As

Filed with the Securities and Exchange Commission on December 16, 2024

Registration

No. 333-________

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ORAGENICS,

INC.

(Exact

name of registrant as specified in its charter)

| FLORIDA |

|

59-3410522 |

(State

or other jurisdiction of

incorporation

or organization |

|

(I.R.S.

Employer

Identification

No.) |

1990

Main Street, Suite 750

Sarasota,

FL 34236

813-286-7900

(Address,

including zip code, and telephone number, including area code of registrant’s principal executive offices)

2021

EQUITY INCENTIVE PLAN

(Full

Title of the Plans)

Janet

Huffman,

Chief

Financial Officer.

1990

Main Street, Suite 750

Sarasota,

FL 34236

813-286-7900

(Name,

Address and Telephone number of Agent for Service)

Copies

to:

Mark

A. Catchur, Esquire

Julio

C. Esquivel, Esquire

Shumaker,

Loop & Kendrick, LLP

101

E. Kennedy Blvd., Suite 2800

Tampa,

Florida 33602

(813)

229-7600

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large

Accelerated Filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

REGISTRATION

OF ADDITIONAL SECURITIES

EXPLANATORY

NOTE

This

Registration Statement on Form S-8 of Oragenics, Inc. (the “Company”) is being filed to register 2,000,000 additional shares

of Company common stock authorized for issuance under the 2021 Equity Incentive Plan (the “2021 Plan”) (which is an amendment

and restatement of the Company’s 2012 Equity Incentive Plan), pursuant to General Instruction E to Form S-8. The table below summarizes

the Plan, as amended to date and the registration statements previously filed to cover shares authorized for issuance under the Plan.

Summary

Plan Table

| Plan History | |

Date | |

Authorized Shares | | |

Post-Split Shares | | |

Registration Statement |

| 2021 Equity Incentive Plan | |

February 2022 | |

| 10,000,000 | * | |

| 166,667 | | |

333-263821 |

| First Amendment to 2021 Plan | |

December 2023 | |

| 1,000,000 | | |

| 1,166,667 | | |

333-276460 |

| Second Amendment to 2021 Plan | |

December 2024 | |

| 2,000,000 | | |

| 3,166,667 | | |

|

*On

January 20, 2023, the Company effected a 1 for 60 reverse stock split and the amounts reflected prior to the January 2023 reverse split

have been adjusted for such reverse split. On December 14, 2023, the Company’s shareholders approved an increase in the number

of authorized shares for issuance under the Plan from 166,667 shares to 1,166,667 shares or an additional 1,000,000 shares. On December

11, 2024, the Company’s shareholders approved an increase in the number of authorized shares for issuance under the Plan from 1,166,667

shares to 3,166,667 shares or an additional 2,000,000 shares. This Registration Statement registers the additional 2,000,000 shares approved

by the Company’s shareholders.

Pursuant

to General Instruction E to Form S-8, the contents of the previously filed Registration Statement, on Form S-8 (No. 333-263821), on March

24, 2022, is incorporated herein by reference, except to the extent supplemented, amended or superseded by the information set forth

herein. Only those items of Form S-8 containing new information not contained in the earlier registration statements are presented herein.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

document(s) containing the information specified in Part I of Form S-8 will be sent or given to participants as specified by Securities

Act Rule 428(b)(1).

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

This

Registration Statement on Form S-8 incorporates by reference the following documents we previously filed with the Securities and Exchange

Commission:

| |

● |

Registration

Statement on Form S-8 filed March 24, 2022 (File No. 333-263821) and Registration Statement on Form S-8 filed January 10, 2024 (File

No. 333-276460); |

| |

|

|

| |

● |

the

Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on March 29,

2024; |

| |

|

|

| |

● |

the

Registrant’s Quarterly Report on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024, and September 30, 2024, filed

with the Commission on May 15, 2024, August 9, 2024 and November 13, 2024, respectively; |

| |

|

|

| |

● |

the

Registrant’s Current Reports on Form 8-K, filed with the Commission on each of January 2, 2024, January 16, 2024, January 23, 2024, February 5, 2024, February 7, 2024, February 12, 2024, February 28, 2024, February 28, 2024, March 1, 2024, March 18, 2024,

April 16, 2024, April 22, 2024, May 7, 2024, May 16, 2024, May 17, 2024, May 22, 2024, May 23, 2024, June 20, 2024; June 26, 2024,

July 10, 2024, July 22, 2024, August 8, 2024, August 12, 2024, August 14, 2024, August 16, 2024, August 21, 2024, September 5, 2024, September 20, 2024, October 9, 2024, October 15, 2024, October 16, 2024, October 18, 2024 and November 29, 2024. |

All

documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended,

subsequent to the effective date of this Registration Statement, prior to the filing of a post-effective amendment to this Registration

Statement indicating that all securities offered hereby have been sold or deregistering all securities then remaining unsold, shall be

deemed to be incorporated by reference herein and to be part hereof from the date of filing of such documents. In no event, however,

will any information that the Registrant discloses under Item 2.02 or Item 7.01 (and any related exhibits) of any Current Report on Form

8-K that the Registrant may from time to time furnish to the Commission be incorporated by reference into, or otherwise become a part

of, this Registration Statement. Any statement contained in any document incorporated or deemed to be incorporated by reference herein

shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein

or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not be deemed to constitute a part of this Registration Statement,

except as so modified or amended, to constitute a part of the Registration Statement.

Item

8. Exhibits.

See

the Exhibit Index immediately following the signature page which is incorporated herein by reference.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Company certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Tampa, State of Florida this 16th day of December, 2024.

| |

Oragenics,

Inc. |

| |

|

|

| |

By: |

/s/

Janet Huffman |

| |

|

Janet

Huffman |

| |

|

Chief

Financial Officer and

Principal

Financial Officer |

POWER

OF ATTORNEY

Each

of the undersigned officers and directors of Oragenics, Inc., hereby constitutes and appoints Janet Huffman, as their true and lawful

attorney-in-fact and agents, for them and in their name, place and stead, in any and all capacities, to sign their names to any and all

amendments to this Registration Statement on Form S-8, including post-effective amendments and other related documents, and to cause

the same to be filed with the Securities and Exchange Commission, granting unto said attorneys, full power and authority to do and perform

any act and thing necessary and proper to be done in the premises, as fully to all intents and purposes as the undersigned could do if

personally present, and the undersigned for himself hereby ratifies and confirms all that said attorney shall lawfully do or cause to

be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this S-8 Registration Statement has been signed by the following persons in the capacities

and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Janet Huffman |

|

Chief

Financial Officer, Interim Principal Executive Officer and Principal |

|

December

16, 2024 |

| Janet

Huffman |

|

Accounting

Officer |

|

|

| |

|

|

|

|

| /s/

Charles Pope |

|

Executive

Chairman of the Board and |

|

December

16, 2024 |

| Charles

L. Pope |

|

Director |

|

|

| |

|

|

|

|

| /s/

Frederick W. Telling |

|

Director |

|

December

16, 2024 |

| Frederick

W. Telling |

|

|

|

|

| |

|

|

|

|

| /s/

Robert C. Koski |

|

Director |

|

December

16, 2024 |

| Robert

C. Koski |

|

|

|

|

| |

|

|

|

|

| /s/

Alan W. Dunton |

|

Director |

|

December

16, 2024 |

| Alan

W. Dunton |

|

|

|

|

| |

|

|

|

|

| /s/

John Gandolfo |

|

Director |

|

December

16, 2024 |

| John

Gandolfo |

|

|

|

|

| |

|

|

|

|

| /s/

Bruce Cassidy |

|

Director |

|

December

16, 2024 |

| Bruce

Cassidy |

|

|

|

|

EXHIBIT

INDEX

Exhibit

Number |

|

Exhibit

Description |

| |

|

|

| 4.1 |

|

2021 Equity Incentive Plan (incorporated by reference as Exhibit 10.1 to Form 8-K filed on February 28, 2022). |

| |

|

|

| 4.2 |

|

First Amendment to Equity Incentive Plan (incorporated by reference to Exhibit 4.2 to Form 8-K filed on December 15, 2023) |

| |

|

|

| 4.3 |

|

Second Amendment to Equity Incentive Plan. |

| |

|

|

| 4.4 |

|

Form of Warrant to purchase shares of Common Stock (incorporated by reference as Exhibit 4.2 to Form S-1/A filed on July 9, 2018). |

| |

|

|

| 4.5 |

|

Warrant Agency Agreement (incorporated by reference as Exhibit 4.2 to Form 8-K filed on July 17, 2018). |

| |

|

|

| 4.6 |

|

Warrant dated May 1, 2020 (incorporated by reference as Exhibit 4.1 to Form 8-K filed on May 4, 2020). |

| |

|

|

| 4.7 |

|

Form of Pre-Funded Warrant (incorporated by reference to Exhibit 4.1 to Form 8-K filed on September 5, 2024 |

| |

|

|

| 4.8 |

|

Form of Placement Agent Warrant. (incorporated by reference to Exhibit 4.2 to Form 8-K filed on September 5, 2024. |

| |

|

|

| 4.9 |

|

Warrant Agency Agreement (incorporated by reference to Exhibit 4.3 to Form 8-K filed on September 5, 2024 |

| |

|

|

| 4.10 |

|

Description of the Registrant’s Securities Registered Pursuant to Section 12 of the Securities Exchange Act of 1934 (incorporated by reference as Exhibit 4.9 to Form 10-K filed on April 17, 2023). |

| |

|

|

| 5.1 |

|

Opinion of Shumaker, Loop & Kendrick, LLP, as to the legality of the securities being registered. |

| |

|

|

| 23.1 |

|

Consent of Independent Registered Public Accounting Firm, Cherry Bekaert, LLP. |

| |

|

|

| 23.2 |

|

Consent of Independent Registered Public Accounting Firm, CBIZ CPAs P.C. |

| |

|

|

| 23.3 |

|

Consent of Shumaker, Loop & Kendrick, LLP to the use of their opinion as an Exhibit to this Registration Statement is included in the opinion filed herewith as Exhibit 5.1. |

| |

|

|

| 24.1 |

|

Power of Attorney (included with the signature page to this Registration Statement). |

| |

|

|

| 107 |

|

Filing Fee Table. |

Exhibit 4.3

SECOND

AMENDMENT TO

ORAGENICS,

INC.

2021

EQUITY INCENTIVE PLAN

This

Second Amendment to the 2021 Equity Incentive Plan (the “Second Amendment”) is made pursuant to Section 13 of the

2021 Incentive Plan (the “2021 Plan”).

Recitals:

WHEREAS,

the 2021 Plan was adopted by the Company and approved by the shareholders on February 25, 2022; and

WHEREAS,

10,000,000 shares were originally authorized to be issued under the 2021 Incentive Plan;

WHEREAS,

the Company effected a 1-for-60 reverse split of the Company’s authorized shares of common stock and issued and outstanding shares

of common stock, including shares under the 2021 Plan, with an effective date of January 20, 2023 (the “Reverse Stock Split”);

WHEREAS,

after the Reverse Stock Split, the shares available for issuance under the 2021 Plan was 166,667 shares of common stock;

WHEREAS,

on December 14, 2023, the Company’s shareholders approved an amendment (the “First Amendment”) to increase the

shares available under the 2021 Plan by 1,000,000 shares; and

WHEREAS,

the Board of Directors believes it would be in the best interest of the Company and its shareholders to increase the authorized shares

available under the 2021 Plan by an additional 2,000,000 shares.

NOW

THEREFORE, Section 2(a) titled “Share reserve” is hereby amended and restated as follows:

| |

(a) |

Share Reserve. Subject to adjustment in accordance with

Section 2(d) and any adjustments as necessary to implement any Capitalization Adjustments, the aggregate number of shares of Common Stock

that may be issued pursuant to Awards will not exceed the sum of (i) 3,166,667 new shares, plus (ii) the Prior Plan’s Available

Reserve; plus, (iii) the number of Returning Shares, if any, as such shares become available from time to time. |

All

other terms and conditions of the 2021 Plan not otherwise modified hereby shall remain in full force and effect. The Second Amendment

was approved by the Board of Directors on October 8, 2024 and approved by the Company’s shareholders on December 11, 2024.

Exhibit

5.1

|

Bank

of America Plaza |

813.229.7600 |

| 101

East Kennedy Boulevard |

813.229.1660

fax |

| Suite

2800 |

|

| Tampa,

Florida 33602 |

|

| |

|

| www.shumaker.com |

December

16, 2024

Oragenics,

Inc.

1990

Main Street Suite 750

Sarasota,

Florida 34236

Re:

Registration Statement on Form S-8

Ladies

and Gentlemen:

We

have assisted Oragenics, Inc., a Florida corporation (the “Company”) in connection with the preparation and filing of its

Registration Statement on Form S-8 with the Securities and Exchange Commission pursuant to the requirements of the Securities Act of

1933, as amended (the “Act”), for the registration of an additional 2,000,000 shares of the common stock of the Company,

par value $.001 per share (the “Shares”), issuable under the Company’s 2021 Equity Incentive Plan (the “Plan”).

In

connection with the following opinion, we have examined and have relied upon such documents, records, certificates, statements and instruments

as we have deemed necessary and appropriate to render the opinion herein set forth.

On

the basis of such examination and our consideration of those questions of law we considered relevant, and subject to the limitations

and qualifications in this opinion, we are of the opinion that: (1) the Shares have been duly authorized by all necessary corporate action

on the part of the Company; and (2) when issued in accordance with such authorization, the provisions of the Plan and relevant agreements

duly authorized by and in accordance with the terms of the Plan, and upon payment for and delivery of the Shares as contemplated in accordance

with the Plan, and either (a) the countersigning of the certificate or certificates representing the Shares by a duly authorized signatory

of the registrar for the Company’s Common Stock, or (b) the book-entry of the Shares by the transfer agent for the Company’s

Common Stock in the name of The Depository Trust Company or its nominee, the Shares will be validly issued, fully paid and non-assessable.

We

are admitted to practice in the State of Florida. This opinion letter is limited to the laws of the State of Florida, and the federal

laws of the United States of America as such laws presently exist and to the facts as they presently exist. We express no opinion with

respect to the effect or applicability of the laws of any other jurisdiction. We assume no obligation to revise or supplement this opinion

letter should the laws of such jurisdictions be changed after the date hereof by legislative action, judicial decision or otherwise.

The

undersigned hereby consents to the filing of this opinion as Exhibit 5.1 to the Registration Statement on Form S-8 and to the use of

its name in the Registration Statement. In giving such consent we do not admit that we are in the category of persons whose consent is

required under Section 7 of the Act.

| |

Very

truly yours, |

| |

|

| |

/s/

Shumaker, Loop & Kendrick, LLP |

| |

SHUMAKER,

LOOP & KENDRICK, LLP |

Exhibit

23.1

Consent

of Independent Registered Public Accounting Firm

We

hereby consent to the incorporation by reference in this Registration Statements on Form S-8 of Oragenics, Inc. (the “Company”)

of the report dated March 28, 2024 relating to the consolidated financial statements of the Company and its subsidiaries as of and for

the year ended December 31, 2023 (which report includes an explanatory paragraph relating to a going concern uncertainty) appearing in

the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission.

| /s/

Cherry Bekaert, LLP |

|

| |

|

| Tampa,

Florida |

|

| |

|

| December

16, 2024 |

|

Exhibit 23.2

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated April 17, 2023, with respect

to the consolidated financial statements of Oragenics, Inc. (the “Company”) as of December 31, 2022 and for the year then

ended (which report includes an explanatory paragraph regarding the existence of substantial doubt about the Company’s ability

to continue as a going concern), included in the Annual Report on Form 10-K for the year ended December 31, 2023.

/s/

CBIZ CPAs P.C. 1

San

Diego, California

December

16, 2024

1

In certain jurisdictions, CBIZ CPAs P.C. operates under its previous name, Mayer Hoffman McCann P.C.

Exhibit

107

CALCULATION

OF REGISTRATION FEE

Form

S-8

(Form

Type)

Oragenics,

Inc.

(Exact

name of registrant as specified in its charter)

Table

1 – Newly Registered Securities

Security Type | |

Security Class Title | |

Fee Calculation Rule | |

Amount Registered(1) | | |

Proposed Maximum Offering Price Per Unit | | |

Maximum Aggregate Offering Price | | |

Fee Rate | | |

Amount Of Registration Fee | |

| Equity | |

Common Stock, par value $0.001 per share | |

Rule 457(c) and (h) | |

| 2,000,000 | | |

$ | 0.333 | | |

$ | 666,000 | | |

$ | 153.10 per 1,000,000 | | |

$ | 101.96 | (2) |

| Total Offering Amounts | | |

| | | |

| | | |

| | | |

$ | 101.96 | |

| Total Fee Offsets | | |

| | | |

| | | |

| | | |

| N/A | |

| Net Fee Due | | |

| | | |

| | | |

| | | |

$ | 101.96 | |

| (1) |

Pursuant

to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall

also cover any additional shares of the Registrant’s Common Stock (“Common Stock”) that become issuable under the

Oragenics, Inc. 2021 Equity Incentive Plan (the “2021 Plan”) by reason of any stock dividend, stock split, recapitalization

or other similar transaction. |

| |

|

| (2) |

This

estimate is made solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(h)(1) and Rule 457(c)

of the Securities Act. The price per share and aggregate offering price are based upon the average of the high and low prices of

Registrant’s Common Stock on December 12, 2024 as reported on NYSE American. |

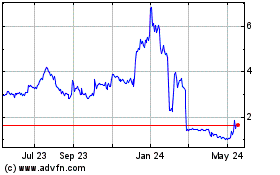

Oragenics (AMEX:OGEN)

Historical Stock Chart

From Dec 2024 to Jan 2025

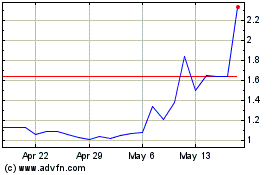

Oragenics (AMEX:OGEN)

Historical Stock Chart

From Jan 2024 to Jan 2025