TIDMPXS

RNS Number : 4030N

Provexis PLC

29 January 2021

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

29 January 2021

Provexis plc

UNAUDITED INTERIM RESULTS FOR SIX MONTHS TO 30 SEPTEMBER

2020

Provexis plc ("Provexis" or the "Company"), the business that

develops, licenses and sells the proprietary, scientifically-proven

Fruitflow(R) heart-health functional food ingredient, announces its

unaudited interim results for the six months ended 30 September

2020.

Highlights

-- Total revenue for the period of GBP237k, 7% ahead of the

prior year (2019: GBP222k) and an all-time high in the first half

of the year for the Fruitflow business.

-- Planned launch by By-Health, a circa GBP4bn listed Chinese

dietary supplement business, of a number of Fruitflow based

products in the Chinese market is progressing well. Potential sales

volumes remain at a significant multiple of existing Fruitflow

sales.

-- By-Health has made a significant investment in nine separate

studies in China, at its sole expense, in support of the Fruitflow

based products which it plans to launch in China. Studies conducted

in China are needed to obtain 'blue cap' health claim status for

dietary supplements, as required by the Chinese State

Administration for Market Regulation (SAMR).

-- The five studies which have been completed by By-Health

showed excellent results in use for Fruitflow, and provide strong

evidence for By-Health in its regulatory submissions for Fruitflow.

If a successful blue cap health claim is achieved it would be

expected to result in some significant orders for Fruitflow,

potentially at a multiple of Fruitflow's existing annual sales.

-- Exclusive Distribution Agreement for Fruitflow+ Omega-3 in

China through the Chinese Cross-Border e-commerce channel ('CBEC')

secured in November 2020, first test order has been placed.

-- Company and its commercial partner DSM have experienced

increased consumer interest for Fruitflow in recent months in light

of the COVID-19 pandemic, as consumers look to nutritional

interventions to help them fortify the circulatory system against

the effects of COVID-19.

-- Fruitflow recognised in a further three published scientific

journals, two of them in the context of COVID-19; the Frontiers in

Nutrition journal stated that nutraceuticals such as Fruitflow may

serve as a 'safe antiplatelet prophylactic treatment for those at

high risk of COVID-19.'

-- GBP1.0 million placing completed in December 2019,

significantly strengthening the Company's capital base and

de-risking the business. The funds raised will provide the Company

with additional working capital to support its international growth

plans; a new production run for Fruitflow+ Omega-3 is now in the

process of being commissioned.

-- Purchase of background and joint foreground Oslo blood

pressure lowering IP in August 2020, for a total consideration of

11.5m new ordinary shares in Provexis, giving the Company full

ownership of its four key patent families for Fruitflow.

-- Underlying operating loss* reduced to GBP95k, 24% lower than

the prior year (2019: GBP126k) and a record low for the Group in

the first half of the year.

-- Cash balance of GBP156k at 30 September 2020 (2019: GBP173k).

The Company raised GBP1.0m from a placing in December 2020 with new

and existing investors at 0.75p per new ordinary share.

*before share based payments of GBP107k (2019: GBP39k), as set

out on the face of the Consolidated Statement of Comprehensive

Income.

Provexis Chairman Dawson Buck and CEO Ian Ford commented:

'The Company is pleased to report on another strong period of

progress.

The publication of two review articles for Fruitflow in recent

months focussing on COVID-19, and the publication of a third

article referencing Fruitflow, gut microbiota and their effects on

hypertension and human blood platelet function, represent

significant opportunities for the Company and DSM to promote

Fruitflow further across scientific, trade customer and consumer

channels.

The COVID-19 virus is having a significant adverse effect on

circulation in many patients, and it is causing wider issues with

inflammation. Fruitflow is a natural, breakthrough ingredient that

helps with platelet aggregation, supporting normal blood flow and

circulation. The Company and its commercial partner DSM have

experienced increased consumer interest for Fruitflow in light of

the pandemic, and are seeking to maximise the resulting commercial

opportunities to the benefit of consumers worldwide.

The Company has developed a strong, long lasting and

wide-ranging patent portfolio for Fruitflow, and it holds other

valuable intellectual property and trade secrets for the

technology. The intellectual property for Fruitflow is of

fundamental importance to the Company and its current and future

commercial partners, and the Company was delighted to have secured

outright ownership of the important blood pressure lowering patent

family in August last year. A number of important patents have been

secured for Fruitflow in recent months, as more fully detailed in

this interim report.

The Fruitflow DSM Alliance has made a strong start to the second

half of the 2020/21 financial year, with third quarter revenues to

31 December 2020 expected to be well ahead of the comparative

quarter in 2019/20.

The Company's Fruitflow+ Omega-3 dietary supplement business has

seen continued growth in its subscriber base, with subscriber

numbers on the www.fruitflowplus.com website now standing at a new

all-time high level. The Company is seeking to expand its

commercial activities with Fruitflow+ Omega-3, and a further new

production run for Fruitflow+ Omega-3 capsules is in the process of

being commissioned.

The Company's distribution agreement with a company which will

act as the distributor for Fruitflow+ Omega-3 in China through the

Chinese CBEC channel has made a good start, with a first test order

now having been placed by the distributor and shipped to China.

The planned launch by By-Health, a circa GBP4bn listed Chinese

dietary supplement business, of a number of Fruitflow based

products in the Chinese market is progressing well with potential

sales volumes remaining at a significant multiple of existing

Fruitflow sales. The collaboration agreement which the Company has

with By-Health, in support of By-Health's planned launch of

Fruitflow based products in the Chinese market, further strengthens

the close relationship between By-Health and Provexis.

The Board was delighted to announce a GBP1.0 million placing in

December 2020, with the funds raised helping to provide the Company

with additional working capital to support its international growth

plans. The placing has significantly strengthened the Company's

capital base and de-risked the business to the benefit of all

shareholders.

The Company would like to thank its customers and shareholders

for their continued support, and the Board remains positive about

the outlook for Fruitflow and the Provexis business for the second

half of the financial year and beyond.'

For further information please contact:

Provexis plc Tel: 07490 391888

Ian Ford, CEO enquiries@provexis.com

Dawson Buck, Non-executive Chairman

Allenby Capital Limited (Nominated Tel: 020 3328 5656

Adviser and Broker)

Nick Naylor / Liz Kirchner (Corporate

Finance)

Matt Butlin (Sales and Corporate Broking)

Chairman and CEO's statement

The Company has had a very active first six months of the year,

seeking to enhance further the commercial prospects of its

innovative, patented Fruitflow(R) heart-health ingredient.

The Company's Alliance partner DSM Nutritional Products ('DSM')

has continued to develop the market for Fruitflow in all global

markets. More than 90 regional consumer healthcare brands have now

been launched by direct customers of DSM, and a number of further

regional brands have been launched through DSM's distributor

channels.

The Company and DSM have experienced increased consumer interest

for Fruitflow in recent months in light of the COVID-19 pandemic,

as consumers have looked to nutritional interventions to help them

fortify the circulatory system against the effects of COVID-19. An

increasing number of further commercial projects have been

initiated with prospective customers, including some prospective

customers which are part of global businesses.

The Company continues to work closely with DSM, seeking to

support various prospective customers globally with their

commercialisation plans for Fruitflow, and the total projected

annual sales value of the prospective sales pipeline for Fruitflow

continues to stand at a substantial multiple of existing annual

sales.

Revenues for the half year were GBP237k (2019: GBP222k), an

increase of 7% relative to the prior year.

Underlying operating loss for the half year was reduced to

GBP95k, 24% lower than the prior year (2019: GBP126k) and a record

low for the Group in the first half of the year.

Scientific journal publications

1. In September 2020 Fruitflow was recognised in a review

article by the Frontiers in Nutrition journal

www.frontiersin.org/articles/10.3389/fnut.2020.583080/full which

stated that nutraceuticals such as Fruitflow may serve as:

'A safe antiplatelet prophylactic treatment for those at high

risk of COVID-19 who may also be at increased risk of thrombotic

complications and an alternative to pharmacological compounds that

may cause greater risk of bleeding.'

2. In January 2021 a review article was published by the

influential journal Medical Hypotheses, a leading peer-reviewed

journal which advances new discussion and innovation in medical

treatments.

The article

www.sciencedirect.com/science/article/pii/S0306987720333715, titled

'Platelet hyperactivity in COVID-19: Can the tomato extract

Fruitflow(R) be used as an antiplatelet regime?' was written by

Professor Asim K Duttaroy, who was the original inventor of

Fruitflow, and Dr Niamh O'Kennedy, Provexis plc's Chief Scientific

Officer.

3. In January 2021 a further review article was published in the

MDPI journal Nutrients www.mdpi.com/2072-6643/13/1/144/htm.

The article, titled the 'Role of Gut Microbiota and Their

Metabolites on Atherosclerosis, Hypertension and Human Blood

Platelet Function' was written by Professor Asim K Duttaroy and it

noted that emerging data suggest a strong relationship between

microbiota-derived compounds and an increased risk of CVD, with

widely accumulated data also indicating that Fruitflow may be

useful in the primary prevention of CVD. The article concluded that

there is a 'strong possibility of finding new approaches to treat

or prevent CVD' with further scientific work required seeking to

develop novel preventative or therapeutic regimes.

The publication of these three review articles is a significant

opportunity for the Company and DSM to promote Fruitflow further

across scientific, trade customer and consumer channels.

By-Health Co., Ltd.

The Company has previously announced it was working with DSM and

By-Health Co., Ltd. ('By-Health'), a listed Chinese dietary

supplement business valued at approximately GBP4bn, to support the

planned launch of a number of Fruitflow based products in the

Chinese market.

The planned launch of a number of Fruitflow based products in

the Chinese market, with potential volumes at a significant

multiple of existing Fruitflow sales, is progressing well, with

activities driven at present by the need to obtain 'blue cap'

health claim status for Fruitflow as a dietary supplement with the

State Administration for Market Regulation (SAMR), a new Chinese

market regulator which has taken over the responsibilities of the

former China Food and Drug Administration (CFDA).

Clinical studies conducted in China are typically required to

obtain blue cap health claim status, and a significant investment

in nine separate studies, in support of the Fruitflow based

products which By-Health plans to launch in China, is being

undertaken at By-Health's expense.

Five studies have been successfully completed in China, one

clinical study and one animal study are currently ongoing and a

further planned two human studies have recently been confirmed by

By-Health. The COVID-19 pandemic has caused some delays to the

ongoing and planned studies, with By-Health seeking to keep these

delays to a minimum.

The five completed studies showed excellent results in use for

Fruitflow, and they provide strong evidence for By-Health in its

blue cap and other regulatory submissions to the SAMR for

Fruitflow, supported by the Company's existing European Food Safety

Authority ('EFSA') health claim for Fruitflow.

If a successful blue cap health claim is achieved for Fruitflow

it would currently be expected to result in some significant orders

for the product, potentially at a multiple of current total sales

values. The Company will provide shareholders with as much

information as it can on the timing of this highly commercially

sensitive and potentially transformative process, subject to the

multi-party confidentiality arrangements which surround the

process.

There are more than 230m people in China who are currently

thought to have cardiovascular disease, and a significant increase

in cardiovascular events is expected in China over the course of

the next decade based on population aging and growth alone (source:

World Health Organisation - Cardiovascular diseases, China). China

is now the world's second-largest pharmaceuticals market, measured

by how much patients and the state spend on drugs (source:

health-care information company IQVIA). The Company believes that

Fruitflow has the potential to play an important role in the

Chinese cardiovascular health market.

Fruitflow+ dietary supplement products

Fruitflow+ Omega-3 is available to purchase from the Company's

subscription focussed e-commerce website www.fruitflowplus.com,

Amazon UK and Holland & Barrett.

In November 2020 the Company announced it had entered into a

distribution agreement with a company which is now acting as the

distributor for Fruitflow+ Omega-3 in China, exclusively through

the Chinese Cross-Border e-commerce ('CBEC') channel. A first test

order has been placed by the distributor and shipped to China.

The distribution agreement in China is separate but wholly

complementary to the Company's work with By-Health, with the CBEC

regulations enabling the distributor to sell Fruitflow+ Omega-3 in

China now, prior to the blue cap health claim which By-Health is

seeking to secure.

Fruitflow+ Omega-3 has a social media presence on Facebook

www.facebook.com/FruitflowPlus, Instagram

www.instagram.com/fruitflowplus and Twitter

https://twitter.com/FruitflowPlus, and the Company was pleased to

support Brentford FC in January 2021 as their Emirates FA Cup

Fourth Round tie sleeve sponsor.

The Company believes that Fruitflow has an important role to

play in women's cardiovascular health, and there is a dedicated

section of its consumer website addressing this topic at

www.fruitflowplus.com/womens-health.

A Fruitflow App is also being developed, primarily for use on

mobile device platforms.

Further interest in the role of Fruitflow in exercise has been

generated by pro cycling Team DSM (formerly Team Sunweb)'s use of

Fruitflow in the Tour de France. The benefits that Fruitflow can

provide for athletes in terms of improved recovery are set out in

more detail on the website at

www.fruitflowplus.com/sportrecovery.

The Company continues to work on a potential Fruitflow+ nitrates

product which would be supported by the Company's strong patent

position in this area, with the involvement now of third party

manufacturers and with some interest already generated from brand

owners. The product will have anti-inflammatory and circulation

benefits for athletes seeking to recover after exercise, properties

which would also be potentially beneficial to a wide range of other

consumers to include people who are less active and people who

suffering from the symptoms of basic ageing.

The Company's Fruitflow+ Omega-3 direct selling business has

been operating largely as normal throughout the COVID-19 pandemic,

and despite some initial delays in the supply chain a new

production run of Fruitflow+ Omega-3 capsules was completed in July

2020 thus ensuring continued supply of the product. A further new

production run for Fruitflow+ Omega-3 capsules is in the process of

being commissioned.

Subscriber numbers on the www.fruitflowplus.com website have

been growing steadily, and currently stand at a further new

all-time high level.

The Company is seeking to expand further its commercial

activities with Fruitflow+ Omega-3 and other Fruitflow+ combination

products, and it is currently in dialogue with some other potential

international direct selling customers.

Intellectual property

The Company is responsible for filing and maintaining patents

and trade marks for Fruitflow as part of the Alliance Agreement

with DSM, and patent coverage for Fruitflow now includes the

following patent families:

Patent family Developments in the period from

Sep-20 to Jan-21

Improved Fruitflow / Fruit Extracts

Improved Fruitflow / Fruit Extracts, A second European patent has been

with patents granted by the European secured (previously referred to

Patent Office in January 2017 and as proceeding to grant) and national

September 2020. protection has been secured in

major European states.

The patent has been granted in eight

other major territories to include Patent applications are proceeding

China; patent applications are proceeding to grant in the US, South Korea

to grant in the US and two further and Hong Kong.

territories; and applications are

at a late stage of progression in

a further six global territories,

with potential patent protection

out to November 2029.

--------------------------------------------

Antihypertensive (blood pressure

lowering) effects US patent protection has been secured

This patent was originally developed for Fruitflow as an antihypertensive

in collaboration with the University (blood pressure lowering) agent.

of Oslo, and it has now been granted

for Fruitflow in Europe, the US

and two other major territories.

Patent applications are being progressed

in a further five major territories

to include the US and China, with

potential patent protection out

to April 2033.

In August 2020 the Company announced

it had agreed to purchase the background

and joint foreground blood pressure

lowering IP owned by Inven2 AS,

the technology transfer office at

the University of Oslo, and Provexis

now owns these important patents

outright, with the licensing option

originally held by Inven2 having

been cancelled.

--------------------------------------------

Fruitflow with nitrates in mitigating

exercise-induced inflammation and

for promoting recovery from intense

exercise Patents have been secured (previously

Patents have been granted around referred to as proceeding to grant)

Europe and in the US, Australia, in the US and also Europe, with

Brazil, China, the Philippines, national protection also secured

New Zealand and Japan. Applications in major European states.

have been accepted for grant in Patent protection has also been

Japan (a further patent), South secured in Brazil and patent applications

Korea, Israel and Hong Kong, and are now also proceeding to grant

further patent protection is being in Japan, South Korea, Israel and

sought in seven territories, with Hong Kong.

potential patent protection out

to December 2033.

--------------------------------------------

Fruitflow for air pollution

The use of Fruitflow in protecting US patent protection has been secured

against the adverse effects of air covering the use of Fruitflow in

pollution on the body's cardiovascular protecting subjects who have certain

system. medical conditions and who have

been exposed to air pollution.

Recent laboratory work has shown

that Fruitflow can reduce the platelet

activation caused by airborne particulate

matter, such as that from diesel

emissions, by approximately one

third.

A US application has proceeded to

grant and there are pending applications

in 16 jurisdictions (including the

US where a further application has

been filed) which extends potential

patent protection for Fruitflow

out to November 2037.

--------------------------------------------

Research and development costs for the half year were GBP135k

(2019: GBP134k), reflecting continued investment in the Company's

extensive intellectual property portfolio for Fruitflow, which is

of fundamental importance to the Company and its current and future

commercial partners.

Capital structure and funding

On 17 December 2020 the Group announced it had raised proceeds

of GBP1.0 million via the placing of 133,333,349 ordinary shares of

0.1p each at a gross 0.75p per share with investors, with no

commissions payable. The placing shares were admitted to trading on

AIM on 23 December 2020.

Outlook

The Company is pleased to report on another strong period of

progress.

The publication of two review articles for Fruitflow in recent

months focussing on COVID-19, and the publication of a third

article referencing Fruitflow, gut microbiota and their effects on

hypertension and human blood platelet function, represent

significant opportunities for the Company and DSM to promote

Fruitflow further across scientific, trade customer and consumer

channels.

The COVID-19 virus is having a significant adverse effect on

circulation in many patients, and it is causing wider issues with

inflammation. Fruitflow is a natural, breakthrough ingredient that

helps with platelet aggregation, supporting normal blood flow and

circulation. The Company and its commercial partner DSM have

experienced increased consumer interest for Fruitflow in light of

the pandemic, and are seeking to maximise the resulting commercial

opportunities to the benefit of consumers worldwide.

The Company has developed a strong, long lasting and

wide-ranging patent portfolio for Fruitflow, and it holds other

valuable intellectual property and trade secrets for the

technology. The intellectual property for Fruitflow is of

fundamental importance to the Company and its current and future

commercial partners, and the Company was delighted to have secured

outright ownership of the important blood pressure lowering patent

family in August last year. A number of important patents have been

secured for Fruitflow in recent months, as more fully detailed in

this interim report.

The Fruitflow DSM Alliance has made a strong start to the second

half of the 2020/21 financial year, with third quarter revenues to

31 December 2020 expected to be well ahead of the comparative

quarter in 2019/20.

The Company's Fruitflow+ Omega-3 dietary supplement business has

seen continued growth in its subscriber base, with subscriber

numbers on the www.fruitflowplus.com website now standing at a new

all-time high level. The Company is seeking to expand its

commercial activities with Fruitflow+ Omega-3, and a further new

production run for Fruitflow+ Omega-3 capsules is in the process of

being commissioned.

The Company's distribution agreement with a company which will

act as the distributor for Fruitflow+ Omega-3 in China through the

Chinese CBEC channel has made a good start, with a first test order

now having been placed by the distributor and shipped to China.

The planned launch by By-Health, a circa GBP4bn listed Chinese

dietary supplement business, of a number of Fruitflow based

products in the Chinese market is progressing well with potential

sales volumes remaining at a significant multiple of existing

Fruitflow sales. The collaboration agreement which the Company has

with By-Health, in support of By-Health's planned launch of

Fruitflow based products in the Chinese market, further strengthens

the close relationship between By-Health and Provexis.

The Board was delighted to announce a GBP1.0 million placing in

December 2020, with the funds raised helping to provide the Company

with additional working capital to support its international growth

plans. The placing has significantly strengthened the Company's

capital base and de-risked the business to the benefit of all

shareholders.

The Company would like to thank its customers and shareholders

for their continued support, and the Board remains positive about

the outlook for Fruitflow and the Provexis business for the second

half of the financial year and beyond.

Dawson Buck Ian Ford

Chairman CEO

Consolidated statement of comprehensive

income Unaudited Unaudited Audited

Six months ended 30 September 2020 six months six months year

ended ended ended

30 September 30 September 31 March

2020 2019 2020

GBP GBP GBP

Notes

----------------------------------------- ------ ------------- ------------- ----------

Revenue 237,075 222,262 347,937

Cost of goods (20,728) (19,733) (35,782)

----------------------------------------- ------ ------------- ------------- ----------

Gross profit 216,347 202,529 312,155

Selling and distribution costs (22,956) (19,527) (40,656)

Research and development costs (135,171) (134,078) (251,865)

Administrative costs (including share

based payment charges) (262,104) (223,377) (455,948)

R&D tax relief: receivable tax credit 1,590 8,900 11,502

Underlying operating loss (95,480) (126,155) (320,888)

Share based payment charges - share

options (28,039) (39,398) (103,924)

Share based payment charges - blood

pressure IP (78,775) - -

----------------------------------------- ------ ------------- ------------- ----------

Loss from operations (202,294) (165,553) (424,812)

Finance income 87 155 347

Loss before taxation (202,207) (165,398) (424,465)

Taxation - - -

Loss and total comprehensive expense for

the period (202,207) (165,398) (424,465)

------------------------------------------------- ------------- ------------- ----------

Attributable to:

Owners of the parent (187,832) (150,884) (406,229)

Non-controlling interests (14,375) (14,514) (18,236)

Loss and total comprehensive expense for

the period (202,207) (165,398) (424,465)

------------------------------------------------- ------------- ------------- ----------

Loss per share to owners of the parent

Basic and diluted - pence 3 (0.01) (0.01) (0.02)

----------------------------------------- ------ ------------- ------------- ----------

Consolidated statement of financial

position Unaudited Unaudited Audited

30 September 2020 30 September 30 September 31 March

2020 2019 2020

Notes GBP GBP GBP

------------------------------------- ------- ------------- ------------- -------------

Assets

Current assets

Inventories 80,997 26,132 10,084

Trade and other receivables 142,177 147,327 139,637

Corporation tax asset 13,090 25,100 27,702

Cash and cash equivalents 156,272 173,263 291,335

-------------

Total current assets 392,536 371,822 468,758

---------------------------------------------- ------------- ------------- -------------

Total assets 392,536 371,822 468,758

---------------------------------------------- ------------- ------------- -------------

Liabilities

Current liabilities

Trade and other payables (169,248) (158,934) (150,077)

Total current liabilities (169,248) (158,934) (150,077)

---------------------------------------------- ------------- ------------- -------------

Net current assets 223,288 212,888 318,681

---------------------------------------------- ------------- ------------- -------------

Total liabilities (169,248) (158,934) (150,077)

---------------------------------------------- ------------- ------------- -------------

Total net assets 223,288 212,888 318,681

---------------------------------------------- ------------- ------------- -------------

Capital and reserves attributable

to

owners of the parent company

Share capital 2,070,822 1,983,988 2,059,322

Share premium reserve 17,767,071 17,474,796 17,699,796

Merger reserve 6,599,174 6,599,174 6,599,174

Retained earnings (25,703,718) (25,353,106) (25,543,925)

---------------------------------------------- ------------- ------------- -------------

733,349 704,852 814,367

Non-controlling interest (510,061) (491,964) (495,686)

Total equity 223,288 212,888 318,681

---------------------------------------------- ------------- ------------- -------------

Consolidated statement of cash flows Unaudited Unaudited Audited

30 September 2020 six months six months year

ended ended Ended

30 September 30 September 31 March

2020 2019 2020

GBP GBP GBP

Cash flows from operating activities

Loss after tax (202,207) (165,398) (424,465)

Adjustments for:

Finance income (87) (155) (347)

Tax credit receivable (1,590) (8,900) (11,502)

Share-based payment charge 106,814 39,398 103,924

Changes in inventories (70,913) 19,734 35,782

Changes in trade and other receivables (2,459) (87,585) (80,086)

Changes in trade and other payables 19,171 35,791 26,934

----------

Net cash flow from operations (151,271) (167,115) (349,760)

------------------------------------------- ------------- ------------- ----------

Tax credits received 16,202 14,720 14,720

Total cash flow from operating activities (135,069) (152,395) (335,040)

------------------------------------------- ------------- ------------- ----------

Cash flow from investing activities

Interest received 6 16 399

Total cash flow from investing activities 6 16 399

------------------------------------------- ------------- ------------- ----------

Cash flow from financing activities

Proceeds from issue of share capital - - 300,334

Total cash flow from financing activities - - 300,334

------------------------------------------- ------------- ------------- ----------

Net change in cash and cash equivalents (135,063) (152,379) (34,307)

Opening cash and cash equivalents 291,335 325,642 325,642

Closing cash and cash equivalents 156,272 173,263 291,335

------------------------------------------- ------------- ------------- ----------

Consolidated statement Total

of changes in equity Share Share Merger Retained equity Non- Total

30 September 2020 attributable

to owners controlling

capital premium reserve earnings of interests equity

the parent

GBP GBP GBP GBP GBP GBP GBP

------------------------ ---------- ----------- ---------- ------------- ------------- ------------- ----------

At 31 March 2019 1,983,988 17,474,796 6,599,174 (25,241,620) 816,338 (477,450) 338,888

Share-based charges - - - 39,398 39,398 - 39,398

Total comprehensive

expense for the period - - - (150,884) (150,884) (14,514) (165,398)

At 30 September 2019 1,983,988 17,474,796 6,599,174 (25,353,106) 704,852 (491,964) 212,888

------------------------ ---------- ----------- ---------- ------------- ------------- ------------- ----------

Share-based charges - - - 64,526 64,526 - 64,526

Issue of shares -

placing

17 December 2019 75,334 225,000 - - 300,334 - 300,334

Total comprehensive

expense for the period - - - (255,345) (255,345) (3,722) (259,067)

At 31 March 2020 2,059,322 17,699,796 6,599,174 (25,543,925) 814,367 (495,686) 318,681

------------------------ ---------- ----------- ---------- ------------- ------------- ------------- ----------

Share-based charges -

share options - - - 28,039 28,039 - 28,039

Share-based charges -

blood pressure IP - - - 78,775 78,775 - 78,775

Issue of shares 19

August

2020 - blood pressure

IP 11,500 67,275 - (78,775) - - -

Total comprehensive

expense for the period - - - (187,832) (187,832) (14,375) (202,207)

At 30 September 2020 2,070,822 17,767,071 6,599,174 (25,703,718) 733,349 (510,061) 223,288

------------------------ ---------- ----------- ---------- ------------- ------------- ------------- ----------

1. General information, basis of preparation and accounting

policies

General information

Provexis plc is a public limited company incorporated and

domiciled in the United Kingdom (registration number 05102907). The

address of the registered office is 2 Blagrave Street, Reading,

Berkshire RG1 1AZ, UK.

The main activities of the Group are those of developing,

licensing and selling the proprietary, scientifically-proven

Fruitflow(R) heart-health functional food ingredient.

Basis of preparation

This condensed financial information has been prepared using

accounting policies consistent with International Financial

Reporting Standards in the European Union (IFRS).

The same accounting policies, presentation and methods of

computation are followed in this condensed financial information as

are applied in the Group's latest annual audited financial

statements, except as set out below. While the financial figures

included in this half-yearly report have been computed in

accordance with IFRS applicable to interim periods, this

half-yearly report does not contain sufficient information to

constitute an interim financial report as that term is defined in

IAS 34.

Use of non-GAAP profit measure - underlying operating profit

The directors believe that the operating loss before share based

payments measure provides additional useful information for

shareholders on underlying trends and performance. This measure is

used for internal performance analysis. Underlying operating loss

is not defined by IFRS and therefore may not be directly comparable

with other companies' adjusted profit measures. It is not intended

to be a substitute for, or superior to IFRS measurements of

profit.

The interim financial information does not constitute statutory

accounts as defined in section 434 of the Companies Act 2006 and

has been neither audited nor reviewed by the Company's auditors

James Cowper Kreston pursuant to guidance issued by the Auditing

Practices Board.

The results for the year ended 31 March 2020 are not statutory

accounts. The statutory accounts for the last year ended 31 March

2020 were approved by the Board on 29 September 2020 and are filed

at Companies House. The report of the auditors on those accounts

was unqualified, contained an emphasis of matter with respect to

going concern, and did not contain a statement under section 498 of

the Companies Act 2006.

The interim report for the six months ended 30 September 2020

can be downloaded from the Company's website www.provexis.com.

Further copies of the interim report and copies of the 2020 annual

report and accounts can be obtained by writing to the Company

Secretary, Provexis plc, 2 Blagrave Street, Reading, Berkshire RG1

1AZ, UK.

This announcement was approved by the Board of Provexis plc for

release on 29 January 2021.

Going concern

The Directors are of the opinion that at 29 January 2021, the

Group and Company's liquidity and capital resources are adequate to

deliver the current strategic objectives and 2021 business plan and

that the Group and Company remain a going concern.

Accounting policies

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 31 March 2020, as

described in those annual financial statements.

2. Segmental reporting

The Group's operating segments are determined based on the

Group's internal reporting to the Chief Operating Decision Maker

(CODM). The CODM has been determined to be the Board of Directors

as it is primarily responsible for the allocation of resources to

segments and the assessment of performance of the segments. The

performance of operating segments is assessed on revenue.

The CODM uses revenue as the key measure of the segments'

results as it reflects the segments' underlying trading performance

for the financial period under evaluation. Revenue is reported

separately to the CODM and all other reports are prepared as a

single business unit.

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 September 30 September 31 March

2020 2019 2020

DSM Alliance Agreement 171,976 162,448 232,667

Fruitflow+ Omega-3 56,753 59,814 115,270

Fruitflow+ nitrates - in development 8,346 - -

237,075 222,262 347,937

-------------------------------------- ------------- ------------- ---------

3. Earnings per share

Basic earnings per share amounts are calculated by dividing the

profit attributable to owners of the parent by the weighted average

number of ordinary shares in issue during the period.

The loss attributable to equity holders of the Company for the

purpose of calculating the fully diluted loss per share is

identical to that used for calculating the basic loss per share.

The exercise of share options would have the effect of reducing the

loss per share and is therefore anti-dilutive under the terms of

IAS 33 'Earnings per Share'.

Basic and diluted loss per share amounts are in respect of all

activities.

There were 193,500,000 share options in issue at 30 September

2020 (2019: 193,500,000) that are currently anti-dilutive and have

therefore been excluded from the calculations of the diluted loss

per share.

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 September 30 September 31 March

2020 2019 2020

Loss for the period attributable

to owners of the parent - GBP 187,832 150,884 406,229

Weighted average number of shares 2,061,960,851 1,983,988,174 2,005,600,196

Basic and diluted loss per share

- pence 0.01 0.01 0.02

----------------------------------- -------------- -------------- --------------

On 17 December 2020 the Group announced it had raised proceeds

of GBP1.0 million via the placing of 133,333,349 ordinary shares of

0.1p each at a gross 0.75p per share with investors, with no

commissions payable. The placing shares were admitted to trading on

AIM on 23 December 2020. The new shares issued would change the

weighted average number of shares in issue as shown above for the

period ended 30 September 2020, but they would not significantly

change the resulting loss per share calculations.

4. Share capital and Total Voting Rights

At 29 January 2021, the date of this announcement, the Company's

issued share capital comprises 2,204,154,856 ordinary shares of 0.1

pence each, each with equal voting rights. The Company does not

hold any shares in treasury and therefore the total number of

ordinary shares and voting rights in the Company is

2,204,154,856.

The above figure may be used by shareholders in the Company as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or change to

their interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

5. Cautionary statement

This document contains certain forward-looking statements with

respect to the financial condition, results and operations of the

business. These statements involve risk and uncertainty as they

relate to events and depend on circumstances that will incur in the

future. Nothing in this interim report should be construed as a

profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUAWGUPGGPB

(END) Dow Jones Newswires

January 29, 2021 07:37 ET (12:37 GMT)

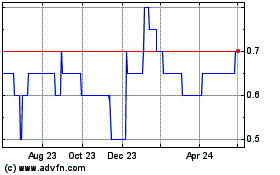

Provexis (AQSE:PXS.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

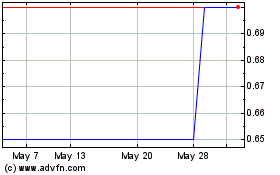

Provexis (AQSE:PXS.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025