14,000 BTC Transferred To Exchanges In Four Days – Worrying Trend For Bitcoin Price?

June 30 2024 - 4:30AM

NEWSBTC

Recent on-chain data shows that substantial amounts of Bitcoin have

made their way to centralized exchanges in the last few days. How

could this impact the Bitcoin price? Bitcoin Price To Face Further

Selling Pressure? In a new post on the X platform, prominent crypto

analyst Ali Martinez revealed that Bitcoin investors have been

transferring their assets to centralized exchanges in recent days.

The relevant indicator here is CryptoQuant’s Exchange Reserve

metric, which tracks the total amount of a particular

cryptocurrency held on all exchanges. Related Reading: Shiba Inu

Army On The Move: 35 Billion SHIB Invade Shibarium It is worth

noting that the value of this metric rises when investors are

making more deposits than withdrawals of a cryptocurrency (Bitcoin,

in this scenario) into centralized exchanges. Meanwhile, when the

metric’s value falls, it means that holders are transferring their

assets out of the trading platforms. According to CryotoQuant data,

more than 14,000 BTC (valued at approximately $851.2 million) have

been sent to crypto exchanges in the last four days. As shown in

the chart below, the exchange reserve metric is at its highest

level in nearly a month. Typically, an increase in the exchange

reserve indicates high selling pressure, as investors often use

centralized exchanges to sell assets. Consequently, the movement of

huge amounts to trading platforms could exacerbate the downward

pressure on the Bitcoin price. Furthermore, the exodus of

significant amounts to centralized exchanges could trigger price

volatility for the premier cryptocurrency. This would imply an

increased likelihood of big price movements in the future.

However, there has not been any impact on the Bitcoin price in the

past day. As of this writing, the price of the premier

cryptocurrency stands at around $60,700, reflecting a bare 0.3%

increase in the last 24 hours. Price Rebound Imminent For

BTC: Santiment Fortunately, it is not all gloom for the Bitcoin

price at the moment. Prominent on-chain analytics platform

Santiment has offered a positive outlook for the price of the

market leader. According to the blockchain firm, Bitcoin’s recovery

following dips in the past two weeks has been short-lived.

Santiment believes that a price rebound is imminent for the premier

cryptocurrency. The rationale behind this analysis is based on two

factors; the recent negative sentiment from the crowd and the low

relative strength index (RSI). Santiment said in its post: But note

the continued negative sentiment pouring in from the crowd,

indicating their patience is wearing thin. This, along with a low

RSI of just 36, are strong indications a bounce is close. Related

Reading: BlackRock Global Allocation Fund Reveals Major Bitcoin ETF

Stake With 43,000 Shares Featured image from iStock, chart from

TradingView

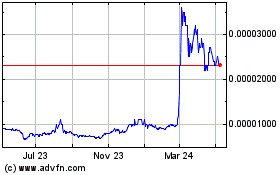

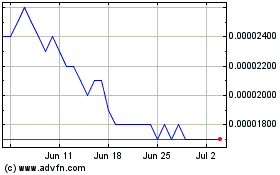

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024