Bitcoin Hype Bites Back As BTC Crashes Under $64,000

October 01 2024 - 2:00AM

NEWSBTC

Data shows social media users had become overly excited about

Bitcoin after the recent rally, which may be why BTC has retraced.

Bitcoin Topped Out As Hype Around The Coin Shot Up According to

data from the analytics firm Santiment, crowd sentiment around BTC

has noted a sharp surge recently. The indicator of relevance here

is the “Positive vs. Negative Sentiment Ratio,” which keeps track

of the difference between the positive and negative comments

related to Bitcoin that are being made on social media platforms.

Related Reading: Bitcoin Breaks $66,000, But Analyst Warns Against

Fresh Longs—Here’s Why The indicator separates posts related to

negative and positive sentiments by putting them through a

machine-learning model devised by the analytics firm. When the

value of this metric is greater than 0, it means the social media

users are participating in more positive talks than negative ones.

On the other hand, it being under this threshold suggests the

dominance of bearish sentiment on these platforms. Now, here is a

chart that shows what the Positive vs. Negative Sentiment Ratio’s

recent trajectory has been like: As displayed in the above graph,

the Bitcoin Positive vs. Negative Sentiment Ratio had observed a

significant surge during the cryptocurrency’s earlier run toward

the $66,000 level. Yesterday, when Santiment shared the post,

social media users made 1.8 bullish posts for every 1 bearish post.

Thus, the traders had become quite optimistic after the price

surge. This, however, may not have been an ideal development for

the coin. Historically, BTC has tended to move in the direction

opposite to what the crowd is expecting, with the probability of a

contrary move only rising the more lopsided the sentiment gets.

Today, Bitcoin has retraced back under the $64,000 level, a

possible indication that the earlier hype that the social media

users had shown has backfired, just like it has done many times.

It’s also not just the social media users that have been excited

recently, as the Fear & Greed Index, an indicator created by

Alternative that considers more factors than just social media, has

also been showing a rising optimism in the sector. The Fear &

Greed Index currently sits at a value of 61, which suggests that

the investors are leaning towards being bullish around Bitcoin and

the cryptocurrency sector in general. Related Reading: Shiba Inu

Rallies 34%, But Will FOMO End The Rally? The sentiment-related

indicators could follow in the coming days, as they may dictate

whether BTC can regain its bullish momentum. The crowd calming down

would be a sign in the right direction if history is to go by. BTC

Price After the latest plunge, Bitcoin has returned to the $63,400

level. Featured image from Dall-E, Alternative.me, Santiment.net,

chart from TradingView.com

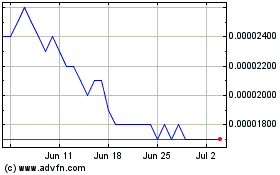

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024