Bitcoin Bulls Rejoice: Fed Minutes Confirm QT Is Ending

February 20 2025 - 8:00AM

NEWSBTC

On Tuesday, February 19, the Federal Reserve released their meeting

minutes, revealing that central bankers are considering an end—or

at least a significant slowdown—to quantitative tightening (QT).

The document states: “Several participants suggest halting or

slowing balance sheet reduction pending debt ceiling resolution.”

These remarks have fueled optimism among Bitcoin experts who view

the potential end of QT as a bullish signal. Many see it as a

precursor to greater liquidity entering financial markets, a

condition that has historically benefited risk assets like

cryptocurrencies. The newly published minutes confirm that certain

Fed officials are worried about the interaction between ongoing

balance sheet reduction and the looming debt ceiling debate. The

possibility of large-scale US Treasury issuance once the debt

ceiling is resolved appears to be a key driver behind calls to

pause or halt QT. Related Reading: Bears In Trouble? Bitcoin

Liquidity Signals A Brutal Squeeze To $111,000 No explicit shift to

quantitative easing (QE) was announced, but the acknowledgment that

balance sheet reduction might be curtailed has been enough to stoke

speculation in digital asset circles. The minutes must be

unanimously approved by the Federal Open Market Committee (FOMC),

further suggesting an intentional message from policymakers.

Implications For Bitcoin Renowned market commentator and host of

the On the Margin podcast, Felix Jauvin, took to X to emphasize the

significance of the Fed’s signaling, writing: “There it is, QT

coming to an end this spring. Reminder that every FOMC member has

to unanimously approve these minutes, this is intentional.” While

Jauvin underscores the unanimity behind these minutes, he stops

short of predicting an immediate shift toward QE. Instead, he

points to a specific chain of events that the Fed seems to be

navigating. The Fed has already reduced the pace of balance sheet

runoff by half compared to its initial rate. Jauvin also notes that

as the reverse repo facility (RRP) nears zero and the Fed reaches

its target reserve level of roughly 3% of GDP, an end to QT becomes

more likely. Related Reading: Bitcoin Meets Fiscal Reality:

Fidelity’s Timmer Predicts What’s Next Moreover, concerns loom over

the Treasury General Account (TGA) potentially being rebuilt once

the debt ceiling is resolved, leading to sizable bill issuance

which could lead to interim disruptions in funding markets.

Therefore, rather than pivot to QE, Jauvin believes the Fed could

pursue a temporary Supplementary Leverage Ratio (SLR) exemption,

allowing commercial banks to absorb additional government debt.

“They are very very very very far from any sort of formal QE.

Instead, it’s more likely they pursue an SLR exemption allowing

commercial banks to be the marginal buyer of debt,” Jauvin

predicts. A formal return to QE, Jauvin concludes, would only

materialize if financial and economic conditions deteriorate

significantly, including a major collapse in risk assets and a drop

in rates to near zero. In response to an X user asking if ending QT

is bullish without necessarily indicating an immediate move to QE,

Jauvin offered a succinct explanation: “Therefore think for the

current liquidity backdrop it is marginally improving in that we

will have the possible sequence of TGA drawdown into QT ending into

potentially SLR exemption, and that’ll be it for now. QE shouldn’t

even be in the current vocabulary of discourse as it stands.”

Renowned crypto analyst Pentoshi agrees, highlighting a previously

published forecast: “QT coming to an end… My guess, QT ends by

start of Q3. With all that’s taking place currently Trump will

likely end up forcing it. Was correct on QT guess in Nov 21. Let’s

see.” He cited how the conclusion of quantitative easing in late

2021 coincided with the end of the crypto bull run. Now, market

watchers are keenly observing whether the inverse—a potential

termination of QT—could spark renewed momentum for Bitcoin and

other digital assets. At press time, BTC traded at $97,208.

Featured image created with DALL.E, chart from TradingView.com

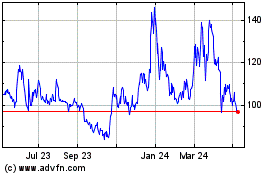

Quant (COIN:QNTUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

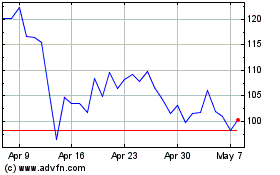

Quant (COIN:QNTUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025