Bitcoin Failed Attempt To Break $64,000 Could Lead To A Disaster – Analyst

October 08 2024 - 6:30PM

NEWSBTC

After weeks of massive volatility, Bitcoin faces heightened risk

after failing to break above a key resistance level of around

$64,000. Following the Federal Reserve’s decision to cut interest

rates, many investors and traders anticipated a full-blown rally

throughout October. However, it appears that the expected surge may

not materialize just yet. Related Reading: Dogecoin Analyst Expects

A ‘Multi-Year Bullish Breakout’ – 200% Surge Potential Top crypto

analyst Carl Runefelt has shared his insights on the current

situation, emphasizing the significance of the $64,000 resistance.

Breaking past this crucial level is critical for Bitcoin to regain

bullish momentum and fuel a rally into Q4 2024. Bitcoin could

struggle to sustain upward momentum without this breakout, leaving

the market vulnerable to further downside. The next few days will

be critical for Bitcoin’s price action as traders and analysts

closely watch how the market responds. With Q4 underway, Bitcoin’s

performance could set the tone for the broader crypto market. As

investors brace for the market’s next move, the outcome of

Bitcoin’s battle with the $64,000 level will likely determine

whether the rally continues or stalls. Bitcoin Analyst Predicts

Sub-$60K Dip After Bitcoin’s recent failed breakout attempt, the

cryptocurrency is trading at a critical juncture at around $62,000.

This level will likely determine whether BTC can reclaim momentum

and push past local highs of $66,000 or drop further to $60,000 or

even lower. Analysts and investors are growing increasingly

uncertain as the bullish sentiment that dominated the past few

weeks is beginning to fade. Now, fear and hesitation are creeping

back into the market. Top crypto analyst Carl Runefelt recently

shared a detailed technical analysis on X, highlighting the

precarious situation Bitcoin finds itself in. According to

Runefelt, Bitcoin’s price structure has become fragile after two

failed attempts to break through the key resistance level. He notes

that BTC’s price dropped below important support levels after each

failure, which could lead to further downsides. In his analysis,

Runefelt sets a price target of $60,000, marking a 5% dip from

current levels if Bitcoin cannot reclaim its previous momentum. He

warns that if Bitcoin fails to hold critical support at $60,000, it

could signal the beginning of a deeper correction. Related

Reading: Solana (SOL) Path To New Highs: Analyst Eyes $160 As

Critical Breakpoint As market sentiment shifts from bullish to

fearful, the next few days will determine whether Bitcoin can

regain its strength or face a prolonged decline. Investors are

watching closely, preparing for the market’s next move. BTC Price

Action: Key Levels To Watch Bitcoin is trading at $62,421 after

failing to break above the daily 200 moving average (MA) at

$63,538. The price recently surged 25%, only to experience a sharp

10% dip, putting BTC at a critical juncture. Bitcoin faces serious

risk in the coming weeks if it does not break past local supply

levels around $66,000. The daily 200 MA has been a critical

resistance level, and without reclaiming it soon, bearish momentum

could take hold. If Bitcoin cannot recover and break through this

level, analysts expect a deeper correction down to $57,500. This

area is considered a crucial demand zone that could provide

support, but a failure to hold above current levels would signal a

more significant retracement. Related Reading: Can SUI Fall To

$1.40? On-Chain Data Exposes Declining Demand Bulls must push the

price back above the daily 200 MA in the short term to avoid

further downside risk. The next few days will be critical for

determining whether BTC can stabilize or faces continued downward

pressure. Featured image from Dall-E, chart from TradingView

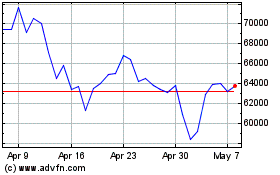

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024