Bitcoin Holds Steady at $63,000: Analysts Weigh In on Next Steps

August 26 2024 - 11:00PM

NEWSBTC

Bitcoin appears to be entering a rebound phase, given its recent

increase that brought the asset’s price close to the $66,000 mark.

Particularly, after briefly touching a 24-hour high of $64,893

earlier today, Bitcoin has retraced slightly, now trading at

$63,786, reflecting a minor 0.2% decline over the past day. Despite

this slight pullback, analysts remain divided on the immediate

future of Bitcoin, with some pointing to key technical levels that

could determine the next significant move. Related Reading: Crypto

Analyst Sounds Alarm: Here’s Why It’s Your ‘Last Chance To Buy

Bitcoin’ Next Step For Bitcoin Renowned crypto analyst, Emperor on

X, shared his insights on Bitcoin’s price action earlier today. In

a detailed post, Emperor noted that Bitcoin had successfully

bounced from a critical support zone of around $58,000, which he

had previously identified as a potential buy zone. According to

Emperor, Bitcoin has now reclaimed the 200-day Exponential Moving

Average (EMA) on the 4-hour chart, which he views as a positive

development. He highlighted that Bitcoin’s recent price movement,

including front-running the quarterly open and sweeping weekend

range lows, is characteristic of a strong uptrend. Emperor

suggested that while Bitcoin may not see a continuous upward push

this week, it remains bullish, with the next target being the

monthly open. The analyst concluded, noting: I will be taking

some profits on swing positions. Ultimate direction is up but now

is the time to take profit on Bitcoin gradually while you bid alts.

Is Another Noticeable Correction Going To Happen? While Emperor’s

analysis points to a bullish outlook for Bitcoin, other analysts

are more cautious. Macro Johanning, another well-known figure in

the crypto space, provided an update on Bitcoin’s recent price

action, noting that Bitcoin had recently swept the high at $65,100.

Johanning suggested that this move to the upside might have

temporarily exhausted Bitcoin’s bullish momentum, potentially

leading to a dip to around $61,000 before further upward movement.

He highlighted the importance of upcoming economic data releases in

Bitcoin’s short-term direction. Johanning pointed to several key

events scheduled for the week, including the release of US Consumer

Confidence data on Tuesday, Nvidia’s earnings report on Wednesday,

Q2 2024 GDP data, and July Pending Home Sales on Thursday, followed

by July PCE Inflation data on Friday. Related Reading: Bitcoin

Price Faces Challenge at $65K: Can It Break Through? These events

will likely influence market sentiment and add volatility to

Bitcoin’s price action. According to Johanning, Bitcoin’s next

significant resistance level is around $67,000, which could become

a target once the consolidation phase resolves. Featured image

created with DALL-E, Chart from TradingView

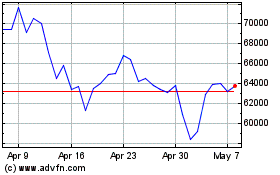

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Jul 2024 to Aug 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Aug 2023 to Aug 2024