Secret Bitcoin Driver: Exchanges Receiving $40 Million USDT Fuel Per Day

December 18 2024 - 11:00PM

NEWSBTC

On-chain data shows a massive amount of the stablecoin USDT has

been moving to exchanges recently, potentially acting as fuel for

the Bitcoin and wider cryptocurrency rally. USDT Exchange Inflows

Have Remained High Recently In a new post on X, the on-chain

analytics firm Santiment discussed the trend in the Exchange Flow

Balance for Tether’s USDT. The “Exchange Flow Balance” here refers

to an indicator that keeps track of the net amount of a given asset

entering or exiting the wallets associated with centralized

exchanges. When the value of this metric is positive, it means the

inflows outweigh the outflows, and a net amount of the coin is

entered into the exchanges’ wallets. Such a trend is usually a sign

of demand among investors for trading away the cryptocurrency.

Related Reading: Ethereum On-Chain Demand Should Sustain ETH Above

$4,000, IntoTheBlock Says On the other hand, the negative indicator

implies the holders are withdrawing a net number of tokens from

these platforms. This kind of trend suggests the market is in a

phase of accumulation. Now, here is a chart that shows the trend in

the Exchange Flow Balance for USDT over the last couple of years:

As displayed in the above graph, the Exchange Flow Balance for USDT

has observed several large positive spikes over the past month,

implying that large investors have been depositing their tokens.

For assets like Bitcoin, a positive Exchange Flow Balance can be a

bearish sign, as it could suggest the holders are planning to sell.

However, the same isn’t true when the asset involved is a

stablecoin. Investors generally store their capital in these

fiat-tied tokens to avoid the volatility of Bitcoin and other

cryptocurrencies. Such users eventually plan to venture into the

volatile side once they feel the conditions are right. And when the

time comes, they naturally transfer to exchanges to swap to Bitcoin

or whatever desired coin. This act of selling USDT does not affect

its value since the coin is, by definition, always stable around

the $1 mark. Related Reading: Solana Struggles Against Bitcoin

& Ethereum: Glassnode Explains Why On the other hand, The asset

they are shifting to does witness fluctuations from the purchase.

As such, stablecoin exchange inflows are usually considered a

bullish sign for Bitcoin and other assets. During the last eight

weeks, exchanges have received a net average of $40 million USDT.

“Helping to fuel this bull rally and the many historic crypto

pumps, look for stablecoin ‘dry powder’ to continue flowing in

during this final stretch of 2024,” explains the analytics firm.

Bitcoin Price Bitcoin set a new all-time high (ATH) beyond the

$108,000 mark yesterday, but the coin appears to have seen a

pullback since then, as its price is now trading around $104,500.

Featured image from Dall-E, Santiment.net, chart from

TradingView.com

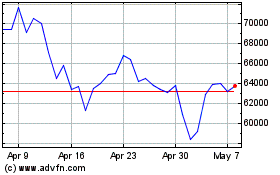

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024