There is no doubt that the U.S. market started 2013 with a bang

with heavy inflows across all kinds of risky assets. In fact, the

S&P recorded eight sessions of gains, the longest streak of

rally in the last eight years. Also the fact that investors are

pouring in more cash in stocks, mutual funds and ETFs indicates the

rise of investor confidence in the market. (3 Ways to Play the

S&P 500 Rally with ETFs).

However, keeping aside the growing economic momentum and rising

consumer demand, U.S. stocks appear to be expensive when compared

with their emerging market counterparts. Additionally, although the

fiscal cliff overhang has been shed off, still the concerns over

the sequester looms large over the economy.

In such a scenario investors have not completely been weaned

away from the attractions of the emerging markets. In reality

emerging market ETFs are known for their cheap valuation and better

economic growth prospects than the developed economies. (Three

Overlooked Emerging Market ETFs).

In recent months, the emerging markets have shown strong growth

momentum at a time when the developed economies like the U.S. and

Europe were handling their fiscal issues. Emerging market gained 5%

in December last year.

Growth in the emerging markets is expected to rise in 2013 as

well. Among these markets, China appears to be attracting investor

attention once again as it is back on the growth path after years

of underperformance.

Numbers now suggest that China seems to be outperforming both

the U.S. and overall emerging market as a whole. Stocks in the

country actually posted growth of 25% in the past six months (Try

Small Cap ETFs to Gain from Chinese Domestic Demand).

In addition, India appears to be back on track attributable to

various government reforms. The Indian economy is largely dependent

on foreign capital inflow. And with the allowance of foreign direct

investments in the retail industry, the market is surely poised to

benefit going forward.

Healthy corporate earnings and an increase in business spending

will also boost the performance of the Indian equities and the

economy. The growth will be further spurred by the reinstallation

and improvement in the infrastructure of the country (Can India

ETFs Continue Their Solid Run?).

Also, valuations for emerging market stocks appear to be cheaper

compared to U.S. stocks. After the recent rally, U.S. stocks appear

to be trading at a premium of 40% on the basis of price-to book

ratio.

So, considering the strong growth momentum in the emerging

economies and a more attractive valuation of stocks, it seems that

emerging market ETFs are poised for strong growth heading into

2013. In fact emerging market ETFs have experienced a heavy inflow

of assets from the start of the year.

In 2013 emerging markets ETFs have recorded an inflow of nearly

$6.8 billion. Of this, approximately $5 billion was poured into the

two largest emerging market ETFs, namely, iShares MSCI Emerging

Markets and Vanguard FTSE Emerging Markets (Emerging Market ETFs:

EEM vs. VWO). Both the ETFs have been briefly described below:

iShares MSCI Emerging Markets ETF

(EEM)

One of the popular ways to track the emerging market is through

EEM which follows the MSCI Emerging Market Index. The fund appears

to be rich in both volume and assets under management.

EEM manages an asset base of $51.9 billion and trades with

volume of more than 56 million. The fund’s asset base is spread

across a large basket of 843 securities and has a minimal company

specific risk as just 16.08% is invested in top ten holdings.

Among individual holdings, Samsung Electronics, Taiwan

semiconductor and China Mobile forms the top line of the fund. The

fund charges an expense ratio of 66 basis points annually.

In terms of individual countries, China enjoys the maximum

allocation with a share of 18.04% while South Korea, Brazil and

Taiwan also gets double digit allocation in the fund with a share

of 14.38%, 12.74% and 10.38% (China ETF Investing 101).

Vanguard FTSE Emerging Markets ETF

(VWO)

VWO is another popular ETF to track emerging market. The fund

manages an asset base of $61,625 million and trades at volume level

of more than 22 million shares a day.

The fund invests its asset base in 888 securities with just

14.05% invested in top ten holdings. Among individual holdings,

Samsung, China Mobile and America Movil occupies the top three

positions with respective share of 2.51%, 1.86% and 1.39%.

For sectors, financial gets the maximum allocation closely

followed by technology, basic materials and energy sectors.

Among various nations, China, South Korea and Brazil and Taiwan

enjoy double digit allocation in the fund with respective share of

17.9%, 14.46%, 12.02% and 10.88%. The fund charges a fee of 20

basis points annually.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

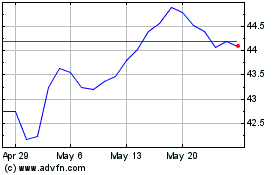

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Nov 2024 to Dec 2024

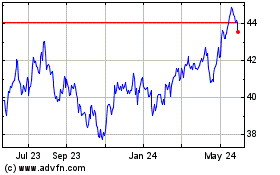

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Dec 2023 to Dec 2024