Tron Hits Key Price Levels as Revenue and Adoption Soar: What’s Next?

January 13 2025 - 6:30PM

NEWSBTC

Despite broader bearish trends in the cryptocurrency market, Tron

(TRX) has demonstrated resilience with notable growth in key

metrics. Recent analysis from CryptoQuant contributors sheds light

on Tron’s expanding ecosystem and revenue surge, presenting a

compelling case for its role in blockchain technology’s ongoing

evolution. One major highlight is the substantial increase in

Tron’s daily on-chain revenue. According to the data shared by the

analyst, Crazzyblockk, this rise has been driven by the network’s

enhanced gas fee revenue and higher transaction volumes.

Additionally, Tron’s price movement appears to be now becoming

interesting as it approaches critical support and resistance

levels, which could dictate its near-term trajectory. Related

Reading: TRON Reclaims Its Crown With 43% Dominance In Altcoin

Transactions Daily Revenue Growth Reflects Network Utility Tron’s

daily on-chain revenue has grown by 119% since January 1, 2024, a

metric closely tied to rising gas usage and increased transaction

activity on its blockchain, according to CryptoQuant analyst

Crazzyblockk. This surge as disclosed by the analyst highlights

Tron’s scalability in “processing high transaction volumes” while

maintaining “cost efficiency.” The revenue growth also highlights

the network’s expanding adoption within the decentralized finance

(DeFi) and smart contract ecosystems. The network’s ability to

generate substantial gas fee revenue serves as a benchmark for

blockchain performance, with Tron’s figures signaling growing user

engagement and utility. The analyst wrote: The year-to-date revenue

expansion signals increasing user demand and network utility,

further solidifying Tron’s position as a leading blockchain for

high-speed, low-cost operations. Crazzyblockk also suggests that

this trend reflects the network’s economic viability and its

strengthening position among blockchains optimized for high-speed

and low-cost operations. Additionally, this development is

especially significant as blockchain networks compete to attract

developers and investors with notable decentralized applications.

The analyst concluded by noting: With this explosive momentum in

daily revenue, Tron is setting a new standard for blockchain

economic models. Investors, developers, and users alike should keep

a close watch as this trend continues to reshape decentralized

finance and smart contract adoption. Tron Approaches Key Level

Meanwhile, from a technical perspective, Tron has reached a

critical level near its 1-Year Moving Average (MA) plus two

standard deviations, at approximately $0.25. Darkfost another

CryptoQuant analyst warned that failing to hold this level could

result in a decline to its 1-Year MA support of around $0.15.

However, the analyst highlighted Tron’s ecosystem growth offers

optimism for long-term investors. Related Reading: TRON Founder

Justin Sun Expected to Meet Trump as Potential Web3 Advisor The

network has seen notable activity, including a sharp increase in

the USDT volume on its blockchain, which rose from $8 billion in

early 2023 to $27 billion by late 2024. This growth points to

strong adoption and an influx of capital into the Tron network.

Additionally, metrics like the Moving Average Convergence

Divergence (MACD) indicate that TRX was recently oversold, a

condition that in the past has often preceded bullish momentum.

Featured image created with DALL-E, Chart from TradingView

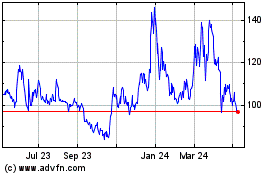

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

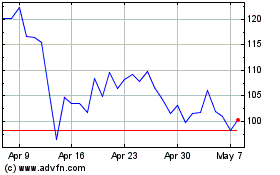

Quant (COIN:QNTUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025