Ethereum Gains On Bitcoin Following Fed Rate Cut: Altseason Soon?

September 25 2024 - 8:00AM

NEWSBTC

Ethereum (ETH) price has outshined Bitcoin (BTC) over the last week

since the US Federal Reserve (Fed) slashed interest rate by 50

basis points (bps) on September 18, 2024. Ethereum Gains On

Bitcoin, Prelude To Altseason? Ethereum has had an impressive last

few days as far as its price action is concerned. ETH has surged by

16% to $2,666 since the Fed cut rates for the first time in four

years. BTC has risen by 9% in the same period, trading at $63,643

at press time. Related Reading: Ethereum Poised For A Comeback

Following Interest Rate Cut: Steno Research The ETH/BTC trading

pair has surged from 0.0385 on September 18, to 0.0420 on September

23, indicating an increase of almost 9%. Notably, the ETH/BTC

trading pair is a crucial trading pair observed by crypto analysts

to gauge market sentiments toward altcoins relative to BTC.

When ETH and other altcoins gain value against BTC, it suggests

increased investor interest in altcoins, potentially signaling the

beginning of an “altseason.” Conversely, when BTC outperforms ETH,

it may indicate a shift back to Bitcoin dominance. It’s worth

highlighting that the Ethereum futures funding rate has turned

positive since the interest rate cut, standing at 0.0058% according

to data from cryptocurrency futures trading and information

platform CoinGlass. For the uninitiated, a positive funding rate

implies that traders holding long positions – in this case, long

ETH – are paying short positions, reflecting bullish market

sentiments. The change in funding rate suggests greater optimism

regarding ETH’s future price, likely driven by increased demand and

confidence following the rate cut. That said, investors should be

cautious of sharp movements in funding rates, as this could lead to

market corrections amidst excessive optimism or due to any changes

in external factors. Ethereum Faces Stiff Competition From

Other Blockchains Throughout 2024, Ethereum has faced criticism for

its lackluster performance relative to its competitors. Even major

developments, like the US Securities and Exchange Commission’s

(SEC) approval of ETH exchange-traded funds (ETFs) failed to propel

the second-largest cryptocurrency by market cap

significantly. In contrast, competing smart contract

platforms like Solana (SOL), Binance Coin (BNB), and Tron (TRX)

have made impressive strides not only in terms of price

appreciation but also regarding the development of ecosystem

infrastructure. Related Reading: Tron-Based SUN Token Skyrockets

197% As SunPump’s Momentum Continues For instance, the Solana

ecosystem witnessed many developments at Singapore’s

recently concluded Solana Breakpoint 2024 event. Among other

announcements, Franklin Templeton unveiled its plans to launch a

mutual fund on Solana. Similarly, all eyes are on the release

of former Binance CEO Changpeng Zhao from prison on September 29,

2024. Crypto analysts predict that Zhao’s release could spark

bullish momentum for Binance’s native token BNB, which has shown

incredible resilience despite the exchange’s former CEO being

imprisoned on money laundering charges. With the rising adoption of

Ethereum layer-2 solutions offering high scalability with minimal

transaction costs, expect the smart contract space to become

increasingly competitive. ETH trades at $2,660 at press time, up

3.3% in the last 24 hours. Featured image from Unsplash, Charts

from Tradingview.com

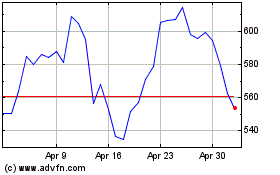

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024