Cardano (ADA) Among Only Coins Seeing Loss-Taking: What It Means

February 28 2024 - 9:00AM

NEWSBTC

Cardano (ADA) is among the few cryptocurrencies that are still

observing loss-taking being the dominant behavior among investors.

Bitcoin & Ethereum See Profit-Taking, While Cardano Is Seeing

Capitulation According to data from the on-chain analytics firm

Santiment, Bitcoin (BTC) and Ethereum (ETH) have both been seeing

the investors majorly selling at profits, while Cardano has seen

the loss-taking outweigh the profit-taking. The indicator of

interest here is the “Ratio of Daily On-Chain Transaction Volume in

Profit to Loss,” which, as its name already suggests, tells us

about how the loss-taking volume of any asset compares against its

profit-taking volume. This metric works by going through the

transaction history of each coin currently being moved on the

blockchain to see what price it moved at before this. If the

previous transfer price for any coin was less than the spot value

it is being sold at now, then its sale is contributing towards the

profit-taking volume. Related Reading: Polygon (MATIC) Whale Makes

Large Deposit To Binance, Bearish Sign? Similarly, the coins of the

opposite type (that is, those with last price higher than the

latest transfer price) add to the loss-taking volume. The indicator

takes the total volume of each type and outputs their ratio. Now,

here is a chart that shows the trend in this ratio for a few

different top cryptocurrencies over the last few months: The value

of the metric seems to have been greater than one for most of these

assets recently | Source: Santiment on X As displayed in the above

graph, all of these assets, except for Cardano, have their Ratio of

Daily On-Chain Transaction Volume in Profit to Loss sitting at

positive values right now. Such values of the metric imply the

profit-taking volume is currently greater than the loss-taking

volume for these assets. Ethereum, in particular, seems to have

been observing the most aggressive profit-taking spree recently, as

the cryptocurrency has been seeing about 2.3 green transactions for

every underwater movement. Bitcoin is seeing the second-highest

ratio, with 1.8 profit-taking transactions taking place for every

loss-taking transfer. It’s much more balanced for the altcoins,

however, as XRP (XRP) and Litecoin (LTC) have only been witnessing

minimally higher dominance of profit selling. Cardano has outright

been seeing the loss-taking volume pulling ahead of the

profit-taking one, implying that the investors have been going

through capitulation. These loss sellers may be ditching the asset

in favor of Bitcoin and others, who have offered greener pastures

recently. Related Reading: 95% Of Bitcoin Now In Profit: Why This

Could Be A Signal To Sell Historically, the dominance of

profit-taking has been something that has led to tops for

cryptocurrencies. Loss-taking, on the other hand, has often

facilitated bottoms to form as weaker hands flush out in such

events and stronger, more resolute investors take their coins. As

such, Cardano has been behind the other top coins in this metric

recently may mean that the coin could still have the potential to

rise, whereas the others may be nearing possible tops. ADA Price

While Cardano has performed worse than the likes of Bitcoin and

Ethereum recently, its returns have still not been that bad as the

asset is up 8% over the past week and trading around $0.63. Looks

like the price of the asset has been surging recently | Source:

ADAUSD on TradingView Featured image from Shutterstock.com,

Santiment.net, chart from TradingView.com

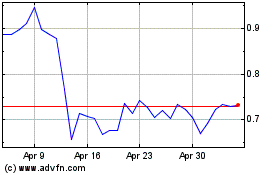

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024