TIDMSLP

RNS Number : 6985L

Sylvania Platinum Limited

07 September 2023

_____________________________________________________________________________________________________________________________

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse regulation (EU) no.596/2014 as amended by the

Market Abuse (Amendment) (EU Exit) Regulations 2019.

7 September 2023

Sylvania Platinum Limited

("Sylvania", the "Company" or the "Group")

Final Results to 30 June 2023

Sylvania (AIM: SLP) the platinum group metals ("PGM") producer

and developer, with assets in South Africa, is pleased to announce

its final results for the year ended 30 June 2023. Unless otherwise

stated, the consolidated financial information contained in this

report is presented in United States Dollars ("USD").

Operational Highlights

-- Sylvania Dump Operations ("SDO") exceeded target production

by delivering 75,469 4E PGM ounces for the year (FY2022: 67,053 4E

PGM ounces);

-- Run of Mine ("ROM") grades received from the host mine at

Mooinooi increased significantly over the year contributing to

additional ounce production;

-- Successful commissioning of Tweefontein MF2 improved metal recoveries;

-- Optimisation of blending improved grade, recovery and ounce

production, especially at the Eastern operations; and

-- Pilot-scale work on pelletizer project completed; the Company

is currently engaging with potential industry partners to assess

the commercial viability of the technology.

Financial Highlights

-- Net revenue generated for the period totalled $130.2 million (FY2022: $152.0 million);

-- Group EBITDA of $66.0 million (FY2022: $82.8 million);

-- Net profit of $45.4 million (FY2022: $56.2 million);

-- New Dividend Policy approved by the Board and effective from 1 July 2022;

-- Interim dividend of three pence per Ordinary Share declared

by the Board and paid in April 2023;

-- Final cash dividend of five pence per Ordinary Share declared

by the Board, maintaining an annual eight pence per Ordinary Share

dividend for FY2023 (FY2022: eight pence per Ordinary Share);

-- Group cash balance of $124.2 million (excluding $0.8 million

restricted cash held as guarantees) with no debt and no pipeline

financing; and

-- Bought back a total of 4.8 million Ordinary Shares during the

year at an average price of 81.5 pence per share, equating to $4.9

million in aggregate.

ESG Highlights

-- Doornbosch achieved 11-years Lost-Time Injury ("LTI") free in June 2023;

-- New initiatives relating to improved water management

undertaken at the Company's operations during the period and a

Dynamic Water Balance developed for each plant;

-- 24 local community members took part in this year's training

and development programme, 11 of whom are women;

-- Support for three ongoing internships and eight internal

learnerships, plus 12 external bursaries maintained, and Community

Based Employee Training provided to 10 employees; and

-- No occupational illnesses were recorded in FY2023.

Outlook

-- Re-mining of Dam 6A at the Mooinooi Plant has commenced with

the focus on optimising the blend to ensure the planned grade

profile is achieved;

-- Continuous operational performance improvements relating to

the optimisation of feed sources, throughput, recoveries, and cost

saving initiatives planned;

-- The updated Mineral Resource Estimate ("MRE") at Volspruit is

expected to be completed during Q1 FY2024, and the Preliminary

Economic Assessment ("PEA") for the entire project is expected

during Q3 FY2024;

-- The Group maintains strong cash reserves to allow funding of

expansion and process optimisation capital, and upgrading of the

Group's exploration and evaluation assets with the potential to

return value to shareholders;

-- The commissioning of the Lannex MF2 flotation circuit to

commence in Q1 FY2024, which will further improve PGM recovery

efficiencies; and

-- Annual production target of 74,000 to 75,000 4E PGM ounces for FY2024.

Post Period End

-- On 14 July 2023, the Company announced that 3,624,275

Ordinary Shares held in Treasury had been cancelled; and

-- On 9 August 2023, the Company announced that its wholly owned

South African subsidiary, Sylvania Metals (Pty) Limited ("Sylvania

Metals"), entered into an unincorporated Joint Venture Agreement

("JV") with Limberg Mining Company (Pty) Limited ("LMC"), a

subsidiary of ChromTech Mining Company (Pty) Limited ("ChromTech"),

the Thaba Joint Venture ("Thaba JV").

Share Buyback

-- The Company will reinstate the Share Buyback programme

initiated in May 2023 and will purchase on market Ordinary US$0.01

Shares ("Ordinary Shares") of the Company's issued share capital up

to a maximum of $6.4 million. This is the balance of the $10.0

million originally allocated to the Share Buyback.

Commenting on the results, Sylvania's CEO Jaco Prinsloo

said:

"I am pleased with another strong production performance by the

SDO in delivering 75,469 4E PGM ounces for the period, exceeding

our original forecast production. This performance, once again,

emphasises our teams' impeccable work ethic, a big thank you to all

of you. Keep up the great work!

"The performance was achieved as a result of several factors

including the Tweefontein MF2 circuit optimisation following

commissioning in Q2 FY2023 which continues to contribute to

improved recoveries. The Lesedi MF2 plant was fully commissioned

with optimisation of the fine grinding and flotation circuit

resulting in improved performance, which, together with improved

feed stability and flotation performance at Mooinooi, has

contributed towards the overall improved recovery performance.

Focus has remained on increasing runtime and improving operational

stability and has contributed to improved efficiencies at all

sites.

"With regards to safety, our Doornbosch plant achieved 11-years

LTI-free in June 2023, which is a major milestone for the operation

and is testament to Sylvania's high safety standards. Regrettably,

during FY2023, there were two LTIs recorded, an ankle and a knee

sprain. Fortunately, both employees recovered well. We have

increased our efforts to instil a safety-first mindset by launching

the 'Make It Personal' safety campaign during H2 FY2023, designed

to improve and maintain personal safety across all our

operations.

"Commodity prices remained a challenge with declines of around

28% in the average basket price received for the period. This

negatively impacted our overall financial results for the year;

however, we remain optimistic about price improvements.

"Rising input costs are a reality for the Group, and for the

broader sector, therefore we continue to sustain a pragmatic cash

management policy with disciplined capital allocation and control,

as well as production cost control. This approach has ensured that

the Company has the necessary cash reserves to cover working

capital for the pipeline period, finance capital projects, fund

growth and exploration, and mitigate any potential future

difficulties it may have to deal with. Nonetheless, despite these

challenges, I am pleased to report that the Board has declared a

final cash dividend of five pence per Ordinary Share for FY2023,

resulting in a combined annual dividend of eight pence for the

financial year.

"The announcement of the Thaba JV with LMC post year-end

represents a major step forward in Sylvania's growth strategy and

is a significant step forward for Sylvania Metals in expanding our

operations and leveraging the Group's expertise in the recovery of

chrome and PGM concentrates. The Thaba JV combines the strengths

and expertise of both companies in the mining and processing

industry. Sylvania Metals has a proven record in the recovery, sale

and distribution of PGMs, while LMC contributes ChromTech's

extensive experience of chrome operations, with particular

expertise in fine chrome beneficiation.

"I am enthusiastic about the year ahead and believe our

operations will continue to deliver a strong production performance

and, as a consequence, have set an annual production target of

74,000 to 75,000 4E PGM ounces for FY2024."

The Sylvania cash generating subsidiaries are incorporated in

South Africa with the functional currency of these operations being

South African Rand ("ZAR"). Revenues from the sale of PGMs are

received in USD and then converted into ZAR. The Group's reporting

currency is USD as the parent company is incorporated in Bermuda.

Corporate and general and administration costs are incurred in USD,

Pounds Sterling ("GBP") and ZAR.

For the 12 months under review, the average ZAR:USD exchange

rate was ZAR17.75:$1 and the spot exchange rate was

ZAR18.89:$1.

Operational and Financial Summary

Production Unit % Change FY 2023 FY 2022

Plant Feed T 9% 2,615,994 2,393,355

--------- ---------- ----------

Feed Head Grade g/t -4% 1.89 1.96

--------- ---------- ----------

PGM Plant Feed Tons T 12% 1,372,936 1,221,687

--------- ---------- ----------

PGM Plant Feed Grade g/t -5% 3.06 3.21

--------- ---------- ----------

PGM Plant Recovery % 5% 55.86% 53.24%

--------- ---------- ----------

Total 4E PGMs Oz 13% 75,469 67,053

--------- ---------- ----------

Total 6E PGMs Oz 12% 95,965 85,659

-------------------------- --------- ---------- ----------

USD Audited ZAR

FY 2022 FY 2023 % Change Unit Unit % Change FY 2023 FY 2022

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

Financials

Average 4E Gross

2,890 2,086 -28% $/oz Basket Price(1) R/oz -16% 37,035 43,964

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

142,489 116,575 -18% $'000 Revenue (4E) R'000 -5% 2,069,339 2,167,753

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

Revenue (by-products

12,368 13,312 8% $'000 including base metals) R'000 26% 236,295 188,154

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

-2,912 309 111% $'000 Sales Adjustments R'000 112% 5,491 -44,299

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

151,944 130,196 -14% $'000 Net Revenue R'000 0% 2,311,125 2,311,608

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

Direct Operating

48,039 48,277 0% $'000 costs R'000 17% 856,920 730,842

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

Indirect Operating

17,426 13,492 -23% $'000 costs R'000 -10% 239,477 265,115

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

General and Administrative

2,860 2,790 -2% $'000 costs R'000 14% 49,523 43,510

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

82,768 65,964 -20% $'000 Group EBITDA(4) R'000 -7% 1,170,861 1,259,195

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

1,254 5,203 315% $'000 Net Interest R'000 384% 92,353 19,078

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

56,151 45,352 -19% $'000 Net Profit(4) R'000 -6% 804,998 854,252

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

16,405 14,491 -12% $'000 Capital Expenditure R'000 3% 257,215 249,579

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

121,282 124,160 2% $'000 Cash Balance(5) R'000 18% 2,345,382 1,986,185

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

Ave R/$ rate R/$ 17% 17.75 15.21

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

Spot R/$ rate R/$ 15% 18.89 16.38

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

Unit Cost/Efficiencies

SDO Cash Cost per

716 640 -11% $/oz 4E PGM oz (3) R/oz 4% 11,355 10,899

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

SDO Cash Cost per

561 503 -10% $/oz 6E PGM oz (3) R/oz 5% 8,930 8,532

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

Group Cash Cost Per

897 771 -14% $/oz 4E PGM oz (3) R/oz 0% 13,685 13,643

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

Group Cash Cost Per

702 606 -14% $/oz 6E PGM oz (3) R/oz 1% 10,757 10,679

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

All-in Sustaining

1,052 874 -17% $/oz Cost (4E) R/oz -3% 15,509 16,008

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

1,256 1,033 -18% $/oz All-in Cost (4E) R/oz -4% 18,345 19,109

-------- --------- ------ --------------------------- ------ --------- ---------- ----------

(1) The gross basket price in the table is the average gross

basket for the year, used for revenue recognition of ounces

delivered over FY2023, before penalties/smelting costs and applying

the contractual payability.

(2) Revenue (6E) for FY2023, before adjustments is $129.1

million (6E prill split is Pt 52%, Pd 17%, Rh 9%, Au 0.2%, Ru 17%,

Ir 5%).

(3) The cash costs include operating costs and exclude indirect

cost for example royalty tax and EDEP payments.

(4) The net profit and Group EBITDA include the profit on the

sale of Grasvally Chrome (Pty) Ltd of $1.3 million.

(5) An additional $823,144 restricted cash is held which serves

as guarantees to Eskom and the DMRE.

A. OPERATIONAL OVERVIEW

Health, safety and environment

During the period under review, the operations continued to

focus on health, safety and environmental compliance. The Group is

proud to report that there were no significant health or

environmental incidents reported during the year and that it

remains fatality-free since inception in 2006.

The Doornbosch operation achieved 11 years LTI-free on 26 June

2023, which is a remarkable achievement by industry and global

standards, and management are exceptionally proud of the Doornbosch

team. Lannex achieved three years LTI-free during the period and

Millsell and Tweefontein are now both LTI-free for more than a

year. Regrettably, there was one LTI at the Mooinooi operation (an

ankle sprain) and one LTI at the Lesedi operation (a knee sprain)

during Q3 FY2023.

The Company continues to target zero harm to employees and every

injury that is recorded is fully investigated and corrective

measures are implemented to prevent any future reoccurrences. By

working together with management and all our employees, we

continuously strive to maintain high safety standards and a safe

working environment at all operating sites, with each plant

continuing to operate in accordance with legislated safety and

occupational regulations pertaining to the industry. Moreover, we

launched the 'Make It Personal' campaign, which is designed to

improve and maintain personal safety on site. We believe that by

making safety a personal matter that everyone is responsible for,

it will become second nature for all. This will assist to ensure

all workers make it home safely, every day, in line with Sylvania's

goal of achieving zero harm.

Operational performance

The SDO surpassed the Company's original guidance for the

financial year by delivering an annual production of 75,469 4E PGM

ounces, w hich was 13% higher than the prior financial year.

PGM plant feed tons were 12% higher than the previous period

owing primarily to the improvement of feed stability and running

time at Lesedi, following the tailings related disruptions

experienced during FY2022, and optimisation of feed stability and

feed sources received from the host mines at the other operations.

PGM feed grades decreased by 5% year-on-year, impacted by a lower

grade feed source being mined at Lesedi, while recovery

efficiencies increased by 5%. This significant recovery improvement

was enabled by successful optimisation and commissioning of the

Lesedi MF2 and Tweefontein MF2 circuits, respectively during the

year, while Mooinooi also saw improved performance as flotation

stability and ROM quality improved.

The SDO cash cost per 4E PGM ounce increased by 4% in ZAR (the

functional currency) from ZAR10,899/ounce to ZAR11,355/ounce while

the USD cash cost decreased 11% to $640/ounce against $716/ounce in

the prior year, due to currency movements. The increase in local

currency costs was again primarily driven by higher electricity

costs and reagent price increases. The effects of rising inflation

worldwide and international instability continues to directly

impact the cost of reagents, fuel and transport, which all cause

operating costs to increase.

Operational focus areas

Based on the success of the roll-out of our secondary milling

and flotation programme, Lannex will be the last of our SDO plants

where a MF2 circuit will be commissioned, and we expect to complete

this by the end of Q1 FY2024. This will further improve PGM

recovery efficiencies and enable optimisation of PGM concentrate

quality.

PGM concentrate quality remains a focus area with the potential

to improve smelter payability, as both concentrate grade and metal

recoveries contribute positively towards the revenue stream of the

Group. We are also evaluating a filtration plant to convert to dry

filtered concentrate transport instead of the current slurry

tankers, which would assist in reducing concentrate transport costs

and remediate handling challenges at off-take smelters.

Unfortunately, the Company again experienced localised power

supply constraints to operations during the year as a result of

load curtailment by the national power utility, as well as

vandalism and cable theft at its substations, which especially

impacted on production performance at the Lesedi operation that

experienced over 300 hours downtime during FY2023. Fortunately, no

other operations were materially affected by load reduction. The

procurement, installation and commissioning of a back-up generator

for Lesedi is expected to be completed by the end of Q1 FY2024.

This forms part of the power mitigation strategy.

Capital Projects

Capital expenditure for the year increased 3% to ZAR257.2

million ($14.5 million) from ZAR249.6 million ($16.4 million) in

the 2022 financial year in line with the Group's capital project

strategy. Capital expenditure for the year was mainly incurred on

the construction of the Lannex and Tweefontein MF2 flotation

circuit s of ZAR94.1 million ($5.3 million) and ZAR46.2 million

($2.6 million) on various tailings deposition facilities.

The Lannex MF2 project was executed during the year and

commissioning of the flotation circuit has commenced in Q1 FY2024

with the fine grinding circuit commissioning to commence in Q3

FY2024. Progressive improvement in recoveries is expected at Lannex

throughout the year.

The procurement and installation of the back-up generators for

the Lesedi and Millsell operations are on track to be commissioned

during early FY2024 in order to reduce the impact of power

interruptions caused by instability of the national and provincial

supply grids. While the Company is fully committed to reducing its

carbon footprint in line with its ESG objectives, standalone

emergency backup plants operating fully on renewable technologies

are still not currently a viable option for the operations.

However, these will be introduced in future, where feasible, to

lower diesel consumption and boost energy capacity during peak day

time running hours.

Approximately ZAR20.2 million ($1.1 million) was spent during

FY2023, with a further ZAR15.9 million ($0.9 million) planned for

FY2024 for the required expansion of the Company's tailing

facilities. This is to ensure integrity and capacity at the

tailings deposition facilities, cater for remaining sources that

need to be processed at the operations and extend operational life

at selected operations.

As part of its commitment to further improve the viability of

its exploration projects at the Volspruit and Far Northern Limb

projects, the Company anticipates spending approximately ZAR9.0

million ($0.5 million) during FY2024 on the required regulatory

Social and Labour Plan ("SLP") spend. More work is currently being

carried out through assays and testwork to improve the fundamental

parameters that underpin the projects' viability. The outcome of

these will be considered before further investment in resource

optimisation and feasibility studies is made.

Sylvania partnered with a 'binding technology' player to

co-develop a novel chemical bonding process. The aim is to create a

cold-bonded chromite ore pellet suitable for ferrochrome ("FeCr")

smelters but with the added potential to markedly cut the smelters'

electrical energy consumption per ton of FeCr produced. In exchange

for funding development costs in the venture, Sylvania holds the

licence for any future chrome pellet production in South Africa.

This research and development project is expected to yield positive

results and may enable the Company to diversify into other areas

and commodities. The pelletizer project has progressed well, and

pilot-scale work has been completed. Additionally, potential

industry partners are being engaged with to assess the commercial

viability of the technology.

Post-period end, on 9 August 2023, Sylvania announced that its

wholly owned South African subsidiary, Sylvania Metals has entered

into an unincorporated JV with LMC, a subsidiary of ChromTech, the

Thaba JV. T he Thaba JV will process PGM and chrome ores from

historical tailings dumps and current arisings from the Limberg

Chrome Mine, located on the northern part of the Western Limb of

the Bushveld Complex, South Africa. The Thaba JV will add

attributable production of approximately 6,500 4E PGM ounces and

introduce 200,000 tons of chromite concentrate to Sylvania Metals'

existing annual production profile. Construction is expected to

commence in November 2023, with orders for long-lead time equipment

being placed from the end of September 2023.

Outlook

Based on the very robust performance during FY2023 and the

continued drive for operational enhancements, particularly in

optimising feed sources, throughput, recoveries, and cost-saving

initiatives, I am expecting another strong operational performance

during FY2024. As the optimisation of the Tweefontein MF2 circuit

continues and Lannex MF2 circuit comes online during the year, it

will assist to mitigate the impact of slightly lower PGM feed

grades at some operations, and Sylvania will therefore be able to

maintain an annual production guidance between 74,000 to 75,000 4E

PGM ounces for the financial year.

B. FINANCIAL OVERVIEW

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE YEARED 30 JUNE 2023

2023 2022

Note(s) $ $

Revenue 1 130,196,100 151,944,273

Cost of sales (61,290,716) (61,823,181)

Royalties tax 2 (4,903,977) (6,920,404)

Gross profit 64,001,407 83,200,688

Other income 3 1,792,134 82,132

Other expenses 4 (4,020,070) (3,608,140)

------------- -------------

Operating profit before net finance costs

and income tax expense 61,773,471 79,674,680

Finance income 5,780,364 1,711,371

Finance costs (576,958) (457,363)

------------- -------------

Profit before income tax expense 66,976,877 80,928,688

Income tax expense 5 (21,625,108) (24,777,844)

Net profit for the period 45,351,769 56,150,844

------------- -------------

Items that are or may be subsequently reclassified

to profit and loss:

Foreign operations - foreign currency translation

differences (17,183,248) (17,747,559)

Total other comprehensive loss (net of tax) (17,183,248) (17,747,559)

------------- -------------

Total comprehensive income for the year 28,168,521 38,403,285

------------- -------------

Cents Cents

---------------------------------------------------- -------- ------------- -------------

Earnings per share attributable to the ordinary

equity holders of the Company:

Basic earnings per share 17.01 20.62

Diluted earnings per share 16.95 20.40

---------------------------------------------------- -------- ------------- -------------

1. Revenue is generated from the sale of PGM ounces produced at

the six retreatment plants, net of pipeline sales adjustments,

penalties and smelting charges. Revenue excludes profit/loss on

foreign exchange.

2. Royalty tax was paid at a rate of 5.6% on attributable

platinum ounces and decreased from the prior reporting period due

to the lower revenue.

3. Other income includes the profit on the sale of Grasvally Chrome (Pty) Ltd.

4. Other expenses relate to corporate activities and include

consulting fees, travel cost, audit fees, insurance, forex

profit/(loss) on revenue, Directors' fees, share based payments and

other administrative costs.

5. Income tax expense include current tax, deferred tax and dividend withholding tax.

The average gross basket price for PGMs in the financial year

was $2,086/ounce - a 28% decrease on the previous year's basket

price of $2,890/ounce. The decrease in the overall PGM basket price

was primarily due to a circa 40% decrease in rhodium and palladium

prices.

Revenue on 4E PGM ounces delivered decreased by 18% in dollar

terms to $116.6 million year-on-year (FY2022: $142.5 million) with

revenue from base metals and by-products contributing $13.3 million

to the total revenue (FY2022: $12.4 million). Net revenue, after

adjustments for ounces delivered in the prior year but invoiced in

FY2023, decreased 14% on the previous year's $151.9 million to

$130.2 million. The decrease in revenue is as a result of the 28%

drop in the basket price, mitigated by the increase in

production.

The operational cost of sales is incurred in ZAR and represents

the direct and indirect costs of producing the PGM concentrate and

amounted to ZAR1.1 billion for the reporting period compared to

ZAR996.0 million for the period ended 30 June 2022. The main cost

contributors being employee costs of ZAR354.0 million (FY2022:

ZAR300.6 million), reagents and milling costs of ZAR114.4 million

(FY2022: ZAR81.1 million), and electricity costs of ZAR135.3

million (FY2022: ZAR113.4 million). In addition to these the

Company paid mineral royalty tax of ZAR87.1 million (FY2022:

ZAR105.3 million). The decrease in mineral royalty tax is directly

related to the decrease in net revenue and earnings

year-on-year.

Group cash costs decreased by 14% year-on-year from $897/ounce

(ZAR13,643/ounce) to $771/ounce (ZAR13,685/ounce). Direct operating

costs increased 17% in ZAR (the functional currency) from ZAR730.8

million to ZAR856.9 million and indirect operating costs decreased

10% from ZAR265.1 million to ZAR239.5 million. The decrease in

indirect costs is attributable to the decrease to the annual

rehabilitation closure cost provision adjustment of ZAR22.2 million

(FY2022: ZAR23.0 million increase) and the reduction in mineral

royalty taxes.

All-in sustaining costs ("AISC") decreased by 17% to $874/ounce

(ZAR15,509/ounce) from $1,052/ounce (ZAR16,008/ounce). Similarly

all-in costs ("AIC") of 4E PGMs decreased by 18% to $1,033/ounce

(ZAR18,345/ounce) from $1,256/ounce (ZAR19,109/ounce) recorded in

the previous period as a result of the higher ounce production

during FY2023.

General and administrative costs, included in the Group cash

costs, are incurred in USD, GBP and ZAR and are impacted by

exchange rate fluctuations over the reporting period. These costs

decreased 2% to $2.8 million from $2.9 million in the reporting

currency year-on-year mainly due to the depreciation of the ZAR

against the USD in USD terms.

However, in ZAR terms there was a 14% increase to ZAR49.5

million from ZAR43.5 million in FY2022. The increase relates mainly

to administrative and shared services employee costs (ZAR2.6

million), professional services and fees (ZAR0.6 million), and

overseas travel (ZAR2.8 million).

Group EBITDA decreased 20% year-on-year to $66.0 million

(FY2022: $82.8 million), the decrease is mainly attributable to the

lower metal prices in FY2023 compared to FY2022.

The Group net profit for the year was $45.4 million (FY2022:

$56.2 million).

Interest is earned on surplus cash invested in South Africa and

Mauritius at an average interest rate of 5.52% per annum across the

portfolio. Interest is accounted for on various leases that are in

place.

The Group paid ZAR317.0 million ($17.9 million) in income tax

for the financial year compared to ZAR342.6 million ($22.5 million)

for the previous financial year. The decrease is as a result of

decreased taxable profits mainly due to the decrease in the metal

prices during the year. Income tax is paid in ZAR on taxable

profits generated at the South African operations. Dividend

withholding tax of $1.8 million (ZAR32.6million) was paid during

the year.

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIODED 30 JUNE 2023

2023 2022

Note(s) $ $

Net cash inflow from operating activities 6 62,986,987 69,611,329

Net cash outflow from investing activities 7 (15,568,808) (17,168,387)

Net cash outflow from financing activities 8 (40,778,927) (32,748,480)

------------ ------------

Net increase in cash and cash equivalents 6,639,252 19,694,462

Effect of exchange fluctuations on cash held (3,761,823) (4,547,472)

Cash and cash equivalents at the beginning

of reporting period 121,282,425 106,135,435

Cash and cash equivalents at the end of the

reporting period 124,159,854 121,282,425

------------ ------------

6. Net cash inflow from operating activities includes net cash

inflow from operations of $77,677,868, finance income of $5,093,760

and taxation paid of $19,784,637.

7. Net cash outflow from investing activities includes payments

for property, plant and equipment of $12,869,246, exploration and

evaluation assets of $1,621,616 and advances paid to the joint

operation and third-party loan of $239,528.

8. Net cash outflow from financing activities includes dividend

payments $35,460,674, payment for share transactions $4,912,348 and

the repayment of borrowings and leases $405,905.

The cash balance on 30 June 2023 was $125.0 million (FY2022:

$121.3 million), including $0.8 million in financial guarantees

(FY2022: $0.9 million) which was reallocated to 'other financial

assets' for reporting purposes in FY2023. Cash generated from

operations before working capital movements was $64.0 million, with

net changes in working capital of $13.7 million mainly due to the

movement in trade receivables of $12.1 million. Net finance income

amounted to $5.1 million and $19.8 million was paid in income tax

for the period, including dividend withholding tax of $1.8

million.

At the corporate level, 3.6 million shares were bought back

through the Share Buyback programme for a cost of $3.6 million. In

December 2022, the Company cancelled 1.2 million Ordinary Shares

held in Treasury and a further 3.6 million Ordinary Shares held in

Treasury were cancelled post year-end, on 13 July 2023. Bonus

shares of 1.8 million Ordinary Shares were exercised by various

persons displaying management responsibilities ("PDMRs") and

employees which vested from bonus shares awarded to them in August

2019. 0.7 million of the vested bonus shares were repurchased by

the Company to satisfy the tax liabilities of PDMRs and certain

employees and a further 0.5 million shares were repurchased from

PDMRs and certain employees during September 2022 and May 2023. The

Company paid its first cash interim dividend of three pence per

Ordinary Share amounting to $9.9 million. Dividends of $35.5

million were paid out and a further $1.0 million was paid through

the Employee Dividend Entitlement Plan ("EDEP").

The impact of exchange rate fluctuations on cash held at year

end was a $3.8 million loss due to the ZAR depreciating against the

USD by 15%.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

FOR THE YEARED 30 JUNE 2023

2023 2022

Note(s) $ $

ASSETS

Non-current assets

Exploration and evaluation expenditure 46,464,143 46,087,453

Property, plant and equipment 48,650,611 46,298,978

Other financial assets 9 6,352,325 283,450

Other assets 30,024 -

Deferred tax asset 11,088 -

Total non-current assets 101,508,191 92,669,881

------------ ------------

Current assets

Cash and cash equivalents 10 124,159,854 121,282,425

Trade and other receivables 11 35,714,003 52,939,589

Other financial assets 9 1,800,402 1,029,205

Inventories 12 5,103,550 4,258,960

Current tax asset 1,472,104 3,486,226

------------ ------------

168,249,913 182,996,405

Assets held for sale - 3,771,661

------------ ------------

Total current assets 168,249,913 186,768,066

Total assets 269,758,104 279,437,947

------------ ------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

FOR THE YEARED 30 JUNE 2023 (continued)

2023 2022

Note(s) $ $

EQUITY AND LIABILITIES

Shareholders' equity

Issued capital 13 2,790,000 2,801,557

Reserves 14 17,461,465 38,663,288

Retained profit 219,112,582 209,221,487

Total equity 239,364,047 250,686,332

------------ --------------

Non-current liabilities

Borrowings and leases 15 380,833 35,031

Provisions 16 4,040,854 5,936,804

Deferred tax liability 12,118,702 11,614,765

Total non-current liabilities 16,540,389 17,586,600

------------ --------------

Current liabilities

Trade and other payables 13,522,940 11,110,196

Borrowings and leases 15 330,729 48,957

------------ --------------

13,853,669 11,159,153

Liabilities directly associated with

the assets classified as held for sale - 5,862

------------ --------------

Total current liabilities 13,853,669 11,165,015

------------ --------------

Total liabilities 30,394,057 28,751,615

------------ --------------

Total liabilities and shareholder's

equity 269,758,104 279,437,947

------------ --------------

9. Other financial assets consist of:

a. Contribution paid to the host mine for rehabilitation purposes.

b. A loan receivable granted to TS Consortium from Sylvania

South Africa (Pty) Ltd. Sylvania South Africa (Pty) Ltd interest in

the TS Consortium joint operation increased to 75% in the assets

and liabilities during the reporting period.

c. Two separate loans to Forward Africa Mining Pty (Ltd) secured

over the Grasvally Plant and bearing interest at the Johannesburg

inter-Bank Offer Rate (JIBOR) + 3%.

10. The majority of the cash and cash equivalents are held in ZAR and USD.

11. Trade and other receivables consist mainly of amounts receivable for the sale of PGMs.

12. Inventory held includes spares and consumables for the SDO.

13. The total number of issued ordinary shares at 30 June 2023

was 279,000,000 Ordinary Shares of US$0.01 each (including

15,939,737 shares held in Treasury).

14. Reserves include the share premium, foreign currency

translation reserve, which is used to record exchange differences

arising from the translation of financial statements of foreign

controlled entities, share-based payments reserve, treasury share

reserve, the non-controlling interests reserve and the equity

reserve. The decrease relates mainly to the movement in the foreign

currency translation of $17,747,559 due to the weakening of the ZAR

against the USD.

15. Borrowings and leases consist of right-of-use lease liabilities.

16. Provision is made for the present value of closure,

restoration and environmental rehabilitation costs in the financial

period when the related environmental disturbance occurs.

C. MINERAL ASSET DEVELOPMENT

The Group owns various mineral asset development projects on the

Northern Limb of the Bushveld Igneous Complex located in South

Africa for which it has approved mining rights. In the 2021

financial year, a new phase of targeted studies was commissioned on

both the Volspruit and Far Northern Limb PGM opportunities to

determine how best to optimise the respective projects. In October

2022, significant progress was reported in the Exploration Results

and Resource Statement and work continued during FY2023 towards

unlocking mineral potential on these projects.

Volspruit Project

Historical resource statements for Volspruit reported relatively

low in-situ grades and, consequently, low PGM concentrates would

have necessitated capital-intensive in-house smelting and refining

facilities using unproven technologies. This was one of the primary

reasons for the relatively slow progress on this project in earlier

years. Based on the improved metal prices in recent years and an

improved focus on unlocking the potential and further value from

existing assets, the Company initiated a resource optimisation

study in 2021.

The primary objective was to improve the ore feed grades for the

project to enable the production of a higher grade, saleable PGM

concentrate, eliminating the need for expensive and complicated

downstream processing infrastructure.

The Statement of Exploration Results, Mineral Resources, and

Scoping Study released in October 2022 provided a revised Mineral

Resource Estimate (" MRE") defining a narrower mineralised zone of

the Volspruit North Body, on which a Preliminary Economic

Assessment ("PEA") was completed. The result of this initial study

was a ROM/Mill feed grade of 15.7 million tons at a grade of 2.13

g/t 3E and a stripping ratio of 6.7 over the life of mine.

Further optimisation studies were identified during the initial

study that have continued into the 2023 financial year. More

specifically, these include a MRE of the South Body, and the

inclusion of the rhodium into an updated Mineral Resource over the

entire project area. Updated geological information has been

included in the current study phase through the completion of a

detailed relogging programme on the historical core which will be

included in the interpretation for the new MRE expected to be

completed by the end of Q1 FY2024.

A drilling programme of 10 large diameter drillholes was

completed in the third quarter of 2023, from which further

metallurgical test work will be completed with the aim of

increasing the metal recoveries and providing the required detail

for plant and infrastructure design to be carried out during the

Preliminary Feasibility Study ("PFS") phase. The metallurgical test

work results are expected in the third quarter of FY2024. An

updated PEA is expected in the same quarter that will include the

updated Mineral Resources of the North and South Bodies with the

addition of rhodium.

All capital and operational cost inputs will be updated and

revised. With the completion of the updated scoping study, the

Company will assess whether to proceed to a PFS and the declaration

of a Joint Ore Reserves Committee (" JORC") compliant mineral ore

reserve over the entire Volspruit project.

The investment in the permitting requirements necessary for the

existing mining right has made steady progress during the 2023

financial year with the updated SLP including revised Local

Economic Development projects submitted in the fourth quarter. The

Water Use License application for mining and on-site processing

operations and the updated Environmental Impact Assessment

submissions are expected to occur in the first quarter of

FY2024.

Far Northern Limb Projects

The Company currently holds approved mining rights for PGMs and

Base Metals for both the Hacra and Aurora project areas. Similarly

to Volspruit, historical MREs for the project areas did not provide

sufficient ore feed grade to produce a saleable PGM concentrate,

and consequently limited progress was made in previous years to

develop these projects.

As reported last year, the Company commissioned a targeted

review of both the Hacra and Aurora projects through infill

drilling projects, relogging programmes and selected optimisation

studies, which was reported in the Statement of Exploration

Results, Mineral Resources, and Scoping Study released in October

of 2022. A proof-of-concept study that included the

reinterpretation of the mineralisation at Aurora enabled the

identification of the near surface T-zone on the La Pucella farm.

This represents approximately 12% of the potential strike length

held under mining rights on Aurora.

A JORC-compliant Measured and Indicated Resource of 16.2 million

tons (including 10% geological loss) at a grade of 2.63 g/t 3E was

declared for this proof-of-concept study over the limited area.

Initial economic evaluation of the resource indicated a need for

increased resource volume, and further studies during the 2023

financial year were conducted to determine the continuity of

mineralisation along the remaining strike length. At the end of

FY2023, 30,385 metres (76%) of the 40,230 metres of historical core

available within the mining right had been relogged. This programme

will be completed in Q2 FY2024. A technical study, to be completed

in the third quarter of FY2024, will assess the continuity of the

T-Zone mineralisation and allow for targeted resource upgrade

drilling programmes to be designed.

As reported in the Statement of Exploration Results, Mineral

Resources, and Scoping Study released in October 2022, the Hacra

North underground target has provided for some significant drilling

results. Work continues to evaluate the underground potential with

a technical review of the project expected to be completed during

the first quarter of FY2024.

D. CORPORATE ACTIVITIES

Dividend Approval and Payment

The Board declared the payment of a cash dividend for FY2022 of

eight pence per Ordinary Share, paid on 2 December 2022. Payment of

the dividend was made to shareholders on the register at the close

of business on 28 October 2022 and the ex-dividend date was 27

October 2022.

As stated in the FY2022 report the Board committed to review the

Company's Dividend Policy and effective 1 July 2022, the new

Dividend Policy was instituted. The new Dividend Policy allows for

a pay out of a minimum of 40% of adjusted free cash flow for the

financial year. Where annual dividends are declared, these will be

paid in two tranches with an interim dividend equating to one third

of the expected full dividend and the final dividend equating to

the remaining unpaid balance of the minimum of 40% of actual

adjusted free cash flow. The payment of dividends remains at the

discretion of the Board. In accordance with the new Dividend

Policy, the Board declared its first interim dividend of three

pence per Ordinary Share, which was paid out on 6 April 2023.

Payment of the interim dividend was made to shareholders on the

register at the close of business on 3 March 2023 and the

ex-dividend date was 2 March 2023.

The Board has now declared the payment of a final cash dividend

for FY2023 of five pence per Ordinary Share, payable on 1 December

2023, which will bring the combined dividend for FY2023 to eight

pence per Ordinary Share. Payment of the final dividend will be

made to shareholders on the register at the close of business on 27

October 2023 and the ex-dividend date is 26 October 2023.

Further to the dividends paid to shareholders, in accordance

with the Company's EDEP whereby eligible employees receive an

equivalent dividend paid on shares bought back by the Company in

the market and ring-fenced for the EDEP, a total of ZAR16.9 million

($1.0 million) was paid out during the financial year.

Transactions in Own Shares

Returning capital to shareholders remains a key element of the

Company's strategic goals and it will continue to review

opportunities to do so, when and wherever possible.

At the commencement of the 2023 financial year, shares in the

Company were valued at 88 pence per Ordinary Share and at the close

of FY2023, the share price had depreciated 9% to 80 pence per

Ordinary Share, largely influenced by the macroeconomic environment

and volatile PGM prices . As stated previously, even though a great

many of the factors influencing the share price are outside of the

Company's control, management always pays close attention and will

continue to manage the business in the best way possible to provide

maximum value for shareholders.

Options over 1,755,000 Ordinary Shares were exercised by various

PDMRs and employees which vested from bonus shares awarded to them

in August 2019. All shares awarded came from Treasury. 702,300 of

the vested bonus shares were repurchased by the Company to satisfy

the tax liabilities of PDMRs and certain employees, and an

additional 498,950 shares were bought back from various employees

during FY2023.

In May 2023, the Company announced an on-market Share Buyback

programme to purchase Ordinary $0.01 Shares of the Company's issued

share capital, up to a maximum consideration of $10.0 million. 3. 6

million shares were bought back through the programme for a cost of

$3.6 million up to 30 June 2023. The Board has taken the decision

to reinstate this Share Buyback programme to acquire Ordinary

US$0.01 Shares to a maximum consideration of $6.4 million.

On 15 December 2022, 1,155,657 Ordinary Shares held in Treasury

were cancelled. Additionally, post financial year-end, on 13 July

2023, a total of 3,624,275 Ordinary Shares held in Treasury were

cancelled.

At 30 June, the Company's issued share capital was 279,000,000

Ordinary Shares, of which a total of 15,939,737 Ordinary Shares

were held in Treasury. Therefore, the total number of Ordinary

Shares with voting rights was 263,060,263.

E. ENVIRONMENT, SOCIAL AND GOVERNANCE ("ESG")

Operating as a values-centric business, sustainability remains

at the core of our business operations, forming the bedrock of our

comprehensive ESG approach. Sylvania stands resolute in its

dedication to fostering a constructive impact on its workforce, the

sector, and the communities in which it operates.

Sylvania's ESG journey follows a pathway that began with

identifying and activating the drivers of ESG, gathering baseline

information on potential material risks to ensure that future

targets are based on verifiable information and assumptions. The

transition phase included designing an ESG strategy and reporting

framework. Finally, ESG was embedded throughout Sylvania's business

strategy, identifying and including ESG in the Sylvania strategic

risk register. This ensures that mitigation strategies for risks or

opportunities linked to ESG elements are prioritised.

The spotlight is increasingly on the mining and processing

sector due to potential operational hazards and environmental

impacts, affecting both employees and communities. As a mineral

re-processor, our Company treats its commitment to the planet and

people as seriously as its obligations to customers and

shareholders. Sylvania believes that a sustainable industry player

fosters diversity and inclusivity among its workforce for their

growth, while responsibly lessening its environmental footprint and

benefiting local communities. Our strategy aligns with the

International Council on Mining and Metals' ("ICMM") principles for

sustainable development, harmonizing with the United Nations

Sustainable Development Goals ("UNSDGs").

In the current year, our ESG review accentuates climate action,

water security, tailings management and rehabilitation for

environmental aspects. Socially, it underscores female empowerment,

workforce diversity, safety, health, training, community relations,

and addressing gender-based violence. Governance-wise, the focus

encompasses process, code of conduct, sustainable growth,

stakeholder engagement, economic contribution, and resource

management. Further details will be outlined in the Company's

upcoming report, ESG: Supporting our Strategy.

CONTACT DETAILS

For further information, please

contact:

Jaco Prinsloo CEO

Lewanne Carminati CFO +27 11 673 1171

Nominated Adviser and Broker

Liberum Capital Limited +44 (0) 20 3100 2000

Richard Crawley / Scott Mathieson

/ Kane Collings

Communications

BlytheRay +44 (0) 20 7138 3205

Tim Blythe / Megan Ray sylvania@BlytheRay.com

CORPORATE INFORMATION

Registered and postal address: Sylvania Platinum Limited

Clarendon House

2 Church Street

Hamilton HM 11

Bermuda

SA Operations postal address: PO Box 976

Florida Hills, 1716

South Africa

Sylvania Website : www.sylvaniaplatinum.com

About Sylvania Platinum Limited

Sylvania Platinum is a lower-cost producer of platinum group

metals (PGM) (platinum, palladium and rhodium) with operations

located in South Africa. The Sylvania Dump Operations (SDO)

comprises six chrome beneficiation and PGM processing plants

focusing on the retreatment of PGM-rich chrome tailings materials

from mines in the Bushveld Igneous Complex. The SDO is the largest

PGM producer from chrome tailings re-treatment in the industry. The

Group also holds mining rights for PGM projects in the Northern

Limb of the Bushveld Complex.

For more information visit https://www.sylvaniaplatinum.com/

For the purposes of MAR and Article 2 of Commission Implementing

Regulation (EU) 2016/1055, this announcement is being made on

behalf of the Company by Jaco Prinsloo .

ANNEXURE

GLOSSARY OF TERMS FY2023

The following definitions apply throughout the period:

3E ounces include the precious metal elements Platinum, Palladium

3E PGMs and Gold

4E ounces include the precious metal elements Platinum, Palladium,

4E PGMs Rhodium and Gold

--------------------------------------------------------------------

6E ounces include the 4E elements plus additional Iridium

6E PGMs and Ruthenium

--------------------------------------------------------------------

AGM Annual General Meeting

--------------------------------------------------------------------

AIM Alternative Investment Market of the London Stock Exchange

--------------------------------------------------------------------

All-in sustaining Production costs plus all costs relating to sustaining current

cost production and sustaining capital expenditure.

--------------------------------------------------------------------

All-in sustaining cost plus non-sustaining and expansion

All-in cost capital expenditure

--------------------------------------------------------------------

BCM Bank cubic metres

--------------------------------------------------------------------

CLOs Community Liaison Officers

--------------------------------------------------------------------

Fresh chrome tails from current operating host mines processing

Current arisings operations

--------------------------------------------------------------------

DMRE Department of Mineral Resources and Energy

--------------------------------------------------------------------

EBITDA Earnings before interest, tax, depreciation and amortisation

--------------------------------------------------------------------

EA Environmental Authorisation

--------------------------------------------------------------------

EAP Employee Assistance Program

--------------------------------------------------------------------

EEFs Employment Engagement Forums

--------------------------------------------------------------------

EDEP Employee Dividend Entitlement Programme

--------------------------------------------------------------------

ESG Environment, social and governance

--------------------------------------------------------------------

EIA Environmental Impact Assessment

--------------------------------------------------------------------

EIR Effective interest rate

--------------------------------------------------------------------

EMPR Environmental Management Programme Report

--------------------------------------------------------------------

ESG Environment, Social and Governance

--------------------------------------------------------------------

GBP Pounds Sterling

--------------------------------------------------------------------

GHG Greenhouse gases

--------------------------------------------------------------------

GISTM Global Industry Standard on Tailings Management

--------------------------------------------------------------------

GRI Global Reporting Initiative

--------------------------------------------------------------------

JORC Joint Ore Reserves Committee

--------------------------------------------------------------------

IASB International Accounting Standards Board

--------------------------------------------------------------------

ICE Internal combustion engine

--------------------------------------------------------------------

IFRIC International Financial Reporting Interpretation Committee

--------------------------------------------------------------------

IFRS International Financial Reporting Standards

--------------------------------------------------------------------

Phoenix Platinum Mining Proprietary Limited, renamed Sylvania

Lesedi Lesedi

--------------------------------------------------------------------

LSE London Stock Exchange

--------------------------------------------------------------------

LTI Lost-time injury

--------------------------------------------------------------------

LTIFR Lost-time injury frequency rate

--------------------------------------------------------------------

MF2 Milling and flotation technology

--------------------------------------------------------------------

MPRDA Mineral and Petroleum Resources Development Act

--------------------------------------------------------------------

MRA Mining Right Application

--------------------------------------------------------------------

MRE Mineral Resource Estimate

--------------------------------------------------------------------

Mt Million Tonnes

--------------------------------------------------------------------

NWA National Water Act 36 of 1998

--------------------------------------------------------------------

Platinum group metals comprising mainly platinum, palladium,

PGM rhodium and gold

--------------------------------------------------------------------

PAR Pan African Resources Plc

--------------------------------------------------------------------

PDMR Person displaying management responsibility

--------------------------------------------------------------------

PEA Preliminary Economic Assessment

--------------------------------------------------------------------

PFS Preliminary Feasibility Study

--------------------------------------------------------------------

Pipeline ounces 6E ounces delivered but not invoiced

--------------------------------------------------------------------

Revenue recognised for ounces delivered, but not yet invoiced

Pipeline revenue based on contractual timelines

--------------------------------------------------------------------

Pipeline sales Adjustments to pipeline revenues based on the basket price

adjustment for the period between delivery and invoicing

--------------------------------------------------------------------

Project Echo Secondary PGM Milling and Flotation (MF2) program announced

in FY2017 to design and install additional new fine grinding

mills and flotation circuits at Millsell, Doornbosch, Tweefontein,

Mooinooi and Lesedi.

--------------------------------------------------------------------

Revenue (by products) Revenue earned on Ruthenium, Iridium, Nickel and Copper

--------------------------------------------------------------------

ROM Run of mine

--------------------------------------------------------------------

SDO Sylvania dump operations

--------------------------------------------------------------------

SLP Social and Labour Plan

--------------------------------------------------------------------

Sylvania Sylvania Platinum Limited, a company incorporated in Bermuda

--------------------------------------------------------------------

tCO2e Tons of carbon dioxide equivalent

--------------------------------------------------------------------

TRIFR Total recordable injury frequency rate

--------------------------------------------------------------------

TSF Tailings storage facility

--------------------------------------------------------------------

UNSDGs United Nations Sustainability Development Goals

--------------------------------------------------------------------

USD United States Dollar

--------------------------------------------------------------------

WULA Water Use Licence Application

--------------------------------------------------------------------

UK United Kingdom of Great Britain and Northern Ireland

--------------------------------------------------------------------

ZAR South African Rand

--------------------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSLRMFTMTMMMBJ

(END) Dow Jones Newswires

September 07, 2023 02:04 ET (06:04 GMT)

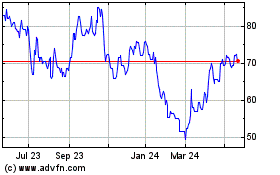

Sylvania Platinum (AQSE:SLP.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

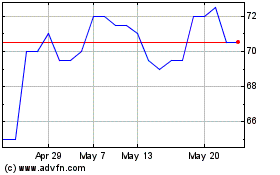

Sylvania Platinum (AQSE:SLP.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025