Given the surging market but the shaky underlying fundamentals,

some are taking a different approach when it comes to investing

this time around. While long-term value investing is ever popular,

a few are looking to more technical approaches in order to play

this market. Chief among these techniques are ones that focus in on

charts, looking only at price movements instead of underlying

company fundamentals.

While the techniques are often putdown and dismissed by more

‘traditional’ analysts, some are able to use them very effectively

and profit of the chart patterns. Generally speaking chartists tend

to believe in three key principles, (relatively) efficient markets,

momentum, and repeatability. Basically, technical analysts often

believe that everything is already priced in for a company’s stock,

trends are hard to shake, and events are often cyclical; history

tends to repeat itself and many fail to learn from this (read Three

Technology ETFs Outperforming XLK).

The main problem with technical analysis, besides the assumption

of efficient markets, tends to be that investors can see whatever

they want to in many chart patterns. Changing the time period

involved can often greatly influence a signal while there are

literally dozens of different data points that investors can use,

none of which are foolproof. Additionally, investors should note

that there can be somewhat of a ‘self-fulfilling prophecy’ for

charting strategies; if enough people are implementing the

techniques they will certainly come true, although it will be

impossible to tell if the chartists themselves made the trends come

true.

Nevertheless, charting can be a powerful tool in an investor’s

arsenal and can often help many to see burgeoning trends more

clearly. Unfortunately, the techniques can be hard to learn and

take some practice in order to develop a reasonable system that

works. For those who are unwilling or unable to develop their own

technical analysis ideas, but like the strategies nonetheless, a

few funds from PowerShares could allow investors to broadly

implement some of the basic strategies in their portfolios (read

Does Your Portfolio Need A Hedge Fund ETF?).

Investors actually have three choices in the space, targeting

distinct markets. All three also use a variety of metrics in order

to implement their technical analysis strategies, focusing in on

relative strength characteristics, as constructed by index provider

Dorsey Wright. For those who are intrigued by this strategy, we

have highlighted some of the key points from the products

below:

DWA Technical Leaders Portfolio

(PDP)

For investors seeking to make a technical play on the U.S.

market, PDP is an excellent choice. The fund takes relative

strength characteristics into account—among other factors, in order

to select roughly 100 securities for inclusion in the fund. With

this focus, the product has amassed over half a billion in AUM

while charging investors 70 basis points a year in services. Top

individual holdings include Apple

(AAPL) so no big

surprises there, but after that Priceline.com

(PCLN), Silgan

Holdings (SLGN),

Liberty Media Corp

(LMCA), and

American Tower Corp

(AMT) round out the top

five (see Three Low Beta Sector ETFs).

Overall, the fund currently has a tilt towards consumer

discretionary firms (28.4%), although industrials (21.7%),

materials (11.4%) and technology (10.1%) make up double digit

weightings as well. Unfortunately, with the focus on some low

yielding sectors, the fund may not be a great destination for

income, paying out a paltry 0.4% in 30 Day SEC Yield terms.

However, the product has gained 2.2% over the past year compared to

a 1.4% gain for SPY in the same time period. This

suggests that even with the higher fees of PDP, the product has

outgained broad market cap weighted funds over some time periods,

although it has underperformed in recent months.

DWA Developed Market Technical Leaders Portfolio

(PIZ)

If investors are looking to make a broad play on developed

markets, across four continents, PIZ could be a quality pick. Much

like its U.S. focused counterpart, PIZ holds 100 securities and

focuses in on relative strength characteristics as the basis of its

research. However, investors should note that the product has seen

less in asset inflows and charges more, coming in at 80 basis

points a year in fees (read Five Cheaper ETFs You Probably

Overlooked).

In terms of top countries, the UK, Australia, and Canada, make

up the top three, while the product is heavily tilted towards large

cap stocks for its exposure. Sector holdings are pretty spread out

as five sectors make up at least 10% of assets. At the top,

industrials make up 20.5% of the fund while the two consumer

segments combine to make up about 29% as well. Unfortunately, the

product has managed to underperform its broad based counterpart,

losing about 15.6% over the past year compared to 11.9% for

EFA in the same time frame. Furthermore, many

shorter time frames are hardly friendlier to the ETF, suggesting

that it has struggled to make up for its higher expenses although

it does pay out a decent yield of 1.7% in the process.

DWA Emerging Markets Technical Leaders Portfolio

(PIE)

In order to play emerging markets with technical analysis, PIE

could offer investors quality levels of exposure. The product holds

about 100 securities in its basket focusing in on markets from

around the world including those in Asia, Europe, Latin America,

and Africa. The fund does charge a rather high 90 basis points a

year in fees but it does have almost $180 million in AUM,

suggesting reasonable bid ask spreads (see Three Overlooked

Emerging Market ETFs).

For country exposure, the fund has a definite focus on emerging

Asia, as four of the top five allocations come from that region of

the world. These top destinations are led by Malaysia at 19.1%,

South Korea at 16.4% and then Latin America’s top entrant with

Mexico at 15.5% of the fund. From a sector perspective,

industrials take the top spot at a little over one-fifth of the

assets while consumer sectors each have about 18.4% and materials

round out the top four with 11.3% of the total. Performance trends

in the emerging markets space, however, look to favor this fund

over its broad based counterparts like VWO or

EEM. Yet, with that being said, VWO has beaten out

PIE over shorter time periods, especially when taking into account

PIE’s relatively high fees.

Conclusion

Given that PowerShares has ETFs in each of the three distinct

markets, investors can begin to see some trends that have

developed. First, the broad technical strategy that PowerShares is

implementing seems to work better in light bear markets with

oscillating trends. This is evidenced by PDP beating SPY over the

long term but falling behind as of late as the U.S. market has

rallied. Additionally, the strategy seems to be doing poorly in

strong bear markets, like in the case of developed markets over the

past few months and years.

Obviously, these are all just generalizations and investors need

to take these conclusions with a grain of salt. There is no reason

why the trends outlined above will continue anymore than the trends

that technical analysts follow on a regular basis. However, with

that being said, the products could produce strong performances

when markets are not trending in one direction or another. That is

because these funds seem built to find trending securities in their

underlying benchmarks, possibly allowing them to outperform during

these uncertain times.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Author is long VWO.

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

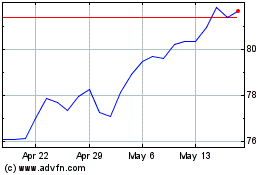

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Jan 2025 to Feb 2025

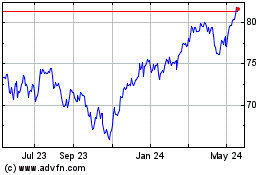

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Feb 2024 to Feb 2025