Evrima Plc Conditional Agreement with New Investee

March 24 2021 - 7:10AM

UK Regulatory

TIDMEVA

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY EVRIMA PLC TO

CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION

(EU) NO. 596/2014 AS AMED ("MAR") OR EQUIVALENT, TRANSITIONAL REGULATIONS IN

THE UNITED KINGDOM. ON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE ("RIS"), THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

Evrima plc

AQSE: EVA

("Evrima" or the "Company")

Evrima plc enters Non-Binding Investment Memorandum to act as "Cornerstone"

Investor in Eastport Venture Inc.'s Pre-IPO Fundraising

Particulars of the RIS Announcement

1. Eastport Ventures Inc. ("Eastport Ventures"): Background

2. Eastport Ventures: Underlying Asset Overview and Link to Corporate

Presentation

3. Investment Memorandum: Cornerstone Eastport Ventures, Pre-IPO Fundraise

4. Related Party Disclosure

5. Statement by Evrima's Executive Chairman

1. Eastport Ventures: Background

Eastport Ventures is a company incorporated and registered in Ontario, Canada,

which was formed by seasoned explorers and corporates for the purpose of

identifying and evaluating mineral opportunities in Southern Africa, with a

specific geologic focus on Botswana. The commercial objective of the company

was patiently to acquire and build a portfolio of advanced exploration and

investment opportunities at junctures in the resources demand cycle when

commodity markets were depressed. This covered a range of commodites that the

Eastport Ventures' team believed would attract capital investment upon an

upturn in global capital markets, coupled with a renewed appetite for

undervalued mining and exploration assets.

Eastport Ventures has hitherto amassed a portfolio of interests covering

copper, nickel, uranium, and diamonds; it has additionally created an internal

investment division that currently has a value in excess of C$1,000,000.

The mineral assets within Eastport Ventures have attracted an aggregate of over

USD$15,000,000 in both historic and current capital expenditure.

The key members involved in Eastport from inception include:

President & Co-Founder: Mr Rick Bonner

Mr Bonner brings 30-plus years of mineral exploration experience on four

continents exploring for copper, gold, uranium, and diamonds (including whilst

with Rio Tinto and BHP) to Eastport Ventures. His explorations have taken him

into a number of challenging environments including the former Soviet Union,

Western and East Africa, and Arctic Canada.

A co-founder of Westport Resources Namibia, he built a significant exploration

company for Forsys Metals Corp, a TSX-listed company that reached a valuation

in excess of C$900M with its share price rising from the low cents to >C$10 a

share. Mr Bonner's responsibilities included advancing the Valencia uranium

deposit from exploration to a NI 43-101 compliant measured resource.

Please see also Section 4. of this announcement, "Related Party Disclosure".

Chief Executive Officer & Co-Founder: Burns Singh Tennent-Bhohi

Please refer to Section 4. of this announcement, "Related Party Disclosure".

Strategic Adviser and Shareholder: Dr. Laurie Curtis

Dr. Curtis brings over 30 years of experience in the mining industry and

capital markets, with a proven track record in corporate development, mine

development, and project financing.

He was the founder of Intrepid Minerals and was a key member of the senior

management and technical teams that oversaw all aspects from discovery through

to operations. Under his guidance as CEO / COO, Intrepid transitioned through

merger and acquisition to become a gold producer and developer, ultimately

attaining a market capitalisation in excess of $1 billion.

Dr. Curtis has also held several positions in the financial sector including

Research and Mining Analyst at Clarus Securities, and Vice President and Senior

Analyst of Global Resources for Dundee Capital Markets. Dr Curtis is currently

a Director of Excellon Resources (TSX:EXN) and a shareholder of Eastport

Ventures.

Strategic Adviser and Shareholder: Mr. Nick Tintor

Mr Tintor is a mining executive and geologist who holds a BSc. In Geology from

the University of Toronto and has in excess of 30 years of experience in the

Canadian and international mining industry.

For the past twenty years he has been involved in all aspects of junior mining

company management from project generation, to finance and executive

management.

He also brings deep global relationships in the mining industry and especially

in the Canadian resources investment banking sector. Mr Tintor was also a key

member of Moto Gold, which was sold in 2009 to Randgold for C$500M.

Mr Tintor is currently Chair of Benz Mining (TSX-V:BZ), which has seen its

share price increase by more than 1,000% over the last 12 months. Mr Tintor is

a shareholder of Eastport Ventures.

2. Eastport Ventures: Underlying Asset Overview and Link to Corporate

Presentation

Matsitama Copper Project

The Matsitama Copper Project comprises of nine exploration licences that cover

a total area of 2,405 km2 , being the bulk of the Matsitama Schist Belt. The

project is targeting massive and disseminated sulphide deposits related to

IOCG-style deposits, which can be substantial in size.

Eastport Ventures holds extensive historic data including over 2,000 drill

holes, of which a number require follow-up based on the reporting of what the

board of Eastport Ventures believes to be highly attractive, mineable grades

and widths.

Extracted highlights:

Phudulooga: DS07-011 - 4.42% Cu, 5.94 g/t Ag over 3.3m at 24.1m

depth*

DS07-012 - 3.36% Cu, 3.72 g/

t Ag over 3.4m at 85.8m depth**

Nakalakwana: NH-014 - 2.47% Cu over 10.0m at 65.9m

depth***

NH-016 - 2.42% Cu over 5.26m at 60.4m

depth****

Regional Targets: +30 copper occurrences

*; **; ***; **** Depths from surface

Keng Nickel Project

The Keng Nickel Project is comprises of one exploration licence that covers 363

km2 and of one contiguous pending (Q2 decision anticipated) licence covering

984 km2 . The project targets the marginal area of the Molopo Farms Complex,

which is a large layered mafic intrusive, with geologic similarities to the

Bushveld Complex in South Africa. Previous explorers have intersected narrow

veins with high grades of sulphide mineralisation:

KP-019 1.25% Ni, 0.96% Cu over 0.1m - sulphide vein

KP-020 14.6% Ni, 0.87% Co over 0.3m - sulphide vein

Presence of veining with metals supports the Norilsk-Talnakh nickel deposit

target model.

Foley Uranium Project

A single large licence (846km2), targets shallow, calcrete-hosted uranium

deposits similar to A-Cap's Letlhakane deposit (365Mlbs) to the immediate

south-east. The uranium is hosted in near flat-lying geology and would be

mineable as open-pit, low-cost, heap-leachable mines.

Jwaneng Diamond Project

The Jwaneng Diamond Project is comprised of two contiguous licences covering

157 km2 to the immediate north of De Beers Group's Jwaneng diamond mine,

reputedly the world's richest diamond mine.

Eastport Ventures' exploration programme will test the Kgare kimberlite for

diamonds by drill, collecting a two-tonne sample. Kgare has impressive

diamond-related features including a garnet population with +10% G10 and a +19%

mantle-sourced chromite population. The indicator chemistry plus a >7 Ha

surface area combine to present what could prove an exciting commercial

opportunity.

Eastport Ventures' programme will "lift" approximately five tonnes for diamond

recovery in 2021, with all required drilling permits being in place.

Active Prospecting Licence ("PL") Applications

Additionally, Eastport Ventures has submitted a number of PL Applications

targeting licences that have a combination of, pre-existing exploration and

highly prospective geology for nickel,copper and platinum group metals.

Eastport Ventures: Investment Division

Investments Include: Premium Nickel Resources Corporation

Eastport Ventures owns 2,750,000 shares of Premium Nickel Resources Corporation

("PNR"), representing 3.74% of that company.

PNR is a company dedicated to the exploration and development of high-quality

nickel-copper-cobalt (Ni-Cu-Co) resources. PNR is led by a skilled team with

strong financial, technical, and operational expertise to take an asset from

discovery through exploration to mining.

PNR has focused its efforts on discovering world-class nickel sulphide assets

in jurisdictions with rule-of-law that fit strict criteria within PNR's values

and principles, which conform to the highest acceptable industry standards.

The following statement, to which a link is also provided, was released last

month by Premium Nickel Resources Corporation - PNR Press Release:

"Toronto, Ontario, February 16, 2021 - Premium Nickel Resources ("PNR") is

pleased to announce that it has been selected as the preferred bidder for the

Botswana nickel-copper-cobalt ("Ni-Cu-Co") assets formerly operated by BCL

Limited ("BCL"), and currently in liquidation.

In June 2020, PNR submitted an indicative offer to the BCL Liquidator to

acquire the former producing Selebi-Phikwe, Tati Phoenix and Selkirk Mines as

well as regional exploration joint ventures on highly prospective Ni-Cu-Co

projects located in Botswana.

On February 10, 2021 the Honourable, Moagi Lefoko, the Minister of Mineral

Resources, Green Technology and Energy Security of Botswana, affirmed in

Parliament the press release by the Liquidator for the BCL Group of Companies,

stating that PNR was selected as the preferred bidder to acquire the assets

formerly owned by BCL. This announcement follows an independent technical

evaluation on behalf of the Liquidator, and a review by the Government of

Botswana, over the last seven months.

PNR would like to thank the Minister of Mineral Resources, Green Technology &

Energy Security, Botswana for publicly announcing that PNR was being awarded

the Preferred Bidder status last week, as has been widely reported in the

global media. PNR will now complete the documentation with the Liquidator to

govern the six-month exclusivity period to complete due diligence on these

assets. During the exclusivity period, PNR will negotiate definitive agreements

to finalize terms on the prioritized assets to be purchased.

PNR continues to monitor the global Covid-19 developments and is committed to

working with health and safety as a priority and in full respect of all

government and local Covid-19 protocol requirements. PNR has developed Covid-19

travel, living and working protocols in anticipation of moving forward to on

site due diligence and is integrating these protocols with those of The

Government of Botswana and surrounding communities."

A link to a Corporate Presentation by Eastport Venturesmay be found here. A

link will also shortly be made available on Evrima's website

3. Investment Memorandum

Evrima plc has entered into a Non-Binding Investment Memorandum ("IM") with

Eastport Ventures along terms outlined below:

Period of Exclusivity ("PoE")

Evrima plc shall be granted a 30-day period of exclusivity, enabling the

Company's Directors and advisers to consider terms of investment, complete

adequate due diligence (including third-party review by independent advisers

including, but not limited to, Competent Persons qualified under JORC and NI

43-101) and to evaluate the broader capital market demand for investments in

companies of the character of Eastport Ventures.

Investment Decision

Should the outcome of the Company's due diligence during the PoE described

above be satisfactory, the Company shall arrange to proceed with a cornerstone

investment in Eastport Ventures prior to the latter company commencing the

process of a public listing.

4. Related Party Disclosures

,Burns Singh Tennent-Bhohi is a Director and shareholder of Evrima and the

Chief Executive Officer/Co-Founder and a shareholder of Eastport Ventures, Mr

Guy Miller is a Director and shareholder of Evrima and a shareholder of

Eastport Ventures.

Mr Rick Bonner, who holds in excess of 3% of Evrima, is also a shareholder and

director of Eastport Ventures. Mr Simon Bate who holds in excess of 3% of

Evrima, is also a shareholder and Eastport Ventures' local Director in,

Botswana.

5. Simon Grant-Rennick, Evrima Executive Chairman's, Statement

"Evrima is consistently reviewing opportunities where it can leverage its

experience and investment capital while avoiding operational funding

liabilities. The Company is seeking to assume substantive positions in

businesses that have defined the future route to a liquidity event.

Eastport Ventures represents a company that has been patient in amassing a

basket of assets that have benefitied from a tremendous amount of past capital

investment but subsequenty been "orphaned" owing to global commodity market

conditions.

I look forward to providing updates to shareholders and the wider market."

Evrima plc,

24th March 2021

The Directors of the Company, who have issued this RIS announcement after due

and careful enquiry, accept responsibility for its content.

Enquiries

Company:

Simon Grant-Rennick (Executive Chairman)

simon@evrimaplc.com

Burns Singh Tennent-Bhohi (Chief Executive Officer & Executive Director)

burns@evrimaplc.com

Guy Miller (Non-Executive Director)

Direct Office Line: +44 (0) 20 3778 0755

Keith, Bayley, Rogers & Co Limited (AQSE Corporate Adviser)

Graham Atthill-Beck: +44 (0) 20 7464 4091; +44 (0) 7506 43 41 07; +971 (0) 50

856 9408; Graham.Atthill-Beck@kbrl.co.uk ; blackpearladvisers@gmail.com

Peterhouse Capital Limited (Corporate Stockbroker):

Lucy Williams: +44 (0) 20 7469 0930

Duncan Vasey: +44 (0) 20 7220 9797 (Direct)

END

(END) Dow Jones Newswires

March 24, 2021 08:10 ET (12:10 GMT)

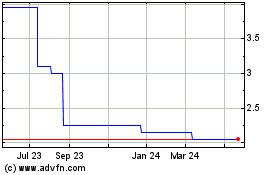

Evrima (AQSE:EVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

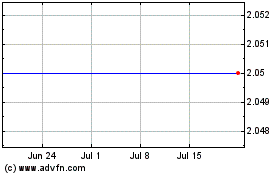

Evrima (AQSE:EVA)

Historical Stock Chart

From Jul 2023 to Jul 2024