fargo Credit Agreement”), which provides for revolving loans, term loans and letters of credit in an aggregate principal amount of up to $80,000,000. Merger Sub was the initial borrower, and following the Merger, the Company assumed all of the rights and obligations of Merger Sub under the Wells Fargo Credit Agreement. Certain subsidiaries of the Company are guarantors under the Wells Fargo Credit Agreement and the obligations under the Wells Fargo Credit Agreement are secured by a first priority lien on substantially all assets of the borrower and the guarantors (subject to certain exclusions and exceptions). The Wells Fargo Credit Agreement includes representations and warranties, covenants, events of default and other provisions that are customary for facilities of their types. The proceeds of the Wells Fargo Credit Agreement were used to pay for a portion of the Merger Consideration (as defined below).

Item 1.02. Termination of Material Definitive Agreement.

In connection with the closing of the Merger, on the Closing Date, the Company repaid in full all outstanding borrowings under the Credit Agreement, dated October 27, 2022, by and among the Company and its subsidiaries, GulfMark Asset Holdings, LLC, Service Transport Company, and Cadence Bank, as administrative agent, swingline lender and issuing lender, and the other lenders party thereto, as amended by Amendment No. 1 thereto dated as of August 2, 2023, as further amended by Amendment No. 2 thereto dated as of July 16, 2024, and as further amended by Amendment No. 3 thereto dated November 8, 2024 (the “Credit Agreement”), and the Credit Agreement was terminated.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The disclosure set forth in the Introductory Note of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.01.

Pursuant to the Merger Agreement, at the effective time of the Merger (the “Effective Time”):

•each share of the Company’s common stock, par value $0.10 per share (the “Common Stock”) (other than shares of Common Stock (i) held by the Company as treasury stock or owned by ARE Equity immediately prior to the Effective Time or (ii) held by any subsidiary of either the Company or ARE Equity immediately prior to the Effective Time) issued and outstanding immediately prior to the Effective Time (other than shares held by any holder who is entitled to appraisal rights and properly exercised such rights under Delaware law) was converted into the right to receive $38.00 in cash, without interest (the “Merger Consideration”);

•each equity award that was subject to time-based vesting conditions that was outstanding immediately prior to the Effective Time (each such award, an “Adams RSA”) automatically became fully vested and was

canceled and converted into the right to receive an amount in cash equal to the product of the Merger Consideration and the number of shares subject to such Adams RSA; and

•each equity award that was subject to performance-based vesting conditions that was outstanding immediately prior to the Effective Time (each such award, an “Adams PSA”, and together with the Adams RSAs, the “Company Stock Awards”) automatically became fully vested at target performance (as set forth in the applicable award agreement) and was canceled and converted into the right to receive an amount in cash equal to the product of the Merger Consideration and the number of shares of the Company’s Common Stock issued and outstanding under the Adams PSA immediately prior to the Effective Time.

The description of the effects of the Merger Agreement and the transactions contemplated by the Merger Agreement does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Merger Agreement, which was filed as Exhibit 2.1 to the Company’s Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 12, 2024, and which is incorporated herein by reference.

Item 2.03. Creation of Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

The disclosure set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 3.01.

In connection with and as a result of the consummation of the Merger, shares of the Company’s Common Stock will cease to trade on the NYSE American prior to market open on February 5, 2025. The Common Stock is eligible for delisting from the NYSE American and termination of registration under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company has requested that the NYSE American file a Notification of Removal From Listing and Registration on Form 25 with the SEC to delist the Company’s Common Stock from the NYSE American and the deregistration of the Company’s Common Stock under Section 12(b) of the Exchange Act on the Closing Date. After the Form 25 becomes effective, the Surviving Corporation intends to file a Form 15 with the SEC to terminate the registration of the Company’s Common Stock under Section 12(g) of the Exchange Act and suspend its reporting obligations with the SEC under Sections 13 and 15(d) of the Exchange Act.

Item 3.03. Material Modification of Rights of Security Holders.

The disclosure set forth in the Introductory Note of this Current Report on Form 8-K and the disclosure set forth in Items 2.01, 3.01, and 5.02 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

In connection with the consummation of the Merger, at the Effective Time, holders of shares of the Company’s Common Stock (except as described in Item 2.01) and Company Stock Awards ceased to have any rights in connection with their holding of such securities (other than their right to receive (i) with respect to the Company’s Common Stock, the Merger Consideration, as described in the Item 2.01, and (ii) with respect to Company Stock Awards, the consideration described in Item 2.01), all as further described in the Merger Agreement.

Item 5.01. Changes in Control of Registrant.

The information set forth in the Introductory Note and under Items 2.01, 3.03 and 5.02 of this Current Report on Form 8-K is incorporated by reference in this Item 5.01.

As a result of the Merger, a change in control of the Company occurred, and the Company is now a wholly owned subsidiary of ARE Equity. The total amount of consideration payable to holders of the Company’s Common Stock and Company Stock Awards in connection with the Merger was approximately $102 million. The funds used by ARE Equity to consummate the Merger and complete the related transactions came from equity contributions and a bridge loan from the shareholders of ARE Equity, and proceeds from borrowings under the Wells Fargo Credit Agreement.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth in the Introductory Note and under Item 2.01 of this Current Report on Form 8-K is incorporated by reference in this Item 5.02.

In connection with the consummation of the Merger, and as contemplated by the Merger Agreement, each of Murray E. Brasseux, Dennis E. Dominic, Michelle A. Earley, Richard C. Jenner, John O. Niemann, Jr., Townes G. Pressler and Kevin J. Roycraft resigned from the board of directors of the Company and the committees thereof, effective as of the Effective Time. No director resigned as a result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

In connection with the consummation of the Merger, Todd P. Sullivan, William W. Sullivan and John R. Sullivan were appointed to the board of directors of the Company, effective as of the Effective Time.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| 2.1* | Agreement and Plan of Merger by and among Adams Resources & Energy, Inc., Tres Energy, LLC, and ARE Acquisition Corporation (incorporated by reference to Exhibit 2.01 to the Company’s Current Report on Form 8-K filed with the SEC on November 12, 2025). |

| |

| 104 | Cover Page Interactive Data File — the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

* The schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally a copy of such schedules and exhibits, or any section thereof, to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | ADAMS RESOURCES & ENERGY, INC. |

| | | |

| | | |

| | | |

| Date: | February 4, 2025 | By: | /s/ Tracy E. Ohmart |

| | | Tracy E. Ohmart |

| | | Chief Financial Officer |

| | | (Principal Financial Officer and |

| | | Principal Accounting Officer) |

v3.25.0.1

Cover Page

|

Feb. 04, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 04, 2025

|

| Entity Registrant Name |

ADAMS RESOURCES & ENERGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-7908

|

| Entity Tax Identification Number |

74-1753147

|

| Entity Address, Address Line One |

Wortham Tower Building

|

| Entity Address, Address Line Two |

2727 Allen Parkway

|

| Entity Address, Address Line Three |

9th Floor

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77019

|

| City Area Code |

713

|

| Local Phone Number |

881-3600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

AE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000002178

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

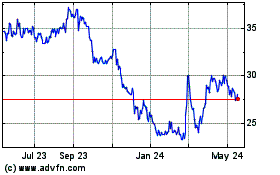

Adams Resources and Energy (AMEX:AE)

Historical Stock Chart

From Jan 2025 to Feb 2025

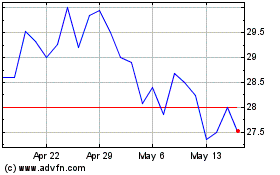

Adams Resources and Energy (AMEX:AE)

Historical Stock Chart

From Feb 2024 to Feb 2025