TIDMGCON

RNS Number : 9045N

Global Connectivity PLC

28 September 2023

Global Connectivity Plc (the "Company" or "GCON")

Interim Results

Global Connectivity Plc (AQSE: GCON), a leading provider of

broadband services to rural areas of the UK through its investment

in Rural Broadband Holdings Solutions Limited, today announces its

unaudited half year results for the six months ended 30 June

2023.

Overview

- Since completion of its transaction with Tiger Infrastructure

Partners LP ("Tiger"), Global Connectivity Plc has been in a period

of transition as its subsidiaries are now owned by Rural Broadband

Solutions Holdings Ltd (RBSHL) in which the Company continues to

own a 15% stake.

- Following the merger with Voneus Broadband and the acquisition

of Broadway Partners, GCON's involvement in the broadband market

has now been consolidated and it is expected that the Company's

asset value will be further enhanced.

Financial Highlights

- Net assets were up by GBP3.0m compared to 31 December 2022

mainly as a result of a net gain on financial assets at fair value

through profit or loss of GBP3.2m.

- The Company has estimated the fair value of its investment in

RBSHL, an unquoted equity instrument, and recognised an increase in

fair value based on the information provided by the investee

company.

- As at 30 June 2023, the current cash was circa GBP33k.

However, the standard running costs have reduced significantly (by

36% on the same period of the previous year) and the directors

expect GBP0.55m to be received from SWS in repayment of the

intercompany loan over the next 18 months.

Operational Highlights

- Macquarie Capital, the Israel Infrastructure Fund and Tiger

Infrastructure Partners have merged SWS Broadband and Cadence

Networks with Voneus Broadband, and simultaneously acquired

Broadway Partners.

- The combined group will be funded with up to GBP250 million in

new capital from the three shareholders and bank lenders to advance

the company's and the UK government's shared objective of closing

the digital divide.

- The combined company has a target to serve over 350,000 premises across the UK.

Outlook

- GCON's involvement in the broadband fibre market is now anchored.

- It can therefore be expected that the process of seeking

suitable investments to further the growth of GCON will

accelerate.

-S

For further information please contact:

Keith Harris

Executive Chairman

Global Connectivity Plc

Email: info@globalconnectivityplc.com

https://www.globalconnectivityplc.com/

Claire Louise Noyce

AQSE Stock Exchange Corporate Adviser & Corporate Broker

Hybridan LLP

Tel: +44 20 3764 2341

Email: claire.noyce@hybridan.com

www.hybridan.com

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the "

UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Chairman's Statement

SIGNIFICANT DEVELOPMENT

In my Chairman's Statement in our Final Accounts for the year

ended 31 December 2022, published on 27 June 2023, I reflected on

the anticipated benefits to GCON of our financial and strategic

relationship with Tiger Infrastructure Partners Fund III LP

("Tiger"). These arise from the transaction we entered into which

led to the formation of Rural Broadband Solutions Holdings Limited

("RBSHL"), the company now owned 85% by Tiger and 15% by GCON.

I am pleased to report that, within a year of signing the

agreement with Tiger, RBSHL has been part of a significant

transaction with Tiger, both for the development of the whole UK

rural broadband market and for GCON. Earlier this week, on 25

September 2023, GCON announced that Macquarie Capital, the Israel

Infrastructure Fund and Tiger (through RBSHL) have merged their

fibre broadband interests, and simultaneously acquired Broadway

Partners.

The combined group will operate under the name Voneus Broadband,

under which Macquarie Capital has been operating since investing in

this business sector, in 2019. The combined group will be funded

with up to GBP250 million from its three major shareholders and

bank lenders to accelerate its progress and the UK government's

shared objective of closing the digital divide. These consolidation

and financial developments place Voneus in a game-changing position

to service the needs of hard-to-reach communities with broadband

connectivity. The company has a target to serve over 350,000

premises across the UK.

This transaction creates a business of substantial scale that

can benefit from numerous synergies including improved cost

economies, a larger future build pipeline and diversified

contractor relationships. The component parts which now make up

Voneus operate in adjacent geographical areas.

The capital contribution to the new group will be funded

disproportionately so that RBSHL will increase its stake in Voneus

Broadband from the current 32%. There are no capital demands on

GCON, and it has protection from dilution, in respect of its

ownership of the combined company, until Tiger's capital

contribution exceeds GBP75 million.

Separately, over the past several months, the board of GCON has

been actively investigating appropriate investment opportunities in

a variety of technically based businesses that enhance connectivity

either between consumers or companies that provide services to

consumers where enhanced connectivity is essential. We have

declined to pursue two of these opportunities due to these (on more

detailed examination) not fulfilling all the criteria that the

Company has with respect to suitability, fit and growth potential

and are advancing discussions in respect of a further two. Now that

GCON's involvement in the broadband fibre market is anchored, it

can be expected that the process of seeking suitable investments to

further the growth of GCON will accelerate.

Keith Harris

Chairman

27 September 2023

I ncome Statement

(Unaudited) (Unaudited) (Audited)

Period from 1 January Period from 1 January Year ended 31 December

2023 to 30 June 2023 2022 to 30 June 2022 2022

Note GBP'000 GBP'000 GBP'000

--------------------------- ----- -------------------------- -------------------------- --------------------------

Turnover - - -

Cost of sales - - -

--------------------------- ----- -------------------------- -------------------------- --------------------------

Gross profit - - -

Net gain on financial

assets at fair value

through profit or loss 6 3,171 - -

Other administration fees

and expenses 3 (139) (347) (338)

Management services

recharges - 51 82

--------------------------- ----- -------------------------- -------------------------- --------------------------

Operating profit/(loss) 3,032 (296) (256)

--------------------------- ----- -------------------------- -------------------------- --------------------------

Finance income 1 - -

Reversal)/(increase) of

impairment of

intercompany loan - (356) 616

Net finance

income/(expense) 1 (356) 616

--------------------------- ----- -------------------------- -------------------------- --------------------------

Profit/(loss) before

income tax 3,033 (652) 360

Income tax expense 4 - - -

--------------------------- ----- -------------------------- -------------------------- --------------------------

Profit/(loss) for the

period 3,033 (652) 360

--------------------------- ----- -------------------------- -------------------------- --------------------------

Basic and diluted

profit/(loss) per share

(pence) 5 0.84 (0.18) 0.10

--------------------------- ----- -------------------------- -------------------------- --------------------------

Statement of Comprehensive Income

(Unaudited) (Unaudited) (Audited)

Period from 1 January Period from 1 January Year ended 31 December

2023 to 30 June 2023 2022 to 30 June 2022 2022

Note GBP'000 GBP'000 GBP'000

-------------------------- ------ -------------------------- -------------------------- --------------------------

Profit/(loss) for the period 3,033 (652) 360

Other comprehensive - - -

expense

Total comprehensive

income/(expense) for the period 3,033 (652) 360

---------------------------------- -------------------------- -------------------------- --------------------------

Balance Sheet

(Unaudited) (Unaudited) (Audited)

As at 30 June 2023 As at 30 June 2022 As at 31 December 2022

Note GBP'000 GBP'000 GBP'000

----------------------------------------- ----- -------------------- -------------------- ------------------------

Assets

Non-current assets

Investment in subsidiaries - 1,966 -

Amounts due from related parties 7 275 - 275

Other financial assets 6 6,375 - 3,204

Subscriptions due 950 950 950

----------------------------------------- ----- -------------------- -------------------- ------------------------

Total non-current assets 7,600 2,916 4,429

----------------------------------------- ----- -------------------- -------------------- ------------------------

Current assets

Amounts due from related parties 7 308 881 483

Trade and other receivables 8 24 29 89

Cash at bank 33 140 24

----------------------------------------- ----- -------------------- -------------------- ------------------------

Total current assets 365 1,050 596

----------------------------------------- ----- -------------------- -------------------- ------------------------

Total assets 7,965 3,966 5,025

----------------------------------------- ----- -------------------- -------------------- ------------------------

Equity

Capital and reserves attributable to

owners of the Parent:

Issued share capital 3,619 3,619 3,619

Warrant reserve 77 77 77

Share option reserve 288 301 278

Retained earnings 3,925 (120) 892

----------------------------------------- ----- -------------------- -------------------- ------------------------

Total equity 7,909 3,877 4,866

----------------------------------------- ----- -------------------- -------------------- ------------------------

Liabilities

Current liabilities

Trade and other payables 9 56 89 159

Total current liabilities 56 89 159

----------------------------------------- ----- -------------------- -------------------- ------------------------

Total liabilities 56 89 159

----------------------------------------- ----- -------------------- -------------------- ------------------------

Total equity and liabilities 7,965 3,966 5,025

----------------------------------------- ----- -------------------- -------------------- ------------------------

The financial statements were approved and authorised for issue

by the Board of Directors on 27 September 2023 and signed on its

behalf by:

Keith Harris Selwyn Lewis

Director Director

Statement of Changes in Equity

Share capital Share premium Warrant reserve Share Retained earnings/ Total

Option (deficit)

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Unaudited

Balance at 1 January

2022 3,619 - 77 257 532 4,485

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Comprehensive expense

Loss for the period - - - - (652) (652)

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Total comprehensive

expense for the

period - - - - (652) (652)

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Transactions with

owners

Share based payments

relating to share

options - - - 44 - 44

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Total transactions

with owners - - - 44 - 44

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Balance at 30 June

2022 3,619 - 77 301 (120) 3,877

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Audited

Balance at 1 January

2022 3,619 - 77 257 532 4,485

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Comprehensive income

Profit for the year - - - - 360 360

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Total comprehensive

income for the year - - - - 360 360

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Transactions with

owners

Share based payments

relating to share

options - - - 21 - 21

Total transactions

with owners - - - 21 - 21

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Balance at 31 December

2022 3,619 - 77 278 892 4,866

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Unaudited

Balance at 1 January

2023 3,619 - 77 278 892 4,866

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Comprehensive expense

Profit for the period - - - - 3,033 3,033

Total comprehensive

income for the period - - - - 3,033 3,033

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Transactions with

owners

Share based payments

relating to share

options - - - 10 - 10

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Total transactions

with owners - - - 10 - 10

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Balance at 30 June

2023 3,619 - 77 288 3,925 7,909

----------------------- -------------- -------------- ---------------- --------- ---------------------- --------

Cash Flow Statement

(Unaudited) (Unaudited) (Audited)

Period from 1 January Period from 1 January Year ended 31 December

2023 to 30 June 2023 2022 to 30 June 2022 2022

Note GBP'000 GBP'000 GBP'000

-------------------------- ------ -------------------------- -------------------------- --------------------------

Cash flows from operating

activities

Profit/(loss) for the period

before tax 3,033 (652) 360

Adjustments for:

Net gain on financial (3,171) - -

assets at fair value

through profit or loss

Finance income (1) - -

Increase/(reversal) of

impairment of amounts due from

related parties - 356 (616)

Share based payments relating to

share options 10 20 21

Operating loss before changes in

working capital (129) (276) (235)

Decrease/(increase) in trade and

other receivables 65 34 (26)

(Decrease)/increase in trade and

other payables (103) (49) 21

---------------------------------- -------------------------- -------------------------- --------------------------

Cash used in operations (167) (291) (240)

Interest received 1 - -

Net cash used in operating

activities (166) (291) (240)

---------------------------------- -------------------------- -------------------------- --------------------------

Cash flows from investing

activities

Investment in subsidiary - -

Repayment from/(loan to)

subsidiary 175 (594) (521)

Reorganisation costs - - (240)

Net cash generated from/(used in)

investing activities 175 (594) (761)

Cash flows from financing

activities

Issue of shares - - -

Net cash (used - - -

in)/generated from

financing activities

-------------------------- ------ -------------------------- -------------------------- --------------------------

Net increase/(decrease) in cash

and cash equivalents 9 (885) (1,001)

Cash and cash equivalents at

beginning of the period 24 1,025 1,025

Cash and cash equivalents at end

of the period 33 140 24

---------------------------------- -------------------------- -------------------------- --------------------------

Notes to the Financial Statements

1 General Information

These interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the financial statements of the

Company as at and for the year ended 31 December 2022 which have

been prepared in accordance with International Financial Reporting

Standards ("IFRS") as adopted by the UK.

The interim financial statements for the six months ended 30

June 2023 are unaudited and have not been reviewed by the Company's

auditors MAH, Chartered Accountants . The comparative interim

figures for the six months ended 30 June 2022 are also

unaudited.

2 Basis of preparation

The accounting policies applied by the Company in the

preparation of these condensed interim financial statements are the

same as those applied by the Company in its financial statements

for the year ended 31 December 2022.

3 Other administration fees and expenses

Period ended Period ended Year ended

30 June 2023 (Unaudited) 30 June 2022 (Unaudited) 31 December 2022 (Audited)

-------------------------------- -------------------------- -------------------------- ----------------------------

Audit fees 10 8 15

Directors' remuneration and

fees 46 59 112

Directors' insurance cover 8 11 21

Professional fees 15 75 133

Reorganisation costs* - 130 (50)

Share based payment expense 10 21 21

Other expenses 50 43 86

-------------------------------- -------------------------- -------------------------- ----------------------------

Administration fees and

expenses 139 347 338

-------------------------------- -------------------------- -------------------------- ----------------------------

* costs incurred last year were able to be recovered from Tiger

when the reorganisation completed on 25 October 2022

Included within other administration fees and expenses are the

following:

Directors' remuneration

The maximum amount of basic remuneration payable by the Company

by way of fees to the Non-executive Directors permitted under the

Articles of Association is GBP200,000 per annum. All Directors are

each entitled to receive reimbursement of any expenses incurred in

relation to their appointment. Mr Langoulant and Mr Lewis are

entitled to receive an annual fee of GBP6,000. Mr Stone was

entitled to receive an annual fee of GBP15,000 up to his date of

resignation on 28 November 2022.

Executive Directors' fees

The Chairman is entitled to an annual fee of GBP80,000 (2022:

GBP90,000 but permitted a reduction when he was receiving fees from

Secure Web Services Limited whilst it was a wholly owned

subsidiary).

All directors' remuneration and fees

Total fees and basic remuneration (including VAT where

applicable) paid to the Directors for the period ended 30 June 2023

amounted to GBP46,066 (30 June 2022: GBP58,688) and was split as

below. Directors' insurance cover amounted to GBP7,959 (30 June

2022: GBP10,562).

Notes to the Financial Statements (continued)

3 Other administration fees and expenses (continued)

All directors' remuneration and fees (continued)

Period ended Period ended Year ended

30 June 2023 (Unaudited) 30 June 2022 (Unaudited) 31 December 2022 (Audited)

--------------------- -------------------------- -------------------------- ----------------------------

Selwyn Lewis 3 3 6

Michael Langoulant 3 3 6

Christopher Stone - 8 14

Keith Harris 40 45 85

Expenses reimbursed - - 1

--------------------- -------------------------- -------------------------- ----------------------------

46 59 112

--------------------- -------------------------- -------------------------- ----------------------------

4 Taxation

The Company is resident in the Isle of Man for taxation

purposes. The Isle of Man has a 0% rate of corporate income tax

(2022: 0%) to which the Company is subject.

5 Basic and diluted profit/(loss) per share

(a) Basic

Basic profit/(loss) per share is calculated by dividing the

profit/(loss) attributable to equity holders of the Company by the

weighted average number of shares in issue during the period.

Period ended Period ended Year ended

30 June 2023 (Unaudited) 30 June 2022 (Unaudited) 31 December 2022 (Audited)

-------------------------------- -------------------------- -------------------------- ----------------------------

Profit/(loss) attributable to

equity holders of the Company

(GBP'000) 3,033 (652) 360

Weighted average number of

shares in issue (thousands) 361,926 361,926 361,926

-------------------------------- -------------------------- -------------------------- ----------------------------

Basic profit/(loss) per share

(pence per share) 0.84 (0.18) 0.10

-------------------------------- -------------------------- -------------------------- ----------------------------

(b) Diluted

Diluted profit/(loss) per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The company

has two categories of dilutive potential ordinary shares: warrants

and share options.

Although the Company is reporting a profit from continuing

operations for the period the exercise price of the warrants or

performance criteria for the share options have not been met and

therefore exercise cannot take place yet. The basic and diluted

profit per share as presented on the face of the Income Statement

are therefore identical.

Notes to the Financial Statements (continued)

6 Other financial assets

Instruments measured at fair value 30 June 2023 (Unaudited) 30 June 2022 (Unaudited) 31 December 2022 (Audited)

through profit and loss

----------------------------------- ------------------------- ------------------------- ---------------------------

Start of the period 3,204 - -

Reclassification on reorganisation - - 3,204

Net gain on financial assets at 3,171 - -

fair value through profit or loss

----------------------------------- ------------------------- ------------------------- ---------------------------

End of the period 6,375 - 3,204

----------------------------------- ------------------------- ------------------------- ---------------------------

Categorised as

Level 3 - unquoted investments 6,375 - 3,204

----------------------------------- ------------------------- ------------------------- ---------------------------

Total financial assets 6,375 - 3,204

----------------------------------- ------------------------- ------------------------- ---------------------------

The infrastructure funding deal with Tiger Infrastructure

Partners Fund III LP ("Tiger") completed on 25 October 2022. As a

result the Company transferred ownership of its two previously

wholly owned subsidiaries, Secure Web Services Limited and Cadence

Networks to a new intermediate holding company, Rural Broadband

Solutions Holdings Limited, of which the Company now owns 15%. At

the same time part of intercompany loan with Secure Web Services

Limited was capitalised leaving a balance of GBP825,000 to be

repaid over three years at a rate of GBP275,000 per annum.

The Company has estimated the fair value of its investment in

Rural Broadband Solutions Holdings Limited, an unquoted equity

instrument, and recognised an increase in fair value based on the

information provided by the investee company.

7 Amounts due from related parties

This balance is unsecured and interest free. GBP550,000 relates

to a loan (31 December 2022: GBP725,000). GBP32,760 (31 December

2022: GBP32,760) relates to management services recharges which are

repayable on demand.

8 Trade and other receivables

30 June 2023 (Unaudited) 30 June 2022 (Unaudited) 31 December 2022 (Audited)

----------------------------- ------------------------- ------------------------- ---------------------------

Prepayments 13 18 19

VAT receivable 11 11 70

----------------------------- ------------------------- ------------------------- ---------------------------

Trade and other receivables 24 29 89

----------------------------- ------------------------- ------------------------- ---------------------------

The fair value of trade and other receivables approximates their

carrying value.

9 Trade and other payables

30 June 2023 (Unaudited) 30 June 2022 (Unaudited) 31 December 2022 (Audited)

-------------------------- ------------------------- ------------------------- ---------------------------

Directors' fees payable - - 46

Other payables 56 89 113

-------------------------- ------------------------- ------------------------- ---------------------------

Trade and other payables 56 89 159

-------------------------- ------------------------- ------------------------- ---------------------------

The fair value of trade and other payables approximates their

carrying value.

10 Post Balance Sheet Events

As of 25 September 2023 Macquarie Capital, the Israel

Infrastructure Fund and Tiger Infrastructure Partners have merged

SWS Broadband and Cadence Networks with Voneus Broadband, and

simultaneously acquired Broadway Partners. The combined group will

be funded with up to GBP250 million in new capital from the three

shareholders and bank lenders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXFLFFDARIDFIV

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

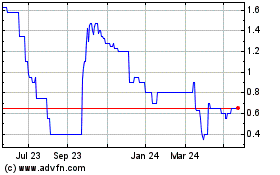

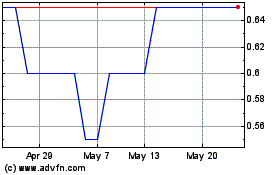

Global Connectivity (AQSE:GCON)

Historical Stock Chart

From Apr 2024 to May 2024

Global Connectivity (AQSE:GCON)

Historical Stock Chart

From May 2023 to May 2024