TIDMGWMO

RNS Number : 7091B

Great Western Mining Corp. plc

06 June 2023

GREAT WESTERN MINING CORPORATION PLC

("Great Western", "GWM" or the "Company")

Gold & Silver Processing Update

Great Western Mining Corporation PLC (AIM - GWMO, Euronext

Growth - 8GW), which is exploring and developing multiple

early-stage gold, silver and copper targets in Nevada, USA, is

pleased to provide an update on its Western Milling gold and silver

processing project.

Highlights

-- Concrete work ongoing. Process equipment at location

-- Special Use Permit now granted with NDEP approval expected August 2023

-- Guidance on plant capacity and anticipated recoveries

-- Independent calculations of material available for processing

-- First revenues expected this year

Background

In 2022 Great Western formed Western Milling LLC, a 50-50 joint

venture ('JV') with Nevada-based mining contractor Muletown

Enterprizes to construct a mill for processing precious metals.

Great Western's claims in the Walker Lane Trend of Nevada are not

only prospective for gold and silver but also have large volumes of

spoil and other material from historic mines, particularly at the

Mineral Jackpot and Olympic Gold properties, which are available

for processing into precious metals through this mill. The material

consists of tailings, multiple spoil heaps and a stockpile of mined

material which has never previously been processed, independently

evaluated. Further material is widely dispersed over Great

Western's 60km(2) of claims and has yet to be assessed, while the

JV may also buy in material from third parties. Phase one of the

project consists of gravity separation and phase two will use

contained chemical leaching for further recovery. The mill is

currently under construction and is due to be producing gold and

silver concentrates this year.

Joint Venture

Under the JV agreement, Muletown is providing a mill site on

private land, a large inventory of plant and equipment and

supervision of construction. Great Western is financing the

construction and commissioning of the mill and has the funds

available to meet this commitment.

The mill site is located adjacent to a major north-south highway

close to the settlement of Mina, Mineral County, Nevada,

approximately midway between Great Western's Mineral Jackpot and

Olympic Gold properties. Mains power and water are available and

there is ample space for the laydown of material awaiting process.

Each partner has its own raw material available for processing

which will be batch-processed and not commingled, except where the

JV itself decides to buy in third party material and process it

jointly. The JV will be a profit centre and earn a throughput fee

from whoever owns the material being processed.

Construction Status

Groundwork at the mill site commenced in February 2023 but

further progress was delayed by an extended late recurrence of

severe winter weather conditions. With improved conditions,

concrete is currently being set and should be completed in the next

few days. As well as initial gravity separation, the design of the

mill caters for the requirements of the leaching operation which is

planned as a second phase. When the concrete work has been

completed, the team will assemble and install the mill plant and

equipment. Virtually all the equipment needed is now available and

located close to the mill. A simplified flow diagramme of the plant

design has been uploaded to the Company's website under the

"Priorities / Production" section.

Permitting

The JV has been formally granted a 'Special Use Permit' for

establishment of the mill by the County Commissioners of Mineral

County, Nevada. A permit to produce gold and silver from the mill

has been filed with NDEP (Nevada Department for Environmental

Protection) and is expected to have completed all the approval

stages by August this year. Once approval for the gravity plant has

been secured, production operations will be permitted and the JV

will then lodge a further application with NDEP for approval of the

phase 2 contained chemical leaching plant, designed to enhance gold

and silver recovery.

Material

Great Western's feedstock of material to be processed at the

mill will initially come from the Mineral Jackpot group of claims

comprising five historic gold and silver mines and the 800-acre

Olympic Gold Project. The mill will be suitable for processing new

ore from shallow mining operations when available and the wider

area is rich in mining waste, some of which the JV will negotiate

to purchase at a later stage.

Prior to committing to the JV, Great Western commissioned an

independent resource report on a large tailings heap at Olympic

Gold, tailings being relatively easier to evaluate than spoil

heaps, and this resulted in a JORC-compliant Inferred Resource

based on the results of auger drilling carried out by the Company

in 2022. The report also provided JORC-compliant Exploration

Targets for multiple spoil heaps at Mineral Jackpot and a stockpile

at Olympic Gold. The results of the report can be found on the

Company's website under "News" in an RNS dated 9 November 2022. The

table below indicates the metal potentially available from

processing the assessed material, based on the volumes and grades

reported and announced, ranging from a low case to a high case. The

quantities below are expressed in Troy ounces ('oz') and the

Company estimates that it will be able to recover an aggregate 80%

of the reported quantities through a combination of the gravity

separation and leaching processes.

Au Metal Ag Metal

Low Case (oz) (oz)

Olympic Gold Tailings - Inferred Mineral

Resource 1,600 3,000

--------- ---------

Olympic Gold Tailings - Exploration Target

for underlying material 50 150

--------- ---------

Olympic Gold Stockpile - Exploration Target 300 600

--------- ---------

Mineral Jackpot Spoil Heaps - Exploration

Target 30 5,500

--------- ---------

Total 1,980 9,250

--------- ---------

Au Metal Ag Metal

High Case (oz) (oz)

Olympic Gold Tailings - Inferred Mineral

Resource 1,600 3,000

--------- ---------

Olympic Gold Tailings - Exploration Target

for underlying material 250 400

--------- ---------

Olympic Gold Stockpile - Exploration Target 900 1,900

--------- ---------

Mineral Jackpot Spoil Heaps - Exploration

Target 60 35,000

--------- ---------

Total 2,810 40,300

--------- ---------

Costs & Revenues

Plant capacity will be up to 5 tonnes per hour of feedstock but

there is likely to be an initial period of lower volumes before the

plant is running consistently. Plant capacity can subsequently be

increased in excess of 5 tonnes per hour when needed with only

minor investment and without a commensurate increase in operating

expense. The recoverable tailings at Olympic Gold alone are

estimated to be 31,000 tonnes.

The main operating costs at the mill are labour, power and

water. The plant will be manned by a minimum of two operatives, for

safety reasons, possibly supported by a third during busy periods.

The JV's aim will be to operate the mill for 70 or more hours per

week for plus or minus 48 weeks per year to allow for maintenance

and possible weather downtime. In the early stages there may be

downtime while the plant is fine-tuned or modified.

The mill's end-product will be a gold and silver concentrate

which will be sold in bulk to a refinery, with an expectation that

approximately 90% of the final gold and silver value will be

obtained.

Further information will be provided as the construction project

progresses.

Great Western Chairman Brian Hall commented: "At the end of 2020

we produced a doré bar from waste material collected at Mineral

Jackpot. Since then, we have established a working production

partnership, identified and evaluated greatly increased volumes of

material for processing, found an ideal site and are now

constructing a mill which will produce precious metals this year.

This is a transformational move and an exciting time for Great

Western, aimed at producing first revenues and funded directly by

shareholders without recourse to any special financing arrangements

which could have created a burden for the Company. In parallel we

have a busy season of exploration across our numerous prospects, on

which we will be reporting in due course".

For further information:

Great Western Mining Corporation PLC

Brian Hall, Chairman +44 207 933 8780

Max Williams, Finance Director +44 207 933 8780

Davy (NOMAD, Euronext Growth Listing

Sponsor & Joint Broker)

Brian Garrahy +353 1 679 6363

SP Angel Corporate Finance LLP (Joint

Broker)

Ewan Leggat/Harry Davies-Ball +44 203 470 0470

Walbrook PR (PR advisers)

Nick Rome +44 207 933 8783

Notes to Editors

The Company has a large tract of acreage in Mineral County,

Nevada. The area consists of rugged, mountainous terrain, which

means that large parts of it remain under-explored. Mineral

potential is hosted by the regional Walker Lane Structural Belt,

the largest structural and metallogenic belt in Nevada, yet one of

the least explored in recent times, with gold, silver and copper

currently produced in Mineral County. Great Western has seven

distinct concession areas which offer the potential for exploiting

(1) short term gold and silver deposits and (2) long-term,

world-class copper deposits.

Six of the Company's properties are in the west of Mineral

County and are 100% owned and operated. The Company has an option

to acquire a seventh property, the Olympic Gold Project, in the

east of the county. Great Western's small exploration team is

supported by locally based consultants and contractors.

The state of Nevada has recently been rated by the Fraser

Institute of Canada as the world's most mining friendly

jurisdiction. While tightly regulated and environmentally

conscious, Nevada welcomes the mining industry. Great Western takes

care to ensure that its claims are maintained in good standing and

all regulations observed.

There are numerous gold and silver prospects on the Company's

acreage, including extensive historic mine workings which offer the

opportunity for secondary recovery. The Company is party to a 50-50

joint venture known as Western Milling LLC which is constructing a

mill to process pre-mined material for secondary recovery of gold

and silver.

Furthermore, through extensive drilling over a five-year period,

GWM has established a Mineral Resource on its first target area

known as M2, of 4.3 million tonnes at 0.45% copper, for 19,000

tonnes of contained copper metal. This resource has been

independently reported in accordance with JORC guidelines.

GWM has established an Inferred Resource Estimate of 31,000

tonnes grading 1.6 g/t gold and 3.0 g/t silver in tailings for the

OMCO Mine at the Olympic Gold Project. It has also established

Exploration targets. In addition, the Company has reported an

Exploration Target as follows:

-- 3,400 - 6,400 tonnes grading between 0.5 and 1.2 g/t Au and

1.2 and 2.1 g/t Ag in the substrate beneath the tailings volume at

the Olympic Mine.

-- 9,000 - 12,000 tonnes grading between 0.9 and 2.4 g/t Au and

2.0 and 5.1 g/t Ag in a coarse stockpile at Olympic Mine.

-- 4,200 - 7,700 tonnes grading between 40 and 140 g/t Ag and

0.3 and 0.3 g/t Au in spoil heaps at Mineral Jackpot.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUVUNROOUNRAR

(END) Dow Jones Newswires

June 06, 2023 02:00 ET (06:00 GMT)

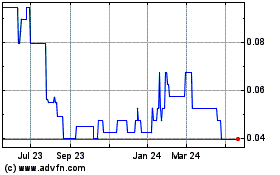

Great Western Mining (AQSE:GWMO.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

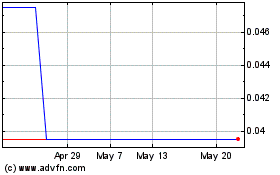

Great Western Mining (AQSE:GWMO.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024