UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment No. )

Filed

by the Registrant ☒

Filed

by a party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive

Proxy Statement |

| |

|

| ☒ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material under § 240.14a-12 |

AIM

ImmunoTech Inc.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On

December 2, 2024, AIM ImmunoTech Inc. (the “Company”) issued a press release, a copy of which is attached hereto as Exhibit

1. Also on December 2, 2024, the Company issued an investor presentation, a copy of which is attached hereto as Exhibit 2. The Company

intends to use the presentation for discussions with its stockholders in connection with the Company’s 2024 Annual Meeting of Stockholders

(the “Annual Meeting”). Also on December 2, 2024, the Company issued the following materials, copies of which are attached

hereto as Exhibit 3.

Forward

Looking Statements

The

materials attached contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the

“PSLRA”). Words such as “may,” “will,” “expect,” “plan,” “anticipate,”

“continue,” “believe,” “potential,” “upcoming” and other variations thereon and similar

expressions (as well as other words or expressions referencing future events or circumstances) are intended to identify forward-looking

statements. Many of these forward-looking statements involve a number of risks and uncertainties. Data, pre-clinical success and clinical

success seen to date does not guarantee that Ampligen will be approved as a treatment or therapy for any diseases or conditions. The

Company urges investors to consider specifically the various risk factors identified in its most recent Annual Report on Form 10-K, and

any risk factors or cautionary statements included in any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, filed

with the U.S. Securities and Exchange Commission (the “SEC”). You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of the materials attached hereto. Among other things, for those statements, the Company claims

the protection of the safe harbor for forward-looking statements contained in the PSLRA. The Company does not undertake to update any

of these forward-looking statements to reflect events or circumstances that occur after the date hereof.

Important

Additional Information

The

Company, its directors and executive officers, Peter W. Rodino, III and Robert Dickey, IV, are deemed to be “participants”

(as defined in Section 14(a) of the Securities Exchange Act of 1934, as amended) in the solicitation of proxies from the Company’s

stockholders in connection with the Annual Meeting. The Company filed its definitive proxy statement (the “Definitive Proxy Statement”)

and a WHITE universal proxy card with the SEC on November 4, 2024 in connection with such solicitation of proxies from

the Company’s stockholders. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH DEFINITIVE PROXY STATEMENT, ACCOMPANYING

WHITE UNIVERSAL PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT

INFORMATION ABOUT THE ANNUAL MEETING. The Definitive Proxy Statement contains information regarding the identity of the participants,

and their direct and indirect interests, by security holdings or otherwise, in the Company’s securities and can be found in the

section titled “Principal Stockholders” of the Definitive Proxy Statement and available here.

Information regarding subsequent changes to their holdings of the Company’s securities can be found in the SEC filings on Forms

3, 4, and 5, which are available on the Company’s website available here or through the SEC’s website at www.sec.gov.

Stockholders will be able to obtain the Definitive Proxy Statement, any amendments or supplements thereto and other documents filed by

the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at

the Company’s website at https://aimimmuno.com/sec-filings/.

Exhibit

1

AIM

ImmunoTech Issues Presentation Detailing Why Shareholders Should NOT

Elect Activist Group’s Nominees to the Board

Highlights

Activist Group’s Nominees’ Checkered Backgrounds, Skewed Incentives and Lack of Independence

Warns

AIM Shareholders of Activist Group’s Plan to Reimburse Individuals More Than $5 Million for Failed Litigation Against AIM, in Addition

to Any Expenses Incurred in Connection With This Year’s Proxy Contest

Urges

Shareholders to Safeguard AIM by Voting “FOR” ALL Four of the Board’s Incumbent Candidates and Discarding Any Proxy

Materials Received from the Activist Group

OCALA,

Fla., December 2, 2024 — AIM ImmunoTech Inc. (NYSE American: AIM) (“AIM” or the “Company”) today issued

a presentation highlighting why shareholders should NOT elect the four director candidates nominated by a group of activist investors

(collectively, the “Activist Group”) as part of their multi-year attempt to take over AIM’s Board of Directors (the

“Board”) at the upcoming 2024 Annual Meeting of Stockholders (the “Annual Meeting”), presently scheduled for

December 17, 2024.

View

the full presentation here. Highlights include:

| | ● | Robert

Chioini – Activist Group Nominee and Interim CEO Candidate |

| | ○ | Fired

as CEO of Rockwell Medical in 2018 because of his “sustained mismanagement”

of the company and “blatant disregard for shareholder concerns,” according

to a Rockwell Medical spokesperson.1 |

| | ○ | Following

his termination, Mr. Chioini “refuse[d] to accept the decision” and, without

authorization, filed a Current Report on Form 8-K on the company’s behalf “making

various assertions regarding the five independent directors who voted in favor of Mr. Chioini’s

removal.”2 |

| | ○ | Has

agreed to have AIM shareholders repay him and other individuals more than $5 million in

litigation expenses for a failed Board takeover attempt in 2023, in addition to any costs

incurred in connection with the attempt to take over the Board at this year’s Annual

Meeting – without letting shareholders vote directly on this reimbursement.3 |

1

See Former pharma executives sue over firings, Modern Healthcare (June 18, 2018), available at: https://www.modernhealthcare.com/article/20180618/NEWS/180619912/former-pharma-executives-sue-over-firings.

2

See Press Release issued by Rockwell Medical on May 24, 2018, available at: https://www.prnewswire.com/news-releases/rockwell-medical-issues-statement-300654699.html.

3

See Definitive Proxy Statement filed by the Activist Group with the Securities and Exchange Commission (the “SEC”)

on November 6, 2024.

| | ○ | Mr.

Chioini was part of the group that orchestrated the 2022 campaign to take over the AIM

Board and planned this with two convicted criminals – Franz Tudor and Michael Xirinachs

– despite owning no AIM stock.4 |

| | ○ | He

sought to hide the involvement of these criminals and recruited another individual,

Jonathan Jorgl, to be the “face” of the effort.5 |

| | ○ | This

history of poor judgment and unacceptable behavior indicates, in the Board’s view,

that Mr. Chioini is unfit to serve as a public company director – let alone CEO. |

| | ● | Todd

Deutsch – Activist Group Nominee |

| | ○ | Worked

with Mr. Tudor, a prior member of the Activist Group, at the Galleon Group, a hedge fund

at the center of an insider trading scandal in 2009 that led to over 50 convictions or guilty

pleas – including Mr. Tudor, who pled guilty to conspiracy to commit securities

fraud.6 |

| | ○ | Maintained

a relationship with Mr. Tudor despite Mr. Tudor’s questionable history. |

| | ■ | The

Delaware Court of Chancery (the “Court”) noted in December 2023 that “[Mr.]

Tudor is now employed by [Mr.] Deutsch to do ‘back office’ tasks.”7 |

| ○ | Has

agreed to have AIM shareholders repay him and other individuals more than $5 million in

litigation expenses for a failed Board takeover attempt in 2023, in addition to any costs

incurred in connection with their attempt to take over the Board at this year’s Annual

Meeting – without letting shareholders vote directly on this reimbursement. |

| ○ | The

Board believes that Mr. Deutsch’s checkered past in relation to Galleon Group, as well

as the fact that he as recently as last year employed a convicted securities law felon, should

give shareholders pause about his judgment and commitment to protecting their best interests. |

| ● | Ted

Kellner – Activist Group Nominee and Leader of 2023 and 2024 Board Takeover Attempts |

| | ○ | Led

a group for the second year in a row that is closely associated with securities law felons

– in an effort to take control of the Board. |

4

See Jorgl v. AIM ImmunoTech Inc. et al., 2022 WL 16543834, at *1 (Del. Ch. Oct. 28, 2022).

5

See Jorgl v. AIM ImmunoTech Inc. et al., 2022 WL 16543834, at *1 (Del. Ch. Oct. 28, 2022).

6

See Jorgl, 2022 WL 16543834, at *3.

7

See December 28, 2023, Opinion of the Delaware Court of Chancery: https://courts.delaware.gov/Opinions/Download.aspx?id=357400

(emphasis added).

| | ○ | Has

insisted that AIM pay him and other individuals a premium of more than $8 million to settle

this proxy contest. |

| | ○ | Realized

he might be associating with a felon convicted of insider trading – yet proceeded anyway. |

| | ■ | The

Court’s discovery found on “handwritten notes on a copy of the letter, Kellner

wrote ‘FRANZ TUDOR – IS A FELON?’ and ‘INSIDER TRADING?’”8 |

| | ○ | Was

found to have lied to shareholders by the Court. |

| | ■ | In

relation to the 2023 nomination notice, the Court noted, “Directors and stockholders

would justifiably want to know whether a nomination is part of a broader scheme. Such

information was withheld from or obfuscated in the Kellner Notice.”9 |

| | ■ | The

Court added, “The Kellner Notice states that before July 2023, ‘no decision

was made [for any of Kellner, Deutsch or Chioini] to work together to advance potential nominations

or otherwise take any action with respect to the Company.’ This statement is false.”10 |

| | ○ | Additionally,

the Delaware Supreme Court wrote the following: “We also note that, according to

the Court of Chancery, Kellner submitted false and misleading responses to some of

the requests” and referenced “Kellner’s and his nominees’

deceptive conduct.”11 |

| | ○ | Has

agreed to have AIM shareholders repay him and other individuals more than $5 million in

litigation expenses for a failed Board takeover attempt in 2023, in addition to any costs

incurred in connection with their attempt to take over the Board at this year’s Annual

Meeting – without letting shareholders vote directly on this reimbursement. |

| | ○ | Mr.

Kellner has lied to AIM shareholders, is trying to get control of the Board and intends to

take more than $5 million out of the Company for reimbursement in connection with the failed

Board takeover attempt in 2023 alone. The Board believes that his election to the Board would

not be in the best interests of all shareholders. |

8

See id. (emphasis added).

9

See id. (emphasis added).

10

See id. (emphasis added).

11

See id. (emphasis added).

| | ● | Paul

Sweeney – Activist Group Nominee |

| | ○ | Not

independent of the Activist Group – has a long-standing personal and business relationship

with Mr. Kellner, with whom he invested together in numerous other private businesses

and ventures. In certain cases, they have done so through special purpose vehicles in which

one or both of them have served as managers, as was the case with Coyote Fund, LLC, FM Qualified

Opportunity Fund LLC, TK-Karma Investment, LLC and DTP3, LLC1.12 |

| | ○ | Received

an aggregate of over $15.0 million in funds from Mr. Kellner for 13 active investments

sponsored by PS Capital Partners, a private equity firm of which Mr. Sweeney is co-founder

and a principal. In fact, Mr. Kellner is quoted on PS Capital Partners’ website saying:

“I have never missed an opportunity to invest with PS Capital and am happy to be

the largest investor in almost every deal.”13 |

| | ○ | Invested

extensively within Fiduciary Real Estate Development, Inc., a business founded by Mr. Kellner,

including ~$150,000 personally and ~$375,000 through PS Capital Partners.14 |

| | ○ | Serves

with Mr. Kellner as a member of a number of clubs and organizations, including Milwaukee

Athletic Club, Greater Milwaukee Committee, Milwaukee World Festival, MMAC and Children’s

Wisconsin. |

| | ○ | Lacks

any relevant board or senior management experience in the biotech industry. |

| | ○ | Has

shown poor judgment, in the Board’s view, in getting involved with the Activist

Group. |

| | ○ | The

Board questions how Mr. Sweeney can act independently as a member of the AIM Board given

his extensive ongoing business and investment relationship with Mr. Kellner, which, in the

Board’s view, would make him highly likely to simply agree with Mr. Kellner’s

positions rather than considering the best interests of all shareholders. |

The

Activist Group nominees have not proposed a compelling plan for AIM and appear to be focused on seeking reimbursement for their past

expenses.

| ● | To

settle, the Activist Group is demanding upwards of $8 million in litigation expenses from

AIM for money its members spent on failed lawsuits against the Company. |

12

See Definitive Proxy Statement filed by the Activist Group with the SEC on November

6, 2024.

13

See PS Capital Partners’ Testimonials Page available at: https://pscapitalpartners.com/testimonials/.

14

See The Activist Group Compiled Nomination Notice.

| ● | If

the Activist Group’s nominees are elected to the Board, they have blatantly stated

in their definitive proxy statement: “In addition to the foregoing amount, each of

Mr. Kellner, Mr. Deutsch and Mr. Chioini intend to seek reimbursement from the Company

of all expenses they incurred in connection with their solicitation for the 2023 Annual Meeting

(including related litigation expenses), which amounts to approximately $5.3 [million]…

and they do not intend to submit the question of such reimbursement to a vote of security

holders of the Company.” |

The

Activist Group Slate is the WRONG Choice for AIM Shareholders.

***

AIM

encourages shareholders to vote “FOR” ALL four of the Board’s incumbent candidates – Stewart L. Appelrouth,

Nancy K. Bryan, Thomas K. Equels and Dr. William M. Mitchell – in connection with the Annual Meeting, on the

WHITE universal proxy card.

For

more information on how to vote, visit: www.SafeguardAIM.com.

***

About

AIM ImmunoTech Inc.

AIM

ImmunoTech Inc. is an immuno-pharma company focused on the research and development of therapeutics to treat multiple types of cancers,

immune disorders and viral diseases, including COVID-19. The Company’s lead product is a first-in-class investigational drug called

Ampligen® (rintatolimod), a dsRNA and highly selective TLR3 agonist immuno-modulator with broad spectrum activity in clinical

trials for globally important cancers, viral diseases and disorders of the immune system.

For

more information, please visit aimimmuno.com and connect with the Company on X, LinkedIn, and Facebook.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “PSLRA”).

Words such as “may,” “will,” “expect,” “plan,” “anticipate,” “continue,”

“believe,” “potential,” “upcoming” and other variations thereon and similar expressions (as well

as other words or expressions referencing future events or circumstances) are intended to identify forward-looking statements. Many of

these forward-looking statements involve a number of risks and uncertainties. Data, pre-clinical success and clinical success seen to

date does not guarantee that Ampligen will be approved as a treatment or therapy for any diseases or conditions. The Company urges investors

to consider specifically the various risk factors identified in its most recent Annual Report on Form 10-K, and any risk factors or cautionary

statements included in any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, filed with the SEC. You are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Among other things,

for those statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the PSLRA. The

Company does not undertake to update any of these forward-looking statements to reflect events or circumstances that occur after the

date hereof.

Important

Additional Information

The

Company, its directors and executive officers, Peter W. Rodino, III and Robert Dickey, IV, are deemed to be “participants”

(as defined in Section 14(a) of the Securities Exchange Act of 1934, as amended) in the solicitation of proxies from the Company’s

stockholders in connection with the Annual Meeting. The Company filed its definitive proxy statement (the “Definitive Proxy Statement”)

and a WHITE universal proxy card with the SEC on November 4, 2024 in connection with such solicitation of proxies from the Company’s

stockholders. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH DEFINITIVE PROXY STATEMENT, ACCOMPANYING WHITE UNIVERSAL

PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION ABOUT THE

ANNUAL MEETING. The Definitive Proxy Statement contains information regarding the identity of the participants, and their direct

and indirect interests, by security holdings or otherwise, in the Company’s securities and can be found in the section titled “Principal

Stockholders” of the Definitive Proxy Statement and available here. Information regarding subsequent changes to their holdings

of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website

available here or through the SEC’s website at www.sec.gov. Stockholders will be able to obtain the Definitive Proxy

Statement, any amendments or supplements thereto and other documents filed by the Company with the SEC at no charge at the SEC’s

website at www.sec.gov. Copies will also be available at no charge at the Company’s website at https://aimimmuno.com/sec-filings/.

Investor

Contact:

JTC

Team, LLC

Jenene

Thomas

908-824-0775

AIM@jtcir.com

Media

Contact:

Longacre

Square Partners

Joe

Germani / Miller Winston

AIM@longacresquare.com

Exhibit

2

Exhibit 3

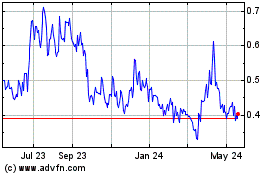

AIM ImmunoTech (AMEX:AIM)

Historical Stock Chart

From Nov 2024 to Dec 2024

AIM ImmunoTech (AMEX:AIM)

Historical Stock Chart

From Dec 2023 to Dec 2024