U.S. Dollar Subdued Following Tame Inflation Data

August 14 2024 - 9:23AM

RTTF2

The U.S. dollar was lower against its major counterparts in the

New York session on Wednesday, as consumer inflation moderated in

July, reinforcing expectations for a rate cut from the U.S. Federal

Reserve in September.

Data from the Labor Department showed that the consumer price

index rose by 0.2 percent in July after edging down by 0.1 percent

in June. The modest increase by consumer prices matched

expectations.

Core consumer prices, which exclude food and energy prices, also

crept up by 0.2 percent in July after inching up by 0.1 percent in

June. The uptick by core consumer prices was also in line with

economist estimates.

Meanwhile, the report said the annual rate of consumer price

growth slowed slightly to 2.9 percent in July from 3.0 percent in

June. Economists had expected the pace of growth to remain

unchanged.

The annual rate of core consumer price growth also slipped to

3.2 percent in July from 3.3 percent in June, in line with

expectations.

Expectations for 50 basis point rate cut at the Fed's Sept.

17-18 meeting diminished following the release of CPI report.

However, traders increased bets of a 25 basis point rate cut by the

Fed in September.

CME Group's FedWatch Tool is currently indicating a 56.5 chance

the Fed will lower rates by a quarter point and a 43.5 percent

chance of a half point rate cut.

The greenback declined to a 7-1/2-month low of 1.1047 against

the euro and near a 4-week low of 1.3689 against the loonie, from

yesterday's close of 1.0993 and 1.3705, respectively. The currency

may locate support around 1.12 against the euro and 1.33 against

the loonie.

The greenback eased against the yen and the franc and was

trading at 147.10 and 0.8650, respectively. This may be compared to

its early 6-day lows of 146.07 against the yen and 0.8616 against

the franc. The currency is poised to challenge support around

142.00 against the yen and 0.85 against the franc.

The greenback retreated to 0.6030 against the kiwi, from an

early 2-day high of 0.6002. This may be compared to a previous

4-week low of 0.6084. If the currency falls further, it is likely

to test support around the 0.63 region.

The greenback pulled back to 1.2863 against the pound. The

currency is seen finding support around the 1.31 level.

Meanwhile, the greenback rose to 0.6601 against the aussie,

reversing from an early fresh 3-week low of 0.6642. The currency is

likely to locate resistance around the 0.64 level.

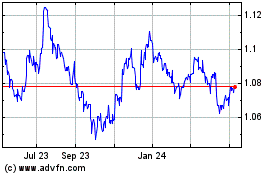

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Jul 2024 to Aug 2024

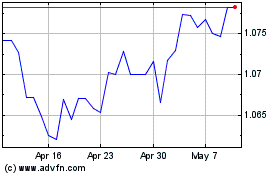

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Aug 2023 to Aug 2024