India ETF in Focus on Recent Rate Hike - ETF News And Commentary

February 02 2014 - 10:47AM

Zacks

India, it seems, is destined for stubborn inflation and repo rate

hike. On January 28, the Reserve Bank of India (RBI) unexpectedly

hiked its repo rate by 25 bps to 8% in a bid to contain inflation.

With the latest hike, India raised its repo rates by the same

amount three times in the past five months (read: India ETFs After

the Surprise Rate Hike).

The Indian economy has been a victim of slowing economic growth,

persistent sky-high inflation, huge current account deficit, lower

per-capita income and massive corruption. After a roller-coaster

ride in much of 2013 on the Fed’s taper concerns and falling

currency (down about 14% in 2013), concerns over the Indian market

have been mounting since the beginning of this year thanks to the

Fed’s decision to start scaling back its QE program.

Investors should note that India’s inflation rate at more-or-less

10% is presently one of the highest in Asia. With a possibility of

continued QE trimming and flight of foreign investments from the

nation, Indian currency – rupee – is likely to weaken further in

the coming days and stir up another round of inflationary pressure.

While a slowing in December inflation has already been recognized,

rising pressure in service sectors and wage-led stress on inflation

were responsible for the RBI’s anxiety.

This apprehension might have prompted RBI to go for another rate

hike since its goal – and the principal agenda in its to-do list–is

to pull down inflation to 6% by 2016.

Further Tightening Ahead?

Economists expect the RBI to clamp down on liquidity in the coming

months as reduction of 4% inflation within two years apparently

seems a tall order for India. Some economists anticipate yet

another 25 bps hike in rate in early summer. However, the RBI

commented that there will be no further tightening in the near term

if consumer-price inflation slackens from the high of 10% to 8% by

early 2015.

However, many economists seem content with the latest RBI move

which is aimed at shoring up the Indian economy over the long term

and serves in ruling out inflationary threats and currency

depreciation. Still, there are economists with the opposite

view as well. As per the CII, the RBI needs to focus on boosting

investments and economic growth instead of curbing inflation (see

Is the Worst Over for These Emerging Market ETFs?).

Concerns

Yes, this step surely comes at the cost of growth (via higher cost

of borrowings) and probably corporate defaults. As per India

Ratings, the number of stressed companies will increase to 10.7%

from the current 9.5% if this latest rate hike results into higher

lending rates.

In fact, the situation may worsen if the RBI goes for further hikes

this year by taking the number of stressed corporates to 13.1% and

the amount of stressed debt to 16.5%. With the World Bank expecting

Indian growth rate below 5% – a 10-year low – for the financial

year 2013–2014, the recent hike is upsetting.

Market and ETF Impact

As one can imagine, this rate hike should give a much-needed boost

to the Indian rupee, helping to stop its fall. With India having a

huge oil import bill, a rate hike should be beneficial on this

front. However, the move definitely caused a slump in the Indian

equities on fears of slowing growth that resulted in losses in most

of the Indian ETFs.

WisdomTree India Earnings Fund

(

EPI) lost 1.61% at the close on January 29,

iShares MSCI India (INDA) shed 1.91%,

iShares India 50 ETF (INDY) slumped 2.25%,

PowerShares India (PIN) dropped 2.20%,

EGShares India Infrastructure ETF

(INXX

) fell 1.41% and

EGShares

India Consumer ETF (INCO) was down 2.72%. Notably, EPI is

by far the largest ETF in terms of asset base and also the most

liquid fund tracking Indian equities (read: Two India ETFs Leading

Emerging Markets Higher).

Rate Hike a Key Tool to Support Currency

India is not the only country taking the rate hike route; the move

has also been taken by a number of other emerging market central

banks in recent times to support their struggling currencies

against the dollar. Turkey was among such nations (read: Indonesia

ETFs Surge on Surprise Rate Hike).

Alongside with India, Turkey also raised its overnight lending rate

sharply on January 28 from 7.75% to 12%, one week repo-rate from

4.5% to 10% and overnight borrowing rate from 3.5% to 8%. Soon

after the announcement, Turkish currency lira went rallying and

gained as much as 3%.

Bottom Line

While a rate hike might help in boosting foreign investors’

confidence in the emerging markets, especially in the current

environment when currency devaluation is a large factor, the growth

picture becomes feeble. Also, investors should note that food and

fuel inflation has a high allocation in the Indian CPI.

Thus it is a bit doubtful as to how far this rate hike will help in

bringing down the overall inflation as the rate hike will largely

and directly bother industrial sectors and indirectly impact

sectors like food. A rate hike might come as a blow to the Indian

manufacturing sector at a time when the sector is struggling with

lower output.

Having said this, we would also like to remind investors that even

after a round of rate hikes, India’s real interest rate still

remains low. Also, the GDP growth outlook remains brighter than

many fast-growing developed markets. Thus, India ETFs could be

worth a closer look by risk-tolerant emerging market ETF investors

at this time.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-IN EARN (EPI): ETF Research Reports

EGS-INDIA CNSMR (INCO): ETF Research Reports

ISHARS-M INDIA (INDA): ETF Research Reports

ISHARS-SP INDIA (INDY): ETF Research Reports

EMERG-GS IIIIF (INXX): ETF Research Reports

PWRSH-INDIA POR (PIN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

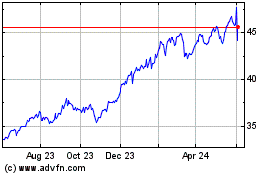

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

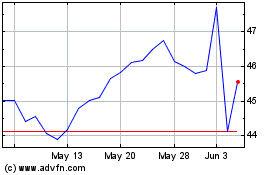

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Jan 2024 to Jan 2025