TIDMCAML

RNS Number : 4697P

Central Asia Metals PLC

10 October 2023

10 October 2023

CENTRAL ASIA METALS PLC

('CAML' or the 'Company')

Q3 2023 Operations Update

Central Asia Metals plc (AIM: CAML) today provides a Q3 2023

operations update for the Kounrad dump leach, solvent extraction

and electro-winning ('SX-EW') copper recovery plant in Kazakhstan

('Kounrad') and the Sasa zinc-lead mine in North Macedonia

('Sasa').

Q3 2023 operational summary

- Zero lost time injuries ('LTIs') at Kounrad or Sasa

- Kounrad copper production, 3,661 tonnes

- Sasa zinc in concentrate production, 5,127 tonnes

- Sasa lead in concentrate production, 7,039 tonnes

Outlook

- On track to achieve 2023 full year guidance:

o Copper: 13,000 to 14,000 tonnes

o Zinc in concentrate: 19,000 to 21,000 tonnes

o Lead in concentrate: 27,000 to 29,000 tonnes

CAML production summary

Metal production

(tonnes) Q 3 2023 Q2 2023 Q1 2023 9 m 2023 9 m 2022

Copper 3 ,661 3,380 3,336 10 ,377 1 0,685

--------- -------- -------- --------- ---------

Zinc 5,127 4,847 4,917 14,891 16,211

--------- -------- -------- --------- ---------

Lead 7,039 7,116 6,618 20,773 20,726

--------- -------- -------- --------- ---------

Nigel Robinson, Chief Executive Officer, commented:

"We are pleased to report another solid period of base metal

production during Q3 2023, and we remain on schedule to meet our

full year guidance. Importantly, this production has been delivered

safely as we have reported zero LTIs at both operations.

"During Q3 2023 we reached the impressive milestone of having

generated over $1 billion in revenue from Kounrad in our 11 years

of operations. This is a fantastic achievement from the Kounrad

team, especially given that the copper has all been produced from

waste material.

"As we look towards the end of the year, we will further

progress our investments at Sasa, as well as complete construction

and commissioning of our Kounrad Solar Power Plant, which should

start generating electricity for us before the end of 2023."

Health and Safety

There were no LTIs reported at either Kounrad or Sasa during Q3

2023 and in the nine months to 30 September 2023, there has only

been one Group LTI.

Kounrad

Kounrad Q3 2023 copper production of 3,661 tonnes brings output

for the first nine months of 2023 to 10,377 tonnes. Copper sales

during Q3 2023 were 3,903 tonnes.

Solid progress on the construction of the 4.77MW solar farm was

achieved during Q3 2023 and at the end of the period the physical

installation works were substantially completed. Commissioning of

the facility is expected to commence before the end of October, and

it is forecast that during the coming winter period it will be

contributing around 10% of daily power requirement.

Sasa

In Q3 2023, mined and processed ore were 199,085 tonnes and

199,427 tonnes respectively, bringing the total for the first nine

months of the year to 595,319 tonnes mined and 596,099 tonnes

processed. The average head grades for the Q3 2023 period were 3 .

04 % zinc and 3 . 79 % lead, and for the first nine months of the

year were on average 2 . 94 % and 3 . 74 % respectively. The

average Q3 2023 metallurgical recoveries were 84 . 6 % for zinc and

93 . 1 % for lead.

Sasa produces a zinc concentrate and a separate lead

concentrate. In Q3 2023, 10 , 249 tonnes of concentrate containing

50 . 0 % zinc and 9 , 919 tonnes of concentrate containing 71 . 0 %

lead were produced. This brings total production for the first nine

months of 2023 to 29,506 tonnes of zinc concentrate at a grade of

50 . 5 % and 29,221 tonnes of lead concentrate at a grade of 71 . 1

%.

Sasa typically receives from smelters approximately 84% of the

value of its zinc in concentrate and approximately 95% of the value

of its lead in concentrate. Accordingly, Q3 2023 payable production

was 4,307 tonnes of zinc and 6,687 tonnes of lead, bringing total

payable production for the nine-month period to 12,530 tonnes of

zinc and 19,734 tonnes of lead.

Payable base metal in concentrate sales for Q3 2023 were 4,097

tonnes of zinc and 7,252 tonnes of lead.

During Q3 2023, Sasa sold 95,044 ounces of payable silver to

Osisko Gold Royalties, in accordance with its streaming

agreement.

Units Q3 2023 Q 2 2023 Q 1 2023 9m 2023 9m 2022

Ore mined t 199,085 199,731 196,503 595,319 602,587

--------- -------- --------- --------- -------- --------

Plant feed t 199,427 200,705 195,968 596,099 604,478

--------- -------- --------- --------- -------- --------

Zinc grade % 3.04 2 .85 2.95 2 .94 3.16

--------- -------- --------- --------- -------- --------

Zinc recovery % 84.6 8 4.7 85.2 8 4.8 84.9

--------- -------- --------- --------- -------- --------

Lead grade % 3.79 3 .85 3.59 3 .74 3.66

--------- -------- --------- --------- -------- --------

Lead recovery % 93.1 9 2.1 94.2 9 3.1 93.7

--------- -------- --------- --------- -------- --------

Zinc concentrate t (dry) 10,249 9,541 9,716 29,506 32,323

--------- -------- --------- --------- -------- --------

* Grade % 50.0 50.8 50.6 5 0.5 50.2

--------- -------- --------- --------- -------- --------

* Contained zinc t 5,127 4,847 4,917 14,891 16,211

--------- -------- --------- --------- -------- --------

Lead concentrate t (dry) 9,919 1 0,020 9,282 29,221 29,172

--------- -------- --------- --------- -------- --------

* Grade % 71.0 7 1.0 71.3 7 1.1 71.0

--------- -------- --------- --------- -------- --------

* Contained lead t 7,039 7, 116 6,618 20,773 20,726

--------- -------- --------- --------- -------- --------

Phase two of the Central Decline development at depths beneath

the 910 metre level is underway and, as at 30 September 2023, the

decline had been developed down to 860 metres. While Sasa awaits a

component to enable testing of cemented backfill, mining on the 800

metre level that has been prepared for paste fill mining operations

has now commenced. Construction of the dry stack tailings plant

project has commenced, as has land clearance for the dry stack

tailings landform.

For further information contact:

Central Asia Metals Tel: +44 (0) 20 7898 9001

Nigel Robinson

CEO

Gavin Ferrar

CFO

Louise Wrathall louise.wrathall@centralasiametals.com

Director of Corporate Development

Emma Chetwynd Stapylton emma.chetwyndstapylton@centralasiametals.com

Investor Relations Manager

Peel Hunt (Nominated Advisor and Tel: +44 (0) 20 7418 8900

Joint Broker)

Ross Allister

David McKeown

BMO Capital Markets (Joint Broker) Tel: +44 (0) 20 7236 1010

Thomas Rider

Pascal Lussier Duquette

BlytheRay (PR Advisors) Tel: +44 (0) 20 7138 3204

Tim Blythe

Megan Ray

Note to editors:

Central Asia Metals, an AIM-listed UK company based in London,

owns 100% of the Kounrad SX-EW copper project in central Kazakhstan

and 100% of the Sasa zinc-lead mine in North Macedonia.

For further information, please visit www.centralasiametals.com

and follow CAML on Twitter at @CamlMetals and on LinkedIn at

Central Asia Metals Plc.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDQKLFBXBLFFBQ

(END) Dow Jones Newswires

October 10, 2023 02:00 ET (06:00 GMT)

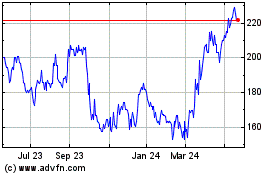

Central Asia Metal (AQSE:CAML.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

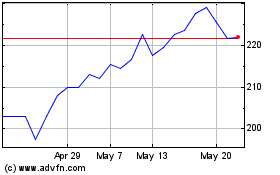

Central Asia Metal (AQSE:CAML.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024