- Extension of the Company's cash runway to early 2024

- Active work on other financing solutions and measures to extend

this horizon

- Confirmation of Aeson®’s early sales momentum

Regulatory News:

NOT FOR DISTRIBUTION DIRECTLY OR INDIRECTLY IN

THE UNITED STATES OF AMERICA, CANADA, AUSTRALIA OR JAPAN

CARMAT (FR0010907956, ALCAR), designer and developer of the

world's most advanced total artificial heart, aimed at providing a

therapeutic alternative for patients suffering from advanced

biventricular heart failure (the "Company" or

"CARMAT"), today announced the completion of a capital

increase for a total amount of €7 million, subscribed in its vast

majority by several of its historical financial shareholders

("Capital Increase").

Stéphane Piat, Chief Executive Officer of CARMAT,

comments: "As the early momentum of Aeson® sales bas been

confirming in recent weeks, I am delighted by the confidence in our

project, demonstrated by three of our long-standing shareholders

(Lohas, Santé Holdings and Therabel Invest). Their financial

support will enable us to continue the deployment of our strategic

plan over the coming months, and particularly to support the

acceleration of our sales and our EFICAS clinical trial in

France.

We are also very actively working on other financing solutions

and measures which, combined with a strict financial discipline,

should enable us to further extend our financial visibility.

We are confident in the robustness and safety of our artificial

heart, and in its strong potential, and are determined to lead

CARMAT to commercial success and profitability, with the support of

our teams, shareholders and partners, for the benefit of patients

suffering from advanced biventricular heart failure."

Use of proceeds from the Capital

Increase

As announced at the time of publication of its 2023 half-year

results, the Company anticipates:

- growth in European sales, with revenue of around €4 to 6

million in the 2nd half of 2023, followed by a sharp increase in

2024;

- production capacity of 500 hearts per year by the end of

2023;

- 30 operational centers for commercial implants by the end of

2023;

- ramp-up of implants in the EFICAS study in France;

- US "PMA” application by the end of 2026.

To date, the early sales momentum has been confirmed, with a

pace of one implant per week achieved over the past three

weeks.

The Company plans to use the proceeds of the Capital Increase to

support its activities over the coming months, and more

specifically to develop its sales and continue its clinical

trials.

Given its sales forecasts and efforts to control costs, CARMAT

estimates its financing horizon to the beginning of 2024.

Meanwhile, the Company intends to implement rigorous financial

discipline, and is very actively working on other financing

solutions and measures, in order to strengthen its financial

structure and alleviate its cash constraints.

Based on its business plan, the Company estimates that it will

have to secure around €50 million in additional financing to cover

its operations and investments until the end of October 20241,

amount to which should be added €14.7 million corresponding to the

first tranche of the EIB2 loan (principal and interest), which is

due on January 31, 2024.

Main terms of the Capital

Increase

The Board of Directors of CARMAT, making use of the delegation

of authority granted to it under the Resolution 16 of the Company's

Combined General Meeting of May 11, 2023 (rights issue in favor of

categories of persons meeting specified characteristics (i.e.

individuals, French or foreign companies or investment funds

investing on a regular basis, or having invested more than 2

million euros over the 36 months preceding the issue in question,

in the life sciences and technologies sector)) (the "AGM")

and in accordance with articles L. 225-138 et seq. of the French

Commercial Code, decided on October 15, 2023 to carry out a capital

increase of €7.0 million, through the issue of 1,944,442 new shares

with a par value of €0.04 each (the "New Shares") at a price

of €3.60 and set the period for subscribing and paying in funds at

one week.

The subscription price corresponds to the closing price on

October 13, 2023. It represents 94.1% of the volume-weighted

average price of CARMAT shares over the 5 trading days prior to the

pricing of the issue.

The existing shareholders Lohas SARL, Santé Holdings SRL and

Therabel Invest SARL, holding respectively 8.3%, 8% and 2.4% of the

share capital, subscribed to the Capital Increase for an amount of

3.75 million euros, 2.5 million euros and 500,000 euros

respectively. Olivier Revol also participated to the to the round

for an amount of 250,000 euros.

It is specified that the subscribers who are also directors on

CARMAT's Board of Directors did not take part in the vote on the

Capital Increase at the Board of Directors' meeting on October 15,

2023.

Impact of the issue on the breakdown of

share capital

The new shares represent approximately 8.5% of the Company's

share capital, on a non-diluted basis, before completion of the

Capital Increase and 7.8% of the Company's share capital, on a

non-diluted basis, after completion of the Capital Increase.

Thus, a shareholder holding 1% of the issued capital before the

transaction will hold 0.92% of the capital after the

transaction.

To the best of the Company's knowledge, the breakdown in share

ownership before and after completion of the Capital Increase is as

follows:

Before the Capital

Increase

(on a non-diluted

basis)

After the Capital

Increase

(on a non-diluted

basis)

Number of

shares

% of capital

Number of

shares

% of capital

Matra Défense SAS (Groupe

Airbus)

2,670,640

11.7%

2,670,640

10.8%

Lohas SARL (Pierre Bastid)

1,905,288

8.3%

2,946954

11.9%

Santé Holdings SRL (Dr Antonino

Ligresti)

1,823,900

8.0%

2,518,344

10.2%

Corely Belgium SPRL (Famille

Gaspard)

880,000

3.9%

880,000

3.6%

Bratya SPRL (Famille Gaspard)

230,000

1.0%

230,000

0.9%

Pr. Alain Carpentier &

Famille

491,583

2.2%

491,583

2.0%

Association Recherche

Scientifique Fondation Alain Carpentier

115,000

0.5%

115,000

0.5%

Therabel Invest SàRL

540,162

2.4%

679,050

2.7%

Cornovum

458,715

2.0%

458,715

1.9%

François IV SAS

319,898

1.4%

319,898

1.3%

Self-retention

7,565

0.03%

7,565

0.03%

Floating

13,400,843

58.7%

13,470,287

54.3%

Total

22,843,594

100.0%

24,788,036

100.0%

Admission of new shares

Settlement-delivery of the new shares and their admission to

trading on the Euronext Growth® Paris multilateral trading facility

under ISIN code FR0010907956 are expected to take place no later

than October 23, 2023, on the same quotation line as the Company's

existing ordinary shares. The new shares will carry dividend rights

and will be immediately assimilated to the Company's existing

ordinary shares, will be of the same class and fungible with the

existing shares, and will carry all the rights attached to the

shares.

Following settlement-delivery, CARMAT's share capital will

amount to 991,521.44 euros, divided into 24,788,036 shares.

The Capital Increase does not give rise to a prospectus subject

to the approval of the Autorité des marchés financiers (the

"AMF").

Risk factors relating to the Capital

Increase

The public's attention is drawn to the risk factors relating to

the Company and its business, presented (i) in Chapter 2 of its

2022 universal registration document filed with the Autorité des

marchés financiers on April 21, 2023, available free of charge on

the Company's website (www.carmatsa.com) and the AMF's website

(www.amf-france.org) and (ii) in section 2.4 of the half-yearly

financial report for the six months ended June 30, 2023 published

on the Company's website on September 25, 2023. Investors are also

invited to consider the Company's need to strengthen its capital

base or to raise additional financing, in particular to meet

commitments made to its lenders. The occurrence of any or all of

these risks could have an adverse effect on the Company's business,

financial situation, results, development or prospects.

In addition, investors are invited to consider the following

specific risks:

- the market price of the Company's shares could fluctuate and

fall below the subscription price of the shares issued as part of

the Capital Increase;

- the volatility and liquidity of the Company's shares could

fluctuate significantly;

- sales of the Company's shares could occur on the market and

have an unfavorable impact on the Company's share price;

- the Company's shareholders could suffer potentially significant

dilution as a result of any future capital increases made necessary

by the Company's search for financing; and

- as the securities are not intended to be listed on a regulated

market, investors will not benefit from the guarantees associated

with regulated markets.

This press release does not constitute a prospectus under

Regulation (EU) 2017/1129 of the European Parliament and of the

Council of June 14, 2017, as amended, or an offer to the

public.

***

About CARMAT

CARMAT is a French MedTech that designs, manufactures and

markets the Aeson® artificial heart. The Company’s ambition is to

make Aeson® the first alternative to a heart transplant, and thus

provide a therapeutic solution to people suffering from advanced

biventricular heart failure, who are facing a well-known shortfall

in available human grafts. The world’s first physiological

artificial heart that is highly hemocompatible, pulsatile and

self-regulated, Aeson® could save, every year, the lives of

thousands of patients waiting for a heart transplant. The device

offers patients quality of life and mobility thanks to its

ergonomic and portable external power supply system that is

continuously connected to the implanted prosthesis. Aeson® is

commercially available as a bridge to transplant in the European

Union and other countries that recognize CE marking. Aeson® is also

currently being assessed within the framework of an Early

Feasibility Study (EFS) in the United States. Founded in 2008,

CARMAT is based in the Paris region, with its head offices located

in Vélizy-Villacoublay and its production site in Bois-d’Arcy. The

Company can rely on the talent and expertise of a multidisciplinary

team of circa 200 highly specialized people. CARMAT is listed on

the Euronext Growth market in Paris (Ticker: ALCAR / ISIN code:

FR0010907956).

For more information, please go to www.carmatsa.com and follow

us on LinkedIn.

Name : CARMAT ISIN code :

FR0010907956 Ticker : ALCAR

Disclaimer

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy, nor shall there be any sale of

shares in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

The distribution of this document may, in certain jurisdictions,

be restricted by local legislations. Persons into whose possession

this document comes are required to inform themselves about and to

observe any such potential local restrictions.

This press release is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017 (as amended, the

“Prospectus Regulation”). Any decision to purchase shares

must be made solely on the basis of publicly available information

on the Company.

In France, the offer of CARMAT shares described below has been

made within the framework of a capital increase reserved for

investors falling within the category of beneficiaries defined in

the sixteenth resolution of the Company's General Meeting of May

11, 2023, in accordance with article L. 225-138 of the French

Commercial Code and applicable regulatory provisions. Pursuant to

article 211-3 of the General regulations of the French financial

markets authority (Autorité des marchés financiers) (the

"AMF") and articles 1(4) and 3 of the Prospectus Regulation,

the offer of CARMAT shares will not require the publication of a

prospectus approved by the AMF.

With respect to Member States of the European Economic Area, no

action has been taken or will be taken to permit a public offering

of the securities referred to in this press release requiring the

publication of a prospectus in any Member State. Therefore, such

securities may not be and shall not be offered in any Member State

other than in accordance with the exemptions of Article 1(4) of

Prospectus Regulation or, otherwise, in cases not requiring the

publication of a prospectus under Article 3 of the Prospectus

Regulation and/or the applicable regulations in such Member

State.

This press release and the information it contains are being

distributed to and are only intended for persons who are (x)

outside the United Kingdom or (y) in the United Kingdom and are (i)

investment professionals falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, as amended (the “Order”), (ii) high net worth entities

and other such persons falling within Article 49(2)(a) to (d) of

the Order (“high net worth companies”, “unincorporated

associations”, etc.) or (iii) other persons to whom an invitation

or inducement to participate in investment activity (within the

meaning of Section 21 of the Financial Services and Market Act

2000) may otherwise lawfully be communicated or caused to be

communicated (all such persons in (y)(i), (y)(ii) and (y)(iii)

together being referred to as “Relevant Persons”). Any

invitation, offer or agreement to subscribe, purchase or otherwise

acquire securities to which this press release relates will only be

engaged with Relevant Persons. Any person who is not a Relevant

Person should not act or rely on this press release or any of its

contents.

This press release may not be distributed, directly or

indirectly, in or into the United States. This press release and

the information contained therein does not, and will not,

constitute an offer of securities for sale, nor the solicitation of

an offer to purchase, securities in the United States or any other

jurisdiction where restrictions may apply. Securities may not be

offered or sold in the United States absent registration or an

exemption from registration under the U.S. Securities Act of 1933,

as amended (the “Securities Act”). The securities of CARMAT

have not been and will not be registered under the Securities Act,

and CARMAT does not intend to conduct a public offering in the

United States.

The distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions.

______________________________

1

I.e., 12 months starting from the

Capital Increase that is the subject of this press release.

2

Under the terms of an agreement

entered into on December 17, 2018, the Company has taken out a loan

with the EIB for €30 million, paid in 3 tranches of €10 million on

January 31, 2019, May 4, 2020 and October 29, 2021. Each tranche to

be repaid, in principal and interest, 5 years after it is disbursed

to the Company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231015654843/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: 01 39

45 64 50 contact@carmatsas.com

Alize RP Press Relations

Caroline Carmagnol Tel.: 06 64 18 99 59

carmat@alizerp.com

NewCap Financial Communication & Investor

Relations

Dusan Oresansky Quentin Massé Tel.: 01 44 71 94 92

carmat@newcap.eu

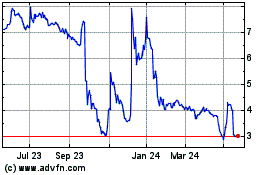

Carmat (EU:ALCAR)

Historical Stock Chart

From Apr 2024 to May 2024

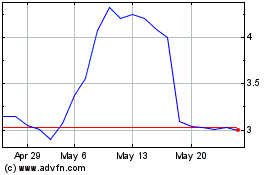

Carmat (EU:ALCAR)

Historical Stock Chart

From May 2023 to May 2024