Exchange Traded Concepts Debuts Yorkville MLP ETF (YMLP) - ETF News And Commentary

March 13 2012 - 7:39AM

Zacks

Thanks to increased interest in energy investing and high

payouts, the MLP space has been extremely popular among ETF

investors. As a result, a number of issuers have sought to launch

new products in this segment, nearly all of which have seen

tremendous inflows in their short time on the market. The latest

company to try its luck in this space looks to be Yorkville which

is the first firm to use the turnkey service from Exchange-Traded

Concepts to bring its High Income MLP ETF (YMLP)

to market.

MLP Market

MLPs, or Master Limited partnerships, are publically traded

partnerships that are generally engaged in the transportation,

storage, production, or mining of minerals and natural resources.

Generally speaking, an MLP will consist of a general partner and

limited partners; general partners control the operations and

management while the limited partners provide capital and are

entitled to receive cash distributions. Obviously, investors in

this space act as ‘limited partners’ and do not engage in operation

and management of the assets (see Inside The Forgotten Energy

ETFs).

The benefit of this structure is that MLPs generally don’t pay

U.S. federal income taxes. This means MLP investors are generally

not subject to double taxation, a key feature of the product

structure. However, in order to qualify for this, MLPs must follow

Section 7704(d) of the IRS code which states that the partnership

must receive at least 90% of its income from qualifying sources.

Additionally, the partnership must pay out almost all cash flows to

holders as distributions, a stipulation which tends to make these

securities have outsized payouts when compared to their more

traditional peers.

YMLP ETF

The new fund will be just the second ETF in the space, tracking

the Solactive High Income MLP Index. This benchmark includes all

MLPs operating with one of the following as a substantial business

segment: exploration and production of oil and/or natural gas;

sale, distribution and retail marketing of propane and other

natural gas liquids; marine transportation of one or more of the

following: crude oil, dry bulk, refined products, liquefied natural

gas (“LNG”), and other commodities; direct mining, production and

marketing of natural resources, including timber, fertilizers, coal

and other minerals (see A Closer Look At The Canadian Energy Income

ETF).

Recently, this resulted in a product that was heavily

concentrated in the energy sector, and it also included three

royalty trusts along with 22 MLPs. While the product will include

royalty trusts, it will remain focused on MLPs; royalty trusts will

not make up more than 20% of the total index. It should also be

noted that the fund requires component securities to have a market

cap of at least $400 million with a three-month average daily

trading volume of at least $1 million in order to be included in

the Solactive Index.

Furthermore, the product will also take a number of steps in

order to make sure that only the highest yielding securities are

included in the fund. First, companies are ranked based on three

key metrics; current yield, coverage ratio, and distribution

growth. Once these ranks are calculated, the firm adds up the three

and ranks all the component firms on this ‘total rank’. The 25

highest ranked firms on this metric are then chosen for inclusion

in the benchmark, ensuring that the product has a focus on high

yielding securities (read Top Three High Yield Financial ETFs).

MLP ETFs

Currently, most products in the MLP space are structured as ETNs

in order to avoid some of the tax headaches that come with the

space. YMLP is structured as a ‘C’ Corporation for federal income

tax purposes which means that distributions are usually

tax-deferred returns of capital. ETNs on the other hand, since they

don’t actually hold the securities, are not subject to the same

rules and payouts are pretty much identical to what investors see

in other types of securities (investors should consult their tax

professionals for more on how this can impact their

portfolios).

While this may be an issue for some, the structure is clearly

popular with investors already. The only other MLP ETF on the

market today, the Alerian MLP ETF (AMLP), has

close to $2.8 billion in AUM and sees volume of about 1.4 million

shares a day. This fund holds a similar number of securities and

sees a comparable expense ratio at 0.85%-- three basis points more

than YMLP. The fund also pays outs a high level to investors as the

fund has a 5.9% yield. Nevertheless, if the MLP ETN space and the

success of AMLP is any guide, there is plenty of room for many

entrants in the space, suggesting that this brand new fund from

Yorkville could see high levels of inflows in short order.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

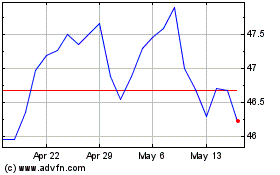

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Jul 2023 to Jul 2024