Australian Fund Managers Seek To Meet Demand For Commercial Loans

May 07 2012 - 3:18AM

Dow Jones News

Australia's fund managers are stepping in to meet the growing

demand for commercial loans left by the deleveraging of the banking

sector.

Specialist loan fund manager Metrics Credit Partners has

partnered with National Australia Bank (NAB.AU) to create a fund to

tap the growing appetite for fixed yielding assets among

Australia's 1.4 trillion ($1.42 trillion) Australian dollar

superannuation industry.

Metrics Executive Director Graham MacNamara said the fund, which

is expected to raise A$3 billion by the end of 2012--half of which

will come from NAB--hopes to cash in on the funding gap left as

Australia's banks rein in their lending and Europe's embattled

lenders retreat to their home markets.

"Heading into the Basel III environment will again increase the

pressure on the banks in terms of the kind of assets they can have

on their balance sheet," he said. "European banks withdrew about

A$15 billion from the (Australian) market in the last quarter. The

withdrawal of that much capacity has to be found from somewhere

else."

Metrics will own and service the loans, but sell units in the

fund to investors such as pension funds, giving them access to a

fixed income stream without having to shoulder the risks of owning

the underlying assets.

MacNamara said the funds loan portfolio currently yields 200 to

500 basis points and he expects "loan margins to remain at these

levels" for the foreseeable future. "If we're successful I think

you'll see some other banks looking to do the same thing," he

added.

Australia's major four banks----Australia and New Zealand

Banking Group Ltd (ANZ.AU), Commonwealth Bank of Australia

(CBA.AU), Westpac Banking Corp. (WBC.AU) and NAB--control around

60% of the country's syndicated corporate loan market, according to

data from Dealogic.

Steve Lambert, NAB's executive general manager for Capital

Markets, said the banks could raise between A$20 billion and A$25

billion a year by 2015 by selling off their syndicated loans.

"NAB is doing this to help address the problem we're facing," he

said. "We're not necessarily as efficient a place to hold long-term

debt as the super funds."

The void left by the banks' deleveraging has also created

opportunities in property loans for fund managers.

Quadrant Real Estate Advisors estimates the exodus of the

European banks from Australia's commercial property sector will

create a A$12 billion borrowing squeeze over the next two years.

Asset managers like Perpetual Ltd. (PPT.AU) and Challenger Limited

(CGF.AU) are expanding their property debt portfolios this year in

a bid to cash in on the high margins in the capital-hungry

sector.

-By Caroline Henshaw, Dow Jones Newswires; 61-2-8272-4689;

caroline.henshaw@dowjones.com

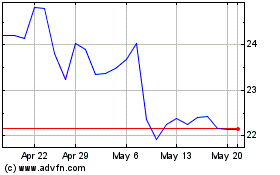

Perpetual (ASX:PPT)

Historical Stock Chart

From Jan 2025 to Feb 2025

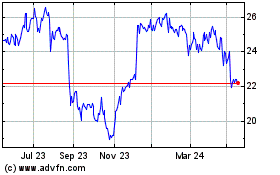

Perpetual (ASX:PPT)

Historical Stock Chart

From Feb 2024 to Feb 2025