Trifast PLC Trading Update (3740A)

January 22 2024 - 1:00AM

UK Regulatory

TIDMTRI

RNS Number : 3740A

Trifast PLC

22 January 2024

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR. Upon the

publication of this announcement via the Regulatory Information

Service, this inside information is now considered to be in the

public domain.

London, Monday 22 January 2024

TRIFAST PLC

(Trifast, Group or Company)

Leading international specialist in the design, engineering,

manufacture, and distribution

of high-quality industrial fastenings and Category 'C'

components principally to major global assembly industries

Trading update

Market conditions during Q3 saw a continuation of the trends

described in the Group's interim results, published on 21 November

2023, characterised by low visibility and volatile demand in a

number of end market and geographic segments. Disappointingly,

performance in December 2023 was impacted by significantly lower

than forecasted volumes in both our Asia operations and global

distribution sales channel. Whilst we had anticipated both of these

areas to see a recovery from subdued activity in H1, demand

conditions and excess customer inventory levels have pushed this

recovery further into 2024 and we now expect these challenging

conditions to persist through to the end of the financial year.

As set out in the interim results and in spite of the difficult

backdrop, management have continued to focus on the Operational

Improvement programme instigated in 2023 to drive improved

efficiency and productivity for HY2 and beyond. Whilst good

progress has been made in reducing cost in a number of areas, this

will not be enough to mitigate the impact of the lower revenue

expectation for the second half. Consequently, the Board now

expects that the Group's results for the year ending 31 March 2024

to be significantly below its previous expectations, with revised

revenue at c.GBP230m and adjusted EBIT margin percentage of

c.5%.

The more testing environment that we are now experiencing in

2024 in terms of growth is being severely impacted by a further

slowdown in customer demand and volumes across the business and to

an extent by the reported macro-economic challenges and

geopolitical events.

As a consequence of the prevailing markets, continued weak

economic outlook and the impact of this on the business we have

accelerated our recovery action plan, including a Group

restructuring programme to further reduce operating cost through a

c.10% cutback in our non-operational staff globally. This programme

is expected to deliver additional annualised savings of c.GBP3m. As

part of the restructure, we will establish a leaner organisational

structure to enable faster decision making. In parallel, we are

undertaking a strategic review of our global footprint to identify

further cost efficiencies which will reset our business for the

future.

As we previously announced, working capital and cash management

remain a key focus; we predict to effectively reduce leverage below

1.5x and Group net debt to be below our target of GBP25m. Our UK

National Distribution Centre and Atlas projects are, as previously

committed, on track to be completed by the end of March 2024.

As a Group, the Balance sheet remains strong, we continue to see

significant scope to rebuild and invest in the business and we

remain confident in the fundamentals of our business model over the

medium-term.

We will provide more detail on the restructuring, strategic

plans and progress at the time of the Group's annual results

scheduled to be released in July 2024.

*Consensus forecasts FY24 prior to this announcement were

revenue of GBP254m adjusted EBIT GBP15.5m

Enquiries please contact:

---------------------------------------------------

Trifast plc

Serena Lang, Non-Executive Chair

Iain Percival, Chief Executive Officer

Darren Hayes-Powell, Chief Financial Officer

Office: +44 (0) 1825 747630

Email: corporate.enquiries@trifast.com

Shareholders: companysecretariat@trifast.com

Peel Hunt LLP (Stockbroker & financial adviser)

Mike Bell

Tel: +44 (0)20 7418 8900

TooleyStreet Communications (IR & media relations)

Fiona Tooley

Tel : +44 (0)7785 703523

Email: fiona@tooleystreet.com

Editors' notes

--------------------------------------------------------------------------

About Trifast plc (TR)

Founded in East Sussex in 1973, TR is a leading international

specialist in the design, engineering, manufacture, and distribution

of high-quality industrial fastenings and Category 'C' components

principally to major global assembly industries.

The Group supplies to customers in c.70 countries across a wide

range of industries, including light vehicle, heavy vehicle,

health & home, energy, tech, & infrastructure (ET&I), general

industrial and distributors. As a full service provider to multinational

OEMs and Tier 1 companies spanning several sectors, we deliver

comprehensive support to our customers across every requirement,

from concept design through to technical engineering consultancy,

manufacturing, supply management and global logistics.

As an international business we are able to provide 24/7 customer

support from across key regions in the UK, Asia, Europe and North

America. In addition to our service locations we operate a number

of manufacturing facilities focused on high volume cold forged

fasteners and special parts. We have also established Technical

& Innovation Centres to support R&D and customer collaboration

across the world.

For more information, visit our

Investor website: www.trifast.com

Commercial website: www.trfastenings.com

LinkedIn : www.linkedin.com/company/tr-fastenings

Twitter: www.twitter.com/trfastenings

Facebook : www.facebook.com/trfastenings

Trifast, TR and TR Fastenings are registered trademarks of the

Company

LEI number: 213800WFIVE6RWK3CR22

Forward-looking statements

This announcement contains certain forward-looking statements.

These reflect the knowledge and information available to the

Company during the preparation and up to the publication of

this document. By their very nature, these statements depend

upon circumstances and relate to events that may occur in the

future thereby involving a degree of uncertainty. Therefore,

nothing in this document should be construed as a profit forecast

by the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFLLLZFLEBBD

(END) Dow Jones Newswires

January 22, 2024 02:00 ET (07:00 GMT)

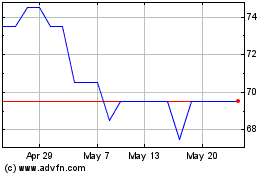

Trifast (AQSE:TRI.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Trifast (AQSE:TRI.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024