Yen Falls Amid BoJ Rate Hike Uncertainty

November 19 2024 - 10:11PM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Wednesday, due to uncertainties over the timing of

the Bank of Japan's (BoJ) next interest rate hike.

Earlier this week, Bank of Japan Governor Kazuo Ueda issued a

warning against keeping borrowing prices too low and hinted at a

potential interest rate hike in December, but he was evasive about

the timeframe.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade deficit of 461,2 billion yen in October. That

missed forecasts for a shortfall of 360.4 billion yen following the

upwardly revised 294.1-billion-yen deficit in September.

Exports were up 3.1 percent on year at 9.426 trillion-yen,

exceeding expectations for an increase of 2.2 percent following the

1.7 percent decline in the previous month.

Imports rose an annual 0.4 percent to 9.887 trillion yen versus

forecasts for a decline of 0.3 percent following the 1.8 percent

increase a month earlier.

In the Asian trading today, the yen fell to 5-day low of 164.72

against the euro and 197.68 against the pound, from recent highs of

163.97 and 196.24, respectively. If the yen extends its downtrend,

it is likely to find support around 167.00 against the euro and

200.00 against the pound.

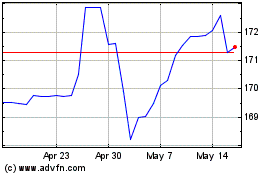

Against the U.S. dollar and the Swiss franc, the yen slipped to

5-day lows of 155.53 and 175.94 from recent highs of 154.59 and

175.27, respectively. The yen may test support around 157.00

against the greenback and 177.00 against the yen.

Looking ahead, U.S. mortgage approvals data and U.S. EIA crude

oil data are due to be released in the New York session.

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Nov 2024 to Dec 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Dec 2023 to Dec 2024