Bitcoin Price Headed For $35,720? Why Muted Volume Could Trigger Major Crash

October 21 2024 - 7:00PM

NEWSBTC

Alan Santana, a crypto analyst on TradingView, has predicted that

the Bitcoin price could potentially experience a drastic decline to

new lows around $35,720, driven by muted buying volume. The analyst

has declared that the current state of the market is bearish,

highlighting potential manipulation from whale investors.

Bitcoin Price Could Crash To $35,720 According to Santana, Bitcoin

has witnessed 75 days of bullish activity but has not reached

projected new price peaks, currently trading within a lower high

below $70,000. While the cryptocurrency did hit an All-Time High

(ATH) in March, surging past $73,000, Santana has concluded that

the general market has become relatively bearish. Related

Reading: Dogecoin Flashes Sell Signal After 30% Rally – Time To

Sell? He disclosed that most of the Bitcoin price action between

August 5 and to present day is forming part of an inverted

correction, which suggests that prices have been rising but without

reaching new peaks. Santana also declared that the current

Bitcoin price action confirms that there is no bullish momentum. He

attributed this lack of momentum to muted whale activities,

highlighting that there are currently no buyers or buying volume at

the current market level. Due to these bearish conditions, Santana

has predicted that Bitcoin could end up crashing to $35,720,

representing a massive 46.68% decrease to new lows. This also means

that Bitcoin’s price will drop by almost half, triggering panic and

fear amongst retail and whale investors. Contrary to Santana’s

bearish analysis, the price of Bitcoin is up by 5.56% and trading

at $68,203, according to CoinMarketCap. The cryptocurrency is

gradually increasing to reach the $70,000 mark, driven by positive

changes in market sentiment and the historically bullish

Q4. Although Santana has stayed firm in his bearish

predictions of Bitcoin due to limited buying power, the analyst has

also received severe backlash from various crypto community

members. One member criticized Santana’s bearish Bitcoin

prediction, suggesting that there were flaws in his analysis.

Others accused the analyst of attempting to manipulate investors by

using a Bitcoin chart from a Blofin exchange, which typically has

lower transaction activity. Bitcoin Market Manipulation And

Bears Despite the heat from crypto members, Santana believes that

market manipulation has led to the current bearish price action in

Bitcoin. The analyst highlights that Bitcoin’s price can be

artificially manipulated by large holders or so-called

Whales. Related Reading: FLOKI Breaks Out Of Downtrend:

Analyst Predicts 200% Rally To New All-Time High He stated that

these whales can push the price of Bitcoin up hoping that retail

investors will dive into the market and buy, ultimately triggering

a bullish wave. According to Santana, if there are no genuine

Bitcoin buyers, the alleged manipulation could backfire, possibly

leading to losses for said market manipulators. Santana has

revealed that retail investors are no longer easily fooled into

buying Bitcoin at the top, showing more caution due to previous

cycles of manipulation and hype. He also disclosed that buyers are

not swayed by exaggerated predictions of substantial future gains

by analysts, claiming that Bitcoin could reach $3,000,000.

Featured image created with Dall.E, chart from Tradingview.com

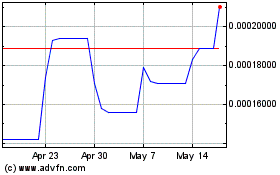

FLOKI (COIN:FLOKIUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

FLOKI (COIN:FLOKIUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024