FTX CEO Sam Bankman-Fried Reveals Reason Behind Billions Of Dollars Tether Purchase

October 11 2021 - 12:00PM

NEWSBTC

The come-up of the FTX cryptocurrency exchange has been one of the

most inspiring stories out of the crypto space. Its success put its

CEO Sam Bankman-Friend on the path to become one of the richest

crypto billionaires. The 29-year-old was featured on the Forbes

2021 List of 400 Richest People In America, which saw the CEO named

as the richest crypto billionaire. Although FTX has had an

impressive track record, the road to the present was not always an

easy one. CEO Sam Bankman-Fried opened up on some of the challenges

the exchange encountered when it had opened its doors for business.

In a piece on Bloomberg Businessweek, the CEO revealed that the

crypto exchange had faced significant challenges in getting the

banks onboard. Turning To Tether CEO Bankman-Fried told Bloomberg

that the company had major problems with getting the banks to work

with them. This was because banks are very skeptical about working

with crypto-related institutions due to regulatory problems and had

refused to work with his exchange. “If you’re a crypto company,

banks are nervous to work with you,” Bankman-Fried said. Related

Reading | Value Of Ethereum Held By Miners Reaches Five-Year

Record Levels Taking this in stride, the CEO had turned his

attention to something else; Tether. Its ease of use made it the

obvious choice for the cryptocurrency exchange in light of its bank

issues. Hence, investing in the stablecoin had been the solution to

this problem. Tether allowed FTX customers to transact and trade on

its platform, and the company could hold Tether instead of going

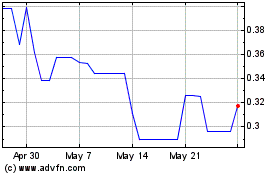

through the hassle of converting crypto to U.S. dollars. USDT price

holding steady to dollar | Source: USDTUSD on TradingView.com

Bankman-Fried revealed that the company had purchased billions of

dollars of USDT in order to help users trade on their platform. But

has clarified that the crypto exchange does not actually treat the

stablecoin like it does the dollar. Battling It Out With The Law

Tether has been in various long-running legal battles. The company

has been accused of circumventing laws and bank fraud, which

resulted in a probe from the U.S. Department of Justice. Another

class-action lawsuit had been filed against the stablecoin issuer,

but Tether had emerged victorious in what it called “a clumsy

attempt at a money grab.” Related Reading | Why A Parabolic

Move Is Expected For Bitcoin, Billionaire Mike Novogratz Most of

Tether’s woes have been linked to how much of its issued coins are

backed by real currency. The stablecoin issuers claim that the

coins are 100% by cash and cash equivalents but investors are wary

of this as data shows that only about 2.9% of all issued coins are

backed by cash reserves. The largest of its backing is in

commercial papers, which account for about 65.4% of Tether’s

reserves. Despite these, Tether still remains a top 5

cryptocurrency by market cap. It boasts the highest number of

trading pairs in the crypto market and has a market cap of $68

billion. Featured image from Decrypt, chart from TradingView.com

Ontology (COIN:ONTUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

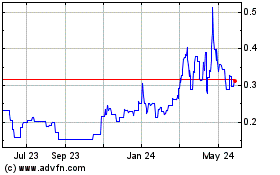

Ontology (COIN:ONTUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Ontology (Cryptocurrency): 0 recent articles

More Ontology News Articles