U.S. Dollar Climbs Amid Strong ISM Manufacturing PMI

April 01 2024 - 8:02AM

RTTF2

The U.S. dollar was higher against its major counterparts in the

New York session on Monday, as U.S. manufacturing sector expanded

in March for the first time since September 2022.

Data from the Institute for Supply Management showed that the

manufacturing PMI jumped to 50.3 in March from 47.8 in February,

with a reading above 50 indicating growth in the sector. Economists

had expected the index to inch up to 48.4.

Last week's U.S. inflation data increased the likelihood of an

interest rate cut at the Fed's June meeting.

The data is "along the lines of what we would like to see," Fed

Chair Jerome Powell said on Friday at a conference and repeated the

central bank is no hurry to cut interest rates. He also

acknowledged the risks of leaving interest rates where they are

now.

Treasury yields rose, with the yield on the benchmark ten-year

note touching 4.31 percent.

The greenback firmed to a 5-day high of 151.77 against the yen

and a 4-day high of 0.9055 against the franc, off its early lows of

151.22 and 0.9004, respectively. The next possible resistance for

the currency is seen around 153.00 against the yen and 0.92 against

the franc.

The greenback strengthened to 1-1/2-month highs of 1.0739

against the euro and 1.2554 against the pound, from its early lows

of 1.0798 and 1.2641, respectively. The greenback is likely to find

resistance around 1.03 against the euro and 1.21 against the

pound.

The greenback appreciated to 4-day highs of 0.6486 against the

aussie and 1.3585 against the loonie, from an early 4-day low of

0.6538 and near a 2-week low of 1.3514, respectively. The greenback

is seen finding resistance around 0.63 against the aussie and 1.37

against the loonie.

The greenback touched a 4-1/2-month high of 0.5944 against the

kiwi, from an early 4-day low of 0.5993. If the currency rises

further, it may find resistance around the 0.58 level.

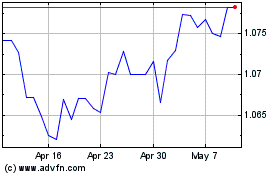

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024