TIDMINC

RNS Number : 2646O

Incanthera PLC

02 October 2023

Incanthera plc

("Incanthera" or the "Company")

FINAL RESULTS FOR THE YEARED 31 MARCH 2023

Incanthera plc (AQSE: INC), the specialist company focused on

innovative technologies in dermatology and oncology is pleased to

announce its audited final results for the year ended 31 March

2023.

Incanthera is dedicated to identifying and commercialising

inspirational therapeutics, combined with uniquely targeted

delivery technologies that show the potential to transform the

future of healthcare.

Highlights:

-- Commercial deal discussions concentrated towards conclusion

-- Refinement of dermatological product formula range

-- Infrastructure investment:

-- Final product formula range manufactured

-- Key commercial relationships established

-- Protection of valuable IP across global territories

Financial Highlights:

-- Financial performance for the year in line with the Board's expectations

-- Total group loss for the year: GBP1,372k (2022: GBP1,008k)

-- Operating expenses: GBP811k (2022: GBP937k)

-- Year-end cash position: GBP3k (2022: GBP295k)

-- Tight cost controls remain across a lean model

Post year end events:

On 5 April 2023, warrants issued in conjunction with the

fundraising on 31 March 2021, have been amended such that they now

expire on the 12 April 2024 and have an exercise price of 10p.

On 25 July 2023, 360,000 ordinary shares of 2p were issued at a

price of 6.95p per share to Dr Simon Ward, a Director, generating

proceeds of GBP32,000.

On 19 August 2023, the Immupharma warrants Subscription period

was extended by 12 months, to the 6 September 2024.

Simon Ward, Chief Executive Officer, commented:

"Our pursuit of the right global deal for our technologies, has

positively resulted in our formulation and delivery technologies

being greater than our original blueprint, through potential

product range, and therefore global market capacity.

Our formulators have refined and perfected our product range and

our virtual infrastructure has moved up several gears to

formulation sampling, production, branding and packaging. These are

critically strong components to securing the global potential

ahead.

I thank our team, and I want to show recognition of the faith

and belief shown by our loyal shareholders, as we look forward to

providing the market with further news."

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

For further enquiries:

Incanthera plc:

www.incanthera.com

+44 (0) 7831 675747

Tim McCarthy, Chairman

tim.mccarthy@incanthera.com

+44 (0) 7747 625506

Simon Ward, Chief Executive Officer simon.ward@incanthera.com

Suzanne Brocks, Head of Communications suzanne.brocks@incanthera.com +44 (0) 7776 234600

Aquis Exchange Corporate Adviser:

Cairn Financial Advisers LLP

Jo Turner / Liam Murray +44 (0) 20 7213 0880

Broker:

Stanford Capital Partners Ltd

Patrick Claridge / Tom Price / John Howes / Bob Pountney +44 (0) 20 3815 8880

Notes to Editors

Incanthera is dedicated to innovative technologies in

dermatology and oncology. It seeks to identify and commercialise

inspirational therapeutics combined with uniquely targeted delivery

systems, for innovative solutions to clinical, commercially

relevant unmet needs.

The Company's current focus is a range of dermatological

applications utilising its unique formulation and delivery

technologies to meet cosmetic and clinically unmet needs. This

range will include the Company's potentially innovative topical

product for the treatment of solar keratosis and the prevention of

skin cancers. The Company is currently focussed upon delivering

this range to a commercial partner.

Originating from the Institute of Cancer Therapeutics ("ICT") at

the University of Bradford, the Company has acquired and developed

a portfolio of specific cancer-targeting therapeutics, with a

strategy to develop each candidate from initial

acquisition/discovery to commercially valuable partnerships at the

earliest opportunity in its development pathway.

For more information on the Company please visit:

www.incanthera.com

@incantheraplc

Chairman's Statement

The year under review has been one of immensely focused work, as

we aim to conclude our commercialisation goals, as promised to

Shareholders.

The management team has been working with focused determination

towards the refinement and conclusion of a potential deal that will

bring our expertise to the commercial forefront, while our

formulation experts have worked with dedication to perfect our

specialist dermatological offering to meet the global stage.

Our Business

Incanthera's mission and purpose is to provide ever better

options for more targeted, holistic care utilising its portfolio of

targeted technologies, formulation expertise and delivery systems

that now transcends across dermatology and oncology.

The primary focus of our team remains the completion of our

combined formulation and delivery technology in a product that we

aim to be the subject of a commercial deal.

Our team and partnerships of highly skilled experts have worked

to produce formulation offerings to meet effective solutions to

target disease in areas demanding solutions, delivering products

that will uniquely address clinically and commercially unmet needs.

In refining that global market-ready product, we believe we can

address identified demand within a multi-billion-dollar market.

In support of that, we have continued to utilise our

in-laboratory facilities, whilst securing and building our

professional working relationships, to support our commercial

ambitions.

The team has worked to ensure financial controls are kept

tightly controlled through a lean business model, keeping operating

costs low as we continue to preserve our cash runway, while

ensuring protection of our valuable intellectual property across

global territories, which continues to be expertly applied and

reviewed.

We continue to work with the Institute of Cancer Therapeutics

('ICT') at the University of Bradford, whose excellence in

discovering innovative oncology IP continues to introduce exciting

new developmental technologies in the global fight towards treating

and defeating cancer. Incanthera's oncology portfolio is regularly

reviewed and evaluated for commercial opportunity and partnerships.

This reflects and honours both our heritage and our future.

Our advisers continue their invaluable support in this process

and we thank them for their contribution and enhancement of our

team's work.

Our team, as always, has performed with loyalty, dedication and

sacrifice throughout this year, as we all work to deliver the

essential news that will be transformative for our company.

Outlook

It has been an important, progressive year for Incanthera, in

which we have concentrated our expertise on our product offering,

evolved existing commercial opportunities and worked hard as a team

to progress our core business for the potential ahead of us.

I would like to thank the team. Their commitment and

resourcefulness have allowed our progression towards this pivotal

moment for ongoing success.

I would also like to thank our Shareholders for their loyalty,

support, and belief in our company.

Tim McCarthy

Chairman

30 September 2023

Chief Executive's Review

Overview of Progression

Our effort towards achieving the right global deal for our

technologies has matured the direction and ambition of everyone

involved, resulting in the potential for our formulation and

delivery technologies being greater than our original

blueprint.

We are very pleased with our various discussions to enter the

global markets for our unique formulation and delivery

expertise.

The long road to that point has been a test of everyone's faith

and patience, but the team has remained true to its promise and

commitment and I thank them for their resilience.

The Year in Review

The management team has matched energy and experience with an

ability to adapt and resolve along the road towards

commercialisation.

We remain resolutely firm in successfully concluding a deal in

the short term.

While the team is firmly focused forward, the great engine of

the team that makes our products the subject of such potential

continues to deliver.

Our formulators have refined and perfected our products to meet

the market demand for currently unmet dermatology indications.

Our virtual infrastructure has also improved across this period,

and we now have in place the personnel, facilities, and

relationships to produce formulation sampling, production, branding

and packaging.

These are critical components to securing the global potential

ahead of us and I thank the individuals involved for their

advancements this year.

Alongside all of this is the essential guidance of our teams of

advisers, whose invaluable input continues to steer and protect us

as we navigate the path towards success.

We also continue to work closely with the Institute of Cancer

Therapeutics (ICT), at The University of Bradford, with a peer

reviewed paper currently on track for publication.

The Team

I am so fortunate that the core of Incanthera is a small team of

like-minded, forward-thinking individuals who have committed to

seeing the vision we set out become reality, no matter the

challenges.

They have risen to meet them head on and their individual

skillsets and personalities are the forces that ensures we remain

aligned with out ambitions, maintain the Company and prioritise the

Company's delivery.

I thank them for their strength and passion in our business.

Summary

I wish to acknowledge the limited and extended duration between

news updates at the conclusion of this year's reporting.

The actuality reflects a substantial level of activity and

progress behind the scenes, resulting in notable improvements and

refinements across our operations. I am very proud of that and the

promise it holds for our future.

I want to show recognition of the faith and belief shown by our

loyal shareholders. This does not leave us, and we strive to

deliver in everything we achieve along this journey.

We look forward to reaching our end goals and rewarding our

shareholders, supporters, and the market with further news.

Dr. Simon Ward

Chief Executive Officer

30 September 2023

Financial Review

I am pleased to present our full year results for the year to 31

March 2023.

The year has been one of strict financial control in the face of

limited financial resources as we progress towards our first

commercial deal.

The financial performance for the year ended 31 March 2023 was

in line with expectations.

Lo sses

T h e total group loss for the year was GBP1,372k (31 March

2022: GBP1,008k) including a charge for share-based compensation of

GBP149k (2022: GBP148k). Operating expenses excluding share-based

compensation reduced to GBP811k (2022: GBP937k).

Sh ar e -b a sed c om pe n sa ti o n

Accounting standards require a charge to be made against the

grant of share options and recognised in the Consolidated Statement

of Comprehensive Income. This amounted to GBP149k (2022: GBP148k)

and has no impact on cash flows.

Hea dc o u nt

Average headcount of the Group for the year was eight (2022:

six).

T a x a t i o n

T h e G r oup has ele c t e d to c l aim r e s e a r ch a nd d

ev el o pme nt tax c r e dits u n d er the s m all or m e d i um e

n t e r pr ise r e s e a r ch a nd d ev el o pme nt sc h eme of

GBP75k ( 2 0 22: GBP77k ).

Cas h fl o ws and fi n ancial po si ti on

The cash position at 31 March 2023 decreased to GBP3k (31 March

2022: GBP295k). Expenditure on development costs and recurring

general and administrative costs were offset to some extent by the

receipt of the 2022 tax credit (GBP77k). There was no further

investment income during the year and the group remains in a

pre-revenue phase.

Div i d e n d s

No dividend is recommended (2022: nil) due to the early stage of

the development of the Group.

Lo ss P er Sh ar e

The basic and diluted loss per share was 1.18p (before

exceptional costs) (2022: 1.36p).

K e y pe r fo r ma n ce ind ica tors

Key Performance Indicators include a range of financial and

non-financial measures (such as development progress). Details

about the progress of our development programmes (non- financial

measures) are included elsewhere in this Strategic Report, and

below are the other indicators (financial measures) considered

pertinent to the business.

Laur a Br odgen

Chi e f Financ ial O f ficer

30 September 2023

Consolidated Statement of Comprehensive Income

for the year ended 31 March 2023

Operating expenses Year ended Year ended

31 March 2023 31 March 2022

GBP'000 GBP'000

Operating expenses (811) (937)

Share-based compensation (149) (148)

---------------------------------------------------------------------------------------- ------------- -------------

Total operating expenses (960) (1,085)

---------------------------------------------------------------------------------------- ------------- -------------

Operating loss (pre exceptional items) (960) (1,085)

---------------------------------------------------------------------------------------- ------------- -------------

Loss on ordinary activities before taxation (960) (1,085)

---------------------------------------------------------------------------------------- ------------- -------------

Exceptional costs

---------------------------------------------------------------------------------------- ------------- -------------

Costs of issue of shares to service providers (78) -

Impairment of Intellectual Property (409) -

---------------------------------------------------------------------------------------- ------------- -------------

Operating loss (post exceptional items) (1,447) (1,085)

---------------------------------------------------------------------------------------- ------------- -------------

Loss before taxation (1,447) (1,085)

Taxation 75 77

---------------------------------------------------------------------------------------- ------------- -------------

Loss and total comprehensive expense attributable to equity holders of the parent for

the

year (1,372) (1,008)

---------------------------------------------------------------------------------------- ------------- -------------

Loss per share attributable to equity holders of the parent (pence)

Basic loss per share (pence) (1.82) (1.36)

Diluted loss per share (pence) (1.82) (1.36)

Loss per share before exceptional costs (pence) (1.18) (1.36)

---------------------------------------------------------------------------------------- ------------- -------------

Consolidated and Company Statements of Financial Position

as at 31 March 2023

Gr oup C om pa ny

-------------------------------- -------------------------------

As a t A s at As a t As a t

3 1 March 3 1 M a r ch 3 1 March 3 1 March

2023 20 22 2023 2022

GBP ' 000 GBP ' 000 GBP ' 000 GBP ' 000

------------------------------------------------ ----------------- ------------- ----------------- ------------

A ssets

N o n-cu rrent assets

P r o p e r t y , pl a nt a nd eq u ip m e nt 1 2 - -

I n t a ngib l e a s s e ts 58 538 - -

I nv estme n t s in and loans to s u bs idi a

ries - - 241 6,254

------------------------------------------------- ----------------- ------------- ----------------- ------------

T ot a l non-cu rrent assets 59 540 241 6,254

C u rren t assets

T rad e a nd o the r r ec e i v ab les 62 118 4 31

C u r r e n t tax r ec e i v ab le 73 75 - -

Cash a nd c ash eq u i vale n t s 3 295 1 212

------------------------------------------------- ----------------- ------------- ----------------- ------------

T ot a l cu rrent assets 138 488 5 243

------------------------------------------------- ----------------- ------------- ----------------- ------------

T ot a l assets 197 1,028 246 6,497

------------------------------------------------- ----------------- ------------- ----------------- ------------

Li ab il i ti es a n d eq u i ty

C u rren t li ab il i ties

T rad e a nd o the r p a y ab les 280 196 77 34

------------------------------------------------- ----------------- ------------- ----------------- ------------

T ot a l cu rrent li ab il i ties 280 196 77 34

------------------------------------------------- ----------------- ------------- ----------------- ------------

Non-current Liabilities

Convertible loan 131 - - -

Total Liabilities 411 196 77 34

E q u i t y

O r d i n a r y s h a r e s 1,528 1,482 1,528 1,482

Sh a r e p r e m i u m 5,169 5,055 5,169 5,055

R eo r g a n i s ati o n r ese r v e 2,715 2,715 - -

Warrant reserve 1,129 1,054 543 468

Other reserves 19 - - -

Sh a r e b as ed c o m p en s a t i o n 259 185 259 185

R e t ain e d ( d e fi c i t ) / p r o fi t (11,033) (9,659) (7,330) ( 727 )

------------------------------------------------- ----------------- ------------- ----------------- ------------

T ot a l eq u i ty a t t r ibutable to eq u i ty

ho lders of t he pa rent (214) 832 169 6,463

------------------------------------------------- ----------------- ------------- ----------------- ------------

T ot a l li ab il i ties a nd eq u i ty 197 1,028 246 6,497

------------------------------------------------- ----------------- ------------- ----------------- ------------

As permitted by s408 of the Companies Act 2006, Incanthera Plc

has not presented its own income statement. The loss for the

financial year within the financial statements of the parent

company was GBP6,603k, operating loss GBP311k (2022: GBP339k).

Consolidated Statement of Changes in Equity

for the year ended 31 March 2023

Ordinary shares Share Reorganisation Warrant Other Share based Retained Total

GBP'000 premium reserve reserveGBP'000s reservesGBP'000s compensation deficit

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ --------------- ------- -------------- --------------- ---------------- ------------ ----------- --------

Bala n ce a

t 31 M a

rch 2 0 21 1,482 5,055 2,715 1,054 - 37 (8,651) 1,691

------------ --------------- ------- -------------- --------------- ---------------- ------------ ----------- --------

T o t a l c

omp r ehens

i v e e xp

ense f or

the p e r i

od - - - - - - (1,008) (1,008)

T ra ns a c

tio n s wit

h o w n ers

Sh a r e b

as ed c om

p en s ati

o n - s h a

re o p t i

o ns - - - - - 148 - 148

T ot a l t

ra ns a c

tio ns with

o w n ers - - - - - 148 - 148

------------ --------------- ------- -------------- --------------- ---------------- ------------ ----------- --------

Bala n ce a

t 31 M a

rch 2 0 22 1,482 5,055 2,715 1,054 - 185 (9,659) 832

------------ --------------- ------- -------------- --------------- ---------------- ------------ ----------- --------

T o t a l c

omp r ehens

i v e e xp

ense f or

the p e r i

od - - - - - - (1,372) (1,372)

T ra ns a c

tio n s wit

h o w n ers

Equity

component

on

convertible

loan notes - - - - 19 - - 19

Share issue

Advisor

agreements 46 114 - - - - - 160

Sh a r e b

as ed c om

p en s ati

o n - s h a

re o p t i

o ns - - - 75 - 74 - 149

T ot a l t

ra ns a c

tio ns with

o w n ers 46 114 - 75 19 74 - 328

------------ --------------- ------- -------------- --------------- ---------------- ------------ ----------- --------

Bala n ce a

t 31 M a

rch 2 0 23 1,528 5,169 2,715 1,129 19 259 (11,033) (214)

------------ --------------- ------- -------------- --------------- ---------------- ------------ ----------- --------

Consolidated and Company Statements of Cash Flows

For the year ended 31 March 2023

Gr oup C om pa ny

-------------------------------------------- ----------------------------- ---------------------------------

Y ear Y ear Y ear Y ear

--------------------------------------------

E nded en ded e nded en ded

3 1 March 3 1 M a 3 1 March 3 1 M a

r ch r ch

2023 20 22 2023 20 22

GBP ' GBP ' 000 GBP ' GBP ' 000

000 000

-------------------------------------------- -------------- ------------- ------------------- ------------

Cas h fl o ws fr om ope r a ting a c

t i v i ties

L o s s b e f o re ta x ati on (1,447) (1,085) ( 6,603) ( 339)

D ep r eci ati o n a nd a m o r t i s

a t i on 71 118 - -

Impairment 409 - 6,400

Sh a r e b as ed c o m p en s a t i o

n 149 148 149 148

-------------------------------------------- -------------- ------------- ------------------- ------------

(818) (819) (54) ( 191 )

Chang es i n w or k ing capit al

( I nc r e as e ) / dec r e as e i n

t rade a nd o ther r ec e i v ab les 56 18 (360) (481)

I nc r e as e / ( dec r e as e ) i n

t rade a nd o ther p a y ab les 234 31 43 (26)

Cas h used i n ope r a tio ns 290 49 (371) (507)

T a x ati o n r ec e i v e d 75 110 - -

N et cash used in ope r a ting a c t

i v i ties (453) (660) (371) (698)

-------------------------------------------- -------------- ------------- ------------------- ------------

Cash flows (used in)/generated from

investing activities

Acquisition of tangible fixed assets - (2) - -

-------------------------------------------- -------------- ------------- ------------------- ------------

Net cash (used in)/generated from investing

activities - (2) - -

Cas h fl o ws fr om fina ncing a c t

i v i ties

P r o ceed s f r o m i s s ue of s h

a r es 160 - 160 -

Is s u e c os ts - - - -

-------------------------------------------- -------------- ------------- ------------------- ------------

N et cash g e n e r a ted fr om fina

ncing a c t i v i ties 160 - 160 -

-------------------------------------------- -------------- ------------- ------------------- ------------

M o v e m en ts in cash a nd cash eq

u i v a lents in t he pe ri od (292) (662) (211) (698)

-------------------------------------------- -------------- ------------- ------------------- ------------

Cash a nd c ash eq u i vale n t s at

s t a rt of p e r i od 295 957 212 910

-------------------------------------------- -------------- ------------- ------------------- ------------

Cas h a n d cash eq u i v a lents at

end of pe ri od 3 295 1 212

-------------------------------------------- -------------- ------------- ------------------- ------------

Notes to the Financial Statements

1. Basis of Preparation

The consolidated financial statements have been prepared in

accordance with UK adopted International Financial Accounting

Standards ('IFRS'), IFRIC interpretations and the Companies Act

2006 applicable to companies operating under IFRS.

The consolidated financial statements are presented in Sterling

(GBP) and rounded to the nearest GBP000. This is the predominant

functional currency of the Group and is the currency of the primary

economic environment in which it operates. Foreign transactions are

accounted in accordance with the policies set out below.

2. B a sis o f c o nsol i d a ti on

The financial statements incorporate the financial statements of

the Company and entities controlled by the Company. Control is

achieved when the Company has the power over the investee; is

exposed, or has rights, to variable return from its involvement

with the investee; and, has the ability to use its power to affect

its returns. The Company reassesses whether it controls an investee

if facts and circumstances indicate that there are changes to one

or more of the three elements of control listed above.

Consolidation of a subsidiary begins when the Company obtains

control over the subsidiary and ceases when the Company loses

control of the subsidiary. Specifically, the results of

subsidiaries acquired or disposed of during the period are included

in the Consolidated Statement of Comprehensive Income from the date

the Company gains control until the date when the Company ceases to

control the subsidiary.

Where necessary, adjustments are made to the financial

statements of subsidiaries to bring the accounting policies used

into line with the Group's accounting policies.

All intra-Group assets and liabilities, equity, income, expenses

and cash flows relating to transactions between the members of the

Group are eliminated on consolidation.

3. Going concern

As part of their going concern review the directors have

prepared detailed financial forecasts and cash flows looking beyond

12 months from the date of the approval of these financial

statements. In preparing these forecasts, the Directors have made

certain assumptions based upon their view of the current and future

economic conditions that will prevail over the forecast period.

Whilst the global economic environment continues to be

turbulent, the impact on the Group is not considered to be

substantial and the assumptions used in the forecasts are not

dependent on revenues but focused on controlled, considered spend

to meet its development and commercial objectives.

The Directors are aware of the risks and uncertainties facing

the business and the assumptions used in the forecasts are the

Directors' best estimate of the future development of the

business.

At 31 March 2023, the group had cash and cash equivalents of

GBP3k. The directors acknowledge there is a material

uncertainty.

The directors and senior management continue to be fully

supportive of the group and are mindful that cash liquidity is a

constrain, they are validating their support by deferring their

salaries for at least twelve (12) months from the date of this

report. Directors are also confirming they will not demand a

repayment of directors' loan until the business becomes

economically viable. The team is also prepared to support by

providing additional funding as when needed for the group &

companies to meet its liabilities when they fall due.

The Directors have also obtained confirmation from the loan note

holder that is their firm intention to convert.

Although the Directors are confident of entering into commercial

deal(s) in the next 12 months which will generate revenues, there

is no assumption in the forecasts of revenue income. The Directors

continue to closely control expenditure, and should the company

require additional funding prior to the receipt of revenues, then

appropriate measures will be taken, which could include a

fundraise. For these reasons, the Directors continue to adopt the

going concern basis of accounting in preparing the annual financial

statements. The financial statements do not include any adjustments

that would result from the going concern basis of preparation being

inappropriate.

Independent auditor's report to the members of Incanthera

PLC

Qualified Opinion

We have audited the financial statements of Incanthera PLC (the

'parent company') and its subsidiaries (the 'group') for the year

ended 31 March 2023 which comprise the consolidated statement of

comprehensive income, consolidated statement of financial position,

consolidated statement of changes in equity, company statement of

changes in equity, company statement of financial position,

consolidated statement of cash flows, company statement of cash

flows and notes to the financial statements, including a summary of

significant accounting policies. The financial reporting framework

that has been applied in the preparation of the group financial

statements is applicable law and UK International Financial

Reporting Standards (IFRSs). The financial reporting framework that

has been applied in the preparation of the parent company financial

statements is applicable law and UK International Financial

Reporting Standards (IFRSs), as applied in accordance with the

provision of the Companies House Act 2006.

In our opinion, except for the possible effects of the matter

described in the basis for qualified opinion section of our

report:

-- the financial statements give a true and fair view of the

state of the group's and of the parent company's affairs as at 31

March 2023 and of the group's loss for the year then ended;

-- the group financial statements have been properly prepared in

accordance with IFRSs as adopted by the United Kingdom;

-- the parent company financial statements have been properly

prepared in accordance with IFRSs as adopted by the United Kingdom

as applied in accordance with the provisions of the Companies Act

2006; and

-- the financial statements have been prepared in accordance

with the requirements of the Companies Act 2006.

Basis for qualified opinion

As explained in note 3, whilst the directors have prepared the

financial statements on the going concern basis, there are material

uncertainties which may cast significant doubt over the group and

parent company's ability to continue as a going concern. Our

evaluation of the directors' assessment of the group and parent

company's ability to continue to adopt the going concern basis of

accounting included a detailed review of the Group's forecasts in

comparison to available management accounts at the date of these

financial statements to assess the reasonability of the estimates

made. We were unable to obtain sufficient evidence to support the

directors' representations about the proposed future actions

described in note 2 to provide funding or support to the group.

Consequently, we are unable to confirm whether the going concern

basis of preparation is appropriate. In addition if the going

concern basis of preparation was inappropriate, the strategic

report would also need to be amended.

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the company

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard as applied to listed entities, and we have

fulfilled our other ethical responsibilities in accordance with

these requirements. We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our

qualified opinion.

4. Loss Per Share

Basic loss per share is calculated by dividing the loss for the

period attributable to equity holders by the weighted average

number of ordinary shares outstanding during the year.

For diluted loss per share, the loss for the year attributable

to equity holders and the weighted average number of ordinary

shares outstanding during the year is adjusted to assume conversion

of all dilutive potential ordinary shares.

As at 31 March 2023, the Group had 32,219,684 (2022: 25,966,380)

share options, warrants and subscriptions outstanding which are

potentially dilutive.

T h e c a lc u l at ion o f the G r ou p 's b a s ic a nd d il u

t ed loss p er s h a re is b a s ed on the f o l l o w i ng d a t

a:

As at As at

Year ended Year ended

31 March 31 March

2023 2022

GBP'000 GBP'000

L o s s f or the y e ar att ribu t ab le to

eq ui ty hold e rs f or b asic l o ss a nd

ad j us t ed f or the eff e c ts of d il u

ti on (1,372) (1,008)

L o s s f or the y e ar att ribu t ab le to

eq ui ty hold e rs f or b asic l o ss a nd

ad j us t ed f or the eff e c ts of d il u

ti on (excl. Exceptional Costs) (885) (1,008)

As at As at

Year ended Year ended

31 March 31 March

2023 2022

GBP'000 GBP'000

Weighted average number of ordinary shares

for basic loss per share 75,211,874 74,082,871

Effects of dilution:

Share options - -

Weighted average number of ordinary shares

adjusted for the effects of dilution 75,211,874 74,082,871

As at As at

Year ended Year ended

31 March 31 March

2023 2022

Pence Pence

Loss per share - basic and diluted (1.82) (1.36)

Loss per share - before exceptional costs (1.18) (1.36)

The loss and the weighted average number of ordinary shares for

the years ended 31 March 2022 and 2023 used for calculating the

diluted loss per share are identical to those for the basic loss

per share. This is because the outstanding share options would have

the effect of reducing the loss per ordinary share and would

therefore not be dilutive under the terms of International

Accounting Standard ('IAS') No 33.

4. Dividend

No dividend is recommended (2022: nil) due to the early stage of

the development of the business.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXZZMGGRMKGFZM

(END) Dow Jones Newswires

October 02, 2023 02:00 ET (06:00 GMT)

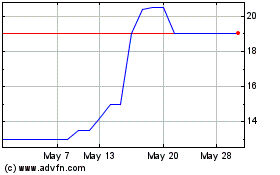

Incanthera (AQSE:INC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Incanthera (AQSE:INC)

Historical Stock Chart

From Dec 2023 to Dec 2024