false

0000889348

0000889348

2024-11-12

2024-11-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November

12, 2024

| CPI AEROSTRUCTURES, INC. |

| (Exact Name of Registrant as Specified in Charter) |

| New York |

|

001-11398 |

|

11-2520310 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 91 Heartland Boulevard, Edgewood, New York |

|

11717 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (631) 586-5200

| N/A |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| ☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| ☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, $0.001 par value per share |

|

CVU |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.05(a) | Amendments to the Registrant’s Code of Conduct and Ethics, or Waiver of a Provision of the Code of Ethics |

As part of its periodic review of the Code of Ethics and Business Conduct

(the “Code”) of the Company, which applies to all directors, officers, and employees of the Company, the Board of Directors

approved certain amendments to the Code, effective as of November 12, 2024. The revisions to the Code were made, among other things,

to (i) expand guidelines on conflict of interest matters, including a requirement for directors and executive officers to seek authorizations

from the Audit and Finance Committee; (ii) enhance sections on fair dealing, confidentiality, and the protection and proper use of Company

assets; and (iii) include other administrative and clarifying adjustments to reflect current regulatory expectations and best practices.

The foregoing summary of the principal changes to the Code is qualified

in its entirety by reference to the amended and restated Code, a copy of which is filed as Exhibit 14.1 to this Current Report on Form

8-K and incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: November 18, 2024 |

CPI AEROSTRUCTURES, INC. |

| |

|

| |

By: |

/s/ Philip Passarello |

|

| |

|

Philip Passarello |

| |

|

Chief Financial Officer |

CPI Aerostructures, Inc. 8-K

Exhibit 14.1

CPI AEROSTRUCTURES, INC.

Code of Ethics and Business Conduct

1.

Introduction.

1.1 The Board of Directors of CPI

AEROSTRUCTURES, INC. (together with its subsidiaries, the "Company") has adopted this Code of Ethics and Business

Conduct (the "Code") in order to:

(a)

promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts

of interest;

(b)

promote full, fair, accurate, timely and understandable disclosure in reports and documents that

the Company files with, or submits to, the Securities and Exchange Commission (the "SEC") and in other public communications

made by the Company;

(c)

promote compliance with applicable governmental laws, rules and regulations;

(d)

promote the protection of Company assets, including corporate opportunities and confidential information;

(e)

promote fair dealing practices;

(f)

deter wrongdoing; and

(g)

ensure accountability for adherence to the Code.

1.2

All directors, officers and employees are required to be familiar with the Code, comply with its

provisions and report any suspected violations as described below in Section 10, Reporting and Enforcement.

2.

Honest

and Ethical Conduct.

2.1

The Company's policy is to promote high standards of integrity by conducting its affairs honestly

and ethically.

2.2

Each director, officer and employee must act with integrity and observe the highest ethical standards

of business conduct in his or her dealings with the Company's customers, suppliers, partners, service providers, competitors, employees

and anyone else with whom he or she has contact in the course of performing his or her job.

3.

Conflicts

of Interest.

3.1

A conflict of interest occurs when an individual's private interest (or the interest of

a member of his or her family) interferes, or even appears to interfere, with the interests of the Company as a whole. A conflict of

interest can arise when an employee, officer or director (or a member of his or her family) takes actions or has interests that may make

it difficult to perform his or her work for the Company objectively and effectively. Conflicts of interest also arise when an employee,

officer or director (or a member of his or her family) receives improper personal benefits as a result of his or her position in the

Company.

3.2

Loans by the Company to, or guarantees by the Company of obligations of, employees or their family

members are of special concern and could constitute improper personal benefits to the recipients of such loans or guarantees, depending

on the facts and circumstances. Loans by the Company to, or guarantees by the Company of obligations of, any director, officer, or their

family members are expressly prohibited.

3.3

Whether or not a conflict of interest exists or will exist can be unclear. Conflicts of interest

should be avoided unless specifically authorized as described in Section 3.4.

3.4

Persons other than directors and executive officers who have questions about a potential conflict

of interest or who become aware of an actual or potential conflict should discuss the matter with the Company’s Chief Executive

Officer. The Chief Executive Officer may not authorize or approve conflict of interest matters. The Chief Executive Officer will seek

determinations and prior authorizations or approvals of potential conflicts of interest from the Company’s Audit and Finance Committee.

Directors and executive officers must

seek determinations and prior authorizations or approvals of potential conflicts of interest directly from the Company’s Audit and

Finance Committee.

4.

Compliance.

4.1

Employees, officers and directors should comply, both in letter and spirit, with all applicable laws,

rules and regulations in the cities, states and countries in which the Company operates.

4.2

Although not all employees, officers and directors are expected to know the details of all applicable

laws, rules and regulations, it is important to know enough to determine when to seek advice from appropriate personnel. Questions about

compliance should be addressed to the Chief Executive Officer.

4.3

No director, officer or employee may purchase or sell any Company securities while in possession

of material nonpublic information regarding the Company, nor may any director, officer or employee purchase or sell another company's

securities while in possession of material nonpublic information regarding that company. It is against Company policies and illegal for

any director, officer or employee to use material nonpublic information regarding the Company or any other company to:

(a)

obtain profit for themself; or

(b)

directly or indirectly "tip" others who might make an investment decision on the basis

of that information.

5.

Disclosure.

5.1

The Company's periodic reports and other documents filed with the SEC, including all financial statements

and other financial information, must comply with applicable federal securities laws and SEC rules.

5.2

Each director, officer and employee who contributes in any way to the preparation or verification

of the Company's financial statements and other financial information must ensure that the Company's books, records and accounts are accurately

maintained. Each director, officer and employee must cooperate fully with the Company's accounting and internal audit departments, as

well as the Company's independent public accountants and counsel.

5.3

Each director, officer and employee who is involved in the Company's disclosure process must:

(a)

be familiar with and comply with the Company's disclosure controls and procedures and its internal

control over financial reporting; and

(b)

take all necessary steps to ensure that all filings with the SEC and all other public communications

about the financial and business condition of the Company provide full, fair, accurate, timely and understandable disclosure.

6.

Protection

and Proper Use of Company Assets.

6.1

All directors, officers and employees should protect the Company's assets and ensure their efficient

use. Theft, carelessness and waste have a direct impact on the Company's profitability and are prohibited.

6.2

All Company assets should be used only for legitimate business purposes. Any suspected incident of

fraud or theft should be reported for investigation immediately.

6.3

The obligation to protect Company assets includes the Company's proprietary information. Proprietary

information includes intellectual property such as trade secrets, patents, trademarks, and copyrights, as well as business and marketing

plans, engineering and manufacturing ideas, designs, databases, records and any nonpublic financial data or reports. Unauthorized use

or distribution of this information is prohibited and could also be illegal and result in civil or criminal penalties.

7.

Corporate

Opportunities. All directors, officers and employees owe a duty to the Company to advance its

interests when the opportunity arises. Directors, officers and employees are prohibited from taking for themselves personally (or for

the benefit of friends or family members) opportunities that are discovered through the use of Company assets, property, information or

position. Directors, officers and employees may not use Company assets, property, information or position for personal gain (including

gain of friends or family members). In addition, no director, officer or employee may compete with the Company.

8.

Confidentiality.

Directors, officers and employees should maintain the confidentiality of information entrusted to them by the Company or by its customers,

suppliers or partners, except when disclosure is expressly authorized or is required or permitted by law. Confidential information includes

all nonpublic information (regardless of its source) that might be of use to the Company's competitors or harmful to the Company or its

customers, suppliers or partners if disclosed.

9.

Fair

Dealing. Each director, officer and employee must deal fairly with the Company's customers, suppliers,

partners, service providers, competitors, employees and anyone else with whom he or she has contact in the course of performing his or

her job. No director, officer or employee may take unfair advantage of anyone through manipulation, concealment, abuse of privileged information,

misrepresentation of facts or any other unfair dealing practice.

10.

Reporting

and Enforcement.

10.1

Reporting and Investigation of Violations.

(a)

Actions prohibited by this Code involving directors or executive officers must

be reported to the Audit and Finance Committee.

(b)

Actions prohibited by this Code involving anyone other than a director or executive

officer must be reported to the Chief Executive Officer.

(c)

After receiving a report of an alleged prohibited action, the Audit and Finance

Committee or the Chief Executive Officer must promptly take all appropriate actions necessary to

investigate.

(d)

All directors, officers and employees are expected to cooperate in any internal investigation of

misconduct.

10.2

Enforcement.

(a)

The Company must ensure prompt and consistent action against violations of this Code.

(b)

If, after investigating a report of an alleged prohibited action by a director

or executive officer, the Audit Committee determines that a violation of this Code has occurred, the Audit and Finance Committee will

report such determination to the Board of Directors.

(c) If, after investigating a report of an alleged prohibited action by any other

person, the Chief Executive Officer determines that a violation of this Code has occurred, the Chief

Executive Officer will report such determination to the Audit and Finance Committee.

(d) Upon receipt of a determination that there has been a violation of this Code, the Audit and Finance

Committee will take such preventative or disciplinary action as it deems appropriate, including, but not limited to, reassignment, demotion,

dismissal and, in the event of criminal conduct or other serious violations of the law, notification of appropriate governmental authorities.

10.3

Waivers.

(a)

The Audit and Finance Committee may, in its discretion, waive any violation of this Code.

(b)

Any waiver for a director or an executive officer shall be disclosed as required by SEC and NYSE

American rules.

10.4

Prohibition on Retaliation.

The Company does not tolerate acts of

retaliation against any director, officer or employee who makes a good faith report of known or suspected acts of misconduct or other

violations of this Code.

* * * * * *

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

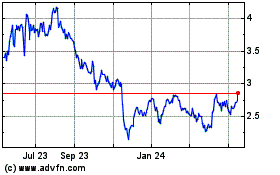

CPI Aerostructures (AMEX:CVU)

Historical Stock Chart

From Dec 2024 to Jan 2025

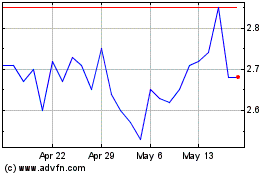

CPI Aerostructures (AMEX:CVU)

Historical Stock Chart

From Jan 2024 to Jan 2025