Trump’s Crypto Token Offering: $300 Million Goal With Minimal US Participation – Details

November 03 2024 - 2:00AM

NEWSBTC

World Liberty Financial, a decentralized finance (DeFi) initiative

endorsed by former President Donald Trump, has disclosed that its

ambitious $300 million crypto token offering is largely aimed at

international investors. To date, fewer than 350 US investors

have engaged with the project, raising questions about its domestic

appeal amidst a landscape of regulatory scrutiny led by the US

Securities and Exchange Commission (SEC). World Liberty Financial’s

Offshore Focus Operating out of Wilmington, Delaware, yet managed

from Puerto Rico, World Liberty recently filed a notice with

American regulatory bodies, announcing its intent to sell only $30

million worth of tokens within the United States. Once this

threshold is reached, the crypto venture company plans to halt the

US offering, despite having approximately $288.5 million worth of

WLF tokens still available for sale. Related Reading: How To Trade

Bitcoin During The US Election, Expert Reveals Zachary Folkman,

co-founder of World Liberty, indicated in a September interview

streamed on X (formerly Twitter), that the company plans to

leverage Regulation S—a provision that allows the sale of tokens to

non-US investors without requirements typically imposed by US

securities laws. The limited interest from US investors may

stem from the SEC’s rigorous approach to regulating

cryptocurrencies, which has prompted many token issuers to focus

their efforts offshore. Trump’s involvement, along with that

of his sons, Donald Jr. and Eric, is highlighted in the company’s

filings. However, the document clarifies that their names are

included for “informational purposes” and do not imply an official

endorsement of the offering. Capital Raising In A Complex Crypto

Landscape During the September interview, Folkman discussed the

potential for non-US sales through Regulation S, but he refrained

from detailing the distribution of tokens between domestic and

international buyers. US investors have been approached

through a different regulatory pathway—Regulation D—which allows

companies to raise unlimited capital from accredited investors,

defined as individuals with a net worth exceeding $1 million,

excluding their primary residence. Both Regulation D and Regulation

S are designed to streamline capital-raising processes for

companies. However, Regulation D imposes stricter investor

protections and disclosure requirements. For instance,

companies utilizing Regulation D must publicly disclose details

about the offering, including the total amount raised and the

number of participating investors. Folkman noted the necessity of

verifying that US buyers meet accredited investor criteria, a

process that adds another layer of complexity to the offering. As

of October 15, World Liberty reported raising $2.7 million under

Regulation D by selling tokens to 348 investors. In contrast,

analytics from Kaiko show that around 17,000 unique addresses have

held the asset at least once, suggesting broader interest that may

not be reflected in US sales alone. Related Reading: Worldcoin

Rejection At $2.1 Sparks Concerns Of Prolonged Downtrend The

divergence between US and offshore sales could be partially

attributed to the anonymity afforded by Regulation S, which does

not require private companies to disclose capital-raising details

or verify the financial status of buyers. Nevertheless, the

regulation mandates that offerings be limited strictly to non-US

persons, ensuring compliance with international investment rules.

Folkman emphasized the company’s commitment to adhering to

regulatory standards during his interview, stating, “We would

expect that any potential non-US token sale would be limited to

non-US persons and comply with applicable restrictions under what

is known as Regulation S.” Featured image from DALL-E, chart from

TradingView.com

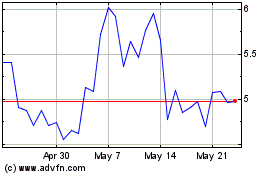

Worldcoin (COIN:WLDUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

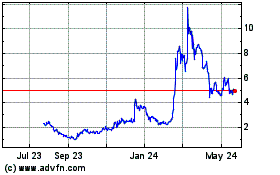

Worldcoin (COIN:WLDUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024