- Increase in services provided in 2023 by all sequencing

platforms, excluding COVID-related activities

- Positive EBITDA for the third year running, despite

inflation impacting reagent costs

- SeqOIA platform to cease operations in the first quarter of

2024

- Planned development of activities for the pharmaceutical

industry following CAP accreditation and CLIA

certification.

Regulatory News:

IntegraGen (FR0010908723 – ALINT – Eligible PEA PME), an

OncoDNA company specializing in the genomics of cancer and rare

genetic diseases, which performs interpretable genomic analyses for

academic and private laboratories, today announced its audited

annual results for fiscal 2023, the accounts having been approved

by the Board of Directors on April 5, 2024.

Bernard Courtieu, CEO of IntegraGen, comments: "The 2023

results demonstrate that despite the cessation or sharp reduction

in activities linked to the COVID-19 pandemic, IntegraGen was able

to control its cost base to maintain a positive EBITDA, despite a

highly inflationary context. Thanks to the loyalty of our customers

and partners supported by the exceptional quality of the work done

by all our employees, we are particularly proud to be able to

present these results, and more generally to continue to contribute

to the projects of researchers and clinicians, ultimately

supporting improved patient care. 2024 will be a year of

significant growth for IntegraGen, with the launch of activities

aimed at pharmaceutical companies as part of the development of

their new drugs, thanks to CAP (College of American Pathologists)

accreditation and CLIA (Clinical Laboratory Improvement Amendments)

certification.”

Slight reduction in genomic services activities at the Evry

laboratory

Genomic service activities, which include services provided for

research laboratories and clinical research teams, are now grouped

together at the Évry site. Annual sales for 2023 amounted to

€4,920k, down 4%, mainly due to the non-recurrence of projects

carried out at Évry in 2022 for the Mutualized Microbiology

Platform (P2M) and particularly linked to the pandemic, as well as

to delayed projects for pharma companies.

In all, our genomics teams successfully completed more than 482

projects for 119 academic and private-sector organizations.

Sharp drop in COVID-19 pandemic-related services for Institut

Pasteur

IntegraGen continued to provide services for the Institut

Pasteur's P2M platform. During the first quarter of 2023, the

platform continued to be called upon in connection with the

pandemic. Covid-19-related activity had begun to decline in the

second half of 2022, giving way to the usual microbiology activity,

which was confirmed in 2023. In 2023, the platform carried out over

17,000 microbial sequencings.

Éléments Financiers

In thousand euros (k€)

2023

2022

Var.%

Sales

12 537

13 167

-5%

other revenues

290

329

-12%

Total revenues

12 827

13 496

-5%

Purchases

-4 211

-5 191

-19%

Payroll

-4 826

-4 551

6%

Other charges and taxes

-3 709

-3 692

0%

Total Charges

-12 746

-13 434

-5%

Gross operating income

81

62

30%

Depreciation and amortization

-198

-202

-2%

Total Operating Expenses

-12 944

-13 635

-5%

Operating Income

-117

-139

-16%

Financial expenses

40

67

-41%

Net income before non recurring items

-77

-72

7%

Net result

-181

-72

153%

Revenues amounted to €12,537k, down 5% on 2022. This decrease is

mainly due to the reduction in activities linked to the COVID-19

pandemic, with a reduction in reagent purchases for the P2M

platform in charge of Institut Pasteur's microbiology sequencing

activities, and a few pandemic-specific projects in the first

quarter of 2022. Operating expenses came to €12,944k, also down 5%

on the previous year. This change was mainly due to lower orders

for consumables (-19%) linked to lower volumes, particularly at P2M

. Other expenses remained stable, despite the efforts made in

Quality Assurance to obtain CAP and CLIA accreditations. Lastly,

personnel costs rose by 6%, mainly due to increases in certain

salaries to reflect inflation. As a result of these various

developments, the company was able to keep costs under control and,

despite a highly inflationary environment, EBITDA remained positive

at €81k in 2022, compared with €62k the previous year (+30%). After

taking into account financial items, exceptional items and tax, net

profit is estimated at a loss of €171k, compared to a loss of €4k

in 2022.

Balance sheet

k€

31/12/2023

31/12/2022

Fixed assets

316

468

Inventories

311

387

Trade receivables

2 960

3 220

Other receivables

1 535

441

Cash and cash equivalents

2 879

4 507

Current assets

7 684

8 555

translation adjustments

0

TOTAL ASSETS

8 000

9 023

En k€

31/12/2023

31/12/2022

Shareholders equity

2 011

2 182

Provisions for liabilities &

charges

157

0

Financial debt

1 125

1 672

Advances received

0

Operating liabilities

2 915

3 216

Other debts

1 784

1 934

Exchange differences

9

18

TOTAL LIABILITIES

8 000

9 023

The cash position at the end of December 2023 was €2,879k,

compared with4,507k at December 31, 2022, a decrease of €1,628k.

This change is explained by the granting of a €1,000k loan to

OncoDNA, which was the subject of a regulated agreement approved by

the Board of Directors, the repayment of the PGE (State Guaranteed

Loan) obtained in 2020 during the pandemic and which the company

began repaying in 2022 for a period of 5 years, and an operating

cash consumption of less than €300k.

OUTLOOK FOR 2024: END OF SEQOIA AND LAUNCH OF GENOMIC

SERVICES FOR THE PHARMACEUTICAL INDUSTRY

In September, the “Groupement de Coopération Sanitaire” SeqOIA

announced that it had decided to internalize its services, with the

termination of the contract with IntegraGen. The cessation of the

latter's activities, which was extended to February 29, will have a

significant impact on 2024 revenues, compared with the €4,362k

generated in 2023 by SeqOIA.

In the fourth quarter of 2023, the company took the decision to

implement a job-saving plan at the Évry site, beyond the

elimination of jobs linked to the SeqOIA contract, in order to

maintain the company's competitiveness.

Nevertheless, IntegraGen expects continued growth in revenues

from genomic services at the Evry site in 2024, based on the order

book and the positive trend observed with academic and

private-sector clients. The Company also expects Evry's genomics

services to become even more profitable, thanks to the automation

and productivity gains achieved.

In addition, investments in certification and quality assurance

have resulted in CAP accreditation and CLIA certification, making

it possible to offer services to the pharmaceutical industry in

support of the clinical development of new molecules in oncology.

The Company expects this fast-growing sector to become a major

focus of the laboratory's business in the short to medium term.

Available cash will allow the Company to finance its operating

and investment needs.

ABOUT INTEGRAGEN

IntegraGen is an OncoDNA group company specializing in the

genomics of cancer and rare genetic diseases. Backed by highly

competent and qualified teams, IntegraGen is a leading player in

DNA sequencing services and genomic data interpretation software.

The company runs one of the largest NGS labs in France and operates

for research institutes of excellence. As part of OncoDNA group,

IntegraGen leverages the power of next generation sequencing with

the mission of delivering the promise of precision medicine to

patients. IntegraGen has about 42 employees and generated €12.5

million of turnover in 2023. Based in France, IntegraGen is part of

the Belgian OncoDNA group present in Spain, UK, Germany and works

with an international network of 35 distributors. The Group also

provides biomarker testing and clinical interpretation tools to

guide treatment and monitoring of late stage solid tumors and

accelerate the development of new cancer drugs.

IntegraGen is listed on Euronext Growth in Paris (ISIN:

FR0010908723 – Mnemo: ALINT – Eligible PEA- PME).

For further information, please visit www.integragen.com or

connect with us on LinkedIn or Twitter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240418179424/en/

IntegraGen Bernard COURTIEU Directeur Général

Virginie Decoster Directeur Financier contact@integragen.com

Tél. : +33 (0)1 60 91 09 00

NewCap Relations Investisseurs Louis-Victor

DELOUVRIER integragen@newcap.eu Tél. : +33 (0)1 44 71 98 53

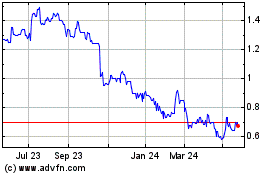

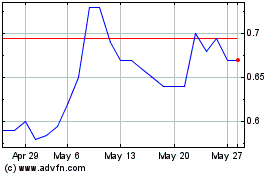

Integragen (EU:ALINT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Integragen (EU:ALINT)

Historical Stock Chart

From Nov 2023 to Nov 2024