Cornerstone Strategic Value Fund, Inc. Announces the Resumption of its Rights Offering and Change in June 2022 Distribution Record Date

May 23 2022 - 8:10AM

Cornerstone Strategic Value Fund, Inc. (the “Fund”) (NYSE American:

CLM) (CUSIP: 21924B302) announced today that the subscription

period for its previously suspended rights offering for shares of

the Fund's common stock (the "Rights Offering") will resume on

Monday, May 23, 2022 and the expiration date will be extended so

that the Subscription Period will expire at 5:00 p.m., New

York time, on Friday, June 10, 2022, unless further extended by the

Fund (the “Expiration Date”). The original record date will

continue to be April 18, 2022.

Related to the timing of the rights offering,

the June 2022 monthly distribution record date has been changed to

June 10, 2022. The payable date of June 30, 2022 and the per share

amounts previously reported are unchanged.

In accordance with an undertaking made by the

Fund in the Registration Statement it filed with the Securities and

Exchange Commission in connection with the Rights Offering, the

Fund suspended its Rights Offering on May 16, 2022 due to the

Fund's net asset value having declined more than 10% from $9.01 on

April 8, 2022 (the effective date of the Fund's registration

statement) to $7.76 on May 13, 2022. All terms of the Rights

Offering will remain the same, except that the expiration date for

the Rights Offering is extended until June 10, 2022, unless further

extended. The Fund will supplement the Prospectus relating to the

Rights Offering to advise stockholders of the decline in net asset

value of the Fund and of the new Expiration Date. The Rights

Offering will continue to be made on the same terms as described in

the Prospectus (and using the same subscription documentation

previously supplied to stockholders), except for the change in

expiration date.

Subscription requests that were submitted prior

to the suspension of the Rights Offering have been cancelled,

payments made in connection with such requests have been returned

to the applicable stockholders, and no shares of common stock will

be issued in connection with such requests.

In order to participate in the Rights

Offering, such stockholders must submit a new subscription request

in accordance with the procedures set forth in the

Prospectus.

The Fund has issued to its stockholders

non-transferable rights entitling the holders to subscribe for an

aggregate of 40,511,576 shares of common stock. Each stockholder

will receive one non-transferable right for each share of the Fund

held as of the Record Date. Fractional Shares will not be

issued upon the exercise of the Rights. Accordingly, the number of

Rights to be issued to a Stockholder on the Record Date will be

rounded up to the nearest whole number of Rights evenly divisible

by three. For every three rights a stockholder receives, he or she

will be entitled (but not required) to purchase one new share of

the Fund at a subscription price equal to the greater of (i) 112%

of net asset value per share as calculated at the close of trading

on the expiration date of the offering or (ii) 65% of the market

price per share at such time. Fractional shares will not be

issued. In addition to the shares offered in the primary

subscription, the Fund may offer a 100% over-allotment to

oversubscribing stockholders. Stockholders who fully

subscribe in the primary offering will have the option to

oversubscribe for additional shares, to the extent available.

Shares will be issued within the 15-day period

immediately following the record date of the Fund’s June 2022

monthly distribution to stockholders. Stockholders exercising their

rights to purchase shares pursuant to the offering will not be

entitled to receive such distribution with respect to the shares

issued pursuant to such exercise.

This press release is not intended to and does

not constitute an offer to sell or the solicitation of an offer to

subscribe for or buy or an invitation to purchase or subscribe for

any securities in any jurisdiction, nor shall there be any sale,

issuance or transfer of securities in any jurisdiction in

contravention of applicable law. The offering is subject to an

effective registration statement covering the rights and shares to

be issued and to other customary regulatory filings and

approvals. Any rights offering conducted by the Fund will be

made only by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended.

Cornerstone Strategic Value Fund, Inc. is a

closed-end, diversified management investment company and is

registered with the U.S. Securities & Exchange Commission

(‘SEC”) under the Investment Company Act of 1940, as amended.

Cornerstone Strategic Value Fund, Inc. is traded

on the NYSE American LLC under the trading symbol “CLM”. The Fund’s

investment adviser is Cornerstone Advisors, LLC, which also serves

as the investment adviser to another closed-end fund, Cornerstone

Total Return Fund, Inc. (NYSE American: CRF). For more information

regarding Cornerstone Strategic Value Fund, Inc. or Cornerstone

Total Return Fund, Inc. please visit

www.cornerstonestrategicvaluefund.com, and

www.cornerstonetotalreturnfund.com.

Past performance is no guarantee of future

performance. An investment in the Fund is subject to certain risks,

including market risk. In general, shares of closed-end funds often

trade at a discount from their net asset value and at the time of

sale may be trading on the exchange at a price which is more or

less than the original purchase price or the net asset value. An

investor should carefully consider the Fund’s investment objective,

risks, charges and expenses. Please read the Fund’s disclosure

documents before investing.

In addition to historical information, this

release contains forward-looking statements, which may concern,

among other things, domestic and foreign markets, industry and

economic trends and developments and government regulation and

their potential impact on the Fund’s investment portfolio. These

statements are subject to risks and uncertainties, including the

factors set forth in the Fund’s disclosure documents, filed with

the U.S. Securities and Exchange Commission, and actual trends,

developments and regulations in the future, and their impact on the

Fund could be materially different from those projected,

anticipated or implied. The Fund has no obligation to update or

revise forward-looking statements.

Contact: (866) 668-6558

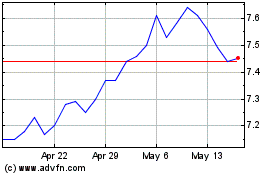

Cornerstone Strategic In... (AMEX:CLM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cornerstone Strategic In... (AMEX:CLM)

Historical Stock Chart

From Jan 2024 to Jan 2025