Regulatory News:

Amplitude Surgical (Paris:AMPLI) (Euronext - FR0012789667), a

leading French player in the international market for lower limb

prostheses, announces and details the Description of the share

buyback program approved by the Ordinary and Extraordinary

Shareholders’ Meeting of 10 June 2015.

1. Legal framework

Pursuant to Articles L.225-209 et seq. of the French Commercial

Code, Articles 241-1 to 241-6 of the General Rules of the Autorité

des marchés financiers as well as the European regulation on market

abuses, this description intends to describe the objectives and the

terms and conditions of the share buyback program of Amplitude

Surgical (the “Company” or “Amplitude Surgical”) as

approved by the Ordinary and Extraordinary Shareholders’ Meeting of

10 June 2015.

This description is made available to the shareholders on

Amplitude Surgical’s website (www.amplitude-surgical.com).

2. Number of shares and portion of share capital held by the

issuer

As at 28 July 2015, Amplitude Surgical’s share capital is

€469,298.52 divided into 46,929,852 shares each with a par value of

€0.01.

As at 28 July 2015, Amplitude Surgical does not hold any of its

own shares.

Amplitude Surgical’s shares are listed on the regulated market

of Euronext in Paris (ISIN Code: FR0012789667, Mnemonic:

AMPLI).

3. Allocation by objectives of the shares held

As at 28 July 2015, Amplitude Surgical does not hold any of its

own shares.

4. Objectives for the share buyback program approved by the

Ordinary and Extraordinary Shareholders’ Meeting of 10 June

2015

The acquisition of the shares may be carried out, in order of

highest priority to lowest, with a view to:

- ensuring liquidity and activity in the market for the shares

of Amplitude Surgical through an investment services provider,

acting independently under a liquidity agreement and in accordance

with a market ethics charter acknowledged by the Autorité des

marchés financiers;

- performing the obligations related to the allotment of options

on shares, the allotment of free shares or other allotments,

allocations or sales of shares to the employees or the corporate

officers of Amplitude Surgical or of an affiliated company, in

accordance with the conditions set forth by the market authorities

and at such times that the Board of Directors or any person acting

upon the authority of the Board of Directors implements such

actions;

- ensuring the coverage of the undertakings of Amplitude

Surgical under rights providing for a cash settlement based on the

positive evolution of the trading price of the shares of Amplitude

Surgical granted to the employees and to the corporate officers of

Amplitude Surgical or of an affiliated company;

- retaining shares and delivering shares of Amplitude Surgical

further to an exchange or as a consideration in the context of

external growth transactions, in accordance with acknowledged

market practice and applicable regulations;

- delivering shares of Amplitude Surgical in connection with the

exercise of rights attached to securities conferring access by any

means, immediately or in the future, to shares of Amplitude

Surgical;

- cancelling all or part of the shares so repurchased, in

accordance with applicable laws and subject to an authorization

being granted by the extraordinary shareholders’ meeting;

– any other action that is or will become permitted by French

law or the Autorité des marchés financiers or any purpose that may

comply with the regulations in force.

5. Terms and conditions

Maximum authorized amount of share capital

The Ordinary and Extraordinary Shareholders’ Meeting of 10 June

2015 authorized the Board of Directors to purchase or arrange for

the purchase of shares of Amplitude Surgical up to a maximum amount

of 10% of the share capital of Amplitude Surgical.

The Ordinary and Extraordinary Shareholders’ Meeting of 10 June

2015 also decided that the number of shares acquired by Amplitude

Surgical in view of holding them for subsequent payment or exchange

in a merger, spin-off or contribution cannot be greater than 5% of

the share capital of Amplitude Surgical.

In accordance with article L.225-209 §2 of the French commercial

code, when shares are repurchased in order to improve liquidity

within the conditions set forth in the General Rules of the

Autorité des marchés financiers, the number of shares taken into

account for the calculation of the 10% limit provided in the first

paragraph of article L.225-209 reflects the number of shares

purchased, less the number of shares sold back during the term of

the authorization.

Pursuant to Article L.225-210 of the French Commercial Code, the

number of shares Amplitude Surgical may hold at any given time

cannot exceed 10% of the shares making up the share capital of

Amplitude Surgical on the date considered.

Considering the fact that Amplitude Surgical does not hold any

of its own shares on 28 July 2015, the maximum number of

shares of Amplitude Surgical which may be re-purchased amounts to,

on 28 July 2015, 10% of the share capital of Amplitude

Surgical, i.e., 4,692,985 shares of Amplitude Surgical.

Maximum purchase price

The Ordinary and Extraordinary Shareholders’ Meeting of 10 June

2015 decided to set the purchase price per share at 200% of the

initial public offering price (i.e., €10), it being noted that, in

the event of transactions on the share capital, in particular by

way of incorporation of reserves and allotment of shares free of

charge, division or regrouping of shares, this price will be

adjusted accordingly.

Maximum amount

The Ordinary and Extraordinary Shareholders’ Meeting of 10 June

2015 decided that the maximum amount allocated for implementation

of the share buyback program is €40 million.

Terms and conditions of acquisitions and sales

The Ordinary and Extraordinary Shareholders’ Meeting of 10 June

2015 decided that the acquisition, sale or transfer of the shares

can be carried out by any means, on the market or over the counter,

including transactions involving blocks of securities or takeover

bids, option mechanisms, derivatives, purchase of options or of

securities in conformity with the applicable regulatory conditions.

Blocks of securities may represent up to the total amount of the

share buyback program.

6. Duration of the share buyback program

18 months from the date of the Ordinary and Extraordinary

Shareholders’ Meeting of 10 June 2015, meaning until 10 December

2016.

7. Statement on the previous share buyback program

The shares of Amplitude Surgical were not previously admitted to

trading on a regulated market. As a consequence, Amplitude Surgical

has not previously implemented any share buyback program.

About Amplitude SurgicalFounded in 1997 in Valence,

France, Amplitude Surgical is a leading French player on the global

surgical technology market for lower-limb orthopedics. Amplitude

Surgical develops and markets high-end products for orthopedic

surgery covering the main disorders affecting the hip, knee and

extremities, and notably foot and ankle surgery. Amplitude Surgical

develops, in close collaboration with surgeons, numerous high

value-added innovations in order to best meet the needs of

patients, surgeons and healthcare facilities. A leading player in

France, Amplitude Surgical is developing abroad through its

subsidiaries and a network of exclusive distributors and agents.

Amplitude Surgical operates on the lower-limb market through the

intermediary of its Novastep subsidiaries in France and the United

States. Amplitude Surgical distributes its products in more than 30

countries and had a workforce of 210 staff on December 31, 2014.

Amplitude Surgical recorded revenue of 58.2 million euros for its

financial year ending on June 30, 2014, with average annual growth

of around 15% since 2005 and an average EBITDA margin of more than

20% over 2005-2014.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150727005969/en/

Amplitude SurgicalPhilippe Garcia, +33 (0)4 75 41 87

41Chief Financial

Officerphilippe.garcia@amplitude-ortho.comorNewCapInvestor

relationsFlorent Alba,+33 (0)1 44 71 98

55amplitude@newcap.frorNewCapMedia relationsNicolas

Merigeau, +33 (0)1 44 71 98 55amplitude@newcap.fr

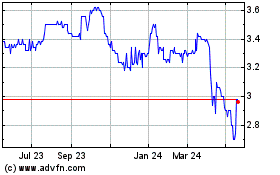

Amplitude Surgical (EU:AMPLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

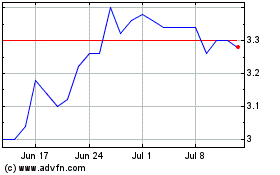

Amplitude Surgical (EU:AMPLI)

Historical Stock Chart

From Apr 2023 to Apr 2024