Thwaites (Daniel) Plc Half-year Report

December 23 2020 - 4:36AM

UK Regulatory

TIDMTHW

INTERIM RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER 2020

CHAIRMAN'S STATEMENT

OVERVIEW

The six month period to 30 September 2020 represents without doubt the most

challenging period in the 213 year history of this business. Shortly before the

start of the period, on 20 March 2020, we closed all our pubs, inns and hotels

following the directive from the UK Government in response to the COVID-19

pandemic. We then took all possible steps to secure the business, control

costs, protect cash flow and take advantage of the support measures put in

place by the Government. In particular the Job Retention Scheme has allowed us

to protect the jobs of most of our employees with only a small number of

initial redundancies.

During the period of closure, we focused on communicating with our staff,

tenants, customers and suppliers, whilst also dealing with the challenges of

lockdown and closure, including destroying over 250,000 pints of beer. We also

spent time and invested considerable resources in developing new operating

procedures to allow us to build a safe and comfortable environment for our

customers and staff on reopening.

After over three months of closure, we reopened all our pubs, inns and hotels

on 4 July, or shortly thereafter and the leisure facilities, swimming pools and

spas were reopened towards the end of the month. Trade built steadily from

reopening and during the period from 4 July to 30 September sales performance

was at 76% of last year.

RESULTS

As a consequence of the three-month lockdown, turnover for the half year was

GBP21.8m, which is a 59% reduction compared to turnover last year of GBP53.4m.

An operating loss of GBP1.4m compares to an operating profit of GBP9.5m last

year.

The economic impact of the pandemic led to an emergency cut in interest rates

by the Bank of England, reducing base rates to a historic low of 0.1%. This cut

in rates, together with the ongoing economic uncertainty, has resulted in

expectations that interest rates will stay low for the foreseeable future and

has had a negative impact on the fair value of our interest rate swaps. This

has required a further increase in the provision of GBP1.8m at the half year

(2019: GBP4.0m increase in the provision due to political and Brexit

uncertainties), and this negative movement is shown in our profit and loss

account.

Net debt at 30 September 2020 was GBP66.6m (2019: GBP61.6m); an increase of

GBP5.0m compared to last year, but an increase of only GBP1.2m in the half year

from GBP65.4m at 31 March 2020, which considering the challenges faced is a

creditable result. This has been achieved with the help of significant support

from the UK Government for the hospitality sector in the form of a business

rates holiday, business grants, the Job Retention Scheme, reduction in VAT on

accommodation, food and soft drinks to 5% and the Eat Out to Help Out scheme.

PUBS AND INNS

All our tenanted pubs closed on 20 March 2020 and the majority reopened on 4

July or shortly thereafter, although a number of pubs offered basic take away

services during lockdown. We took a tailored approach to charging rent during

the period. All tied pubs were given a rent-free period for April, and

thereafter rents were charged based on the level of business rate grants

received by the pubs and the degree to which trading recovered after reopening.

Overall, we gave GBP1.3m of rental support to our tenant pubs over this period.

After reopening on 4 July, we saw trade recover steadily in the pubs, with

volumes of beer sales in July 28% lower than last year. The Eat Out to Help Out

scheme in August accelerated that recovery such that beer volume sales were 13%

down on last year in the month. Beer volume sales continued to recover through

September to a point where they were 96% of last year. At that point the

Government introduced the 10.00pm curfew on 24 September which led to an

immediate and substantial reduction in sales of approximately 25%.

Our pub estate benefits from being largely based in community and rural

locations with very little town and city centre presence.

We have continued our regular maintenance spending on our pubs over this period

but capital expenditure projects have been kept to a minimum to preserve cash.

Our Inns are ideally located in rural and honeypot locations which are very

attractive to the consumer in the current environment. Prior to reopening a

significant amount of time and effort was put into making our properties Covid

safe to make our customers feel comfortable to return, including putting in

place an online order and pay solution. All of the inns reopened on 4 July and

sales built strongly as customers gained in confidence and felt more at ease

with the measures we had put in place. Sales built strongly through July and by

August, with the Eat Out to Help Out scheme and the VAT reduction, sales were

up 13% on last year, and this performance continued into September. The

increased demand for UK leisure breaks led to increased room occupancy and

average room rate.

HOTELS & SPAS

In the hotels & spas sales were very slow to pick up after reopening in July,

as there was very little corporate business since, encouraged by the

Government, most organisations were still working from home. Leisure breaks did

not start to recover until the leisure facilities, swimming pools and spas were

allowed to reopen on 25 July.

Trading improved during August with the leisure facilities open again, and

assisted by the Eat Out to Help Out scheme together with the reduction in VAT,

sales increased such that they were 16% below last year. Performance fell back

slightly in September as demand for leisure breaks subsided as schools reopened

and corporate activity continued to be at a low level. The ongoing restrictions

banning significant group gatherings for weddings, conferences and events

continues to have a negative impact on the level of business in the hotels.

EARNINGS PER SHARE

Due to the losses incurred when the business was closed during lockdown, the

loss per share was 8.2p (2019: earning per share of 2.7p).

DIVID

The Board does not recommend the payment of an interim dividend (2019: 1.10p)

as the preservation of cash continues to be an absolute priority due to the

ongoing restrictions and economic uncertainty. Future dividend policy will be

reviewed in line with the recovery of the business. The Board does not envisage

paying a dividend whilst the business is making losses.

CASH FLOW & FINANCING

The Company has recently increased its total borrowing facilities to GBP90m,

which is made up of the long-term loan of GBP45m, revolving credit facilities

of GBP43m and overdraft facilities of GBP2m. When compared to net debt of

GBP66.6m at 30 September 2020, this gives head room of GBP23.4m, which should

be more than sufficient to take us through the challenges of the winter months

and beyond the end of this crisis.

The Company received covenant waivers or relaxed covenant tests from its

lenders at 30 September 2020 and has recently put in place a revised set of

covenant tests through to March 2023, to deal with the current restrictions on

trading and support the recovery of the business once these restrictions are

lifted.

SUMMARY AND OUTLOOK

It is difficult to describe adequately the uncertainty and anxiety that has

gripped the business over the past nine months. All I can say, once again, is

that without the terrific can-do attitude of our teams within the business, and

their ability to look forward and be positive, then things would have been even

bleaker. I would like to thank every one of them for their fortitude and belief

that we can prevail - it is that which will carry us to the other side of this

pandemic. I would also like to thank our tenanted pub operators for their

incredible tenacity and our customers, suppliers and shareholders for their

steadfast support over this very difficult period.

What has become clear over the past few months is that the pub is deeply

misunderstood by those in the seat of power. Far from being the drinking dens

of 50 years ago, community pubs are the biggest community outreach programme

that this country has, provided free of charge by landlords and landladies the

length and breadth of the country. The employment and social cohesion that the

pub provides are the glue that hold our local communities together. It is

therefore hugely distressing to see that as we exit the second lockdown pubs

have been targeted for special measures in the reshaped tier system which will

lead to the inevitable failure of some of these precious community assets.

These are unchartered waters that we are navigating, and it has been difficult

for the Government to pick their way through them. Earlier in the year they

were hugely supportive of the industry, which they chose to close for long

periods in response to the pandemic and that support was invaluable. I fear

that now that interest in supporting the sector has been superseded by other

political distractions and has weakened significantly. Without further

financial support from Government, our industry will face irrecoverable damage

over the rest of this winter and I hope that the Prime Minister will intervene

to avert that and ensure that the investment he has made so far is not

squandered. It will be repaid many times over on the other side of this, in

particular the extension of a lower rate of VAT and the Business Rates holiday

for a further 12 months would help pubs and hospitality claw their way back to

pay their way once more.

Our country is in a terrible economic state; it has supported interference in

the minutiae of people's lives at the expense of liberty and the freedom to

exercise common sense and self-awareness. I hope that once those at risk from

Covid are protected by a vaccine the Government will step back and allow the

innate creativity and cultural ingenuity of our great nation, its businesses

and its pubs to come to the fore to save the day.

Richard Bailey

Chairman

23 December 2020

Profit and Loss Account for the six months ended 30 September 2020

Unaudited Unaudited Audited

6 months 6 months 12 months ended

ended ended 31 March

30 September 2020 30 September 2019 2020

GBP'm GBP'm GBP'm

Turnover 21.8 53.4 98.1

Operating (loss) profit before property disposals (1.4) 8.7 11.8

Property disposals - 0.8 0.8

______ ______ ______

Operating (loss) profit (1.4) 9.5 12.6

Net interest payable (2.0) (2.0) (3.9)

Loss on interest rate swaps measured at fair

value (1.8) (4.0) (4.5)

Finance charge on pension liability (0.3) (0.5) (0.6)

______ ______ ______

(Loss) profit on ordinary activities (5.5) 3.0 3.6

before taxation

Taxation 0.7 (1.4) (0.3)

______ ______ ______

(Loss) profit on ordinary activities after taxation (4.8) 1.6 3.3

______ ______ ______

(Loss) earnings per share (8.2) p 2.7 p 5.6 p

Balance Sheet as at 30 September 2020

Unaudited Unaudited Audited

30 September 30 September 31 March

2020 2019 2020

GBP'm GBP'm GBP'm

Fixed assets

Tangible assets 294.7 293.3 297.5

Investments 0.7 1.0 0.8

______ ______ ______

295.4 294.3 298.3

Current assets

Stocks 0.6 0.7 0.5

Trade and other debtors 11.0 10.8 11.1

Cash at bank and in hand 2.9 5.9 0.5

______ ______ ______

14.5 17.4 12.1

Creditors due within one year

Trade and other creditors (13.1) (17.0) (13.3)

Loan capital and bank overdraft - (22.5) (0.4)

______ ______ _____

(13.1) (39.5) (13.7)

Net current assets (liabilities) 1.4 (22.1) (1.6)

______ ______ ______

Total assets less current liabilities 296.8 272.2 296.7

Creditors due after one year

Loan capital (69.5) (45.0) (65.5)

Interest rate swaps (22.2) (22.0) (21.4)

______ ______ ______

(91.7) (67.0) (86.9)

Net assets excluding pension liability 205.1 205.2 209.8

Pension liability (32.4) (24.9) (32.3)

______ ______ ______

Net assets including pension liability 172.7 180.3 177.5

______ ______ ______

Capital and reserves

Called up share capital 14.7 14.7 14.7

Capital redemption reserve 1.1 1.1 1.1

Revaluation reserve 75.8 73.8 75.8

Profit and loss account 81.1 90.7 85.9

______ ______ ______

Equity shareholders' funds 172.7 180.3 177.5

______ ______ ______

NOTES:-

1. Basis of preparation

The interim accounts, which have not been audited, have been prepared on the

basis of the accounting policies set out in the Annual Report and Accounts for

the year ended 31 March 2020.

2. Taxation

The taxation charge is based on the estimated tax rate for the year.

END

(END) Dow Jones Newswires

December 23, 2020 05:36 ET (10:36 GMT)

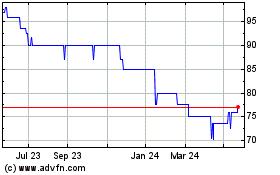

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Dec 2024 to Jan 2025

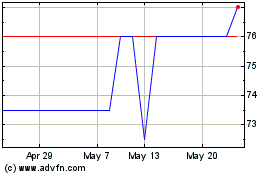

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Jan 2024 to Jan 2025