Analyst Eyes $6,000 For Ethereum As Key Support Level Emerges – Details

October 29 2024 - 8:30AM

NEWSBTC

Price action in Ethereum has attracted the attention of investors

and analysts alike, as it trades near a critical support level at

$2,600. Analyst Ali Martinez has pinpointed this region as the

critical threshold that Ethereum will cross before it makes its

next significant move. Related Reading: Bitcoin Potential For

Monetary Policy Sparks Growing Interest Among Central Banks If this

support is sustained, according to Martinez, it shall serve as the

catalyst in staging a rally to usher the cryptocurrency to the

ambitious target of $6,000. However, things do not seem that smooth

ahead as already some market observers and participants have opined

that the existing support could break under pressure. #Ethereum is

testing a key support zone at $2,400. If this level holds, we might

see $ETH aiming for the channel’s upper boundary near $6,000!

pic.twitter.com/W8J8WVy5CL — Ali (@ali_charts) October 26, 2024

Ethereum has begun forming a rising channel from July 2023. An

ascending channel is a technical pattern in which two parallel

trend lines represent the support and resistance level. Recently,

the price of Ethereum stayed near the lower edge of this corridor.

Martinez believes that Ethereum will rally from here, so everyone’s

holding on tight. Important Support And Resistance Zones The

ascending channel pattern does not occur by accident. It indicates

the probable paths of Ethereum. The trend line acts as a resistance

level in the channel, while the trend line at the bottom actually

acts as a support level for the price to bounce. The move of

Ethereum past $2,600 is also an important retest point that will

act as a pivot for its new price target. Martinez believes this is

a good risk-reward opportunity for the investor and recommends

placing stops at around $2,00 to $2,150. The idea behind these

stop-losses is to limit the potential losses, but they also open up

upside in case Ethereum moves higher towards the upper trendline.

This observation appears somewhat vague, as some analysts are

expressing concerns about a potential breakdown at the $2,500

range. However, Martinez has not provided much insight into how

this situation could still create favorable conditions for a rally

to occur. Indicators Look Positive: On-Chain Data On-chain data

shows 70% of Ethereum holders are profitable. Therefore, this

positive attitude would be further supported in terms of the level

of profitability that reduces the chances of big sellers. When

there aren’t strong motives for selling, then an upward movement

for Ethereum could easily be expected. Related Reading: Floki Inu

Warning: Analyst Says ‘Prepare For The Crash’ – Details Robust

Long-Term Projections Meanwhile, the future estimates for Ethereum

have room for growth. The current market predictions reveal that

Ethereum is trading about 6.5% lower than the predicted target for

next month, which also means the asset is underpriced. More

positive projections for the long term range from 173% possible

returns in a year, according to figures by CoinCheckup. Such growth

could probably give a push to Ethereum’s upward movement and form a

firmer support base that may encourage price levels to stay high

and stabilized. Featured image from StormGain, chart from

TradingView

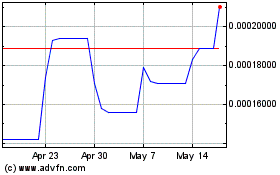

FLOKI (COIN:FLOKIUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

FLOKI (COIN:FLOKIUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024